Past Week in Crypto: Market Woes Drag Bitcoin as Durov’s Arrest Rocks Toncoin

In Brief

In late August, Bitcoin, Ethereum, and Toncoin faced market challenges. This analysis reviews their performance and factors affecting prices.

Bitcoin News & Macro

During the last week of August, Bitcoin struggled to hold above the crucial $60,000 mark as it got pulled down by a mix of market factors. Its tight link with the Nasdaq 100 wasn’t doing it any favors, dragging crypto prices lower in tandem with traditional markets as the month-end pressures built.

Even though CME launched its bite-sized Bitcoin futures for retail traders, that couldn’t stir much excitement, with the market’s larger forces still steering the ship.

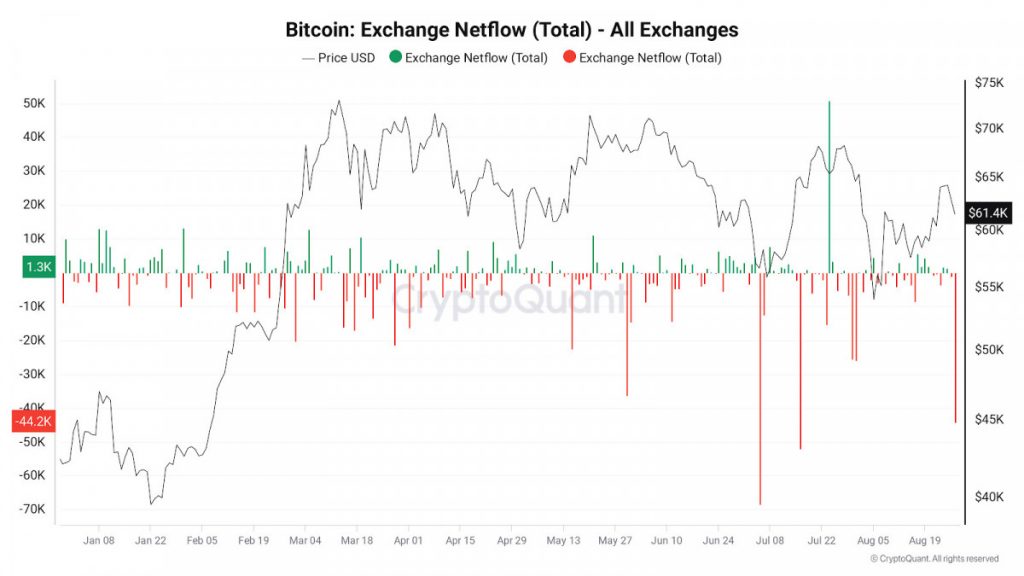

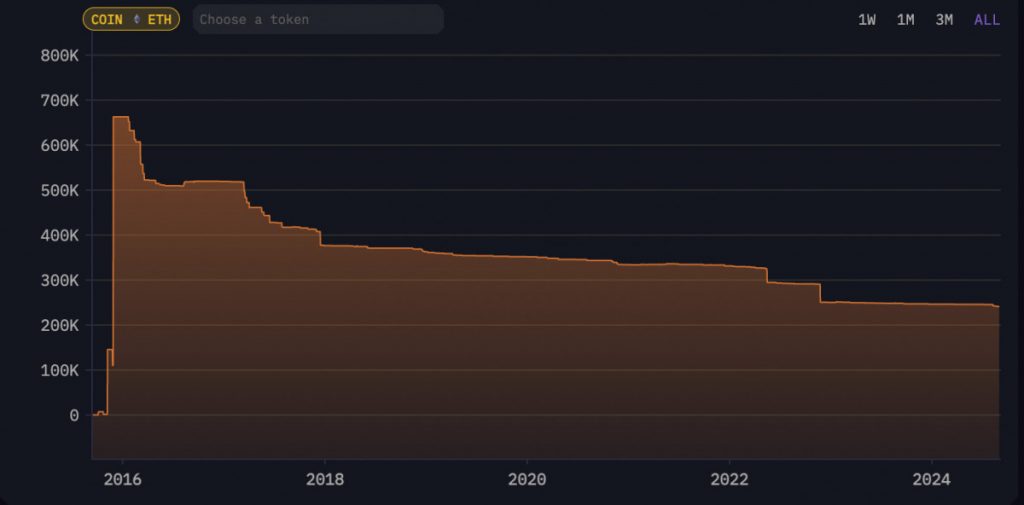

Adding to the shaky sentiment, daily outflows from exchanges have soared to their third-highest level this year, a sign that investors are pulling BTC into private wallets rather than selling.

This movement suggests a mix of caution and strategic hoarding, with many bracing for further dips. Trust in centralized exchanges also took a hit when Binance was accused of seizing Palestinian crypto funds, fueling broader concerns about where to safely store assets during uncertain times.

The broader market slump, particularly in AI and big data sectors, which have crashed nearly 80% this year, feeds directly into the unease, dampening confidence that often trickles down to Bitcoin.

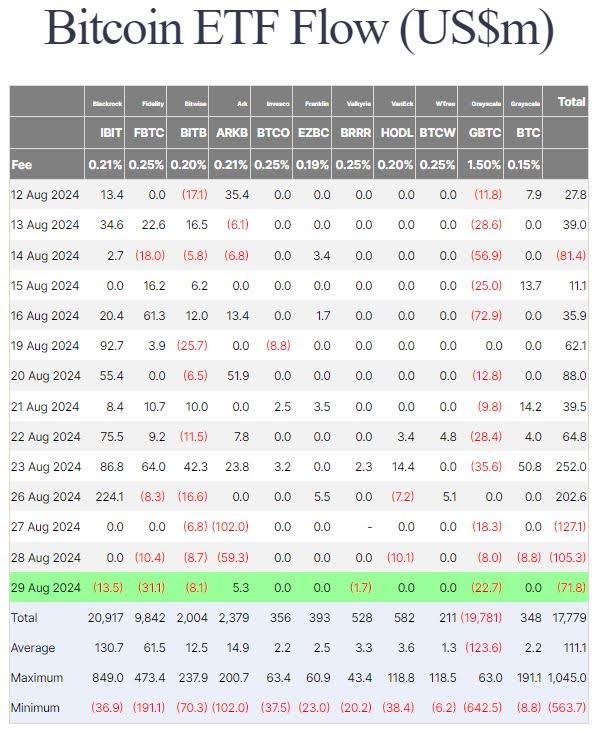

The cooling of institutional interest is another blow, highlighted by BlackRock’s Bitcoin ETF registering its largest outflow in over a month. While some big players are buying the dip, the macroeconomic backdrop, particularly concerns over Fed rate hikes, continues to cast a long shadow.

Meanwhile, the mining sector is feeling the pinch as operators adjust to rising costs, with the 2024 halving set to squeeze profitability even more. This squeeze on miners could tighten supply further, adding another layer of complexity to Bitcoin’s price dynamics.

BTC Price Analysis

Regarding price movements, Bitcoin’s end-of-august was both wild and mild, plunging from above $64,000 and breaking through local supports like a wrecking ball.

This was no ordinary dip, with aggressive selling pressure driving BTC down to the crucial $58,000 support, a level that’s been pivotal for weeks. Bulls tried to push back above $60,000, but each attempt got smacked down, especially around the 50-day EMA, turning former support into stiff resistance. Daily closes below these levels tell a story of sellers firmly in control, with $57,000 now the last line of defense against further downside.

On the 4H chart, BTC is stuck in a bearish cycle, bouncing weakly between $58,000 and $59,000, and is unable to reclaim the 50-EMA. Every attempted rally is met with a wall of sell orders, and bearish engulfing candles keep the bulls in check. The RSI briefly dipped into oversold, sparking a couple of limp rebounds, but overall the trend stayed bearish with little follow-through from buyers. This market feels trapped, with every move lower looking more like distribution than accumulation.

The $57,000 support is now crucial. Lose it, and we could see more blood in the water. On the flip side, reclaiming $60,000 could start to turn the tide, but the battle at these key levels is tight and fierce. For now, bears are keeping the upper hand, and bulls need to show some serious buying power to shift the momentum.

Ethereum News & Macro

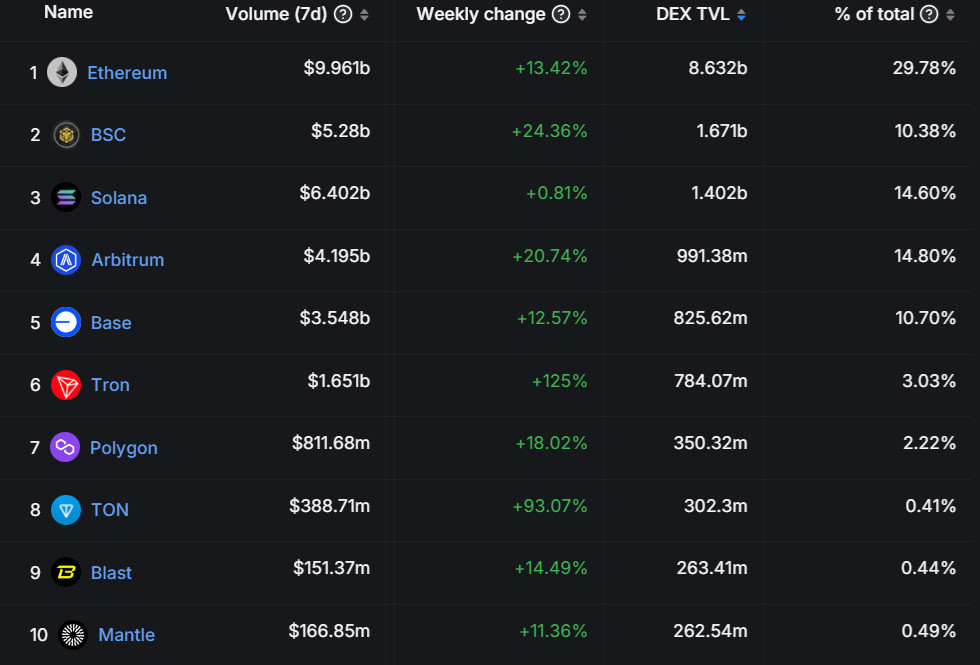

During the end of August, Ethereum was caught in the crossfire as well. Despite a surge in activity across Ethereum DApps, which saw volumes jump 36% in just seven days, the price of ETH has been struggling to keep up, highlighting a growing disconnect between on-chain utility and market performance.

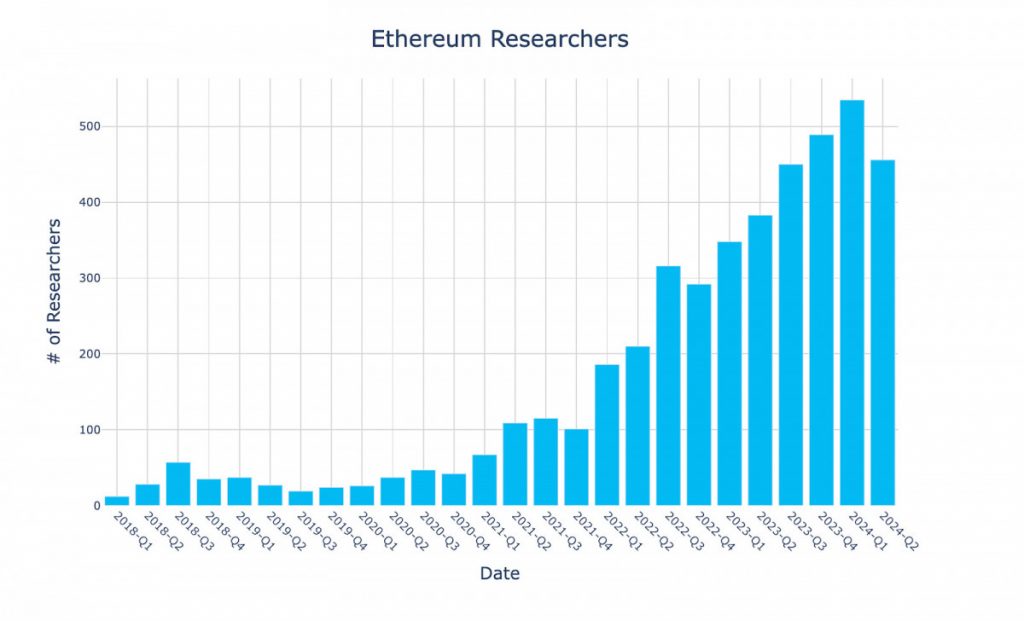

Staking has been another hot spot, with restaking activities climbing as staking rates drop, driven by fierce competition among providers. While this shows strong ongoing interest in Ethereum staking, the pressure on yields is making it less enticing for some, limiting fresh inflows that might otherwise support prices. Behind the scenes, Ethereum’s research landscape is booming, with team sizes up over 2,100% since 2019 – great for the long-term outlook, but it’s yet to make a splash in ETH’s current pricing.

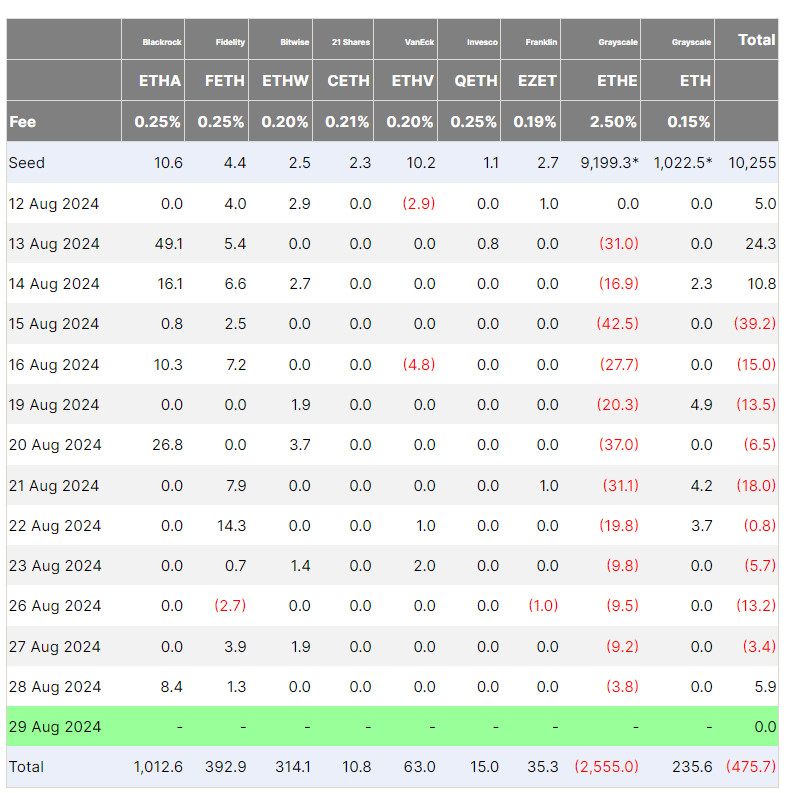

Institutional flows have been mixed. BlackRock’s Bitcoin ETF posted its second-largest outflow recently, spooking the market and adding to the broader risk-off vibe that’s also weighing on Ethereum. On the brighter side, Ether ETFs managed to turn positive after two weeks in the red, hinting at some resilience, though analysts are signaling any significant breakout might still be a ways off.

Vitalik Buterin himself stirred the pot with a $10 million ETH transfer to exchanges, sparking speculation about selling pressure.

While Buterin insists he’s not cashing out and remains committed to the long-term vision, it added to the jittery atmosphere among traders already on edge.

So, market nerves and lingering doubts are keeping ETH pinned down. For now, we’re stuck in a waiting game to see if the fundamentals can finally pull the price back up.

ETH Price Analysis

Now, let’s talk technicals. Ethereum’s week kicked off with a heavy selloff on August 25th, crashing from $2,600 down to $2,450 in a sharp move that cut through support like butter.

The breakdown highlighted seller dominance, with buyers largely… absent. Attempts to rebound have been feeble, constantly rejected by the 20 EMA at $2,621 and the 50 EMA at $2,819, both trending down and acting like a ceiling over the price. Last week’s close under $2,500 set the tone – bearish, with weak consolidation suggesting the market’s catching its breath, not prepping for a rally.

On the 4H chart, the aftermath of the crash is clear – a descending channel that looks suspiciously like a bear flag. Attempts to break higher have been slapped down by the 50 EMA at $2,559, showing sellers still have control. RSI briefly hit oversold but hasn’t managed a convincing recovery, reflecting weak bullish momentum. The $2,500 level is a key battleground – break below, and we’re looking at $2,400; hold above $2,550, and a relief rally could be on the cards. For now though, ETH is stuck in a sideways grind.

Toncoin News & Macro

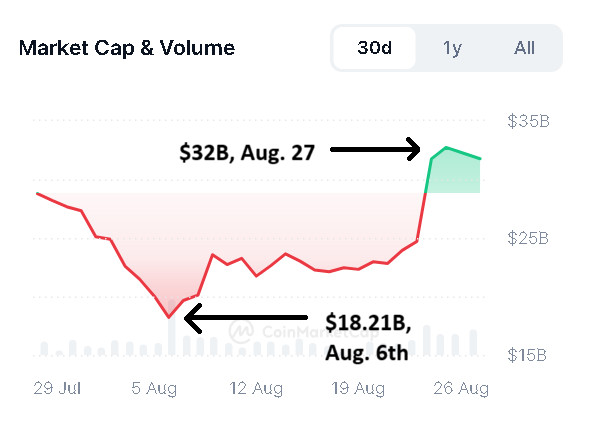

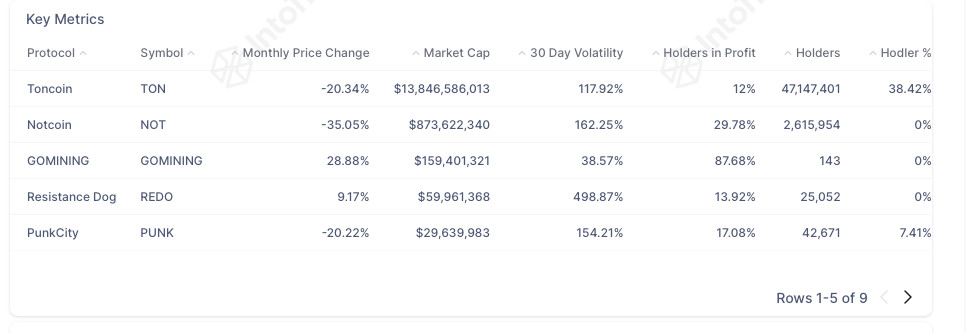

Now, let’s move over to the Toncoin side of things. Last week’s arrest of Telegram CEO Pavel Durov sent shockwaves through the market, rattling investor confidence just as Toncoin hit a significant $13.96 billion market cap.

Durov’s legal woes, including travel restrictions and serious charges, cast a long shadow over Toncoin, prompting traders to react nervously to any hint of trouble linked to the broader Telegram ecosystem.

The Open Network (TON) didn’t do itself any favors, suffering multiple outages that amplified the market’s jitters. A frenzy driven by the memecoin DOGS knocked the network offline for 36 hours, causing sporadic block production and sparking fresh doubts about TON’s ability to handle surges in demand.

These disrupted transactions shook confidence in the network’s stability despite assurances from the TON Foundation that assets remained secure. The outages spotlighted some serious cracks in TON’s armor, leaving traders edgy and quick to sell on any hint of technical trouble.

On a brighter note, Toncoin’s push into new applications and the rollout of Telegram-style mini DApps on platforms like Line showcased its expanding ecosystem.

For now, however, these positive strides were overshadowed by the ongoing network instability and Durov’s unfolding legal saga.

TON Price Analysis

Needless to say, Toncoin’s price action over the past week was heavily influenced the news around Durov’s announcement.

On the 1D chart, the August selloff took TON below the critical $5.50 support, triggering a breakdown that pulled prices down with heavy selling pressure. The subsequent attempt to rally was short-lived, failing to clear the overhead resistance near $5.60. The 20-day EMA remains below the 50-day, underscoring the bearish control, with lower highs suggesting that sellers are dominating.

Zooming into the 4H chart, the price saw a brief spike on the Durov news but quickly ran into stiff resistance around $5.60. The bounce off $5.20 support hinted at some accumulation, but the failure to break above the dashed resistance line shows the market’s hesitation. The RSI has hovered around neutral, reflecting indecision and lack of strong directional momentum.

TON’s price now sits precariously above the $5.20 support, with any break lower likely to see increased bearish activity. If the price fails to hold this level, a retest of $5.00 or even lower could be on the cards, reflecting broader crypto market struggles. Conversely, reclaiming $5.60 convincingly could set up TON for a more meaningful recovery, but with current sentiment, the path ahead looks uncertain.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Alisa, a dedicated journalist at the MPost, specializes in cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a keen eye for emerging trends and technologies, she delivers comprehensive coverage to inform and engage readers in the ever-evolving landscape of digital finance.

More articles

Alisa, a dedicated journalist at the MPost, specializes in cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a keen eye for emerging trends and technologies, she delivers comprehensive coverage to inform and engage readers in the ever-evolving landscape of digital finance.