Crypto Weekly: Bitcoin Nears $100K, Ethereum Gains Traction, and TON Surges with Key Upgrades

In Brief

Bitcoin News & Macro

As ever, Bitcoin is stealing the spotlight this week, turning heads all across the market. Spot Bitcoin ETFs pulled in a jaw-dropping $1.7 billion in fresh inflows, marking the sixth straight week of gains and pushing total assets under management to $95.4 billion. So, institutional demand is clearly on the rise.

Source: SoSoValue

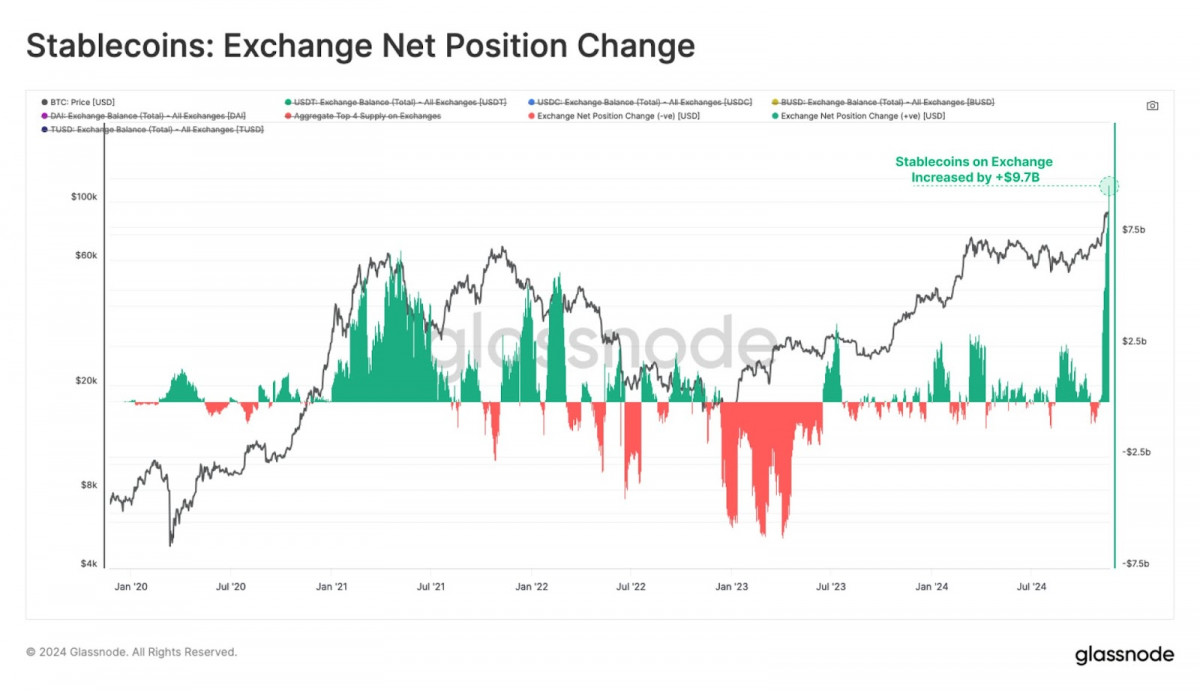

At the same time, Bitcoin smashed through the $99,000 barrier, posting a record 40% monthly candle. The rally is largely driven by the promise of a crypto-friendly U.S. administration under President-elect Donald Trump. Analysts are buzzing with talk of six-figure valuations before the year wraps. Overall, liquidity is pouring into the market as stablecoin inflows hit a record $9.7 billion this month.

Source: Leon Waidmann

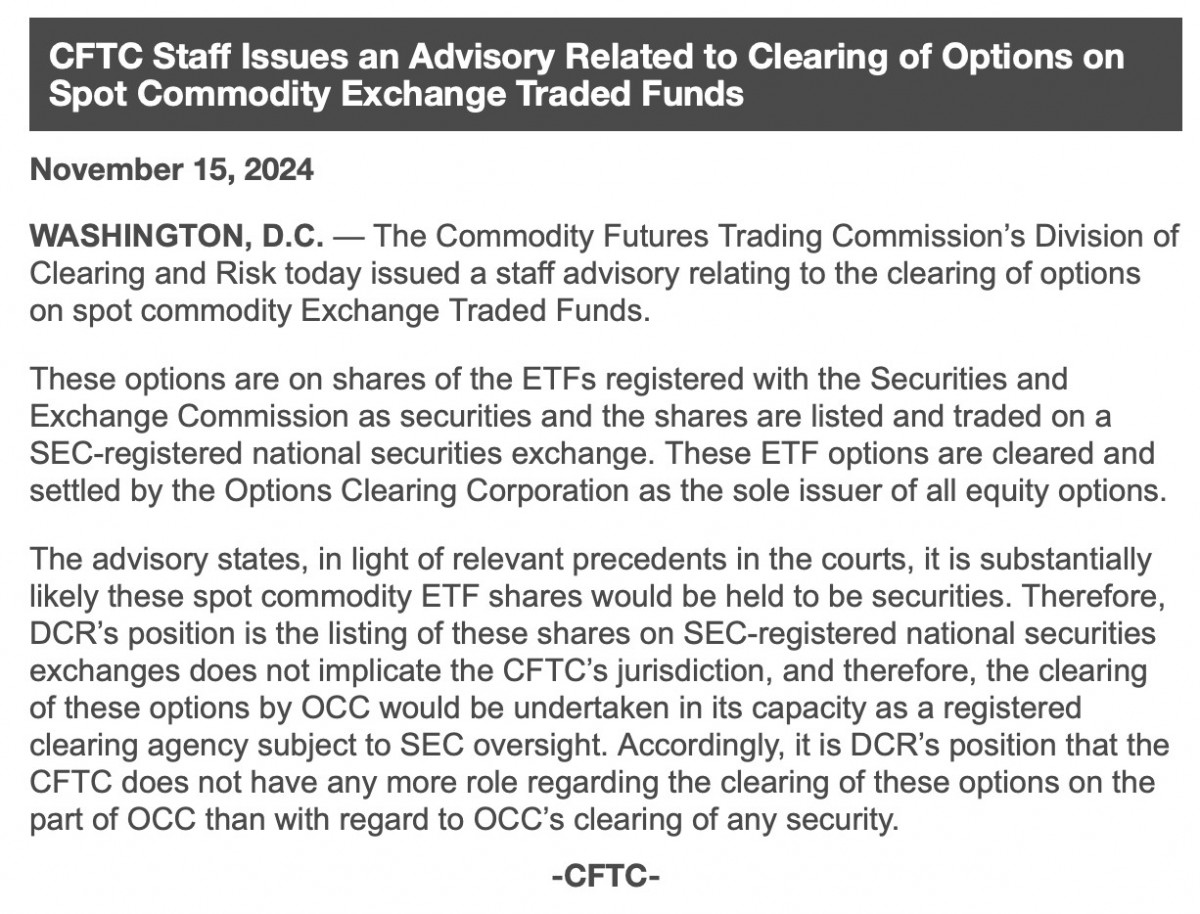

Regulators are also adding to the narrative. The Commodity Futures Trading Commission (CFTC) endorsed tokenized trading collateral in a recent report. This could make Bitcoin a game-changer for fixing inefficiencies in traditional markets.

Source: CFTC

Still, not everyone is jumping on the moonshot bandwagon just yet. On-chain metrics are flashing yellow, with elevated funding rates and large whale movements hinting at a possible local top.

Source: VanEck

The market’s mood remains upbeat, but seasoned traders know it’s wise to keep one eye on the risk dashboard as this rally unfolds.

BTC Price Analysis

In terms of price action, Bitcoin spent the week grinding just below the critical $100,000 mark, consolidating after the recent explosive rally.

Source: TradingView

On the daily chart, price action has been locked in a range between $96,500 and $99,000, with buyers consistently defending the $96,500 level. This support aligns with the 20-day EMA, highlighting bullish control of the trend. Last week’s breakout above $92,000 flipped a key resistance zone into support, setting the stage for a potential push into uncharted territory.

Source: TradingView

Zooming into the 4-hour chart, Bitcoin has carved out a horizontal channel, showing clear signs of accumulation around $96,500. The upper boundary at $99,000-$100,000 has acted as a magnet for profit-taking, but long lower wicks suggest dip buyers are stepping in aggressively. The consolidation has a bullish flag feel, hinting at another leg up if the $100,000 resistance is breached. However, lingering RSI divergence and a breakdown below $96,500 could spark a retracement toward $92,000. All eyes remain on whether the bulls can reclaim $100,000, a move that could ignite FOMO and send BTC soaring further into blue-sky territory.

Ethereum News & Macro

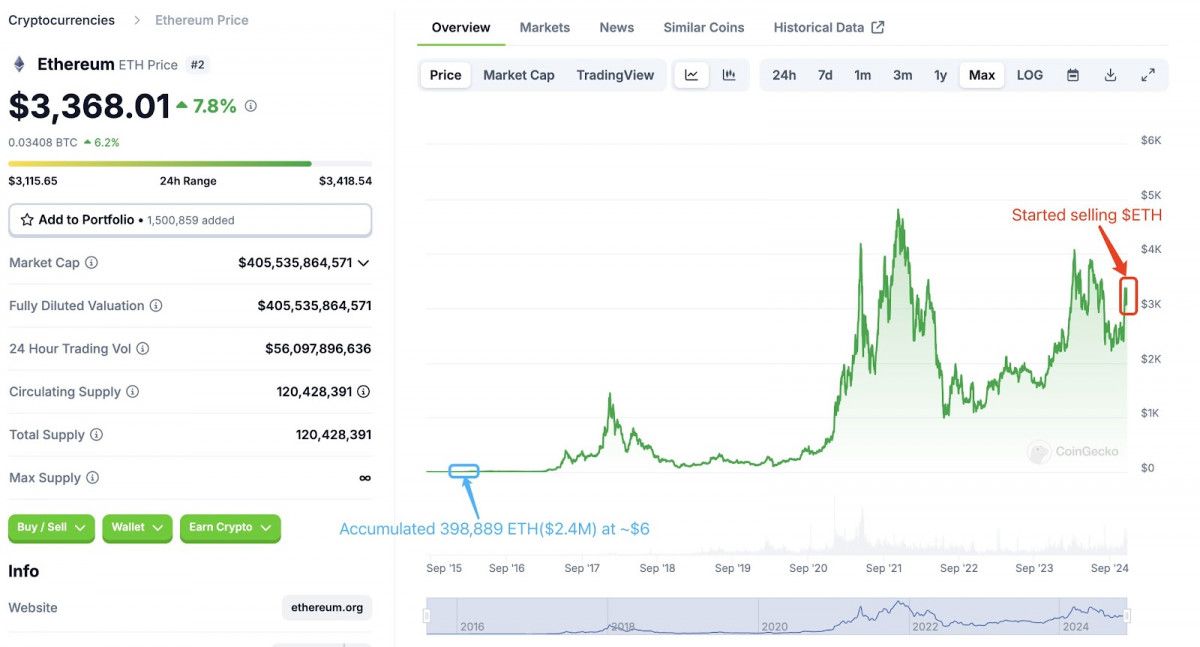

Ethereum also made waves this week, holding its ground despite a hefty $1.3 billion whale sell-off. The market’s vibe is clear: confidence in Ethereum’s upward momentum is building fast.

Source: Lookonchain

On the adoption front, Ethereum’s DApp ecosystem is on fire, with activity jumping 38% in just a month.

Source: DappRadar

This surge underscores growing traction across decentralized platforms, fueling chatter about a potential price breakout.

Adding fuel to the fire, ZA Bank – Hong Kong’s largest virtual bank – is now letting retail users trade Ether and Bitcoin. This move could channel fresh liquidity from Asia straight into the ETH market.

That said, the ride may not be smooth. Analysts warn a price correction could hit before Ethereum rallies to a projected $20,000 peak by 2025. Still, institutional and retail interest – dubbed “smart money” – is staying strong, giving ETH a sturdy foundation. While near-term volatility looms, the mid-term outlook paints a bullish picture.

ETH Price Analysis

Ethereum has also flexed its bullish muscles this past week, rallying from the $3,160 support after a tight consolidation phase.

Source: TradingView

Early on, ETH moved sideways between $3,160 and $3,200, signaling accumulation as buyers absorbed selling pressure. A breakout soon followed, with a bullish engulfing candle driving the price past $3,300 and up to $3,420. The move formed an ascending channel, showcasing a steady, controlled uptrend. Daily closes above the 20-EMA reinforced the bullish structure, while the 4H chart’s 50-EMA provided consistent dynamic support.

Source: TradingView

Now, ETH is testing resistance near $3,400-$3,420, consolidating with smaller-bodied candles as the market takes a breather. A daily close above this level could clear the path to $3,500 and higher, while a rejection might send prices back toward the $3,160-$3,200 zone. The RSI on the 4H chart remains bullish, leaving room for further upside without signs of exhaustion. With strong demand and limited sell-offs, Ethereum’s medium-term outlook remains upbeat, signaling that buyers are firmly in control.

Toncoin News & Macro

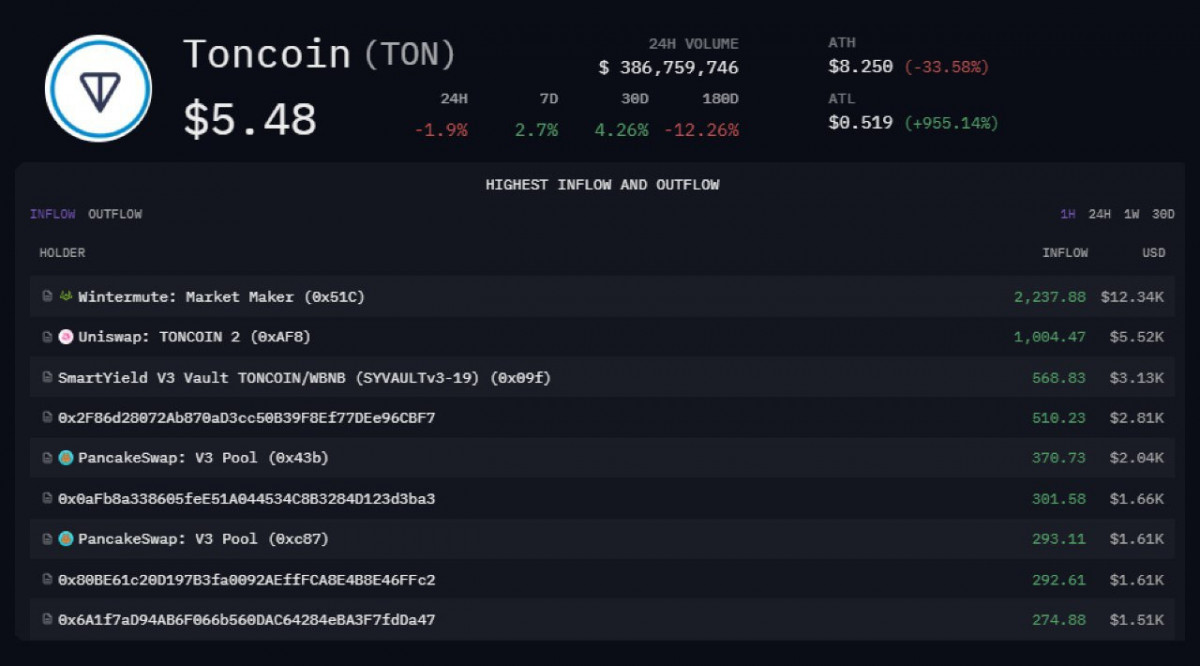

The TON ecosystem has been buzzing this past week. A standout move was the integration of TON’s on-chain data into Arkham, which is set to give traders and institutions sharper tools to dissect trading activity and track large transactions.

Source: Arkham

Another big headline came from NEUTON Protocol, a TON-based project backed by none other than NVIDIA. With a token presale kicking off at rock-bottom prices and upcoming listings on exchanges like BitMart, CoinDCX, and MEXC, this is a clear signal that heavyweight players are starting to take TON seriously. NVIDIA’s involvement lends credibility and could spark fresh demand for Toncoin as investors take notice.

Source: NEUTON

On the DeFi front, TONCO’s debut as the first decentralized exchange on TON marks a pivotal moment. Supported by Algebra Labs, it comes with concentrated liquidity pools and a lof of promise for the TON ecosystem.

Source: TONCO

Capping it all off, Toncoin claimed the fourth spot among the most trafficked blockchains globally – a testament to its rising prominence.

Source: CoinMarketCap

This surge in visibility reinforces TON’s credibility and could translate into stronger market sentiment.

TON Price Analysis

On the price front, TON had a breakout week, with bullish momentum reclaiming key levels and driving prices higher.

Source: TradingView

Early consolidation around $5.50 set the stage for an ascending triangle breakout on both the daily and 4-hour charts, sparking a rally that smashed through $6.00 and peaked at ~$6.40. Strong buying volume fueled the move, signaling real demand, while the daily EMAs confirmed the uptrend as the price stayed above both the 20-EMA and 50-EMA. After the rally, a textbook pullback retested $6.00 as support, holding steady and reaffirming buyers’ control.

Source: TradingView

Now, TON is consolidating near $6.20 in what looks like a bullish flag, hinting at a potential push toward the $6.40-$6.60 zone. The reclaim of $5.50 as support and the solid defense of $6.00 have flipped the market structure bullish, setting up a strong base for further gains. If $6.00 holds, the trend remains firmly in favor of the bulls, with dips likely to attract buyers. A breakout above $6.40 could ignite the next leg up, while a slip below $6.00 may invite retests of lower levels like $5.50 – but overall, the momentum is clearly leaning upward.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.