Crypto’s 2024 Finale: Bitcoin Hits Milestones, Ethereum Eyes $3.5K, TON Quietly Thrives

In Brief

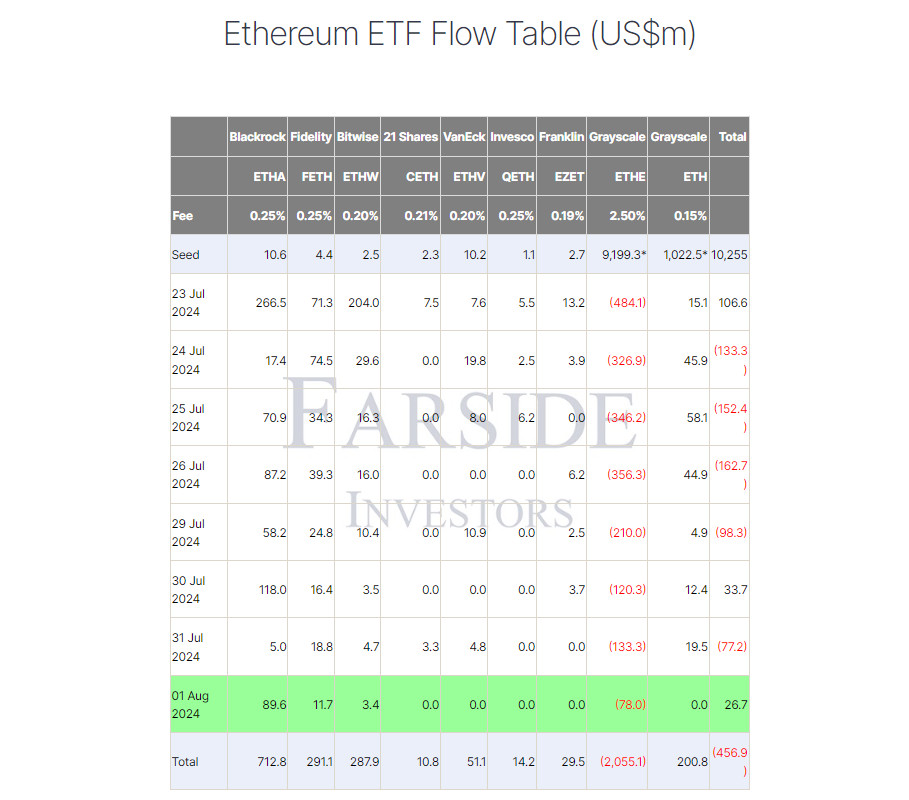

What a wild ride it’s been for crypto this year – big wins, bigger twists, and plenty to keep us all guessing. Bitcoin did smash through six figures after all, solidifying its spot as digital gold’s heavyweight champ. Ethereum took a different route – it made waves midyear when the SEC greenlit spot Ether ETFs, pulling in heavyweights like BlackRock and Fidelity. Meanwhile, TON was mostly flying under the radar but proving that quiet, consistent growth can pack just as much punch, especially when you’ve got Telegram’s massive reach on your side.

Now, as we count down the final hours of December, the action hasn’t let up. Bitcoin’s taken a breather after its historic high, Ethereum’s grappling with a tough resistance, and TON is busy blending blockchain with everyday life in ways that are impossible to ignore. So, what’s the latest buzz as we wrap up 2024? Let’s break it all down and see what might be waiting around the corner in 2025.

Bitcoin

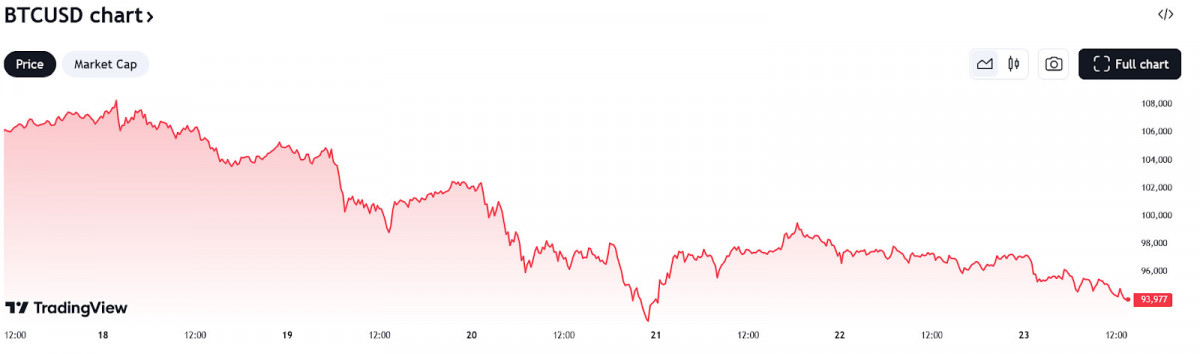

With New Year’s Eve just hours away, Bitcoin is wrapping up 2024 with a mix of triumph and tumult. Hitting the six-figure milestone earlier this month had the crypto world buzzing, but that excitement has been tempered by a sharp correction that’s left the market holding its breath.

BTC/USD 1D Chart, Coinbase. Source: TradingView

After peaking at $108,135, Bitcoin has slid roughly 10%, now hovering near $92,500. Traders are laser-focused on key support levels, asking the million-dollar question: is this just a healthy pause, or could 2025 start with a stumble?

Source: TradingView

There’s still a flicker of holiday optimism. A brief “Santa rally” earlier this week pushed Bitcoin back up to $98,000, showing that bullish momentum isn’t entirely spent.

BTC/USD 1-hour chart. Source: Cointelegraph/TradingView

Binance reserves, now at their lowest since January, have fueled cautious hope – after all, similar levels preceded a major rally earlier this year.

Source: CryptoQuant

But yeah, the correction has dragged on long enough to make even die-hard bulls pause and reassess.

Globally though, Bitcoin has still been flexing its muscle. For one, El Salvador made waves by surpassing 6,000 BTC in its holdings, placing it among the top sovereign Bitcoin owners.

Source: El Salvador Bitcoin Office

In Japan, Metaplanet capitalized on the dip with its largest Bitcoin purchase yet – $60 million worth – while Russia made headlines by allowing Bitcoin for foreign trade. These moves speak volumes to Bitcoin’s evolving role on the geopolitical stage.

Source: Metaplanet

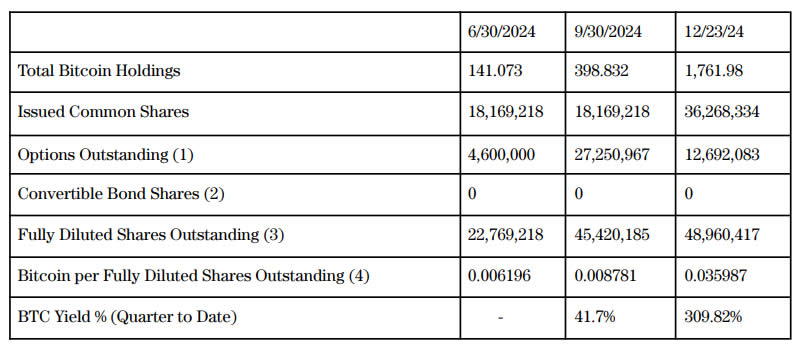

Stateside, the Bitcoin story has been just as eventful. MicroStrategy ended the year by adding 5,200 BTC to its holdings, bringing its total to a jaw-dropping 439,000 BTC, worth over $41 billion.

Source: Michael Saylor

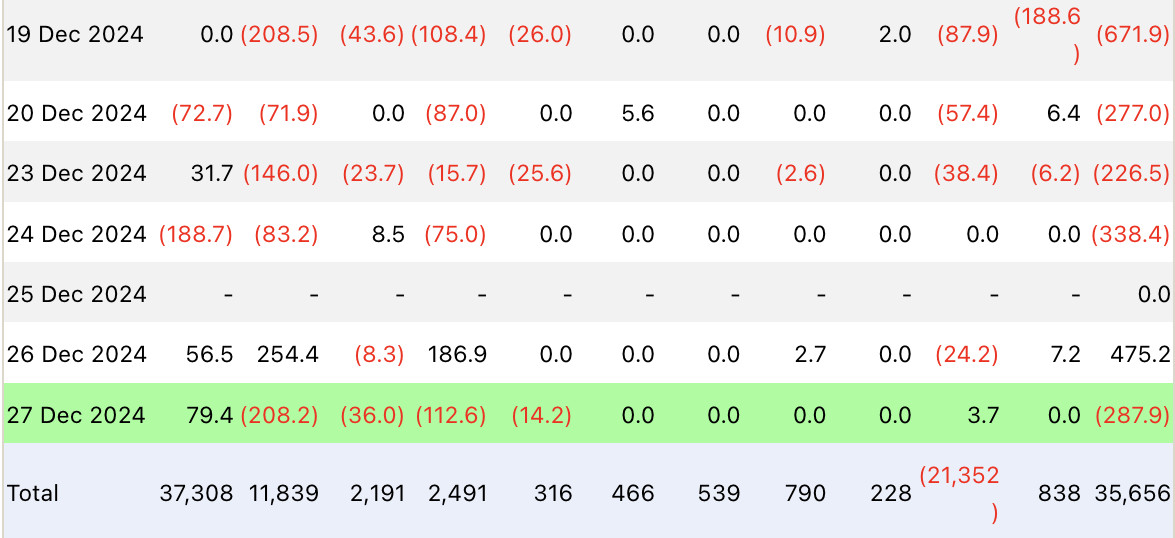

Meanwhile, U.S. Bitcoin ETFs had a rocky close to the year – BlackRock’s fund is bleeding $1.5 billion over four days before inflows started to trickle back after Christmas.

Source: Farside Investors

We’re living through some pretty legendary times, aren’t we? Remember when $100,000 for Bitcoin felt like a pipe dream? Now it’s in the books, a milestone that’s cemented its place in crypto history. But as the final days of 2024 slip away, the excitement has been tempered by a correction that’s run deep enough to make even the most bullish take a step back. The big question now is whether 2025 kicks off with a roaring comeback or another bout of turbulence. Either way, the next chapter in Bitcoin’s wild story is just around the corner, and it’s bound to keep us on the edge of our seats.

Ethereum

Meanwhile, Ethereum has been quietly making its mark, particularly in the ETF market. December alone saw inflows into Ether ETFs more than double, bringing the yearly total past $2.5 billion.

Source: Farside Investors

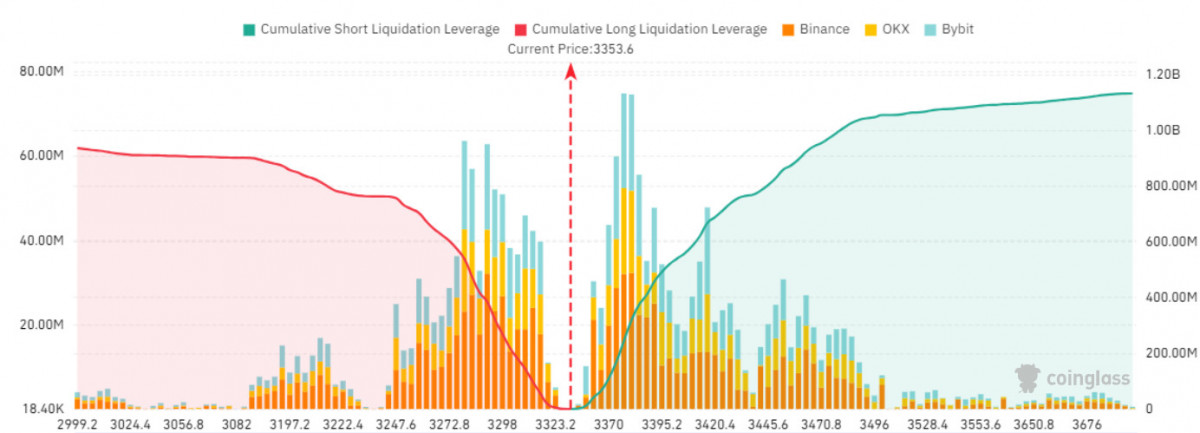

Despite this impressive momentum, Ethereum has struggled to break through the $3,500 resistance, a level that could unlock over $1 billion in liquidations if breached. For now, though, it remains a tough barrier.

Source: CoinGlass

Ethereum hasn’t escaped the broader market pullback, shedding roughly 10% in recent weeks.

ETH/USD 1D Chart, Coinbase. Source: TradingView

However, its role as the backbone of decentralized finance and smart contracts continues to underpin its long-term appeal. Analysts suggest this versatility will be crucial as adoption accelerates in 2025, particularly as Ethereum’s ecosystem grows and altcoin markets prepare for what could be a strong year.

Source: Eric Balchunas

The surge in ETF interest is a testament to Ethereum’s rising prominence. Together with Bitcoin, crypto ETFs brought in $38.3 billion in 2024, with retail investors leading the charge. Looking ahead, institutional investors are expected to play a bigger role, drawn by Ethereum’s growing utility and strong fundamentals.

As the clock winds down on 2024, Ethereum feels like it’s gearing up for a show-stopping 2025. Heavy hitters like VanEck are already tossing around bold targets – $6,000, anyone? – on the back of Ethereum’s relentless push to expand its utility and fortify its network.

Source: VanEck

The road ahead for Ethereum isn’t without its bumps – its ongoing battle to break past that $3,500 resistance makes that crystal clear. But as we close the book on 2024, Ethereum’s knack for combining innovation with scalability is pulling in more institutional interest and strengthening its foothold in decentralized finance. With growing momentum around ETFs, stablecoin adoption, and crosschain development, Ethereum is shaping the very direction of the ecosystem. As the new year approaches, it’s clear Ethereum’s story is still worth paying attention to.

TON

While Bitcoin and Ethereum duke it out for dominance, TON is over here playing it cool, quietly carving out its niche by weaving blockchain tech into Telegram’s massive ecosystem. And as we step into 2025, it’s doing so with a mix of innovation, creativity, and a touch of fun. Telegram just dropped some big news – turning profitable for the first time ever, raking in over $1 billion in revenue this year.

Source: Du Rove’s Channel

And while TON’s not included in that figure, the connection is impossible to miss. With Telegram expanding into new markets, like its recent push for a license in Malaysia, TON’s credibility is climbing right along with it.

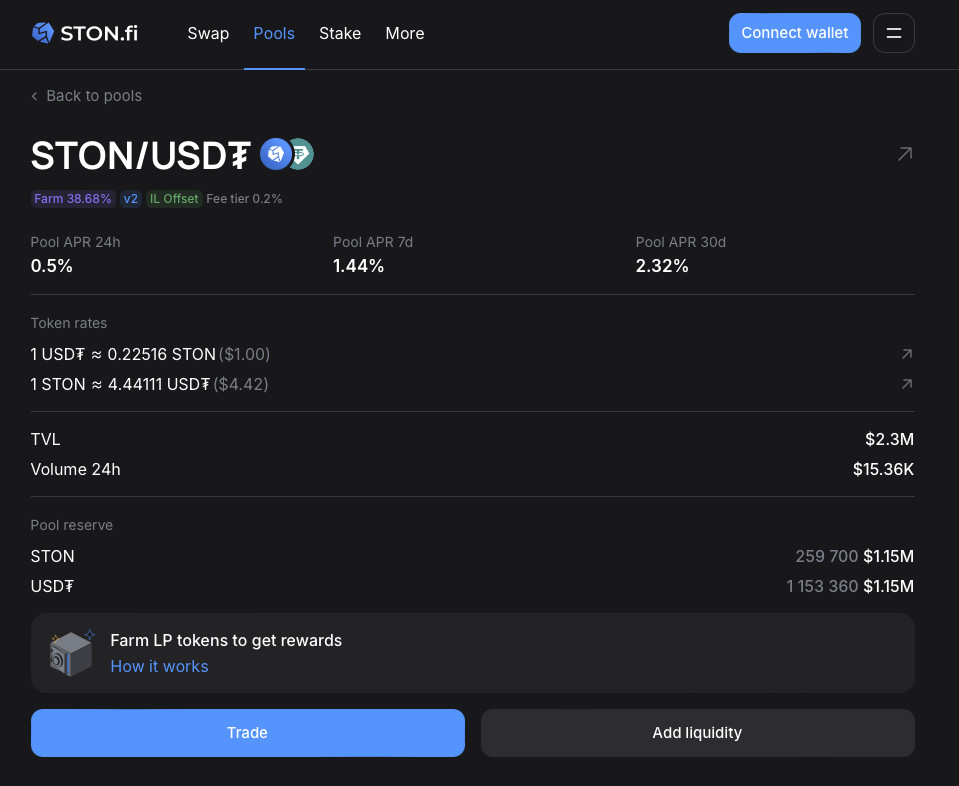

Source: STON.fi

TON isn’t just riding on Telegram’s coattails, though – it’s making its own moves. STON.fi has announced partial impermanent loss protection for its STON/USDT V2 liquidity pool, kicking off in January. It’s a practical step forward for DeFi users looking for safer ways to play the liquidity game. And then there’s Hamster Combat – yes, it’s real – a game launching its own Layer 2 network on TON. It’s proof that TON isn’t just about serious blockchain infrastructure; it’s a canvas for creative, quirky projects that bring a little personality to the space.

2024 has been a breakout year for The Open Network (TON), packed with milestones that have pushed it into the spotlight. Its tight integration with Telegram has been a game-changer, driving a jaw-dropping 5000% surge in wallet creation and fueling a rapidly growing user base. The ecosystem hasn’t just expanded – it’s flourished, with new projects, applications, and over 20 global events bringing developers and communities together to innovate and collaborate. On the market side, Toncoin (TON) closed the year trading at $5.90, with a market cap surpassing $13.7 billion, landing it among the top 10 cryptocurrencies.

TON/USD 1D Chart. Source: TradingView

It’s safe to say TON is thriving, each new update setting the stage for an even bigger presence in the blockchain world.

So, as 2024 wraps up, TON feels like the blockchain equivalent of a well-kept secret – doing its own thing while the giants battle it out. With Telegram’s reach and TON’s growing ecosystem of tools, games, and DeFi features, 2025 could be the year this quiet contender makes some serious noise.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.