August Crypto Upgrades: From Ethereum’s Breakout to Polkadot’s Flex and Polygon’s New Skin

In Brief

August highlighted a mix of noteworthy crypto projects, from live zero-knowledge proof infrastructure and gamified DeFi Layer-2s to metaverse launches and innovative presales, each showing real traction or ambitious potential.

August didn’t come with a flood of shiny new chains, but it did surface a handful of projects that felt worth a closer look. Some were long-promised ideas finally hitting mainnet, others were fresh attempts to rethink familiar models, and at least one or two simply managed to grab more attention than the usual noise. Here are the ones that stood out to us this month, and why they earned a spot in the conversation.

Succinct – A Decentralized Marketplace for Zero-Knowledge Proofs

Kicking things off with infrastructure, one of the more tangible launches this month came from the ZK world. Succinct is building what amounts to a clearinghouse for zero-knowledge computation: a decentralized network of provers that any rollup or dApp can tap into when they need proofs generated or verified. In early August, it stopped being theory and went live on Ethereum mainnet.

We’ve been hearing “zero-knowledge is the future” long enough that it’s easy to glaze over another pitch about cryptographic speedups. But this one felt a bit hard to dismiss: applications can now send proof requests into the wild, and independent provers compete to fulfill them. The result is basically “ZK proofs as a service,” paid and secured through the network’s PROVE token.

What makes it land is the traction. Succinct isn’t starting from a cold boot — it’s already handled millions of proofs during testing, secured billions in value, and plugged into protocols like Polygon, Celestia, Mantle, and Lido. That’s a far cry from a research demo.

Does it solve scaling once and for all? Probably not — bottlenecks always find their way back into crypto systems. But compared to the usual “trust us, it’ll work eventually” refrain, Succinct’s launch carries the weight of something real: infrastructure rollups can lean on today, not in some hypothetical ZK-powered tomorrow.

QF Network – A New High-Performance Layer-1 on the Horizon

From something already live to something still in the blueprint stage: QF Network only offered an announcement this August, but it was enough to plant a flag. The project is the latest Layer-1 chain vying for attention, pitched as a performance monster with a RISC-V execution core, a custom SPIN consensus, and zkTLS for bridging Web2 and Web3. In mid-August the team confirmed what had only been whispers before: mainnet is officially slated for Q4 this year.

That’s about as far as the story goes for now — promises and architecture diagrams. It’s bold on paper: sub-second block times, throughput numbers meant to put Solana to shame, and a developer toolkit that supposedly makes Web2 integration painless. But we’ve all read enough whitepapers to know how wide the gap can be between a crisp pitch deck and a humming mainnet.

The interesting part isn’t whether QF will deliver everything it claims — few projects ever do — but that it’s planting a flag in an increasingly crowded field with a very specific ambition: speed as the defining feature. In an ecosystem where Ethereum is doubling down on modular rollups and Solana is happy to flex transaction charts, QF wants to arrive with “faster than both, trust us” kind of energy.

Will it actually matter when the chain flips on later this year? Hard to say. In all honesty, QF feels more like a theory right now than a living network. But at least they’ve put a date on it, which means the clock is ticking — and in this space, delivering anything at all on time is already a minor victory.

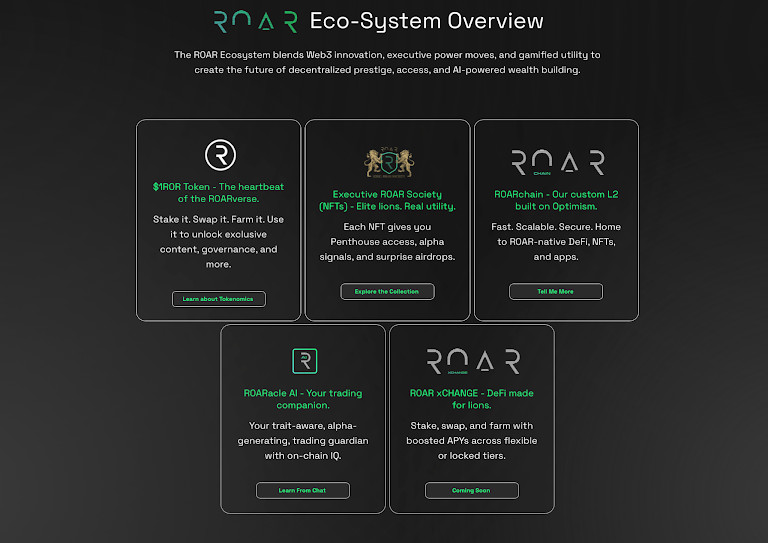

R0AR – A DeFi Super-App Building Its Own Layer-2

Compared to QF’s experimental twist, R0AR is going for a different kind of experiment — community ownership. August was when the project finally opened up its validator license sale and launched another DeFi protocol. Namely, an Optimism-based Layer-2 chain designed to be a one-stop shop: wallets, staking, NFTs, AI trading tools, all orbiting around its 1R0R token. The hook is that it wants to be community-owned from day one — no shadowy sequencer cabal, but a validator set anyone can join by buying a Node NFT license.

That pitch got real in August, when the project opened up its node license sale. Early partners got first dibs mid-month, the wider public followed right after, and suddenly you had retail and small institutions lining up to stake a claim on the network’s infrastructure. Each license gives you the right to run a validator, handle transaction execution, and earn rewards once the mainnet goes live in Q4.

It’s not hard to see the appeal. Most Layer-2s today are technically impressive but structurally centralized — one sequencer, one switch. R0AR is making decentralization its selling point, betting that people will want to actually own a piece of the rails they’re using. If it works, validators won’t just be a security layer; they’ll be a community invested in the chain’s success.

Of course, the question is whether packing all of DeFi into one branded super-app can avoid the fate of a dozen “all-in-one” platforms before it. But R0AR’s timing is sharp: it’s plugging into the Optimism Superchain narrative and dangling tangible upside (node rewards, governance) to early believers. If nothing else, it’s one of the first attempts to make an L2 feel less like a corporate product and more like a co-op.

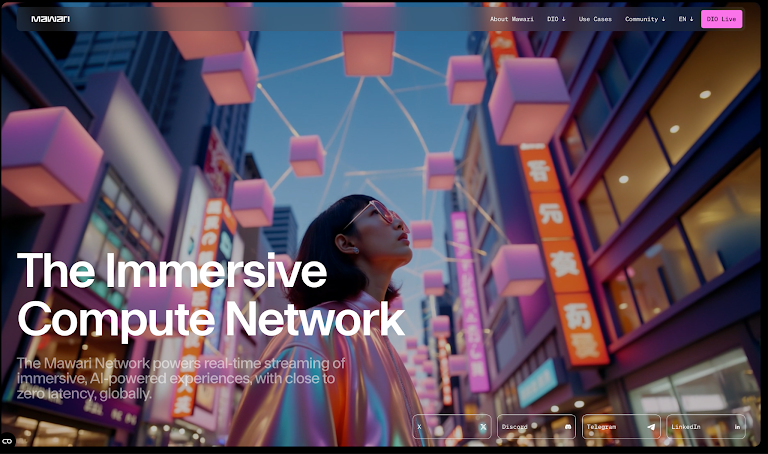

Mawari – Decentralized Streaming for the AR/VR Crowd

Compared to most recent base layer fintech projects, Mawari is going after something stranger: how to stream 3D and XR content without melting your phone or choking a data center. Think of it as a decentralized content delivery network, but instead of static files it’s pushing real-time AR/VR visuals, rendered across a swarm of GPU nodes.

In mid-August, Mawari came out of the shadows with a full network launch and a partnership with Caldera to anchor quality metrics on-chain. The way it works is this: GPU nodes handle the heavy lifting of rendering, “Guardian Nodes” log performance data (latency, frame accuracy, etc.), and that reputation gets baked into a rollup for transparency. Moreover, Mawari’s patented streaming tech claims an 80% cut in bandwidth compared to the usual XR pipelines. So, on paper we’ve got a system that could make metaverse experiences viable on normal devices.

And they’re not just pitching to crypto natives. Mawari has already been piloted with Japanese VTuber agencies, showing it can deliver live, animated characters at scale. That detail matters — VTubing is big business in Japan, and it’s a perfect stress test for whether this network can handle real demand without collapsing under latency.

Does that mean the “metaverse” is saved? Hardly. The entire space still needs people who want to show up in headsets for hours at a time. But Mawari is interesting precisely because it isn’t a consumer app — it’s plumbing. If AR/VR content does take off, somebody has to build the pipes, and right now Mawari looks like one of the few actually laying them.

Irys – Permanent Storage Built on Arweave

There have also been fresh development from the crypto storage field. Irys is a storage layer aiming to make “forever” data a bit more usable. It builds on Arweave’s permaweb, adding tools for provenance and easy archiving so developers and enterprises don’t have to wrestle with raw storage contracts. In late August, it stepped out with a $10 million Series A led by CoinFund — a solid endorsement in a year when most crypto startups are struggling to get checks signed.

That round puts Irys on the hook to deliver its mainnet soon. The pitch is straightforward: businesses, NFT platforms, even historians need a way to anchor data permanently and prove where it came from. Arweave already provides the backbone, but Irys wants to smooth the edges — indexing, integration, and a model that makes it easier for projects to trust their data will still be there in ten years.

It’s not flashy, and it won’t drive speculative mania the way a token presale does, but infrastructure like this tends to stick around once it works. With provenance and permanence becoming hot topics across AI, NFTs, and Web3 in general, Irys’s timing feels smart.

The risk, of course, is that decentralized storage has been “about to take off” for most of the past five years, and adoption curves are slow. But if you believe permanence is going to be a bigger part of the Web3 stack — and with AI models scraping everything, that case is only getting louder — then Irys just earned itself a decent runway to try.

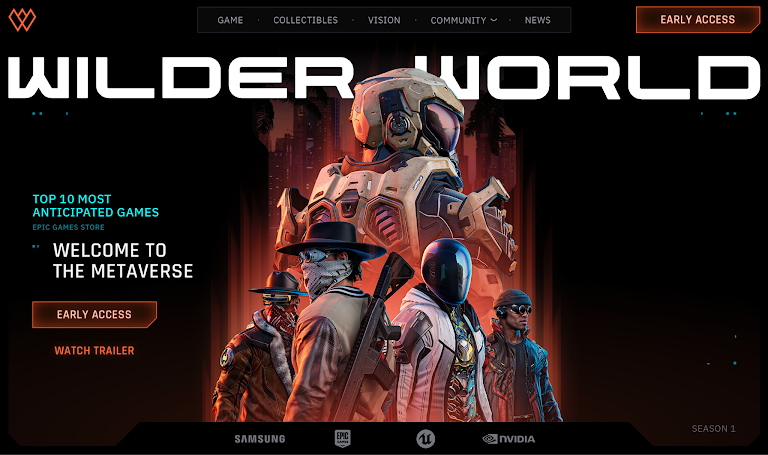

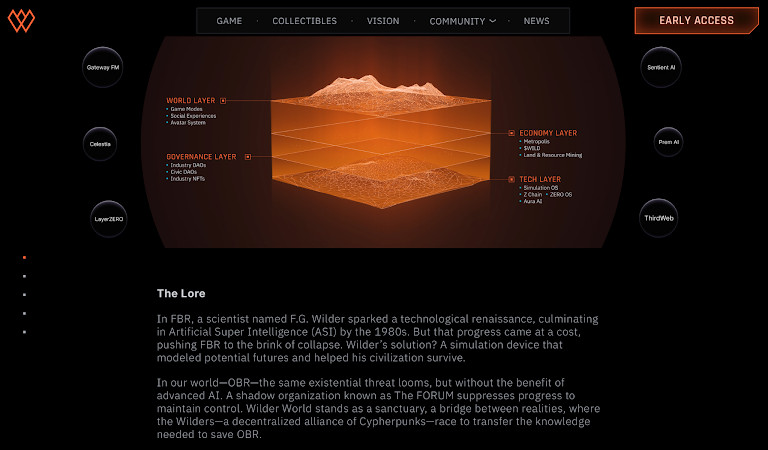

Wilder World – An Unreal Engine Metaverse That Actually Ships

On the gaming front, August’s splash came from Wilder World. The long-teased Unreal Engine metaverse confirmed its arrival on the Epic Games Store. Most “metaverse” pitches sound like they were dreamed up on a whiteboard and left there. Wilder World, at least, is putting something tangible in players’ hands: a 5D open-world game built on Unreal Engine 5, styled as a solarpunk replica of Miami. In August the team confirmed it’s landing on the Epic Games Store with a phased early access rollout, starting with arena-style combat before expanding into racing and, eventually, a full open world.

The setup is classic Web3: land, condos, vehicles, wearables — all NFTs, all tradable. But the vibe isn’t cheap shovelware. The visuals look AAA-grade, the environment has been in production for years, and the Epic Store listing means curious gamers can just click “download” without needing to touch a wallet.

Whether people actually stick around is the open question. Web3 games have a habit of front-loading excitement and then ghosting their own Discords by week three. But Wilder World at least seems to understand the need for pacing: early access is staggered, content drops come weekly, and the team is promising racing modes by year’s end. The bet is clearly not on dropping everything at once but keeping players coming back long-term.

Does this make it the metaverse game to finally crack mainstream? Too early to call. But compared to most of the genre’s half-baked rollouts, Wilder World already feels more alive — and that’s worth noting.

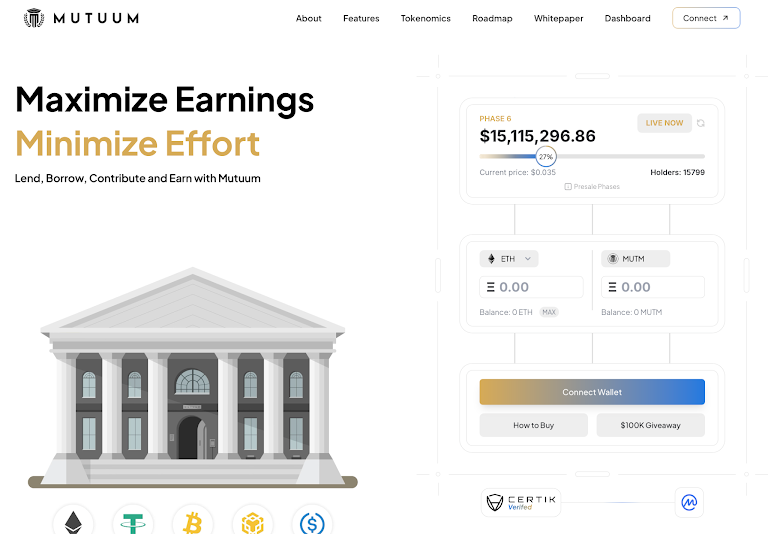

Mutuum Finance – Yet Another Big DeFi Pitch, With a Twist

And because no month in crypto is complete without a buzzy DeFi presale, Mutuum Finance filled that slot in August. Mutuum wants to be your next all-in-one lending hub, pairing peer-to-pool contracts with peer-to-peer deals and wrapping it all around an overcollateralized USD stablecoin. It’s the sort of “rebuild banking on-chain” vision we’ve heard dozens of times, but August gave it a bit of traction: the presale hauled in nearly $15 million from more than 15,000 investors, and CertiK stamped it with a tidy 95/100 audit score.

That kind of fundraising in 2025 is actually no small feat. Each presale round ratcheted the token price up toward an eventual $0.06 listing, and the pitch decks were full of fat ROI projections. It also flaunts a splashy $100k airdrop campaign and a bug bounty, so we get the sense the team knows how to keep a crowd entertained.

Still, it’s honestly hard not to smirk. We’ve seen a parade of “major new DeFi” launches over the years, and most end up as footnotes once the incentives dry up. Mutuum’s edge, if it has one, is the hybrid lending model — letting some users stick to simple pooled lending while others cut custom P2P terms — plus the promise of a homegrown stablecoin to glue the ecosystem together.

Will it last? Maybe. Or maybe it’s another round of déjà vu in the never-ending DeFi talent show. But for August, Mutuum managed to make enough noise, raise enough capital, and score enough early-stage validation that it forced its way into the conversation. And sometimes that’s all a project really needs.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Alisa, a dedicated journalist at the MPost, specializes in cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a keen eye for emerging trends and technologies, she delivers comprehensive coverage to inform and engage readers in the ever-evolving landscape of digital finance.

More articles

Alisa, a dedicated journalist at the MPost, specializes in cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a keen eye for emerging trends and technologies, she delivers comprehensive coverage to inform and engage readers in the ever-evolving landscape of digital finance.