Celebrating a Decade of Tether: How USDT Became the World’s Go-To Digital Dollar

In Brief

Tether has released a documentary celebrating its tenth anniversary, examining its impact on the cryptocurrency industry and its role in economic instability and inflation.

In honor of its tenth anniversary, Tether, the company that created the stablecoin USDT, has announced the publication of a film. This documentary aims to provide a thorough examination of the background and effects of USDT, with a focus on areas affected by economic instability and inflation. In the last ten years, USDT has changed the cryptocurrency industry and beyond, serving as a vital financial resource for millions of people all over the world.

The History of USDT and Its Development

The adventure of USDT started in October 2014, when it was known as Realcoin. The project, which was founded by Craig Sellars, Reeve Collins, and Brock Pierce, soon changed its name to Tether to emphasize its primary goal of offering a reliable cryptocurrency that is linked to the dollar.

Since its conception, the main goal of USDT has been to operate as a digital stand-in for the US dollar, enabling users to store and conduct transactions in a more stable currency, particularly in unstable financial settings. USDT was first developed using the OmniLayer protocol on the Bitcoin blockchain. Since then, it has spread to other blockchains, including as Ethereum and Tron, greatly improving its use and accessibility.

The main characteristic of the stablecoin is its 1:1 peg to the US dollar, which means that every USDT token is supported by an equivalent quantity of fiat money held in reserve. Due to this stability, users may still take advantage of the decentralized, international nature of blockchain technology without having to deal with the price volatility that is often connected with cryptocurrencies like Bitcoin and Ethereum. Given its dollar-pegged nature, USDT has become especially well-liked in nations where there is a lot of inflation and currency depreciation.

USDT as a Financial Lifeline in Areas Affected by Inflation

The documentary from Tether emphasizes how USDT has developed into a financial lifeline for nations facing extreme inflation, which is one of its most important features. Users from Brazil, Argentina, Turkey, and other nations where inflation has reduced the value of local currencies are featured in the documentary teaser. In these areas, USDT serves as a digital dollar, providing a reliable substitute for storing and exchanging value.

For instance, USDT use has exploded in Brazil, where by 2023 it will represent 80% of all cryptocurrency transactions. According to one interviewee in the video, Tether together with USDT accounts for almost 90% of Brazil’s daily transaction volume.

This broad use highlights the need in areas where local monetary systems are failing to maintain buying power for a stable currency. Similar patterns have been seen in Turkey and Argentina, where people have been compelled by hyperinflation to look for alternate means of shielding their wealth from sharp depreciation.

The goal of the documentary “Stability and Freedom in Chaos” is to draw attention to the wider effects of USDT on financial inclusion and empowerment. USDT has not only stabilized nations plagued by inflation but also made it possible for those without access to traditional banking services to engage in the global financial system.

This was underlined by Tether CEO Paolo Ardoino, who said that the company has always focused on the last mile and provided financial technology solutions to communities and individuals that have been “left behind” by traditional banking institutions. A large number of people in developing nations lack access to bank accounts or are not eligible for financial services because of their remote location or low income. USDT acts as a link between them and the rest of the world’s financial system.

A Decade of Growth and Controversy

With a current price of almost $120 billion, USDT has risen since its debut to become the biggest stablecoin by market capitalization. It now ranks third overall among cryptocurrencies, behind only Ethereum and Bitcoin.

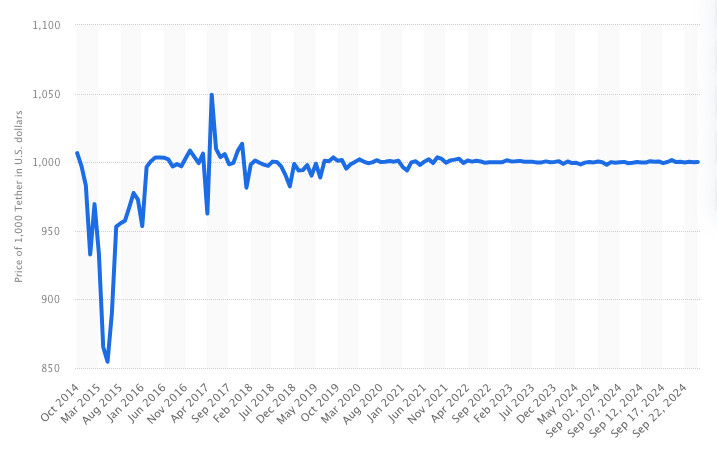

Photo: Statista

However, there has been some dispute about Tether’s success. Over the years, concerns over the transparency of the reserves supporting USDT have given rise to regulatory scrutiny and judicial challenges. Notwithstanding these worries, USDT has persevered and kept its dollar peg, solidifying its place as an essential participant in the crypto ecosystem.

Tether’s tenacity in the face of these difficulties is one of the film’s main themes. Tether has collaborated extensively with international law enforcement organizations to fight fraud and other illegal activity with USDT. Tether played a significant role in helping the US Department of Justice collect approximately $6 million that was connected to fraudulent activities.

Additionally, the business has teamed up with over 180 law enforcement organizations to freeze $1.8 billion in assets linked to illicit activity. These initiatives show that Tether is dedicated to upholding the integrity of its platform despite its ongoing expansion into new markets and areas of influence.

When examining the past price history of USDT, it can be seen that the stablecoin has mostly kept its 1:1 peg to the US dollar. There have been sporadic swings, such the temporary dip to $0.5885 in 2015, but they have been few and transient. Millions of users across the globe have come to trust the stablecoin because of its durability and consistency over time.

The Future of USDT and Stablecoins

The purpose of USDT in the world of finance has grown much beyond its original goal of offering a reliable digital currency. For millions of people today, especially in areas dealing with inflation and economic uncertainty, it is an essential tool. Its status as a store of value, a conduit to the larger cryptocurrency market, and a means of exchange has cemented its role in the financial industry.

However, the future of USDT and stablecoins will certainly be influenced by the development of regulatory frameworks. Stablecoins’ place in the financial system is being examined more closely by governments all over the world, especially in light of its potential to upend established banking and monetary practices. With USDT’s increasing popularity and clout, it is expected to encounter increased regulatory obstacles and demands for greater openness about its reserves and activities.

In conclusion, Tether and its flagship product, USDT, have undergone major changes over the past ten years. USDT has developed into a crucial component of the global financial ecosystem from its modest beginnings as a tool to facilitate crypto trading to its current function as a financial lifeline for millions in nations affected by inflation.

A deeper look at this journey and insights into the obstacles and achievements that have shaped Tether’s first ten years will be provided by the soon-to-be documentary. USDT will surely continue to be at the forefront of this revolution as stablecoins continue to grow and change the financial landscape.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.