Justin Sun Withdrew $200m to Huobi: Exchange in Trouble?

In Brief

A wallet address labeled Justin Sun has withdrawn 200 million $USDT from JustLend and deposited into Huobi.

The wallet address marked as Justin Sun withdraws 200 million USDT from JustLend and deposits it into Huobi. Huobi’s USDT reserves have also increased from around $85 million to the current $285 million. This article delves into the specifics of this transaction, its implications, and the surrounding context.

Justin Sun, founder of TRON and a well-known personality in the cryptocurrency domain, has always been under the spotlight for his strategic investments and his opinions on market dynamics. A recent transaction from a wallet address marked as his has made headlines.

The Big Move: From JustLend to Huobi

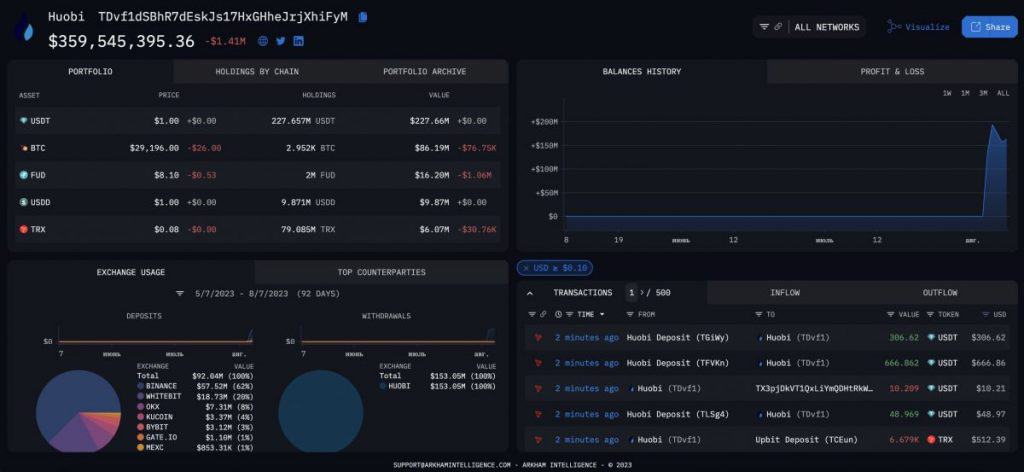

Recently, someone observed a significant transaction where someone withdrew 200 million USDT from JustLend, a well-known decentralized finance platform. This same amount then went into Huobi, a globally known cryptocurrency exchange. The source of this transaction was a wallet address identified as TDvf1dSBhR7dEskJs17HxGHheJrjXhiFyM, which has been labeled as belonging to Justin Sun. This has naturally sparked interest and speculations across the crypto community.

The wallet address marked as Justin Sun (TT2T17KZhoDu47i2E4FWxfG79zdkEWkU9N) withdraws 200 million USDT from JustLend and deposits it into Huobi. Huobi’s USDT reserves have also increased from around $85 million to the current $285 million. Recently, due to the investigation of…

— Wu Blockchain (@WuBlockchain) August 8, 2023

A Ripple Effect: Huobi’s Surging Reserves

Huobi’s USDT reserves have witnessed a significant upsurge, from an initial $85 million to a staggering $285 million. This nearly threefold increase can largely be attributed to the recent deposit made by the aforementioned address.

It’s crucial to understand the broader context in which this transaction is taking place. Recently, certain executives of Huobi have come under police investigation. This scrutiny has led to apprehensions and uncertainty among its user base, prompting them to withdraw their funds from the platform. Amidst this backdrop, the massive deposit into Huobi assumes greater significance and has led many to wonder about the strategic thinking behind such a move.

Analysis and Implications

There are a few potential reasons and implications for this move:

- Diversifying Assets. Justin Sun, given his strategic acumen, might be looking to diversify his holdings. Moving funds between platforms is not uncommon for high-net-worth individuals in the crypto domain.

- Bolstering Confidence. Given the recent negative publicity surrounding Huobi due to the investigations. A significant deposit from a high-profile personality like Sun might serve to restore some confidence in the platform.

- Market Strategy. Sun, with his vast experience, could potentially anticipate a market shift or opportunity that many are not privy to. His actions often carry weight and are closely monitored for insights by analysts.

In the constantly changing world of cryptocurrencies, such significant fund movements, especially when linked to prominent figures like Justin Sun, inevitably create ripples. While the exact reason behind this move remains speculative, it undoubtedly underscores the dynamic and complex nature of cryptocurrency markets. We still need to see the other effects this transaction will cause in the broader context of Huobi’s operations and reputation.

Read more:

- The Founder of Curve Raised $57.46m Through an OTC Sale

- Intense Week in Crypto – CPI, PPI, Huobi Rumors, CRV Loans

- One of the Top Profit Earners on Binance Burns 2,500 ETH

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Nik is an accomplished analyst and writer at Metaverse Post, specializing in delivering cutting-edge insights into the fast-paced world of technology, with a particular emphasis on AI/ML, XR, VR, on-chain analytics, and blockchain development. His articles engage and inform a diverse audience, helping them stay ahead of the technological curve. Possessing a Master's degree in Economics and Management, Nik has a solid grasp of the nuances of the business world and its intersection with emergent technologies.

More articles

Nik is an accomplished analyst and writer at Metaverse Post, specializing in delivering cutting-edge insights into the fast-paced world of technology, with a particular emphasis on AI/ML, XR, VR, on-chain analytics, and blockchain development. His articles engage and inform a diverse audience, helping them stay ahead of the technological curve. Possessing a Master's degree in Economics and Management, Nik has a solid grasp of the nuances of the business world and its intersection with emergent technologies.