Bitcoin Price Surpasses $65K as Bullish Market Momentum Persists

In Brief

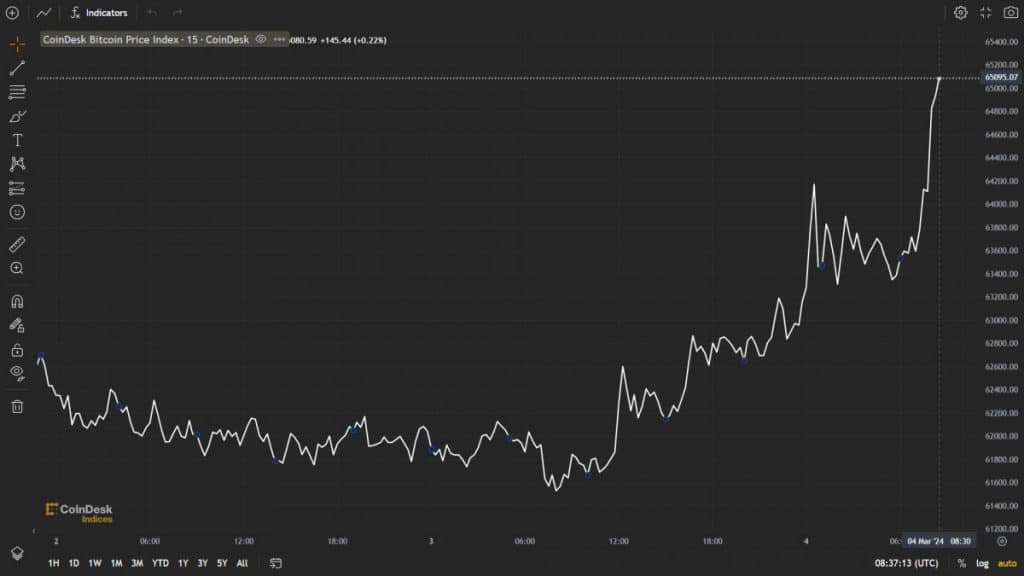

Bitcoin (BTC) price surpassed the $65K reaching $65,520 with a 6% growth rate, hitting an all-time high since November 2021.

Bitcoin (BTC) price surged to new heights, surpassing the $65,000 mark ($65,520) and is hovering approximately 7% below its all-time high recorded in November 2021. According to the analysis, currently showing an upward momentum above the $62,000 resistance, BTC is indicating a breakthrough and a potential upward movement toward the $70,000 range.

After a surge last week, Bitcoin price maintained a strong position above the support zone at $60,000, establishing a base for a renewed uptrend. Subsequently, an upward movement started, surpassing the resistance at $62,000.

Notably, there was a break above a key bearish trend line with resistance at $62,300 on the hourly chart of the BTC/USD pair. The pair surpassed the 76.4% Fibonacci retracement level of the downward move from the $63,583 swing high to the $60,108 low.

Currently, Bitcoin is trading above $65K mark and the 100-hourly Simple Moving Average (SMA). The immediate resistance is observed near the $63,800 level, with the next resistance potentially at $66,500. If surpassed, this could pave the way for a further upward movement towards the $70,000 resistance zone.

Should the bullish momentum persist, there’s a possibility of the price exceeding $66,000. Further upward gains could potentially propel the price towards the 1.618 Fibonacci extension level, derived from the downward move between the $63,583 swing high and the $60,108 low, situated at $65,730.

Should Bitcoin encounter difficulty surpassing the $64,000 resistance zone, there is a potential for a downward correction. Immediate support on the downside is identified near the $62,750 level. The initial significant support lies at $62,250, represented by the 100-hourly Simple Moving Average (SMA).

A close below $62,250 could initiate a notable pullback towards the $61,000 zone. Further losses may lead the price toward the $60,000 support zone.

Bitcoin Approaches All-Time Highs

The recent price action comes amidst a daily open interest for Bitcoin futures on centralized exchanges (CEX), a measure of the total value of all outstanding Bitcoin futures contracts across CEXs, reached an all-time high of $27.53 billion, according to Coinglass data.

Furthermore, there has been a notable uptick in assets under management for spot Bitcoin exchange-traded funds (ETFs), with investment company BlackRock’s IBIT reaching $10 billion last week. Additionally, the largest cryptocurrency by market capitalization is approaching its upcoming halving event scheduled for April 18th.

Institutional buying demand, strengthened by historical gains associated with Bitcoin’s halving event, coupled with a prevailing euphoric sentiment, positions the asset on a trajectory to potentially surpass its all-time high in the near future.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Alisa, a dedicated journalist at the MPost, specializes in cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a keen eye for emerging trends and technologies, she delivers comprehensive coverage to inform and engage readers in the ever-evolving landscape of digital finance.

More articles

Alisa, a dedicated journalist at the MPost, specializes in cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a keen eye for emerging trends and technologies, she delivers comprehensive coverage to inform and engage readers in the ever-evolving landscape of digital finance.