Weekly Crypto Review: Analyzing Top-3 Cryptocurrencies’ Market Performance and Trends

In Brief

Bitcoin, Ethereum, and the TON blockchain experienced price fluctuations, with Bitcoin reaching $71,000 and Ethereum reaching $192 billion. Toncoin is now integrated into Coin Wallet.

Bitcoin (BTC)

News & Macro

Last week, Bitcoin witnessed significant price fluctuations, peaking at around $71,000 before settling at $69,000. This surge was fueled by strong inflows into Bitcoin ETFs, reflecting renewed investor confidence in the market.

Meanwhile, CleanSpark Inc., a leading Bitcoin mining company, reported impressive May results, mining 417 bitcoins with high efficiency and expanding its operations to boost capacity further.

CleanSpark’s Report on Bitcoins Mined in May, Source: CleanSpark

The approval and launch of new cryptocurrency ETFs, particularly for Ethereum, also played a crucial role, driving increased capital inflows and enhancing Bitcoin’s market stability and growth potential.

Price Analysis

Bitcoin’s (BTC) recent 1-day chart is a mixed bag, reflecting uncertainty in market direction compared to previous weeks.

On the daily chart, Bitcoin has been trading in a tight range between $69,000 and $70,800, with closing prices near $69,386. Long red candles hint at mild selling pressure as the market searches for stability.

BTC/USD 1D Coinbase, source: TradingView

This period of relative calm is a stark contrast to previous weeks, which saw more dynamic moves, including a peak around $71,000 that highlighted strong buying activity.

ETH/USD 4H Coinbase, source: TradingView

On the 4-hour chart, the consolidation trend is even clearer, with trading tightly centered around $69,000. The Relative Strength Index (RSI) hovers near the neutral 50 mark, indicating a balance between buying and selling pressures, with no immediate signs of the market being overbought or oversold.

Analyst bitcoinwallah from TradingView points out a symmetrical triangle breakout pattern on the 4-hour chart, suggesting Bitcoin could potentially reach $75,000 if it breaks above the upper trendline.

Bitcoin 4H Symmetrical Triangle Analysis by bitcoinwallah, Source: TradingView

This analysis indicates the market could go either way. A bullish breakout above the $70,800 resistance might signal renewed buyer momentum, pushing prices towards $72,000. Conversely, a drop below the $69,000 support could increase bearish sentiment, potentially driving the market down to the $67,000 level or toward the supportive 50-day EMA.

Ethereum (ETH)

News & Macro

Ethereum, like Bitcoin, is navigating a phase marked by both anticipation and hesitation. The DeFi sector has hit a 15-month high, with total value locked reaching $192 billion, driven by ETH appreciation and reflecting robust underlying demand.

DeFi sector’s TVL (Total Value Locked), source: DappRadar

However, regulatory factors continue to sway market dynamics and investor confidence. SEC Chair Gary Gensler has suggested that eth spot Ether ETF launch might take a while. Although formally approved, these ETFs can’t start trading until they receive the required S-1 registration statement approvals.

Gensler remarked, “These registrants are self-motivated to be responsive to the comments they get, but it’s really up to them how responsive they are,” according to Reuters on June 6. This sentiment is mirrored in the current pessimism seen in ETH’s future.

The recent EU elections are also pivotal, potentially shaping the regulatory framework and paving the way for the first spot Ether ETF. However, positive developments within the Ethereum ecosystem offer some optimism.

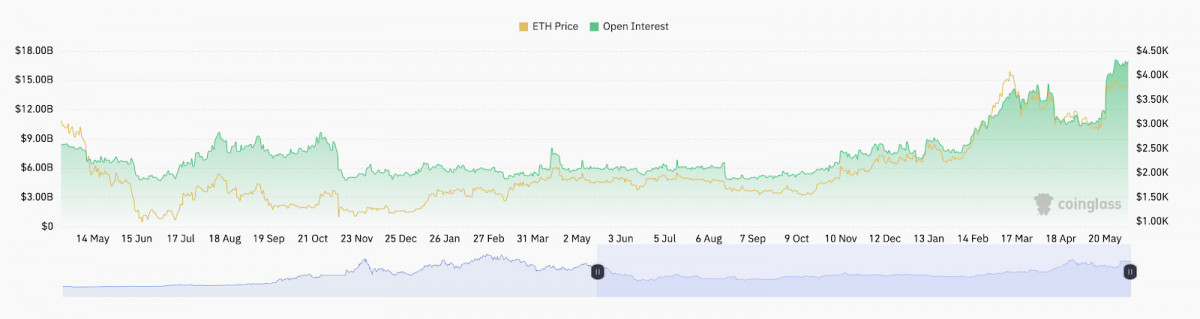

Open interest for ETH futures, source: Coinglass

Ether futures open interest and options trading volume have reached all-time highs, indicating heightened market activity. Additionally, a decline in ETH reserves on crypto exchanges, coupled with increased institutional inflows, has driven Ether’s price upward.

Moreover, Ethereum’s layer-2 solution, Base, has achieved $8 billion in total value locked, underscoring strong network activity and providing price support. These developments suggest a dynamic environment for the foreseeable future of ETH, where both bullish and bearish factors are at play.

Price Analysis

Over the last week, the price of ETH has settled into a narrow trading range, reflecting a market caught in a tug-of-war between buyers and sellers.

ETH/USD 1D Coinbase, source: TradingView

The 1-day chart shows Ethereum seesawing between $3,700 and $3,800, closing near the lower boundary of this spectrum at approximately $3,671. The subtle drift suggests a cooling-off period following more aggressive price movements in prior weeks that saw peaks above $3,900. The mix of green and red candles within this band signals a standoff.

The 20-day EMA is trending slightly downwards, hailing a potential crossover with the 50-day EMA. A downward crossover would signal increased bearish momentum, possibly leading to lower prices in the coming days or weeks.

ETH/USD 4H Coinbase, source: TradingView

On the 4-hour chart, the action is even more downward-leaning while still confined mostly between $3,660 and $3,760. Recently, the price dipped below the 4-hour 50-period EMA, suggesting that short-term momentum is taking a bearish turn. The EMA has acted as a dynamic resistance, capping upward movements and aligning closely with the upper boundary of the trading range. The Relative Strength Index (RSI), hovering below the midpoint at around 38, further supports the near-term bearish sentiment.

Given the current setup, Ethereum may be poised for more definitive moves. If the price can reclaim the 50-period EMA and sustain above it, this could signal a shift back towards bullish conditions, potentially challenging higher resistance levels near the top of the recent range. Conversely, if the price continues to respect this EMA as resistance and the RSI remains subdued, there might be a further downside, with the next levels of support likely found at lower historical points within the recent trading history.

Toincoin (TON)

News & Macro

The past week has been groundbreaking for the TON blockchain, marking significant leaps in global cryptocurrency integration and adoption. Toncoin (TON) is now integrated into the Coin Wallet, a widely-used non-custodial multicurrency wallet available on Android, iOS, macOS, Linux, Windows, and Web.

In a parallel move, American brokerage Robinhood has added TON to its cryptocurrency offerings for European Union users. Additionally, the TON Foundation and Tether have teamed up to launch an ambitious initiative, aiming to establish over 100 global partnerships to integrate USDT on the TON blockchain.

On the technological front, the launch of the Algebra DEX engine stands out. This leading DeFi protocol for decentralized exchanges significantly enhances liquidity management on the TON blockchain, supporting over 25 exchanges with a combined trading volume exceeding $245 million and a total trading turnover of $52 million.

Price Analysis

On the daily chart, Toncoin has exhibited some stability with a gradual uptrend over the past weeks.

TON/USD 1D ByBit, source: TradingView

Toncoin (TON) has maintained a steady uptrend over the past few weeks on the daily chart. The price is currently hovering around $7.00, with a recent close at $7.09. This stability follows a significant rise where the price hit $7.70, indicating a strong bullish surge.

In recent days, however, the market has seen a downtrend, marked by long red candles indicating selling pressure. The price has eased back towards the $7.00 psychological support level. The 50-day Exponential Moving Average (EMA) at $6.63 is crucial support if the downward trend continues. Despite this, the consistent position above the EMA suggests an underlying bullish sentiment, although the recent consolidation with tighter price action and small-bodied candlesticks points to trader indecision.

TON/USD 1D ByBit, source: TradingView

On the 4-hour chart, Toncoin’s struggle to maintain bullish momentum is more evident. The price peaked at $7.50 before retreating to $7.03, showing frequent testing within the $7.00 to $7.50 range. The EMA provides dynamic support that is closely aligned with the price.

The RSI on the 4-hour chart trending near 46 indicates a cooling off from previously overbought conditions, hinting at potential consolidation or preparation for another upward push if buyer momentum increases.

In summary, Toncoin is currently at a crossroads. The market’s movement in the coming days is contingent on several factors: if Toncoin can sustain support above the $7.00 mark and rebound off the 50-day EMA on the daily chart, there’s potential for retesting previous highs near $7.70. Conversely, a break below this crucial support could see the price testing further down toward the $6.50 region, emphasizing the importance of the $6.63 EMA as a pivotal zone for traders to watch.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.