Aster launches Hidden Orders: Invisible orders, visible advantage

In Brief

Aster, a leading decentralized perpetual exchange backed by YZi Labs, has launched Hidden Orders on Aster Pro—making it the first perp DEX to offer fully integrated stealth order execution that enhances trader privacy, reduces slippage, and preserves liquidity.

Aster, the next-generation decentralized perpetual exchange (perp DEX) backed by YZi Labs, proudly unveils its latest upgrade on Aster Pro: Hidden Orders. Hidden orders empower traders with powerful stealth execution when trading perpetuals.

With this launch, Aster – ranked second globally by perp DEX trading volume – becomes the first perp DEX to introduce fully integrated hidden orders, once again pushing the frontier of DeFi innovation.

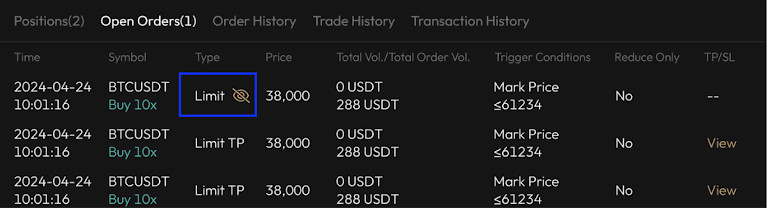

On Aster, traders who select hidden orders place limit orders without revealing any size, price, or presence on the public Aster Pro order book. Trades are placed directly into the main matching engine and only become visible after execution.

“In high-speed, high-stakes perp trading, being seen is often a disadvantage,” shared Leonard, CEO of Aster. “Hidden orders empower traders with full anonymity without compromising liquidity, privacy and fairness.”

Why decentralized perp trading needs hidden orders

In cryptocurrency trading, the ability to place large trades without spooking the market is a privilege that separates professionals from amateurs. Institutions and sophisticated traders often rely on advanced order execution strategies like dark pools and hidden orders to hide their intentions and reduce slippage.

Recent debates among industry leaders have also spotlighted a key tension in current DEX infrastructure: while transparency enables trust, it also exposes large traders to predatory tactics due to real-time order visibility. This underscores a rising demand for privacy-preserving solutions in the perpetual DEX space, ones that can shield traders from front-running and exploitation while still upholding market integrity.

High-volume traders on centralized exchanges already rely on tools like dark pools or iceberg orders to mask intent. However, each has its drawbacks. Dark pools keep trades completely invisible and with no impact to main markets because trades execute via a separate order book. That said, because of the separate infrastructure, dark pools fragment liquidity and can be less liquid than the main order book. Iceberg orders are anonymous and access deep market liquidity, but will partially reveal intent as a portion of the total order is exposed on the public order book at any one time.

Hidden orders solve these challenges:

- Full Privacy: Orders remain invisible until filled, defending price points without signaling intent.

- Stealth Execution: Slippage is reduced and front-running is avoided in volatile markets.

- Integrated Liquidity: Hidden orders operate directly inside the main matching engine, preserving centralized liquidity and tight spreads.

- Superior Speed: Often faster to execute than iceberg orders, with no visible trail.

Built for anonymity, visible advantage

The launch of Hidden Orders on Aster Pro marks a major milestone for the industry: Aster is now the first perpetual DEX to natively support hidden orders—a feature previously exclusive to centralized platforms or fragmented DeFi workarounds.

This upgrade is more than a product release. It’s a clear statement of intent: Aster leads by building—pioneering tools that empower traders with greater control, precision, and privacy in onchain markets.

With Hidden Orders, traders can now:

- Defend key price levels without tipping off competitors

- Enter or exit large positions without front-running risks

- Execute with full anonymity while still benefiting from Aster’s deep, unified liquidity

In a market where visibility often works against you, Aster gives traders the power to operate on their own terms.

Redefining the standard for onchain perpetual trading

This launch reinforces Aster’s position as an industry leader—not just in volume, but in innovation, execution quality, and trader-first design. From the successful introduction of email login for frictionless onboarding, to the debut of Aster Chain Beta, a privacy-preserving ZK Layer 1 built for high-performance perp trading, Aster is consistently raising the bar for what’s possible in DeFi.

And while others focus on replicating centralized tools, Aster focuses on protecting its users—by prioritizing:

- Privacy, with ZK-powered infrastructure

- Fairness, with MEV-resistant execution

- Control, with pro-grade tools like Hidden Orders and integrated liquidity

Aster redefines onchain trading, making it fast, fair, private, and powerful. Experience Hidden Orders now on Aster Pro.

About Aster

Aster is a next-generation decentralized perpetual exchange built for everyone. It offers MEV-free, one-click trading with up to 1001x leverage in Simple Mode (BNB Chain, Arbitrum), and pro-grade tools including Hidden Orders in Pro Mode (BNB Chain, Ethereum, Solana, Arbitrum). Aster Chain is a high-performance blockchain engineered to deliver private and non-custodial onchain orderbook trading. Backed by YZi Labs, Aster is building the future of DeFi: fast, flexible, and community-first.

Learn more at Aster official website, or connect with Aster on the official X account

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Gregory, a digital nomad hailing from Poland, is not only a financial analyst but also a valuable contributor to various online magazines. With a wealth of experience in the financial industry, his insights and expertise have earned him recognition in numerous publications. Utilising his spare time effectively, Gregory is currently dedicated to writing a book about cryptocurrency and blockchain.

More articles

Gregory, a digital nomad hailing from Poland, is not only a financial analyst but also a valuable contributor to various online magazines. With a wealth of experience in the financial industry, his insights and expertise have earned him recognition in numerous publications. Utilising his spare time effectively, Gregory is currently dedicated to writing a book about cryptocurrency and blockchain.