How a CNY Stablecoin Could Reinforce Hong Kong’s Crypto Industry

In Brief

Hong Kong’s fintech innovation and digital asset growth necessitate new challenges, including the creation of a stablecoin linked to the Chinese yuan to accelerate virtual operations.

For a considerable amount of time, Hong Kong has been among the leading global financial hubs. However, as fintech innovation and digital assets grow, Hong Kong will have to overcome new obstacles to remain at the top spot. The creation of a stablecoin linked to the Chinese yuan (CNY) is one viable course of action that has gathered popularity in order to speed up virtual operations and reinforce Hong Kong’s position as a center for digital assets.

The Stablecoin’s Current Landscape

Stablecoin is a currency whose value is tied to a stable asset or group of stable assets, such as fiat money like the US dollar, in order to reduce price volatility. Stablecoins are desirable for use in transactions and as a store of value within the cryptocurrency ecosystem because of their stability.

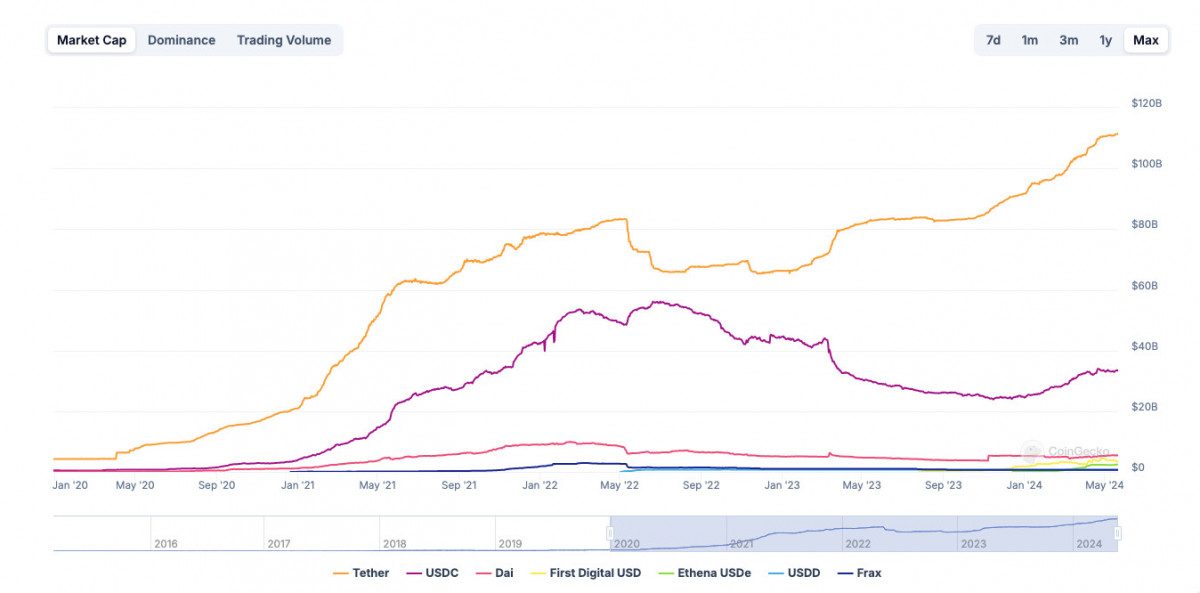

From around $5.9 billion at the beginning of 2020 to over $130 billion by the end of 2023, the stablecoin market has grown rapidly in recent years. Because the US dollar is the world’s reserve currency, the biggest stablecoins, such as Tether (USDT) and USD Coin (USDC), are correlated to the US dollar and control the market.

Photo: CoinGecko

However, some argue that US dollar-pegged stablecoins centralize too much power in the hands of US regulators and institutions. There are also concerns about the transparency and asset backing of major dollar-pegged stablecoins like Tether. These factors have fueled interest in developing stablecoins pegged to other huge currencies.

Hong Kong’s Advantages For the Stablecoins Development

Amid this evolving digital asset industry, Hong Kong enjoys a series of inherent advantages, positioning it to become a leader in the next wave of stablecoin development and adoption:

Offshore CNY Trading Hub

As the world’s major offshore trading center for the Chinese yuan/renminbi (CNY/RMB), Hong Kong promotes unparalleled liquidity, infrastructure, and institutional experience, facilitating cross-border CNY transactions. This CNY prowess gives Hong Kong a natural base to build CNY-pegged digital asset products and markets.

Proximity to Mainland China

Hong Kong’s economic integration with mainland China provides direct ties to the world’s second-largest economy and a gateway for connecting China with global capital markets. Hong Kong is a key participant in China’s Greater Bay Area initiative intertwining the economies of Hong Kong, Macau and nine cities in Guangdong province. This proximity and integration are imperative for developing cross-border digital yuan applications.

Comprehensive Regulatory Environment

Hong Kong has an internationally respected, comprehensive regulatory regime governing financial services activity under the Securities and Futures Commission (SFC). The SFC is already establishing a licensing process for Hong Kong’s digital asset sector, which could extend to cover stablecoin issuance, exchanges, and institutional services.

Institutional Strength & Talent

As an international finance hub, Hong Kong hosts a deep pool of financial services professionals with expertise in trading, investment products, risk management, and more. Hong Kong also has extensive experience developing traditional products that facilitate RMB internationalization and could translate into digital assets.

Independence and Rule of Law in China

While operating under the “one country, two systems” principle with China, Hong Kong maintains an independent judiciary, rule of law, and autonomy over economic/financial matters that are critical for inspiring market confidence in any regulated digital asset activity.

Xiao Geng, the chairman of the Hong Kong Institute for International Finance (HKIIF), has been one of the leading voices promoting the introduction of a controlled stablecoin in Hong Kong that is linked to the RMB or yuan, citing these benefits.

Xiao stated at a recent conference that the city’s digital economy might be revolutionized by the development of a “Greater Bay Area stablecoin” backed by regulated blockchains and smart contracts and tethered to the Chinese yuan. He promoted it as a way to strengthen Hong Kong’s standing in the international financial industry while utilizing the region’s function as a test bed for offshore RMB creation and RMB development.

Overcoming Challenges Related to the Stablecoins

Although appealing in theory, there are obstacles in the way of implementing a CNY stablecoin. To begin with, there is a great deal of regulatory ambiguity. Beijing’s position on a Hong Kong CNY stablecoin is unclear because China has so far outlawed cryptocurrencies and stablecoins. Prior to the release of its official digital currency, China could be hesitant to allow a digital CNY.

Second, there is a problem with Hong Kong’s restricted autonomy. Hong Kong has to work with Beijing on significant financial projects like the creation of a new stablecoin since it is a special administrative area. Considering the political differences between mainland China and Hong Kong, this collaboration can be complicated but also vital.

Third, there is a problem with adoption inertia. USD stablecoins are already well-established on international marketplaces. Thus, even from Hong Kong’s standpoint, it remains to be seen if there will be enough demand for a CNY substitute.

The fourth important aspect is competition. Stablecoin projects are also being pursued by other countries, such as Singapore, which might lead to competition to seize this growing market. The competitive environment may affect the viability of a CNY stablecoin launched in Hong Kong.

Fifth, there is yet another barrier in the form of the technology needed to issue a controlled stablecoin. Stablecoin functioning and legitimacy depend on strong blockchain technology, transparent procedures, and custodial asset management.

Finally, the development or adoption of stablecoins may be impacted by geopolitical tensions, namely the US-China competition, which has additional political undertones. The viability of a CNY stablecoin in Hong Kong as a whole, as well as market acceptability and regulatory choices, may be impacted by these conflicts.

Hong Kong’s Path Towards the CNY Stablecoin

While challenges exist, a CNY-pegged stablecoin could be a critical innovation to maintain Hong Kong’s status as a leading global financial center in the digital asset era. Hong Kong’s unique integration with mainland China’s economies and markets makes it an ideal staging ground.

The end result, according to Andrew Fei, a partner at the law firm King & Wood Mallesons, is that entirely backed digital goods will be subject to a funds charge commensurate with the nature of the underlying; in other words, if the token grants voting or economic rights, it will be regarded as a holding similar to an equity or corporate bond. In order to do this, the bank must adhere to strict paperwork and regulatory requirements, reserve 100% of the stablecoin, and conduct frequent audits.

However, successful execution will require deft coordination between Hong Kong’s regulators and institutions, Beijing’s backing, and buy-in from global markets. If achieved, it could fundamentally enhance Hong Kong’s digital asset offerings and position for decades to come. The stablecoin race is on, and how Hong Kong maneuvers from here will be pivotal.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.