Bitcoin Falls Below $50,000, ETH Under $2,200 Amid Market Selloff

In Brief

BTC declined over 14.91% in the past 24 hours, indicating the lowest level the crypto has reached since February.

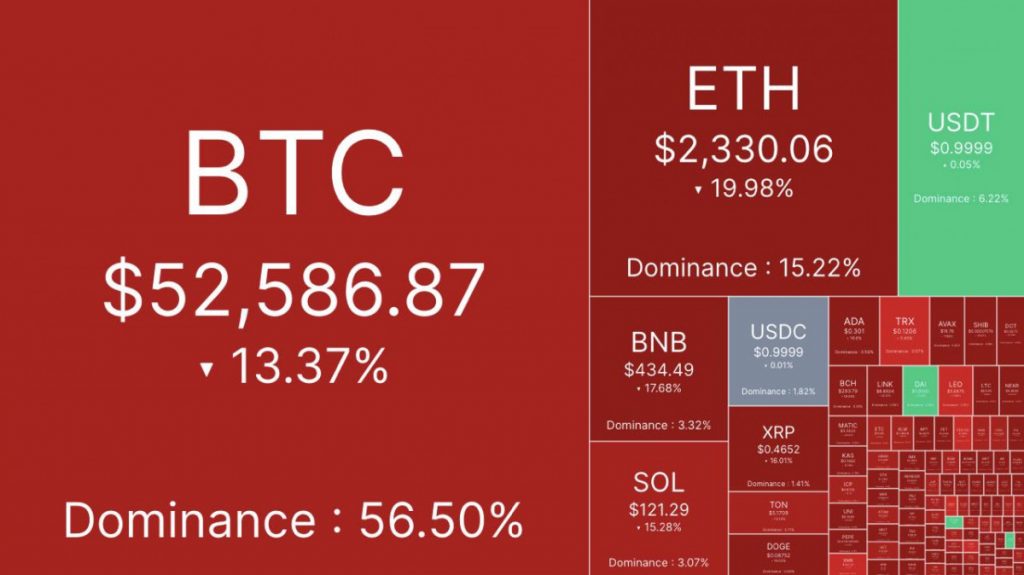

Price of the decentralized cryptocurrency Bitcoin (BTC) dropped significantly below the $53,000 level recorded earlier this morning. It is currently trading at $51,619, marking a decline of over 14.91% in the past 24 hours. This is the lowest level BTC has reached since February.

Furthermore, Bitcoin experienced volatility over the past 24 hours, with its price reaching a low of $49,513 and a high of $60,890, indicating substantial fluctuations.

At the same time, Bitcoin dominance increased to 56.39%, up by 0.74% over the past 24 hours. The global cryptocurrency market capitalization fell by 16.76% to $1.79 trillion today. However, the total cryptocurrency market volume surged by 155.91% to $166 billion, according to data from CoinMarketCap.

Following Bitcoin’s downturn, Ethereum (ETH) also experienced a decline of approximately 21.36%. Currently, ETH is trading at $2,301, marking its lowest level since January. Over the past 24 hours, ETH’s price has fluctuated between $2,171 and $2,922.

The altcoin market mirrored the bearish trend. Among the top 10 cryptocurrencies by market capitalization, BNB fell by 17.64%, while XRP decreased by 16.35%.

Cryptocurrency Market Faces Sharp Decline Amid Global Selloff And Political Uncertainty

The cryptocurrency market experienced a sharp decline during a widespread selloff, driven by investor reactions to several factors. These included macroeconomic updates, asset movements by Jump Crypto, and the increasing likelihood of Kamala Harris winning the upcoming United States election over pro-cryptocurrency candidate Donald Trump.

Over the weekend, Jump Crypto, the cryptocurrency division of Jump Trading, began transferring hundreds of millions of dollars in cryptocurrency assets, including ETH and USDT. This activity prompted speculation that the firm might be liquidating its holdings in response to an ongoing investigation by the U.S. Commodity Futures Trading Commission.

Another contributing factor to the rapid decline is the global spread of stock market sell-offs. Japan’s Nikkei 225 and Topix indices dropped approximately 7% in the morning trading session and are approaching bear market territory, according to CNBC. This decline followed the Bank of Japan’s decision last week to increase its key interest rate to around 0.25%, up from a range of zero to 0.1%.

At the same time, the approaching United States presidential election is introducing uncertainty for cryptocurrency investors, as Vice President Harris’s approval ratings have been rising. While former President Trump is a strong advocate of cryptocurrency, Harris has not demonstrated the same level of support for the industry. Some analysts suggest that increased support for Harris could be unfavorable for cryptocurrency markets, noting that, despite Democrats being relatively neutral towards cryptocurrency, the broader equity and cryptocurrency markets seem to favor a Trump victory.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Alisa, a dedicated journalist at the MPost, specializes in cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a keen eye for emerging trends and technologies, she delivers comprehensive coverage to inform and engage readers in the ever-evolving landscape of digital finance.

More articles

Alisa, a dedicated journalist at the MPost, specializes in cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a keen eye for emerging trends and technologies, she delivers comprehensive coverage to inform and engage readers in the ever-evolving landscape of digital finance.