Japanese Politician Ishiba’s Bold Vision for a Blockchain-Powered Economic Renaissance

In Brief

Japan’s new prime minister, Shigeru Ishiba, plans to leverage blockchain technology and NFTs to boost the economy, marking a significant technological shift in the country.

As its new prime minister, Shigeru Ishiba, reveals bold ambitions to use blockchain technology and non-fungible tokens (NFTs) to boost the country’s economy, Japan finds itself at a technological crossroads. This legal change represents a major turning point for Japan, a nation steeped in cryptocurrency and digital asset history.

Ishiba’s Proposal for a Digital Japan

Shigeru Ishiba, the former Japanese Defense Minister and freshly elected president of the ruling Liberal Democratic Party (LDP) is scheduled to become Prime Minister next week. His rise to prominence has given rise to a new understanding of how developing technology will impact Japan’s economic future.

Ishiba stated his intention to use NFTs and blockchain innovation as instruments for economic development, especially in local communities, in a newly published policy statement.

“We will try to optimize the value of a variety of analog local items, such as food and travel experiences, using blockchain, NFTs, and more. We will do this by bringing their value back to par with world pricing,” Ishiba said.

This strategy corresponds with requests from crypto industry groups calling for the use of NFTs and DAOs to revitalize rural economies. The goal of Ishiba’s government is to generate new sources of income and draw attention to Japan’s varied regional offers by digitizing local assets and experiences.

A New Digital Affairs Minister

Ishiba intends to choose Masaaki Taira, the current leader of the LDP’s web3 taskforce, as the new Minister of Digital Affairs, demonstrating his dedication to this digital transformation. Given her expertise and prior remarks, Taira appears to be strongly in favor of incorporating blockchain and NFT technology into a number of Japanese economic areas.

Taira has made a strong case for how NFTs might increase the value of Japanese intellectual property abroad. He has also underlined the need for tax reform to promote crypto entrepreneurs, stating that the existing system is “not optimized” for enterprises in the current era, particularly those working with lesser-known currencies.

Taira has taken note of the difficulties experienced by new businesses in the cryptocurrency industry, particularly with regard to audits of their token holdings. His nomination suggests that efforts to improve Japan’s climate for blockchain and NFT innovation may be shifting in that direction.

Historical Background: Japan’s Crypto Adventure

In order to appreciate the importance of this legal change, it is important to look into Japan’s turbulent cryptocurrency past. Although there have been some notable hiccups, the nation has led the way in the acceptance of cryptocurrencies.

Japan was host to two of the biggest crypto exchange hacks in history. The most well-known was the 2014 hack of Mt. Gox, which at the time was the biggest Bitcoin exchange in the world and cost 7% of the whole supply of the cryptocurrency. Because of these occurrences, Japanese authorities have been obliged to enter the crypto area far sooner than their colleagues in other nations, which has resulted in a more cautious approach to the regulation of digital assets.

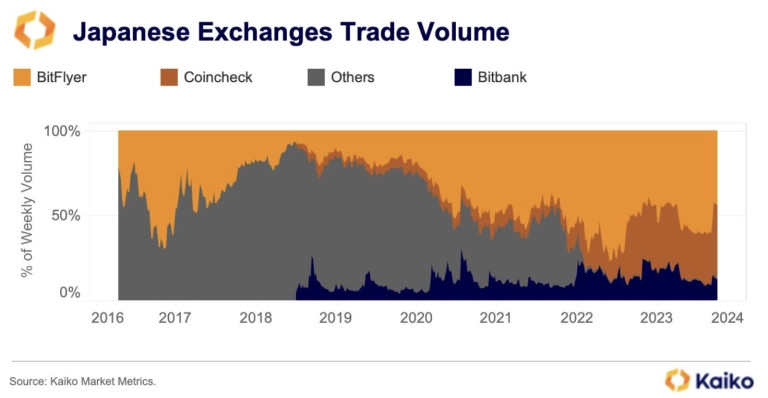

Photo: Kaiko

Japan was among the first countries to create a thorough regulatory framework for cryptocurrency assets, despite these obstacles.

The Purpose of the Japanese Yen in Crypto

The pattern of JPY-denominated trade volumes on exchanges reflects the country of Japan’s attitude toward cryptocurrencies. JPY volumes once outpaced USD volumes, demonstrating Japanese investors’ early fervor for cryptocurrencies. However, exchange listing limitations and unfavorable tax rules have been the main reasons Japan’s crypto sector has trailed behind other areas in recent years.

The difficulties in Japan’s cryptocurrency ecosystem have been demonstrated by the struggle of local exchanges to compete with global behemoths like Binance in terms of trading volume, particularly since the start of the COVID-19 epidemic. Even with these obstacles, well-known exchanges like BitFlyer have continued to rule the domestic market.

Current Developments in Regulation

Japan has been a leader in the regulation of cryptocurrencies in recent years. New stablecoin laws were introduced by a bill that amended the Payment Services Act and was enacted in June 2022. With effect from June 1, 2023, these revisions show Japan’s continued commitment to establishing a stable and safe environment for digital assets.

The country has also experienced increased interest in security tokens, sometimes referred to as digital securities. Recent modifications to key laws and regulations have prepared the path for financial institutions to enter this new sector, focusing especially on digital corporate notes and tokenized equity holdings in real estate funds.

The first public sale of asset-backed security tokens in Japan, conducted in July 2021 by a division of renowned real estate corporation Kenedix, marked an important event in this field. This business, along with other ventures of a similar nature, has traditionally made use of a blockchain-based beneficiary certificate issuing trust mechanism.

The Rise of NFTs in Japan

Japan has not been excluded from the worldwide NFT boom. In this country, digital art and digital trading cards represented by NFTs have become more popular, with some pieces selling for high prices. NFTs’ distinctive quality, which generates unique data based on blockchain technology, has drawn the interest of both investors and artists.

The increasing popularity of NFTs is consistent with Ishiba’s plan to use these digital assets to advertise regional goods and experiences. Japan may be able to open up new markets and sources of income for its many local economies by tokenizing localized characteristics, such as traditional crafts and delicious cuisine.

Japan’s increasing emphasis on NFTs and blockchain technology may have important worldwide ramifications. Japan is a technology leader and one of the greatest economies in the world. As such, its actions frequently affect trends in other nations, especially in Asia.

If effective, other countries wishing to use blockchain and NFTs for economic development may find inspiration in Japan’s incorporation of these technologies into their own economic strategies. Additionally, it may cause a change in the global crypto and NFT markets’ power dynamics, resulting in increased activity and innovation on Japanese platforms.

In addition, the way Japan regulates these technologies may influence global norms. As nations throughout the globe struggle with how to handle the quickly changing realm of digital assets, Japan’s experiences and regulations may offer helpful guidance.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.