How Bitget Wallet Is Redefining Banking in Emerging Markets

In Brief

Bitget Wallet’s Onchain Report highlights the growing adoption of crypto wallets in emerging markets, highlighting their expanding functionalities beyond storing and transferring digital assets.

A recent report from Bitget Wallet, titled Onchain Report: Crypto Wallet Use Cases, offers an in-depth examination of the evolution of crypto wallets and their adoption by users. Utilizing survey data from 4,599 individuals worldwide, the report emphasizes the expanding functionalities of wallets beyond merely storing and transferring digital assets. In various emerging markets, these wallets are becoming essential tools for financial transactions where traditional banking options may be unavailable, inefficient, or limited.

Bitget Wallet, which has recently undergone a brand update and announced its 2025 roadmap, has expanded its user base to over 80 million globally, marking a remarkable 300% growth year-on-year. The company’s strategy is centered on empowering users to trade, earn, pay, and discover new opportunities directly within the wallet interface.

Wallets as Versatile Financial Instruments

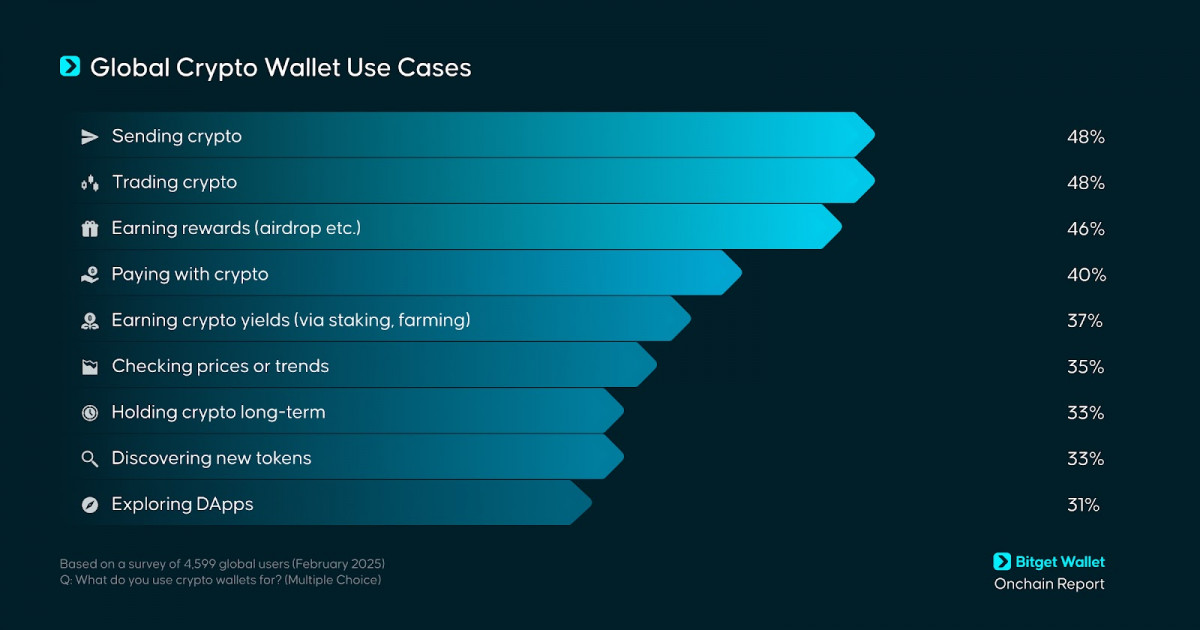

The findings indicate that users now utilize crypto wallets for various purposes. Almost half of the respondents reported using them for trading (48%), earning crypto-based rewards (46%), and making payments (40%). Other applications include staking or farming for yield (37%), monitoring market trends (35%), and exploring new tokens (33%). About one-third of users also utilize wallets to engage directly with decentralized applications (DApps).

These figures signify a move in user behavior from merely storing assets to engaging more actively in financial activities. Wallets are increasingly serving as gateways to different facets of blockchain financial systems.

Diverse Trends Across Regions and Generations

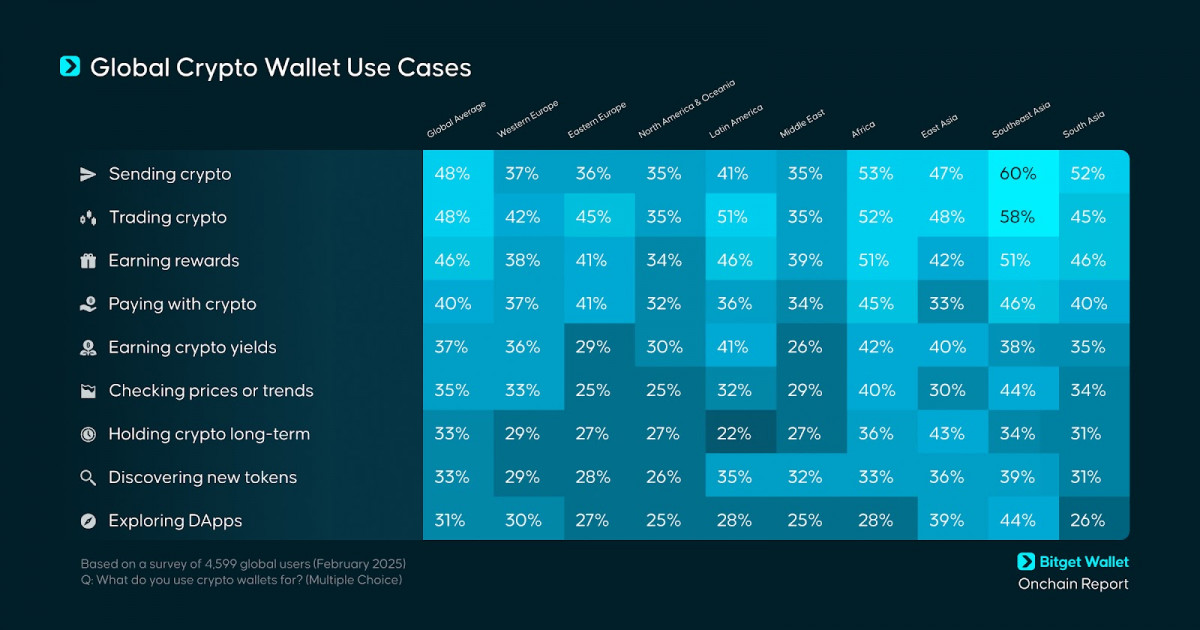

Crypto wallet usage varies significantly based on users’ location and age. In Africa, 53% of users utilize wallets mainly for sending money, whereas in Southeast Asia, this figure rises to 60%. These patterns are closely linked to local demands, especially where traditional remittance options may be expensive or hard to obtain.

In Latin America, the primary motivation for using wallets is often to hedge against inflation. Approximately 41% of users engage in staking or yield farming, indicating a reliance on decentralized finance tools to maintain or increase value amidst economic uncertainty.

In East Asia, the predominant activities are long-term holding (44%) and yield generation (42%). Comparatively, Eastern Europe exhibits strong involvement in crypto payments (41%). Meanwhile, Western Europe and North America place greater emphasis on trading and earning rewards, reflecting their more developed access to financial products and a stronger focus on diversifying portfolios.

For Gen Z respondents, crypto payments are notably more prevalent (43%), highlighting a greater comfort level with digital-first financial tools compared to older age groups.

Infrastructure and Product Strategy

Bitget Wallet showcases a range of current and upcoming features that cater to various use cases. Its 2025 roadmap emphasizes four primary areas: Trade, Earn, Pay, and Discover. The platform now offers a cross-chain decentralized exchange (Super DEX), a real-time token analysis tool (Alpha), and a user-friendly interface for newcomers (Simple Mode).

Future enhancements will focus on broadening yield options and increasing payment flexibility. Upcoming features such as Earn Vaults and payment dashboards are designed to facilitate income-generating strategies. The wallet will also incorporate a payment infrastructure supporting QR code payments, crypto cards, and an in-app store that features over 300 global brands, including Amazon, Shopee, and Google Play.

Currently, Bitget Wallet supports more than 130 blockchains and manages a user protection fund of $300 million. These features aim to boost both functionality and user trust in a market where users may be hesitant due to security concerns or limited financial backgrounds.

Wallets in Daily Use

The report and Bitget Wallet’s strategy indicate a trend toward using wallets for everyday transactions, rather than solely for speculative or investment purposes. This shift is especially pertinent in regions with limited access to traditional financial infrastructure. In many countries, users are adopting crypto wallets for routine financial tasks, such as sending money, purchasing goods and services, and engaging in financial activities like staking and earning crypto rewards.

The incorporation of shopping and payment features within wallet applications may also reflect a movement towards more all-encompassing financial tools, especially for users who heavily depend on mobile devices for their online engagement.

Education and User Onboarding

For widespread adoption to keep progressing, educating users is essential. Bitget Wallet has introduced initiatives aimed at user onboarding, including a $1 million campaign to raise awareness and encourage usage. The wallet provider collaborates with partners throughout the ecosystem to facilitate product integration and real-world applications.

In many emerging markets, potential users might lack familiarity with critical concepts such as private key management, decentralized finance, or blockchain-based rewards. Educational campaigns aim to bridge this gap and ease the onboarding process for new users.

Emerging Trends and Future Outlook

The insights from Bitget Wallet’s report indicate broader trends in the digital finance landscape. In areas where banking access is unreliable, crypto wallets are fulfilling comparable roles. They enable users to transfer funds, store assets, earn yields, and engage in commerce. This doesn’t imply that wallets are entirely replacing banks, but rather that they are addressing significant gaps.

Wallet-based financial systems are likely to continue expanding, particularly if they remain user-friendly, secure, and well-integrated with other platforms. Their influence in the larger digital economy is expected to grow as infrastructure, regulations, and user knowledge improve.

In emerging markets, where conventional financial services have typically fallen short, crypto wallets may offer a more approachable entry point. Their future use will hinge on how effectively providers can adapt wallet features to meet local demands, preserve user confidence, and facilitate the onboarding process for newcomers.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.