Crypto Dream Turned Nightmare: The Forcount Ponzi Scheme’s Devastating Impact on Thousands of Investors

In Brief

Juan Tacuri, a key proponent of the Forcount cryptocurrency project, has admitted to conspiring to commit wire fraud, revealing the intricate Ponzi scheme that defrauded millions of victims.

Juan Tacuri, a prominent proponent of the deceptive Forcount cryptocurrency project, entered a guilty plea to the charge of conspiring to conduct wire fraud. Tacuri’s admission of guilt lifts the veil on the complex worldwide Ponzi scheme that defrauded millions of victims, a large number of them from Spanish-speaking populations in the US.

The Forcount/Weltsys Cryptocurrency Ponzi Scheme

When Forcount was first established in 2017, it advertised as a cryptocurrency mining and trading business, offering staggering profits to investors who purchased its crypto-related products. Tacuri and other marketers claimed that the company’s alleged cryptocurrency trading and mining activities would quadruple investors’ money in as little as six months while making false promises of daily gains.

In fact, Forcount was a traditional Ponzi scam that used money collected from new victims to pay returns to previous investors. It had no genuine cryptocurrency activities. According to U.S. Attorney Damian Williams, Tacuri took in millions of dollars from the victims—money they could not afford to lose—and lavishly spent it on real estate and opulent merchandise.

Tacuri’s Role as a Lead Promoter

Tacuri was instrumental in enticing victims into the fraudulent operation by deceit and hype as one of Forcount’s most active advocates. In order to generate interest and provide the impression of legitimacy, he organized opulent expos around the United States while flaunting his ill-gotten fortune and dressing in fashionable clothes. Tacuri specifically targeted Spanish-speaking populations, highlighting concepts of “financial freedom” to persuade them to make investments.

The victims who invested cash, cryptocurrencies, or paid checks and money orders to the scheme’s organizers, such as Tacuri, were able to track their “profits” as they accumulated on web portals. However, when complaints about excuses, delays, and hidden costs rose, the majority eventually lost their ability to withdraw payments. Forcount started marketing a new crypto token called “Mindexcoin” that Tacuri had fraudulently promised would be widely accepted and valued, but in reality, it was worthless since the scam ran out of money from new recruits.

Forcount completely stopped making payouts by 2021 when the Ponzi scheme failed. After investing their life savings in pursuit of the cryptocurrency illusion, many victims found themselves in financial devastation when Tacuri and other marketers vanished from the scene.

Tacuri’s Punishment and the Warning for Investors

Tacuri has pleaded guilty to the wire fraud conspiracy charge, and as a result of his important part in the $8.4 million Ponzi scam, he may spend up to 20 years in jail. He gave up real estate bought with the illicit Ponzi earnings and approximately $4 million in victim cash as part of his plea agreement.

U.S. Attorney Williams issued a warning, stating that his office would not let up on Tacuri and other Ponzi schemers, particularly when they prey on average, hard-working individuals who are in serious financial need. The indictment makes it very evident that individuals who deceive cryptocurrency investors will face harsh penalties and that authorities will be keeping a close eye on these scams.

The Mechanics of a Crypto Ponzi Schemes

The Forcount case is a prime example of the traditional Ponzi scheme dynamics modified for the cryptocurrency frenzy and digital era. Ponzi schemes are essentially very straightforward in nature: they take money from new victims and use it to pay out imaginary gains to original investors, who are promised continually high investment returns.

A percentage of the money that keeps coming in from promoters who keep bringing in new investors and profiting themselves in the process is poured into creating the appearance of a successful firm. Yet, since there is no real underlying product or source of income, the plan eventually runs out of money as participant withdrawals become more common, recruiting slows down, and fresh investments dry up.

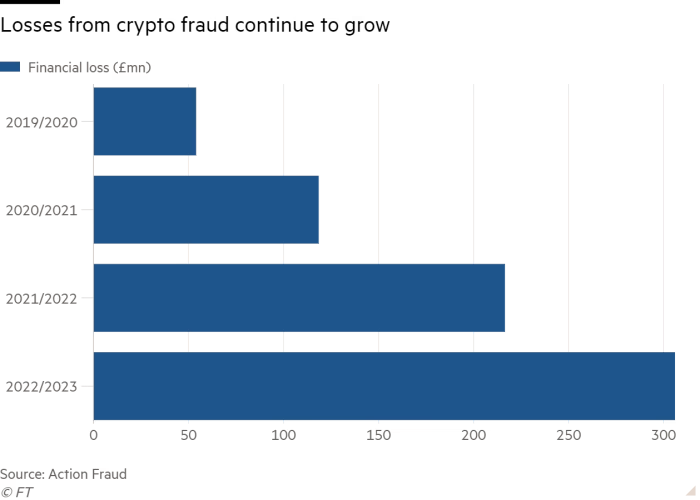

Photo: Action Fraud

Ponzi schemes draw investors hoping to make large profits from these new digital asset classes by taking advantage of the excitement and greed around cryptocurrencies, NFTs, and DeFi. They frequently invent whole new tokens, coins, or cryptocurrencies to act as investment vehicles and influence values through well-planned marketing campaigns.

These scams conceal the lack of real activities by passing off intricate crypto trading plans, mining operations, or DeFi protocols as profitable moneymaking machines. They provide incentives for multi-level marketing systems, paying referrers to quickly grow the incoming cash pyramid.

These scams conceal the founders’ lack of actual monitoring or audits by highlighting decentralization, anonymity, and blockchain transparency as major selling features to further tempt potential victims. They also obscure financial flows using advanced crypto tumblers, mixers, and money laundering tactics. This is the reason asset recovery and tracing are difficult.

The idea is the same regardless of the terminology and technology used: raise money by marketing a fictitious investment opportunity, temporarily redistribute some of the proceeds to trick participants into thinking they are making a profit, and drain off the remaining funds for personal gain until the whole thing falls apart.

Crypto Ponzi schemes continue to pose a severe risk to investors despite increased enforcement efforts because of the industry’s confluence of excitement, greed, unregulated nature, and anonymity.

A Disturbing Rise in Ponzi Crypto Frauds

Ponzi, pyramid, and other cryptocurrency investment frauds have grown astronomically in number. The blockchain analytics company TRM Labs claims that in 2022 alone, at least $7.8 billion was misappropriated into these scams. Before going bankrupt, Australian cryptocurrency startup Blockchain Global stole $58 million from over 17,000 investors.

Indian owners of GainBitcoin were implicated in one of the biggest cryptocurrency Ponzi schemes, having defrauded people nationwide out of about $12.8 billion over a number of years. Before collapsing, HyperVerse, a large pyramid scam with headquarters in Australia and Hong Kong, deceived investors worldwide out of almost $1.9 billion.

Also, Airbit Club, a Ponzi scam that targeted the Latino population, was uncovered by US authorities in 2022 as a $100+ million scam and was shut down as one of the largest.

These are only a few of the more well-known incidents that have come to light; due to the anonymity of cryptocurrencies and the desire of ordinary investors to get wealthy, countless smaller Ponzi schemes are still operating and failing regularly without being discovered.

Even while Ponzi schemes eventually fail, the harm they do is severe: financial devastation, mistrust of cryptocurrencies, and a loss of faith in the veracity of digital assets. Notoriety collapses, such as Forcount is a warning for the general public when it comes to using blockchain technology.

The expansion of cryptocurrencies and DeFi in the future will necessitate the maintenance of integrity and user safeguards via excellent behavior. Profitability and innovation cannot come at the expense of continuing life-destroying programs. The way forward necessitates integrating ethics into the emerging digital economy of cryptocurrency, with unethical actors such as Tacuri being held accountable.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.