Crypto Shift on Campus: How 40% of South Korean Students Are Pushing Crypto Investment in the Digital Age

In Brief

A recent poll in South Korea revealed that 40% of university students are investing in cryptocurrencies alongside foreign stocks, indicating a growing trend in young investors.

Young investors are shifting away from standard financial solutions and toward cryptocurrencies and alternative assets in greater numbers. According to a recent poll, 40% of university students in South Korea are investing in cryptocurrencies in addition to foreign stocks, demonstrating how prominent this trend is there.

The South Korean Youth Perspective

South Korean university students’ investment habits are revealed via a study done by Korea Investment and Securities between June 11 and June 22. 72% of respondents to the research, which included over 400 participants, said they were investing in foreign equities, mostly in firms that were listed on the New York Stock Exchange (NYSE). Eighty-nine percent of these investors said they planned to increase their NYSE holdings in the near future.

The fact that 40% of respondents said they invested in both equities and cryptocurrency is perhaps the most startling result. This data is consistent with a more widespread worldwide trend among young individuals to indicate a greater interest in digital assets.

When asked what their main reason was for investing in cryptocurrencies, more than half of the respondents said it was the high predicted profits. Furthermore, one out of five students said that they were confident in the value of these digital assets in the future.

Photo: Finra Foundation

The poll also revealed that South Korean students had little interest in other Asian stock markets. Merely 5% of respondents stated they had assets in Japanese equities, while only 3% indicated holdings in Chinese markets.

Students Increasing Investment Scale and Risk

The stats reveal that South Korean students are investing more frequently and bigger sums of money than those in a comparable research done two years prior. Merely 18% of participants in the prior survey reported having invested for a duration of three years or more. Now that this percentage has increased to 54%, there has been a noticeable rise in students’ long-term investing activity.

The amount invested has likewise increased in size. With 40% investing more than $7,180, the majority of respondents said they had invested more than $3,590. The fact that 17% of respondents had taken out loans to support their stock and cryptocurrency investments is the most alarming result.

Global Trends in Young Adult Investing

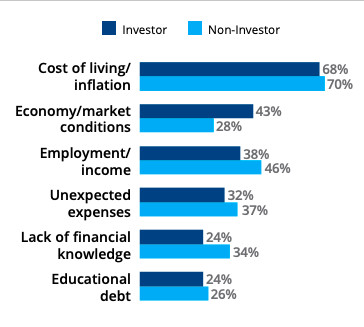

The patterns of investment that have been noted in South Korea are not unique. An increasing number of young adults worldwide, especially those belonging to Generation Z (those born in the late 1990s and early 2000s), are demonstrating a keen interest in alternative investments and cryptocurrencies.

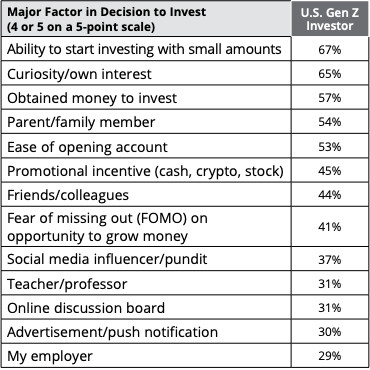

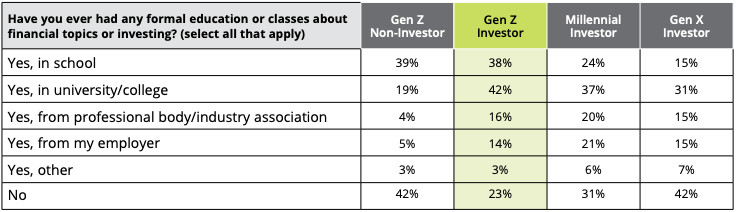

According to a joint survey by the Investor Education Foundation of the Financial Industry Regulatory Authority and the CFA Institute, crypto is the most popular investment among Gen Z investors in the US. According to this survey, 55% of Gen Z investors presently have cryptocurrency holdings in their portfolios. Exchange-traded funds, mutual funds, individual stocks, and non-fungible tokens come next.

Photo: Finra Foundation

Young investors’ preference for individual stocks and cryptocurrencies contrasts sharply with earlier generations’ investing practices. For example, the study discovered that among Gen X investors (those born between 1965 and 1980), mutual funds were the most popular asset class, with cryptocurrencies coming in third.

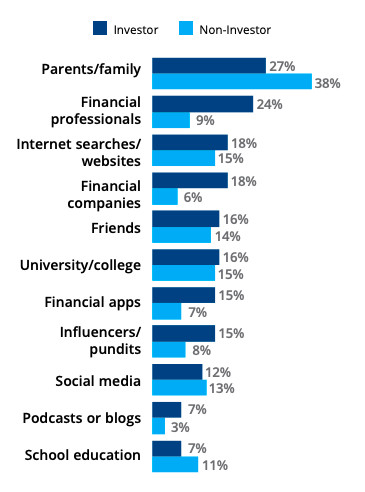

Factors Driving Cryptocurrency Adoption Among Young Investors

Young investors’ increasing interest in cryptocurrency is a result of several causes. Young adults have grown up in a time of fast technology innovation, especially those in Generation Z. They are more inclined to adopt new financial technology like cryptocurrency as they are at ease with digital devices.

Many young individuals show distrust towards conventional financial institutions, having seen financial crises and market volatility firsthand. Because they are decentralized, cryptocurrencies are appealing to anyone looking for alternatives to traditional banking and investing systems.

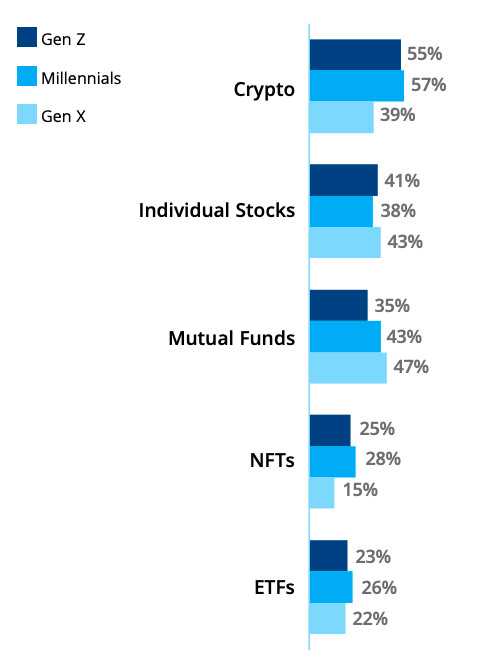

Photo: Finra Foundation, Sources of Financial Information That Gen Zs Trust the Most

Despite the considerable risk involved, youthful investors are drawn to cryptocurrencies because of the possibility of large profits. Although dangerous, the fluctuating nature of cryptocurrency markets presents a chance for major benefits. With very tiny sums of money, young people may now invest in cryptocurrencies more easily, thanks to the growth of investing applications and platforms. For people with little resources, investment has become more accessible in this case.

Students frequently go to social media sites for information and advice about investing. The appeal of cryptocurrencies among this group has probably been aided by the abundance of material about them on these sites. Furthermore, cryptocurrencies are seen by younger investors as an additional tool to diversify their portfolios outside of conventional equities and bonds.

Concerns and Risks of Such Investments

Although the rise of young people purchasing cryptocurrency points to a change in investing habits, it also brings up a number of issues. Prices of cryptocurrencies are often unstable. These assets’ values can change greatly over brief periods of time, which might result in losses for first-time investors. Due to the lack of regulation in the crypto market compared to regular financial markets, individuals may be more susceptible to fraud and market manipulation.

Photo: Finra Foundation

Young investors may be overexposing themselves to high-risk investments without fully appreciating the possible implications, according to certain worries. It is especially concerning to see that some students are taking out loans to pay for their investments.

Financial troubles might result from this practice if investments don’t perform as predicted. Although cryptocurrencies are seen by investors as a type of diversification, portfolios that are overly dependent on them and individual companies may not be sufficiently diversified.

Expert Opinions and Recommendations

Experts and counselors in finance hold differing opinions about the trend of youths making large cryptocurrency investments. Some advocate caution, while others regard it as a logical progression of financial tactics in the digital era.

While cryptocurrency can have a place in an investor’s portfolio, particularly for individuals with a greater risk tolerance, Ted Jenkin, a certified financial planner, advises that exposure should be kept to a minimum. In general, he advises investors to keep their cryptocurrency holdings to a minimal portion of their portfolio.

Others stress the value of risk management and education. It is advised that novice investors diversify their portfolios, do due diligence on the assets they are purchasing, and refrain from making unfinancial investments.

The Movement’s Wider Effect on Financial Markets

Young adults’ changing investing preferences may have long-term effects on the financial system. Younger generations’ investing decisions may have an impact on asset prices and market movements as money passes to them.

The “2024 Study of Wealthy Americans” by Bank of America emphasizes this difference in investing approaches between generations. According to the survey, investors between the ages of 21 and 43 had much different portfolio allocations than those who were 44 and older. While older investors preferred traditional equities, younger investors maintained a much bigger part of their portfolios in cryptocurrency and alternatives.

Photo: Finra Foundation

Younger investors are increasingly prominent in this move away from conventional investing methods, such as the 60/40 portfolio, which consists of 40% bonds and 60% stocks. The investing environment may change as a result of these investors’ increasing wealth and market power, as well as their inclination for cryptocurrencies and alternative assets.

Although the US and South Korea have received most of the attention, young adults worldwide are investing in cryptocurrency. Cryptocurrencies are becoming more and more popular as an investment choice in many nations, especially those with youthful, tech-savvy communities.

For example, despite legislative obstacles, bitcoin acceptance has been high in Nigeria, a nation with a sizable youth population. Young investors have also shown a strong interest in cryptocurrencies in several Southeast Asian nations.

However, national approaches to cryptocurrency regulation differ greatly, which may have an effect on adoption rates and investment trends. While some nations have welcomed cryptocurrencies, others have enacted stringent laws or outright banned them.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.