CryptoQuant: Institutional Interest Shifts To Ethereum, Upward Momentum Is Supported By Stronger Fundamentals

In Brief

Ethereum has outpaced Bitcoin in recent months, driven by growing institutional interest and liquidity inflows while retail participation remains limited.

Cryptocurrency market analyst CryptoMe from research firm CryptoQuant released an update noting that Ethereum has recently outperformed Bitcoin. According to the analysis, over the past three months, Ethereum’s gains have outpaced BTC, and this trend may persist for some time.

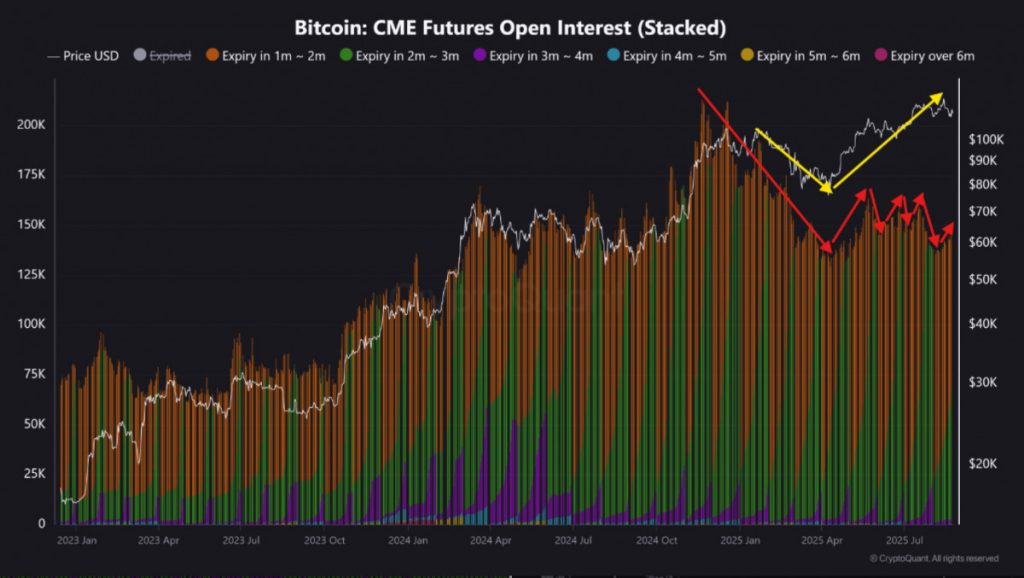

A comparison of Open Interest (OI) in Bitcoin and Ethereum futures on the CME, which includes hedge funds, institutional investors, and large speculators, helps illustrate the difference. For Bitcoin, despite reaching new all-time highs of $110,000 in January and $124,000 later in the year, OI did not recover to previous levels, indicating that rising BTC prices have not attracted the same level of institutional interest in CME derivatives.

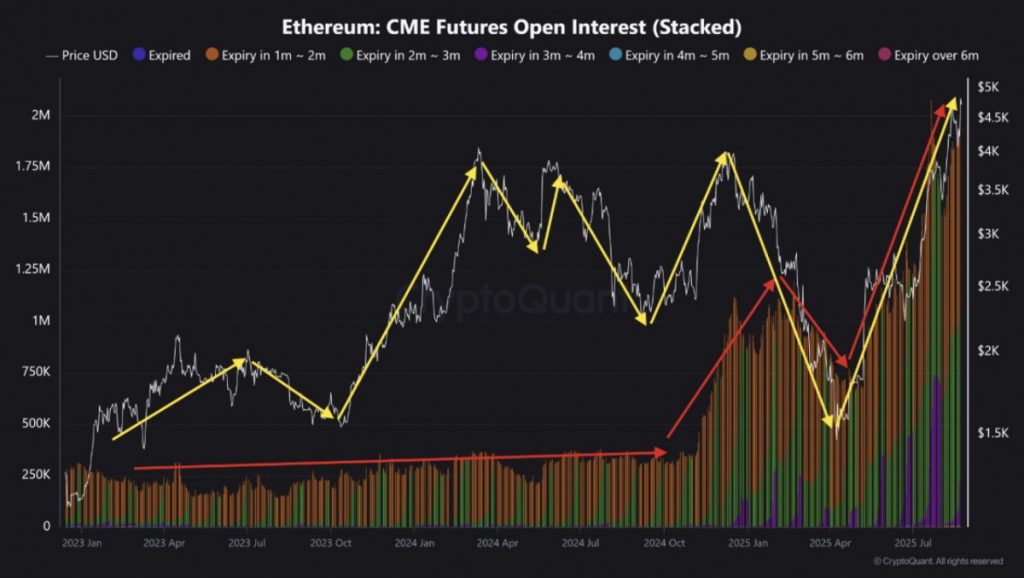

In contrast, Ethereum’s recent price increase has been accompanied by a clear rise in OI, signaling that its upward movement is supported by fresh liquidity inflows. This suggests that Ethereum is beginning to decouple from Bitcoin in terms of market participation and institutional support.

CryptoMe highlighted that CME Open Interest data should be considered alongside CFTC Commitment of Traders (CoT) reports, with particular attention to filtering the positions of large speculators. Even without this adjustment, the overall Open Interest presents a clear picture of market dynamics.

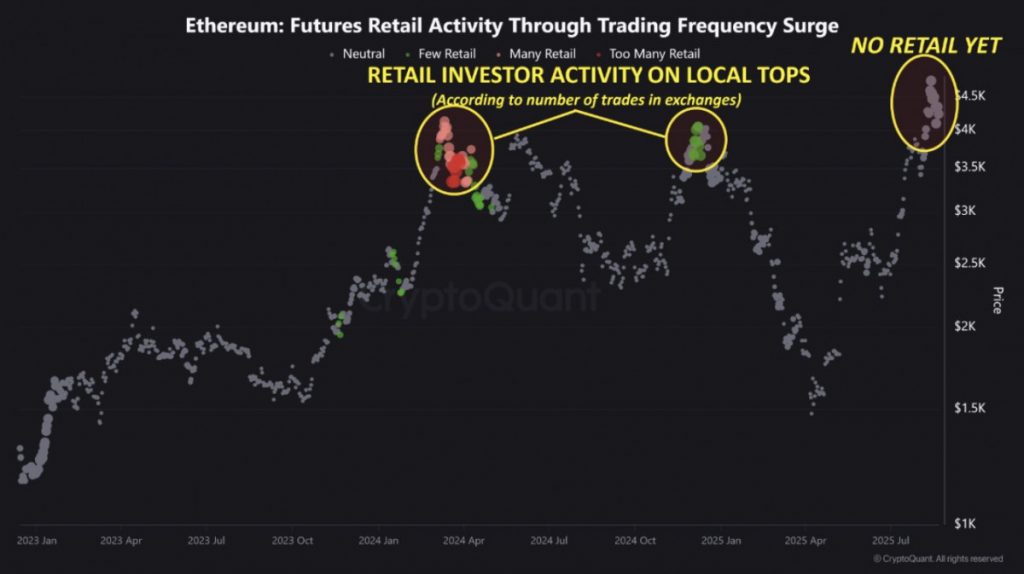

Additionally, data from centralized exchanges indicates that retail investors have not yet significantly entered the market. Typically, retail activity peaks near market tops, providing exit liquidity for larger participants. In the current rally, the absence of substantial retail involvement suggests that Ethereum’s upward movement is supported by stronger fundamentals and may be considered more sustainable.

Ethereum Surges 7% As Institutional Flows Shift From Bitcoin

As of this writing, Ethereum is trading at $4,607, marking a 7.15% increase over the past 24 hours, with a high of $4,947 and a low of $4,080. In contrast, Bitcoin is trading at $111,685, down 3.02% over the same period, reaching a high of $117,370 and a low of $111,479.

Bitcoin experienced a decline over the weekend following a brief rally, with analysts noting that large holders appear to be reallocating positions from Bitcoin to Ethereum. The recent drop comes after Bitcoin surged above $117,000 last Friday, a movement partially influenced by US Federal Reserve Chair Jerome Powell’s comments at Jackson Hole regarding a potential interest rate cut in September.

Furthermore, in recent weeks, institutional investors have also shown a preference for Ethereum, with spot Ether ETFs seeing larger inflows compared to Bitcoin ETFs, reflecting a broader trend of capital shifting toward Ethereum.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Alisa, a dedicated journalist at the MPost, specializes in cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a keen eye for emerging trends and technologies, she delivers comprehensive coverage to inform and engage readers in the ever-evolving landscape of digital finance.

More articles

Alisa, a dedicated journalist at the MPost, specializes in cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a keen eye for emerging trends and technologies, she delivers comprehensive coverage to inform and engage readers in the ever-evolving landscape of digital finance.