Beyond the Hype: Navigating the AI Token Surge and Nvidia’s High-Stakes Earnings in a Volatile Tech Landscape

In Brief

The surge in AI tokens on the cryptocurrency market, akin to the “Super Bowl” of tech earnings, signifies the growing integration of AI, blockchain, and traditional tech equities.

AI tokens on the cryptocurrency market have increased dramatically, and everyone waits for Nvidia’s second-quarter earnings announcement, which many are referring to as the “Super Bowl” of tech earnings. This spike highlights the intricate dynamics at work in today’s financial markets and represents the rising convergence of AI technology, blockchain, and traditional tech equities.

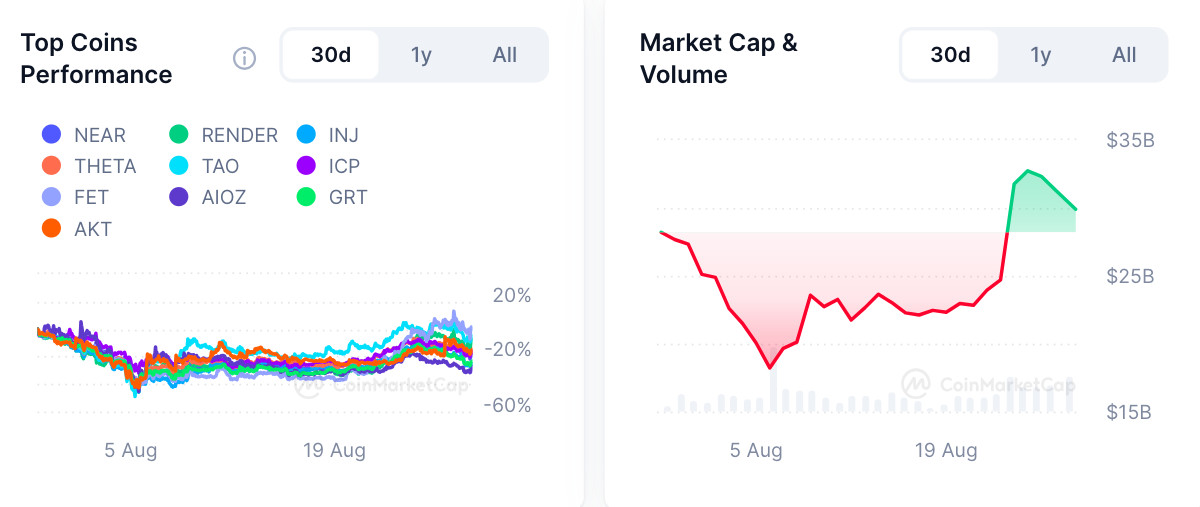

AI Tokens’ Ascent on the Crypto Market

Prior to Nvidia’s results release, a number of cryptocurrencies with an AI concentration had done better than the overall market. There have been notable rises for Near Protocol (NEAR), Artificial Superintelligence Alliance (FET), Bittensor (TAO), and Render (RENDER), with certain tokens seeing double-digit percentage increases.

The native token of Near Protocol, NEAR, surged 35% over the previous week to a four-week high of $5.20. The FET token of the Artificial Superintelligence Alliance, a group that also includes Fetch.ai, Ocean Protocol, and SingularityNET, increased by about 70% in only one week, reaching $1.39. The onchain analytics of Lookonchain saw this sharp increase and noticed that FET trading was exhibiting unique whale transaction behavior.

Photo: CoinGecko

Other AI-related assets have performed admirably as well. The TAO token from Bittensor increased by 26% last week, while the RENDER token from Render increased by over 40%. These shifts point to a wider pattern of investor interest in blockchain initiatives, including artificial intelligence.

Photo: CoinGecko

The Influence of Nvidia

A strong correlation exists between the excitement around Nvidia’s impending earnings announcement and the spike in AI token prices. Since its processors play a critical role in powering AI applications, Nvidia, a prominent maker of GPUs, has come to be associated with AI development.

Wedbush Securities’ well-known tech analyst Dan Ives called Nvidia’s earnings announcement “the largest tech earnings in years.” This opinion reflects the company’s pivotal role in the AI ecosystem as well as its capacity to shape market trends outside of its immediate industry.

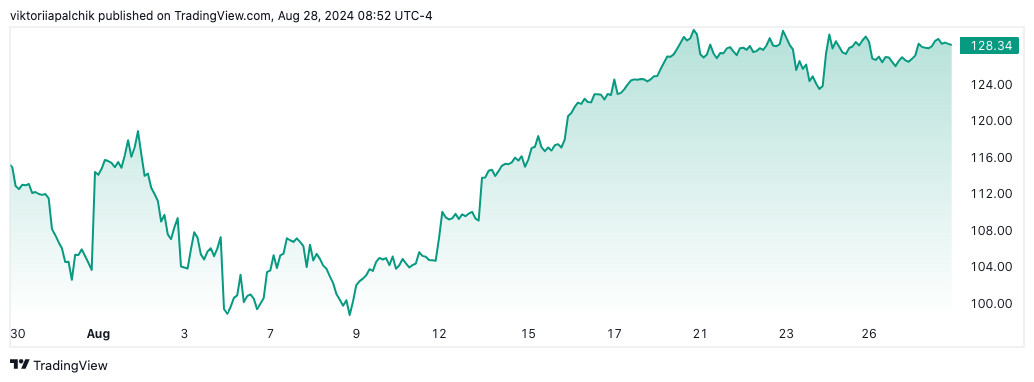

The recent performance of Nvidia has been astounding. Between Q3 2023 and Q1 2024, the company’s sales increased by 18%, with an astounding 262% increase over the previous year. Its stock price has increased by 180% in the previous 12 months, hitting an all-time high of $135 in mid-June, reflecting this development.

The Developments in AI and Market Structure

The relationship between the rise of AI tokens and Nvidia’s success highlights how entwined today’s IT industries are. The creation and use of AI technologies depend heavily on Nvidia’s processors, which in turn fuel demand for blockchain-based AI initiatives and the tokens that go along with them.

Photo: CoinMarketCap

The growing need for data center capacity, which is required to support the expanding number of AI chatbots and other AI-driven apps, emphasizes this link even more. The value of AI-focused cryptocurrencies as well as standard tech equities like Nvidia tend to increase in tandem with increased company investment in AI infrastructure.

Investor Sentiment and Market Expectations

The way the market is responding to Nvidia’s impending earnings announcement is indicative of a generally upbeat outlook for AI technology. As a result of investors positioning themselves to profit from possible development in the AI sector, linked asset values are rising.

This euphoria is, however, restrained by the great hopes for Nvidia. Given that its price-to-earnings ratio is really higher than its historical average, the company’s stock is selling at a premium. According to this valuation, investors may have already factored in substantial future growth, which might lead to volatility if the earnings report falls short of these high expectations.

The Broader Impact on the Tech Sector

The IT industry is anticipated to be impacted by Nvidia’s earnings release. Nvidia is a bellwether for AI and high-performance computing. Thus, its performance and outlook will probably affect investor perception of other tech companies engaged in AI research.

Furthermore, the business’s performance may shed light on trends in corporate AI investment. Robust outcomes and an encouraging outlook from Nvidia might suggest continued corporate investment in AI technology, which could increase trust in the industry overall.

Photo: TradingView

Even with the present optimism, there may be hazards and difficulties to take into account. The IT industry has seen a great deal of volatility in recent months, including cryptocurrencies and companies linked to artificial intelligence. Market corrections may result from worries about overvaluation, regulatory scrutiny, and the sustainability of AI investments.

In addition, the market for cryptocurrencies, which includes AI tokens, is notorious for its extreme volatility. Even while this recent spike is remarkable, it’s important to understand that sharp price swings in both directions are typical in this market.

AI and Blockchain Integration’s Future

The spike in AI token prices before Nvidia’s earnings announcement emphasizes how blockchain and AI technologies are increasingly combining. It’s possible that this combination may open up new doors for investment and innovation.

The decentralized infrastructure required to enable AI systems may be provided by blockchain technology, which might result in more effective and transparent AI applications. On the other hand, AI may improve the security and efficiency of blockchain networks, fostering a mutually beneficial partnership between the two technologies.

The increase in AI tokens serves as a reminder of how interwoven today’s digital environment is as the market awaits Nvidia’s earnings report. The stock price of a typical IT company such as Nvidia is affected not just by its own performance but also by the value of linked technologies and assets.

Insights into the direction of AI investments and the place of blockchain in this dynamic ecosystem are expected to become increasingly clear in the days and weeks ahead. Even while the mood in the market right now seems optimistic, investors and industry watchers should be aware of the possibility of volatility and the importance of doing thorough research in this quickly evolving field.

In the end, the rise in AI tokens and the excitement around Nvidia’s earnings announcement highlight how great AI technology may be. These technologies have the potential to transform businesses and open up new avenues for investment and growth when they develop further and combine with other breakthroughs like blockchain.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.