From Chat App to Crypto Giant: The Meteoric Rise of TON and Its Quest to Democratize Blockchain for 900M Users

In Brief

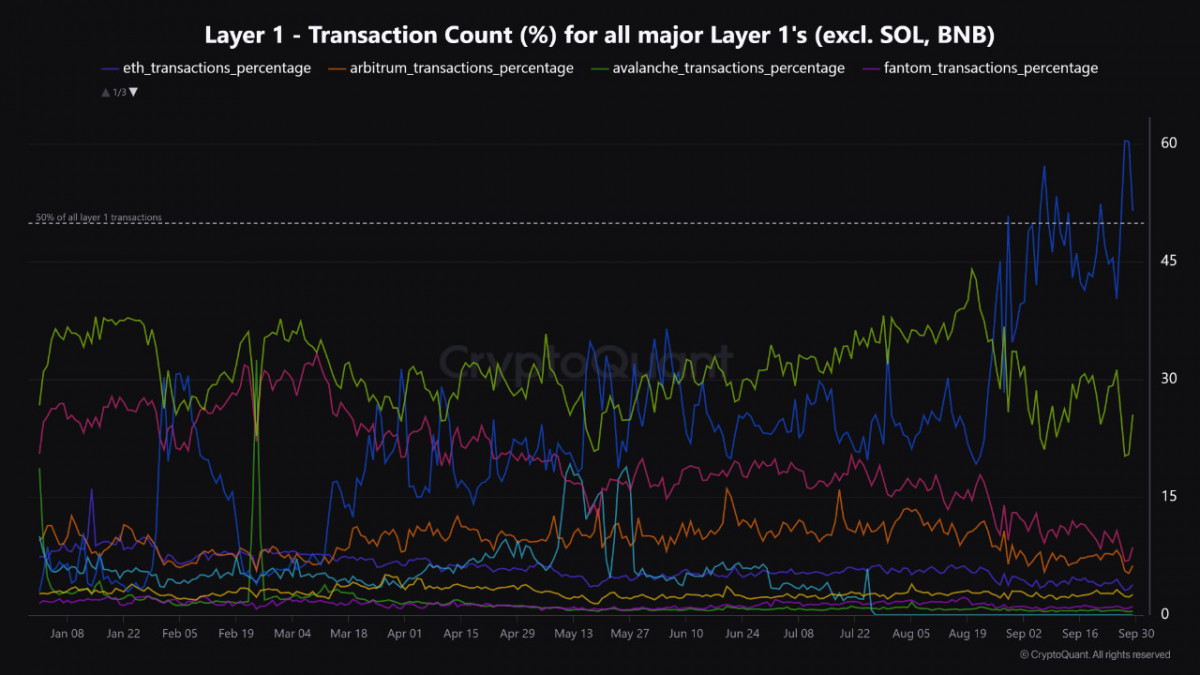

TON, through its partnership with Telegram, surpassed Ethereum and Avalanche in September, gaining 50% of Layer 1 transactions and reducing the difficulty for potential users.

According to recent statistics from CryptoQuant, TON surpassed well-established rivals like Ethereum and Avalanche to take over 50% of all Layer 1 transactions in September.

Telegram’s mutually beneficial partnership has given TON an unrivaled edge: rapid access to a large, tech-savvy user base that is mostly centered in the CIS, India, Brazil, and the US. The difficulty for millions of prospective crypto users to get started has decreased because of the smooth integration of blockchain capabilities into an already-established communication environment.

TON Ecosystem Experiences Unprecedented Growth

The figures clearly illustrate TON’s fast rise. The network’s daily transaction volume has increased dramatically over the last year, from 100,000 to 1.2 million, a 12-fold increase. Total Value Locked (TVL), which increased by around 1800% in less than six months to reach $350 million, has risen in tandem with this tremendous growth in activity. Similar to this, the decentralized exchange (DEX) trade volume on TON has increased dramatically, from $2 million to $40 million since the year’s beginning.

With more than 1,159 projects in several industries, including cross-chain bridges, DeFi platforms, and launchpads, TON’s ecosystem is thriving. This wide range of services has helped the network become more widely used and has raised the average price of the native TON token to $5.5.

The dominance of TON in Layer 1 transactions is mostly due to the recent wave of successful token launches on the platform. Millions of monthly active users have been drawn to projects like Watbird, Hamster Kombat, CatizenAI, DOGS, and Rocky Rabbit. In fact, Hamster Kombat alone has an amazing 110 million MAU. These releases have not only raised transaction volume but have also shown TON’s capacity to serve high-profile, user-intensive apps.

The design of TON provides TON with a number of major advantages over its rivals, especially Ethereum. Its proxy solutions, asynchronous smart contract calls, and multi-chain architecture provide decentralized apps a more adaptable and scalable base. With these technological advantages, TON is positioned as a strong contender for developers looking to create intricate, high-performing dApps.

For services like Bitget Wallet in particular, the integration of TON with Telegram has proven revolutionary. Bitget Wallet has effectively closed the gap between Web2 and Web3, giving millions of users a smooth experience by utilizing Telegram’s large user base. Bitget Wallet is now the most popular Web3 wallet globally in terms of app downloads, with over 30 million users and 12 million monthly active users thanks to this integration.

TON’s Path to Long-term Sustainability

TON is facing a number of obstacles that might affect its long-term prospects, even with its tremendous expansion. Due to its present low trading activity and restricted loan choices, the ecosystem may find it difficult to compete with more well-established DeFi platforms. Furthermore, TON may be less appealing internationally and subject to local regulatory problems as a result of its strong reliance on the CIS market.

The TON ecosystem was rocked by the recent arrest of Telegram CEO Pavel Durov, which resulted in a sharp decline in TVL and token price. This incident shows the possible weaknesses in TON’s strong relationship with Telegram and emphasizes the long-term necessity for more independence.

According to Bitget’s analysis, in order to reduce regulatory concerns and establish itself as a fully autonomous blockchain platform, TON would need to go through a “de-Telegramization” process. Although there’s a chance that some of TON’s present user base may find this shift offensive, it might be essential to TON’s long-term viability and widespread acceptance.

Despite recent losses, Toncoin, the native token of TON, has performed admirably. So far this year, it has returned 149%, much over Bitcoin’s 51% gain in the same time frame. Given its excellent performance and increasing institutional interest, TON could continue to draw interest from investors and developers in the months to come.

Photo: CoinGecko

It’s crucial to remember that even while TON has advanced greatly, it still lags behind some of its rivals in some areas. For example, Solana, which processed over 1.1 billion transactions in September and has 3.9 million daily active addresses, continues to dominate all Layer 1 chains in terms of transaction volume and daily active wallets. In contrast, within the same time period, TON executed 212.5 million transactions and had 2.1 million active addresses every day.

TON’s Impact on the Broader Blockchain Landscape

The triumph of TON underscores a more extensive pattern in the blockchain sector, which is a move towards streamlined, user-friendly solutions that mediate between conventional online services and decentralized technology. Through the utilization of Telegram’s current user base and infrastructure, TON has proven its capacity for quick acceptance and scalability within the blockchain domain.

However, this accomplishment also raises critical issues regarding the future of decentralized networks. TON must find methods to sustain its user base and grow without depending on its existing primary distribution channel as it contemplates severing ties with Telegram in order to reduce regulatory concerns. This problem is not exclusive to TON; rather, it is a reflection of a larger conflict in the blockchain space between the principles of independence and decentralization and the necessity for widespread acceptance.

The growth of TON also has consequences for the larger Layer 1 landscape. Established networks like Ethereum may come under additional pressure to expedite their scaling solutions and enhance user experience as newer, more effective platforms gain popularity. The industry as a whole may innovate as a result of this rivalry, providing end customers with blockchain services that are quicker, less expensive, and easier to use.

The ascent of TON poses a challenge as well as an opportunity to the larger cryptocurrency ecosystem. On the one hand, it shows how blockchain may be made accessible to hundreds of millions of people by means of clever collaborations and intuitive design. However, it also calls into question the role of corporations and centralization in the purportedly decentralized world of cryptocurrency.

The success of TON also prompts more general queries on the potential use of Web3 technologies. Should integrating with current Web2 systems turn out to be the most successful route to widespread adoption, we could witness further blockchain initiatives adopting comparable approaches. A new generation of “hybrid” platforms that incorporate the greatest features of decentralized and centralized systems may result from this.

.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.