Crypto Carnage: The August Bitcoin Bear Run Explained

In Brief

Bitcoin News & Macro

One word: bloodbath. And nobody saw it coming… or did they? Let’s break it down.

Source: TradingView

As last week kicked off with high hopes, Bitcoin flirted with the $70,000 mark, buoyed by positive vibes and a surge in Ethereum-based ETF inflows. The buzz about a potential “macro summer” rally fueled dreams of new all-time highs by 2025. But as the week rolled on, the mood took a turn.

As July drew to a close, the air grew thick with tension. Whispers of Bitcoin hitting an “inflection point” swirled, driven by rising open interest and looming regulatory news. The market was on edge with the introduction of new ETF products and chatter about a Bitcoin Strategic Reserve Bill in the Senate. Optimism mingled with caution as global economic jitters and possible rate hikes started casting long shadows.

August 2 hit like a cold shower. Bitcoin tumbled below crucial support levels, nosediving from close to $70,000 to around $65,000. The catalyst was a wave of leveraged long positions that got liquidated, erasing over $600 million in value. The sudden drop sent shockwaves through the market, sparking fears of an even steeper drop. And, as fate would have it, those fears turned out completely justified.

As the market continued to unravel, Bitcoin sank further, bottoming out near $53,000. And – historians take note – It was the biggest three-day meltdown in the crypto space in a year, wiping a jaw-dropping $500 billion off the market cap. The culprits are likely a toxic mix of over-leveraged bets, macroeconomic anxiety, and overall regulatory uncertainty.

Analyst Peter Schiff came out with a grim prediction that, once the stock market opens, ETF holders are going to start selling as well, adding to the bearish drama. So, traders buckle up.

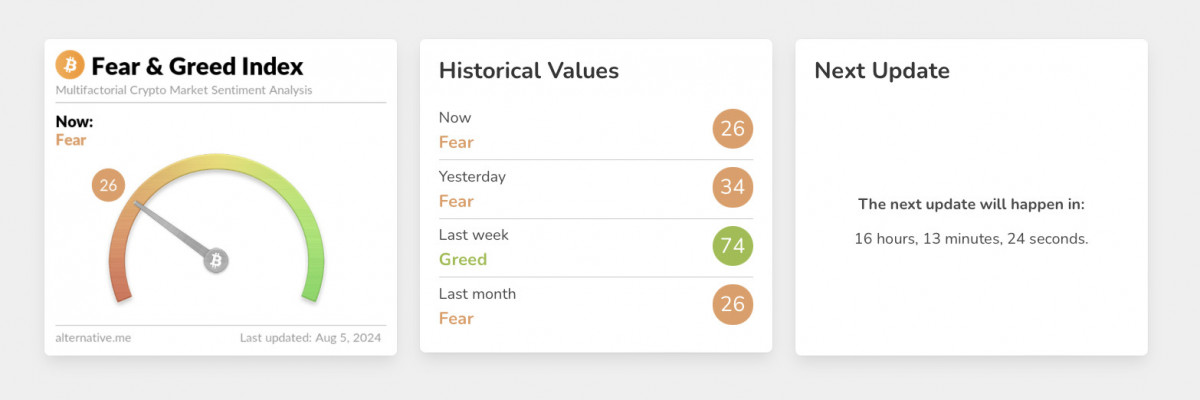

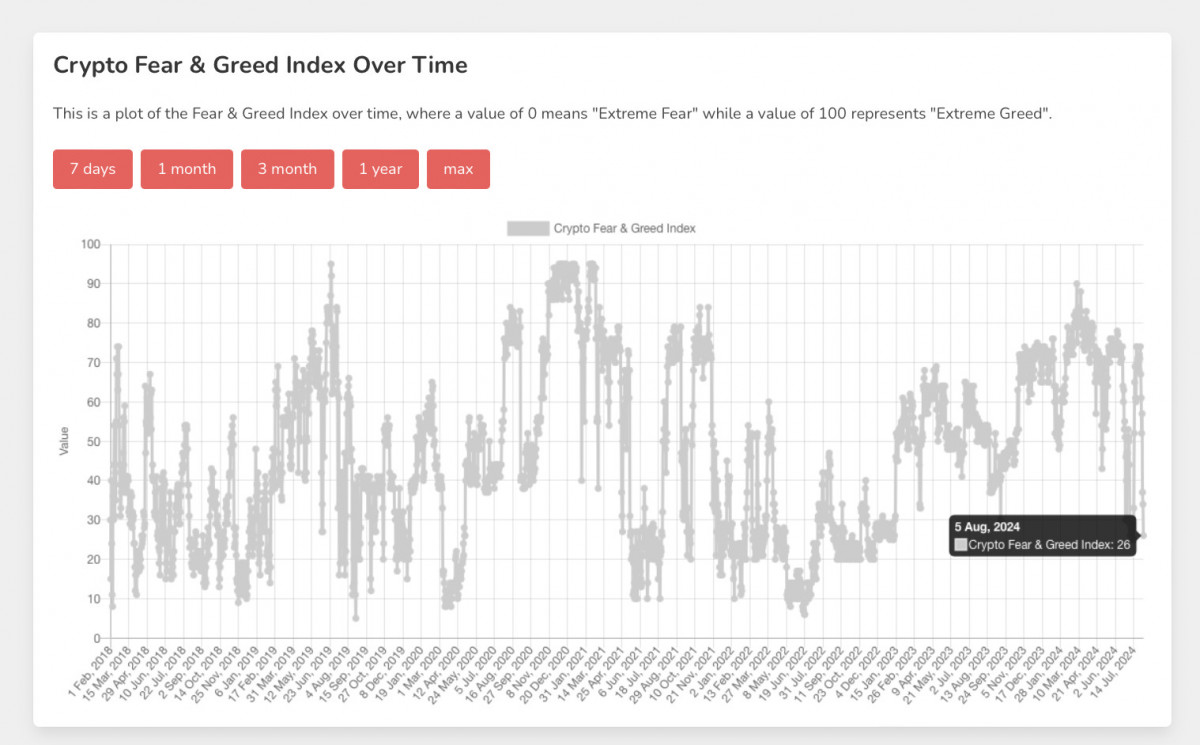

Source: Alternative.me

The Fear & Greed Index is showing – you guessed it – extreme fear, with the current value being around the lowest historical points. So, more action to come, eh?

Source: Alternative.me

As we speak, the market finds itself in deep red, and for now there’s no sign of recovery anywhere on the horizon. Bitcoin’s dominance is climbing as altcoins and stocks take a hit, leaving everyone wondering if we’ve hit bottom or if there’s more pain to come.

BTC Price Analysis

Now let’s zoom in on Bitcoin’s price action, (blue box on the charts). Let’s dive into the daily (1D) chart first.

Source: TradingView

At the beginning of the week, BTC made an ambitious run at the $70,000 mark, a significant resistance level that had been tested and rejected before. The initial surge looked promising, but it quickly unraveled into a classic fakeout. The rejection was swift and harsh, resulting in a cascade of drops that blew past previous support levels.

The $65,000 support, which had been a reliable floor, was smashed in a fierce sell-off. The daily EMAs tell the same story: the 20-day EMA crossed below the 50-day EMA, signaling a bearish trend. This so-called “death cross” accelerated the decline, showcasing the sellers’ strength. The sell-off didn’t just pause at $60,000, another key support; it plowed right through, with heavy volume indicating panic and forced liquidations.

Source: TradingView

Zooming in on the 4-hour (4H) chart, the decline looks even sharper, with little to no consolidation. A brief head-and-shoulders pattern popped up, with the neckline hovering around the $65,000 support. Once that gave way, the drop was relentless. The RSI tickled with overbought territory, but the bearish momentum was unstoppable. As we speak, we’re in some of the deepest oversold zones seen to date. Key levels like the $53,000 mark, which held strong during dips earlier this year, were revisited and quickly shattered.

The action around the weekly open was a big tell. After a feeble attempt to reclaim higher ground, the price closed much lower, setting a bearish tone. Daily closes kept hitting lower lows, highlighting a strong downtrend.

The $50,000 level is now a key battleground. Holding it could stop further losses, but if it breaks, we could see a drop to the $44,000 to $42,000 range. However, if the $50,000 level holds firm, we might see a relief rally, though any upward movement is likely to face tough resistance.

Ethereum News & Macro

Needless to say, Bitcoin’s crash absolutely dominated the market, and Ethereum has been tightly tethered to its big brother’s whims. Despite a flicker of hope with the launch of Ethereum ETFs, the enthusiasm quickly fizzled. Grayscale’s Ethereum Trust reported significant outflows, signaling a lack of strong investor conviction.

Source: SoSoValue

Even with some bright spots, like Celestia gaining ground in data storage, Ethereum couldn’t break free from Bitcoin’s gravitational pull. The crypto world’s attention was laser-focused on Bitcoin, leaving ETH and other altcoins in the shadows.

Adding to the gloom were unsettling headlines – like WazirX’s massive $266 million hack and ongoing regulatory uncertainties. These, coupled with the underwhelming reception of Ethereum ETFs, made ETH particularly vulnerable to the drop.

Technically, Ethereum desperately tried to hold the $2,860 support level. But as Bitcoin stumbled, Ethereum tripped right after, with selling pressure pushing prices further down.

The recent nosedive isn’t just a number on a chart; it’s a stark reminder of Ethereum’s dependency on Bitcoin’s moves. The “Ethereum following Bitcoin” narrative has never been clearer, and the plunge has left investors jittery, casting doubts on ETH’s short-term outlook.

ETH Price Analysis

In the daily chart, the blue box captures Ethereum’s sharp drop mirroring that of Bitcoin. Initially, ETH was clinging to the $3,000 mark, with $3,250 acting as a key support-turned-resistance from previous swings.

Source: TradingView

But as Bitcoin stumbled, Ethereum couldn’t hold its ground, tumbling past $2,860, a critical psychological and technical support level. The 20-day EMA’s slide below the 50-day EMA only confirmed the bearish vibe. We saw red candles stretching out, signaling not just a dip but a full-blown capitulation, worsened by Bitcoin’s deeper cuts.

Source: TradingView

On the 4-hour chart, the picture gets even starker. Ethereum was locked in a range between $3,250 and $2,860, bouncing within these bounds until it hit a wall – a strong bearish engulfing pattern that shattered the lower support. And, sure enough, the engulfing did happen, sending the price of ETH down into the long-forgotten yearly lows.

As of this writing, the price of ETH is dangling around $2,350 – that’s over 30% down since last Monday, with not a single higher high or higher low made during that time.

Now, when we compare Ethereum’s selloff to Bitcoin’s, one thing stands out. Bitcoin dropped like a stone, a straight plunge that rattled the market. Ethereum, on the other hand, seemed to hesitate, breaking down from a drawn-out consolidation phase. This suggests that even before the drop, Ethereum had its own set of issues – perhaps an underlying lack of confidence among traders. So, investors will likely re-asses how much Ethereum they should keep in the near-term.

The key $2,400 mark is now a line in the sand. If that doesn’t hold, $2,000 may be the next stop. Reaching back above $2,500-2,800 could signal a turnaround, but hey, we all know that things are looking heavy right now.

Toncoin News & Macro

Meanwhile, Toncoin had a pretty still week. Not much has happened save the odd integration and/or partnership here and there.

A major highlight was the integration news from CurioDAO, which now allows TON users access to RWA markets. This significant expansion of Toncoin’s utility could potentially boost its value by bridging digital and real-world assets.

Adding to the momentum, Trust Wallet announced a partnership with The Open Network (TON), aiming to enhance GameFi and DApp integration through Telegram’s vast user base. This collaboration promises to streamline TON transactions and expand its use cases, further supporting its price potential.

However, despite these strides, Toncoin did not (and could not) withstand the tsunami caused by the broader market shockwaves. And with that in mind, let’s move over to the charts.

Toncoin Price Analysis

When Bitcoin falls, major coins will follow. TON has been no exception to this rule. However, while Bitcoin and Ethereum were on a bungee jump without a cord, TON took a more scenic route down, albeit still ending up in a steep plunge.

Source: TradingView

Starting with the daily (1D) view, TON’s descent kicked off with a slip from around $6.85 – a level that tried and failed to act as a trampoline. This tumble, highlighted by our blue box of doom, set off a chain reaction of sell orders, plummeting the price down to $4.77 before bouncing back. The 20-day EMA couldn’t catch the falling knife, and the subsequent bearish crossover below the 50-day EMA sealed the deal for a bearish outlook. The whole thing felt like a slow-motion disaster movie, complete with a dramatic volume spike.

Source: TradingView

On the 4-hour (4H) stage, TON’s price action took a more drastic turn. It was comfortably cruising in a narrow range before hitting turbulence and breaking down. The support at $6.40 crumbled, sending the price diving. The RSI screamed “oversold,” just like in Bitcoin and Ethereum, hinting at panic. But unlike a plot twist, there was no surprise recovery; the price remained locked below the 50-EMA, which now felt more like a brick wall than a support line.

What’s next? For TON, the $5.26 level is the current lifeline, with eyes nervously watching if it will slip further to $4.50. If TON can rally above $6.40 and make a dash for $6.85, we might see a flicker of hope. But for now, the vibe is decidedly bearish.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.