Crypto Weekly (Mid-July 2025): Market Pauses, Whales Stir, Toncoin Trips Over A Golden Visa

In Brief

Markets showed signs of cautious optimism this week, with Bitcoin and Ethereum stuck in consolidation despite positive developments, while Toncoin’s rally was cut short by controversy over a false UAE visa claim.

Hey traders – another week gone, and here’s what stood out to us at MPOST. It’s been one of those weeks where the market feels both alert and oddly indifferent. Prices didn’t explode, but they didn’t unravel either. There’s motion, but not momentum – the market’s first leaning forward, then second-guessing itself. You look at the charts and you see the potential. Then you look at the news and, depending on the headline, you’re either cautiously intrigued or rolling your eyes.

We’ve been watching it closely, and the feeling we keep coming back to is “pre-breakout jitters”. You’ve got Bitcoin circling the same key level for the third time and never breaking those. Ethereum quietly repositioning itself, as if preparing for something that hasn’t been named yet. And Toncoin gave us a bit of a drama to put it mildly.

So let’s walk through what’s been happening – and what it might be setting up.

Bitcoin (BTC)

Bitcoin’s spent the better part of the week meandering in a fairly tight range between $105K and $110K – teasing a breakout first, then rejecting it, then trying again, pulling baсk – you get the idea. It’s that annoying kind of price action that’s neither bullish enough to chase, nor bearish enough to fear. As of now, we’re hovering around $109K, which is not nothing, but not exciting either.

So what’s keeping things in this limbo state? Well, for starters, the U.S. jobs report on July 3 came in hotter than expected – which pretty much shoved any dreams of a near-term Fed rate cut right off the table. Rate-sensitive markets (and yes, that includes crypto whether we like it or not) didn’t love that. As a result, risk-on appetite cooled, bond yields crept up, and Bitcoin, despite its big new ETF following, just kind of froze.

Then there’s the weird whale wallet saga. Out of the blue, a 14-year-dormant address holding 80,000 BTC ($8.6B!) lit up, and the internet briefly lost its mind. The community naturally rumored Satoshi’s return. Turns out, it’s probably not him (again), but moments like this usually spook the market more than excite it.

On the other hand, the macro narrative isn’t entirely bleak. Trump’s “Big Beautiful Bill” passed without the feared anti-crypto tax bits, and analysts think the massive debt expansion baked into it could end up being Bitcoin’s best friend long-term.

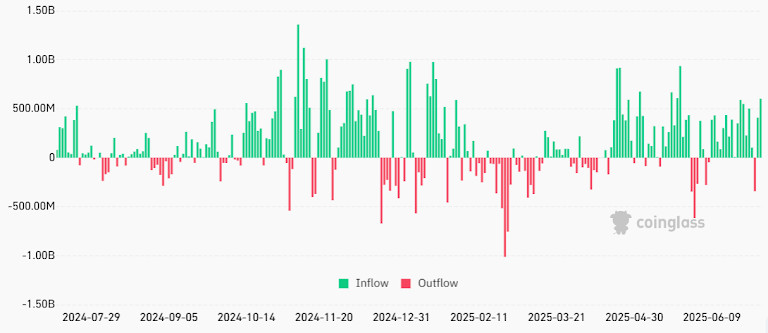

We’re also seeing the quiet continuation of ETF inflows (15-day streak broken, but momentum’s still alive), plus Michael Saylor’s Strategy scooped up another half-billion worth of BTC. So it’s not like nobody’s buying.

Where this leaves us? Pretty much where we started. Still rangebound, still waiting. But hey – the more time spent flirting with $110K without falling apart, the better the odds of a proper breakout later. Unless, of course, some whale decides to sneeze and dump 10,000 BTC on us tomorrow.

Ethereum (ETH)

If you look at Ether’s price action closely, you’ll notice that it was pretty much the spitting image of Bitcoin’s. All we got this past week we had a slow, deliberate climb back above the 50 SMA on the 4-hour chart. As we speak, price is drifting near $2,570, which isn’t fireworks-worthy, but definitely a marked improvement over last week’s shaky $2,400 zone. RSI is perking up too, heading toward 60. It’s not quite overbought, but it’s got that look of something warming up.

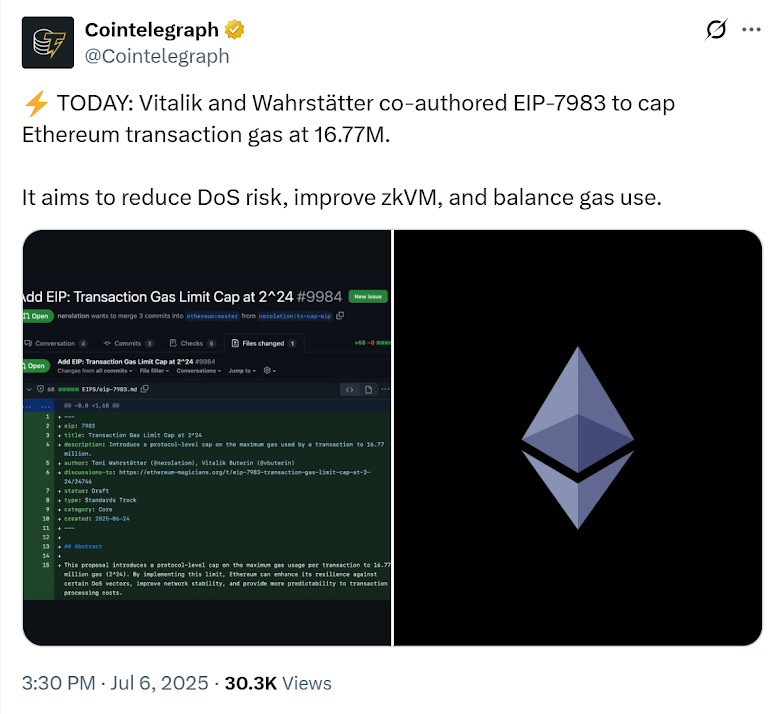

Narratively, ETH had a bit of a moment thanks to Vitalik, who proposed a new gas cap (EIP-7983) that could help stabilize the network under load. Wonky, sure, but also pretty important for Ethereum’s long-term viability, especially if the ecosystem’s serious about scaling with zero-knowledge rollups and onboarding institutions.

And speaking of institutions – BitMine just threw $250 million into an ETH treasury. That’s a pretty loud signal from a company that used to be Bitcoin-only.

There’s also increasing chatter around ETH spot ETF approval odds. If Bitcoin’s already got the green light and is outperforming legacy ETFs in revenue (yes, BlackRock’s BTC fund is now bigger than its S&P 500 fund in yield), why not Ether next?

But again, ETH’s not moving in a vacuum. It still dances to Bitcoin’s rhythm. As long as BTC stays stuck in consolidation mode, ETH probably does too – just with slightly more grace and fewer sharp edges.

Summing up, if Bitcoin finally breaks above $110K, ETH could punch through $2,700 and not look back. If not, it’s more of the same – slow grind, low volatility, and watching gas fees like a hawk.

Toncoin (TON)

For ton, the week started with a bang and ended with a facepalm. After slowly building momentum into early July, Toncoin launched itself toward $3.05 – which looked like a legitimate breakout. But then came the whole “golden visa” drama.

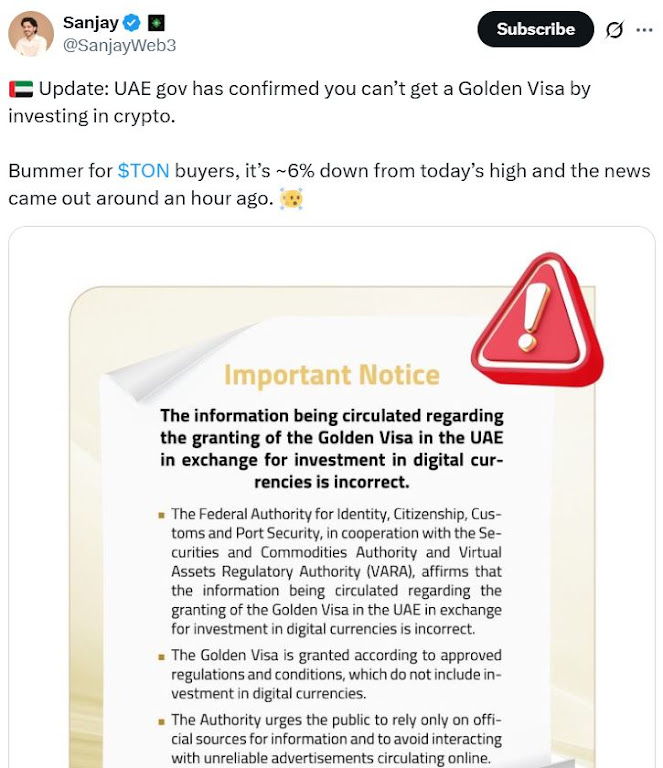

In short: The TON Foundation announced a new partnership with the UAE, claiming that anyone staking $100K worth of TON for three years would become eligible for a shiny 10-year golden visa. For about 12 hours, the market loved it. And then the UAE government flatly denied the whole thing. Said it was completely false. Cue instant selloff, and TON tumbled right back under $2.85.

Technically, the chart now looks more confused than decisive. Price is sitting below the 50 SMA, RSI has dropped to 47-ish, and that impulsive breakout candle now just looks like the kind of thing people wish they hadn’t aped into.

That said – it’s not all doom and gloom. Under the hood, TON continues to evolve. A major core update slashed transaction finality from 30 seconds to under five.

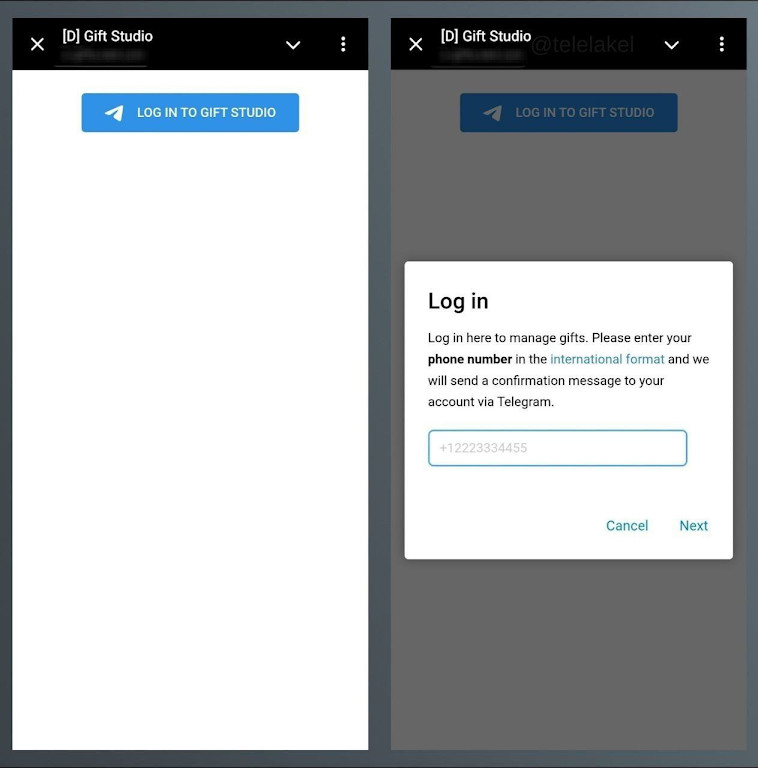

Telegram dropped new NFT monetization features for channel owners, collectibles integration, and a few whispers about upcoming partnerships that could be pretty impactful. If this were any other chain, the tech story would probably be the main headline – but in TON’s case, the UAE frictions are kinda stealing the spotlight right now.

And yes, it’s still shadowing Bitcoin and ETH. There’s no denying it: TON’s flow of capital, sentiment and even volatility is downstream from the majors. So, our short-term view is: if TON claws back above $2.95 on solid volume, that would undo a lot of damage. Otherwise, expect some messy consolidation while traders decide whether to forgive the whole UAE embarrassment or not.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Alisa, a dedicated journalist at the MPost, specializes in cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a keen eye for emerging trends and technologies, she delivers comprehensive coverage to inform and engage readers in the ever-evolving landscape of digital finance.

More articles

Alisa, a dedicated journalist at the MPost, specializes in cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a keen eye for emerging trends and technologies, she delivers comprehensive coverage to inform and engage readers in the ever-evolving landscape of digital finance.