CryptoQuant CEO: Bitcoin Bull Market Begins, Mirroring 2020 Cycle

In Brief

Ki Young Ju shared an analysis suggesting that the current Bitcoin bull market is beginning, resembling the 2020 cycle.

CEO of CryptoQuant, a company specializing in cryptocurrency market data analytics, Ki Young Ju, shared an analysis suggesting that the current Bitcoin bull market is beginning, resembling the 2020 cycle.

According to Ki Young Ju, on-chain data indicating whale accumulation has proven accurate, and the reasons behind this accumulation are becoming clearer. In 2020, Bitcoin remained around $10,000 for six months with high on-chain activity, which later turned out to be linked to over-the-counter (OTC) deals. Similarly, despite limited price volatility in the current market, on-chain activity is high, with approximately $1 billion being added daily to new whale wallets. These additions are likely tied to custody purposes.

The analyst also highlights that mining costs have doubled following the most recent Bitcoin halving. Ki Young Ju noted that this creates upward pressure on prices to ensure mining profitability. A parallel is drawn to the 2020 halving when mining costs similarly increased but were soon offset by a parabolic bull run, which not only covered costs but also brought profitability.

Additionally, he pointed out that many traders are currently shorting Bitcoin, which is contributing to a potential short squeeze, fueling the bull market. He referenced a similar pattern from late 2020 when traders shorted Bitcoin during the price discovery phase, inadvertently driving the bull run through short squeezes.

Discussing year-over-year Q4 performance following Bitcoin halvings, Ki Young Ju noted that in the previous halving cycle, the bull rally commenced in Q4. He suggested that whales are unlikely to allow Q4 to pass with flat year-over-year performance, indicating potential market activity.

He further compared the current recovery, consolidation, and expansion phases with those from four years ago, observing similarities. During the 2020-2021 cycle, Bitcoin rose from $3,000 to $9,000 during the recovery phase, from $9,000 to $19,000 in the run-up to the previous all-time high, and from $20,000 to $68,000 during the full bull market. Similarly, in the 2023-2024 cycle, Bitcoin has moved from $15,000 to $45,000 during the recovery phase, from $45,000 to $68,000 in the lead-up to the prior all-time high, and continues to grow in the ongoing bull market phase.

Bitcoin Surges Past $97,000, While ETF Inflows Record $750M Inflows

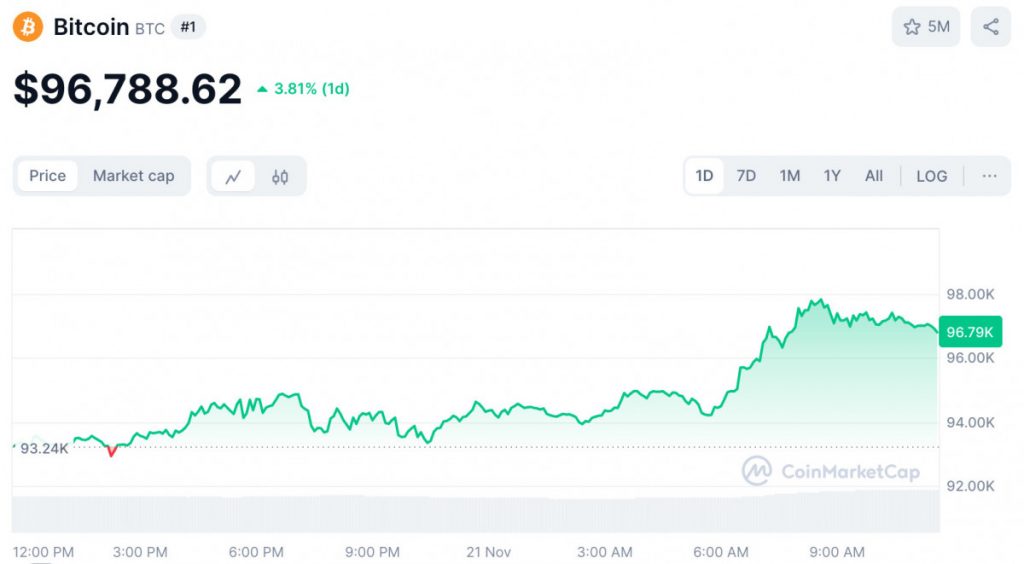

As of the time of writing, Bitcoin is priced at $96,788, marking a 3.81% increase over the past 24 hours. The cryptocurrency’s 24-hour price range is between a low of $92,926 and a high of $97,813. Bitcoin’s market capitalization is currently $1.92 trillion, with a 24-hour trading volume exceeding $90.4 billion. Its market dominance stands at 60.34%, According to data from ConMarketCap.

As per SoSoValue, Bitcoin Exchange-Traded Funds (ETFs) saw inflows of nearly $750 million on Wednesday. Among these, BlackRock’s Bitcoin ETF (IBIT) received $627.7 million in inflows.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Alisa, a dedicated journalist at the MPost, specializes in cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a keen eye for emerging trends and technologies, she delivers comprehensive coverage to inform and engage readers in the ever-evolving landscape of digital finance.

More articles

Alisa, a dedicated journalist at the MPost, specializes in cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a keen eye for emerging trends and technologies, she delivers comprehensive coverage to inform and engage readers in the ever-evolving landscape of digital finance.