This Week In Crypto: Macro Shock Tests BTC And ETH Resilience, While TON Awaits Momentum Shift

In Brief

Geopolitical tensions triggered a sharp but short-lived crypto market selloff, with Bitcoin and Ethereum showing resilience through continued institutional inflows and on-chain accumulation despite price volatility.

Picture this: you’re lounging in a beach chair mid-June, sipping that hard-earned alt-season smoothie, when suddenly a missile whizzes overhead – figuratively and, for the markets, kind of literally. Let’s set the stage.

Everything was coasting decently after a stretch of bullish optimism: spot ETF inflows ticking up, Michael Saylor cracking open his prophecy scrolls, and Texas officially adding Bitcoin to its reserves. Then, bam, news breaks: the U.S. had launched a strike on Iranian nuclear infrastructure. You could almost hear the risk-on trade screaming as it got dragged into a bunker.

And the market did what it always does when the world gets dicey: panic now, think later. Let’s break it down.

Bitcoin (BTC)

Bitcoin had been flirting with $105K early in the week – not quite champagne-popping levels, but a firm nod toward bullish continuation. Then the Iran news hit, and in under 48 hours we were staring down at $98K.

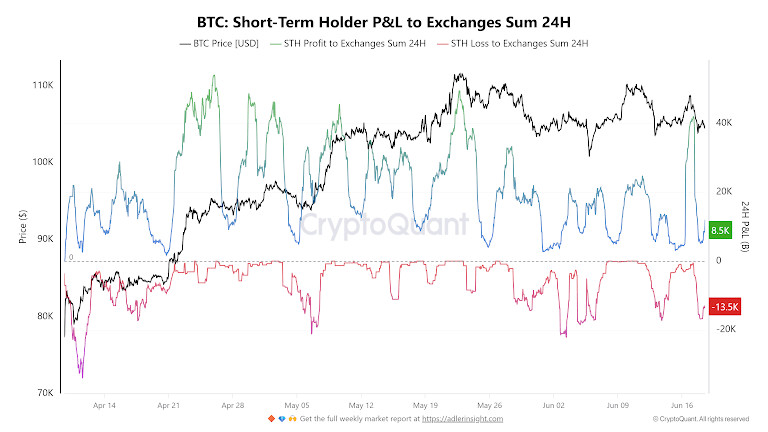

That’s a chunky 8% haircut, and it didn’t come gently. RSI bottomed, leverage got torched, and short-term holders dumped 15,000 BTC at a loss (according to CryptoQuant).

It felt like all the recent euphoria – ETFs, state-level adoption, Saylor’s infinite timeline prophecy – got shoved into a trash compactor.

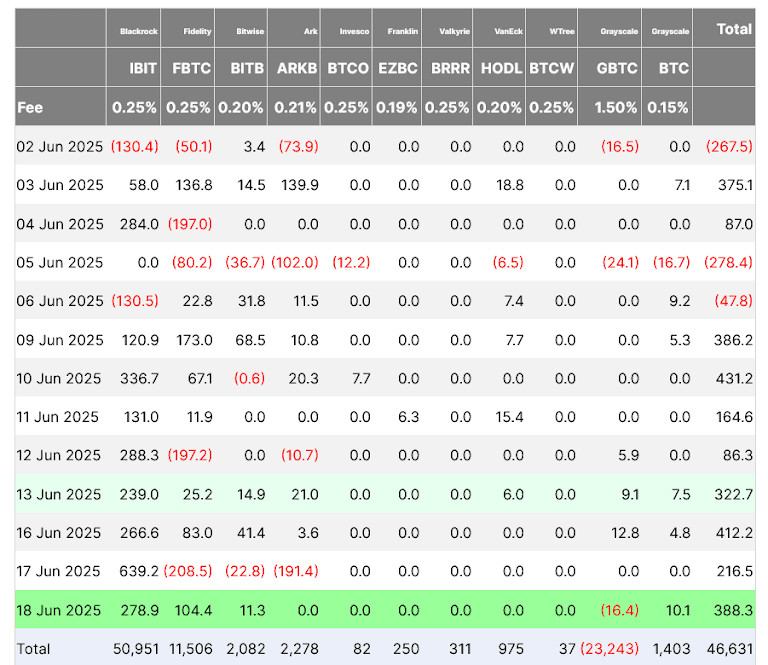

But interestingly, under the hood, the picture wasn’t all doom. ETF inflows stayed strong. In fact, Bitcoin funds recorded eight straight days of net inflows, even as the market nose-dived. It tells you institutions didn’t flinch – if anything, they were quietly reloading.

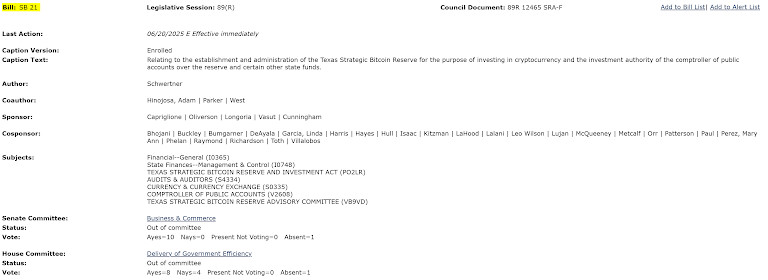

And then there was a big headline coming from Texas: the governor just signed legislation adding Bitcoin to the state treasury. Despite the war tensions, this reinforces the broader narrative where BTC is no longer fringe, but fully-fledged part of policy.

By weekend close, Bitcoin was inching back above $101K, with RSI climbing and candles turning green. Is this the bottom? Too early to say. But if it is, it was one of those dirty, ugly, unceremonious bottoms – the kind that breaks hearts before the ‘good’ rocket takes off.

Ethereum (ETH)

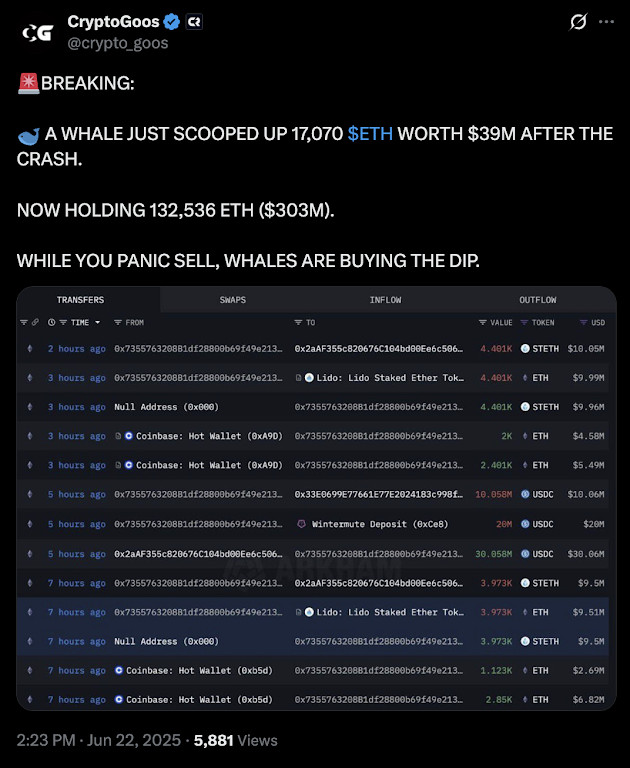

Ethereum had a rough ride too, but its story feels a bit different. It fell harder than Bitcoin, slipping below $2,200 mid-week. But whales were active – $263 million in ETH were bought up while retail was panic selling.

And this doesn’t seems like some random speculative grab either; Ethereum staking just hit an all-time hig with 35 million ETH locked, which is kind of a big deal in an of itsefl. It signals that long-term holders are increasing their grip even while price action gets tossed around.

There’s also the quiet burn of ETF demand still humming in the background. ETH funds aren’t seeing the same headlines as BTC, but they’re pulling inflows too – just under the radar.

The chart, however, looks totally not amazing – at least, for now. RSI still sits in the low 30s, and ETH hasn’t broken back above $2.4K. But it feels like that coiled spring moment. If ETH can close the month above $2.5K, it might set the stage for a nasty short squeeze into Q3.

Toncoin (TON)

Toncoin had every excuse to dump and vanish this week. The token dropped hard, slipping from just under $3 to a brutal low of $2.67. What’s interesting, though, is that TON didn’t implode. It didn’t catch a bid either – but it held the line, trading sideways after the flush.

Zoom in on the chart and you’ll see the story. TON had been consolidating in a tight range for most of June, capped by ~$3 resistance and bottoming near $2.80. That range broke decisively once the geopolitical shock hit – the Iran strike sent every risk asset tumbling, and TON was no exception. RSI collapsed below 30, signaling deep oversold conditions for the first time in weeks.

Now here’s where it gets tricky. Even after bouncing slightly back to $2.75, the 4H chart shows no follow-through. RSI is curling up from the lows, but it’s doing so beneath both the 50-day and 200-day simple moving averages. Generally speaking, momentum is still missing, whiler price structure remains technically broken. Until TON can reclaim that $2.90–$3.00 range and close above it with conviction, we’re looking at a sideways-to-down setup, not a breakout-in-waiting.

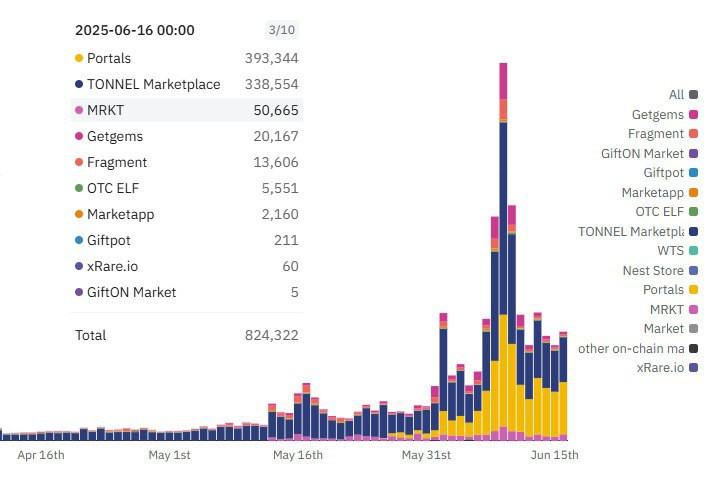

Yes, the ecosystem keeps growing. Portals became Telegram’s top gift app, hitting nearly 400K TON in daily volume. Wallet integrations keep coming. Antarctic just enabled TON deposits with card withdrawal support in the pipeline. There’s even regulatory clarity peeking through, with Durov’s legal friction in France seemingly resolving at last. But none of that has translated into real price strength yet.

The unfortunate truth: Toncoin isn’t leading this market cycle – it’s tagging along. No matter how bullish the tech headlines sound, the chart is king, and right now, the chart says wait.

If BTC and ETH catch a sustainable bid, maybe TON can reclaim its momentum. But until then, it’s still in correction mode – with a slight lean toward accumulation, not ignition.

The Bottom Line – Did We Just Flush or Crash-Land?

Look, everyone wants to know if the worst is over. Is this the dip before liftoff? Or are we just catching our breath before another flush?

Here’s the vibe:

We had a textbook macro shock – war risk, military escalation, and real-world geopolitical uncertainty. It sent markets into a tailspin, flushed leverage, and wrecked the overeager. But under the chaos, the structure seems to have held. ETF inflows didn’t reverse. Institutional demand actually picked up. On-chain data showed accumulation, not capitulation. Ethereum whales stacked. Toncoin launched. Bitcoin got a legislative nod in the U.S.

So no, this isn’t 2022. It felt bad – but structurally, this might be the washout we needed. The one that clears the books before the next move.

If war risk fades, and if BTC reclaims $104K this week, the rocket might just be warming up.

For now? Keep your bias flexible, your stops sane, and your expectations humble. The market doesn’t owe us a rally – but it just might be loading one.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Alisa, a dedicated journalist at the MPost, specializes in cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a keen eye for emerging trends and technologies, she delivers comprehensive coverage to inform and engage readers in the ever-evolving landscape of digital finance.

More articles

Alisa, a dedicated journalist at the MPost, specializes in cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a keen eye for emerging trends and technologies, she delivers comprehensive coverage to inform and engage readers in the ever-evolving landscape of digital finance.