Crypto’s $1.38 Billion Nightmare: Inside 2024’s Shocking Wave of Hacks, Exploits, and Digital Heists

In Brief

2024 crypto hacks reveal flaws, with $1.38 billion stolen, raising doubts about blockchain’s suitability for widespread use.

A number of hacks and attacks in 2024 shocked the crypto sector and revealed serious flaws in what many had thought would be a developing industry. A concerning pattern raises doubts about blockchain technology’s suitability for widespread use.

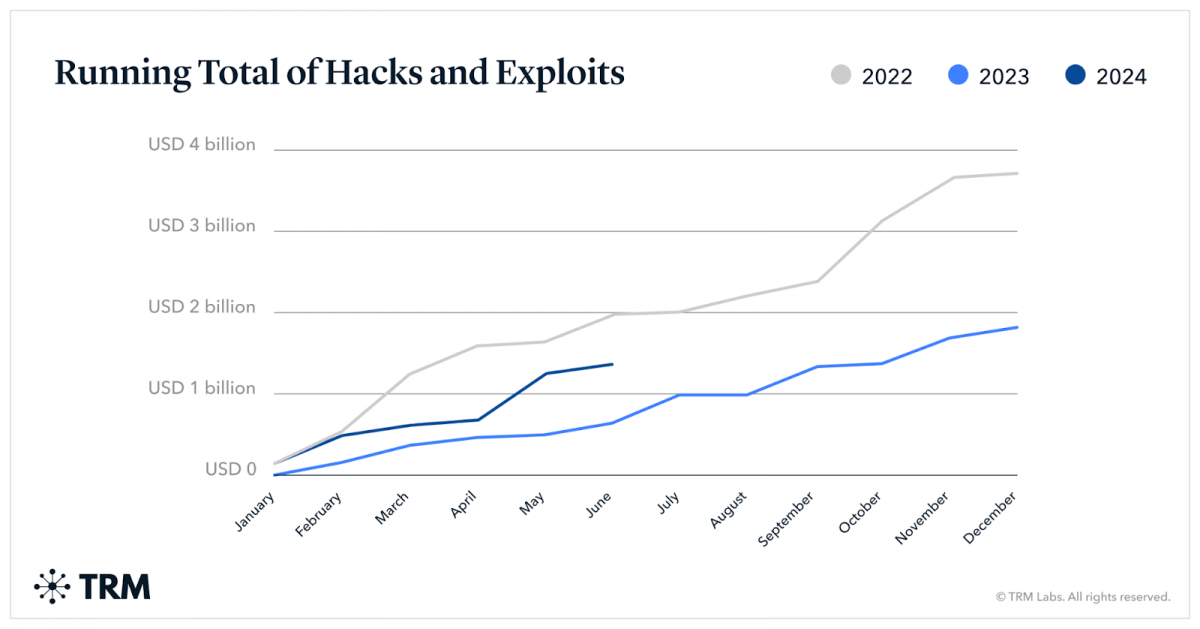

Hackers have already stolen an incredible $1.38 billion from cryptocurrency exchanges and projects by June 2024. This amount is concerning since it not only far exceeds the $657 million that was taken during the same time frame last year, but it also shows that the frequency and severity of assaults have increased.

The fact that 70% of the total money taken came from the top five breaches indicates a move toward more focused, high-impact attacks that have the power to bring down even well-known websites.

Photo: TRM

Top Exploits of the First Half of 2024

Orbit Chain

Orbit Chain lost more than $80 million on January 2 as a result of hacked multisig signers, capping off a spectacular start to the year. This event exposed the flaws in shared control methods, which many projects depend on for increased security, and set a bleak tone for the months that followed.

A day later, shortly after opening a new market, Radiant Capital lost $4.5 million due to a flash loan attack. These consecutive events in the first few days of the year were a sobering reminder that bad actors still find the cryptocurrency market to be a profitable target.

CoinsPaid

Throughout January, the hits continued to come in. The second $7.5 million hack to hit Estonian digital asset processor CoinsPaid in six months. This repeated intrusion raises major issues regarding the efficiency of security measures adopted following the first breaches.

Gamma Strategies and Socket.Tech

Exploits also cost Gamma Strategies and Socket.Tech $3.4 million and $3.3 million, respectively, underscoring the wide breadth of vulnerabilities present in many crypto projects.

Abracadabra Finance

Attacks were especially common in the DeFi sector, which is frequently hailed as the financial industry of the future. The Magic Internet Money (MIM) stablecoin’s platform, Abracadabra Finance, suffered a $6.5 million loss on January 30, which resulted in MIM’s temporary loss of its peg. This event demonstrated the vulnerability of algorithmic stablecoins and how a single exploit could cause significant market disruption.

PlayDapp

One of the biggest assaults of the year occurred in February when PlayDapp, a cryptocurrency gaming and NFT platform, was compromised by two different flaws, resulting in an incredible $290 million loss.

This huge breach showed the possibility of many assaults on the same platform, in addition to highlighting the weaknesses in the quickly expanding blockchain gaming industry. The event brought up important concerns regarding the suitability of the security protocols in place for initiatives managing such substantial amounts of public money.

Mozaic Finance

The attacks didn’t seem to be abating as the year went on. Mozaic Finance lost $2.5 million in March, while Prisma Finance had a $10 million hack. These occurrences highlighted even more how difficult it is for DeFi platforms to protect their protocols from increasingly complex attackers.

Gnus.AI

A new set of difficulties emerged in the second quarter of 2024: an AI network called Gnus.AI lost $1.27 million due to a token-minting exploit, and a well-known crypto investment firm called BlockTower Capital experienced an undisclosed loss from its primary hedge fund. These disparate targets showed that no segment of the crypto ecosystem was safe from possible breaches.

Kraken

It turned out that June was a very turbulent month. One of the biggest cryptocurrency exchanges, Kraken, was the target of a $3 million attack by someone claiming to be a security researcher. In addition to causing financial loss, this event raised questions about the morality of white hat hacking and the limitations of security research in the cryptocurrency industry.

UwU Lend

In June, UwU Lend had two distinct assaults and lost $22.8 million in total. These attacks, which made use of weaknesses in smart contracts and price manipulation, brought attention to the ongoing dangers associated with DeFi lending protocols. Given how frequently these assaults occurred on a single platform, concerns were raised over the efficacy of security fixes and the pace at which vulnerabilities may be fixed in the rapidly evolving DeFi market.

Bittensor

The attacks continued throughout July with no signs of stopping. The $8 million breach on the Bittensor blockchain was probably caused by stolen private keys. This event made clear how difficult it is to maintain safe key management in the cryptocurrency industry.

Li.Fi

The cross-chain DeFi platform Li.Fi suffered a $10 million loss in an attack that took advantage of wallets with endless approvals. This incident highlighted the risks associated with popular DeFi practices that put user convenience ahead of security.

WazirX

The biggest cryptocurrency exchange in India, WazirX, reportedly lost $234.9 million from its multi-sig wallet on July 18. This attack is perhaps the most recent and concerning. In addition to resulting in a large financial loss, this enormous hack severely undermines user confidence in centralized exchanges, especially in developing cryptocurrency markets.

Crypto Security In Question

The persistent attacks that occur throughout 2024 present a concerning image of the condition of crypto security. They show that the crypto market is still open to a variety of attacks despite years of development and assurances of improved security measures. The possibilities for attack appear limitless, ranging from social engineering schemes and compromised private keys to smart contract vulnerabilities and pricing manipulation in DeFi protocols.

By 2024, security breaches will be more frequent and severe, necessitating a thorough review of present procedures. The adoption of stronger security measures, such as regular and required security audits for all key cryptocurrency projects and exchanges, must be given top priority by the industry. Maintaining the decentralized nature of cryptocurrency may require more stringent regulatory oversight in order to guarantee that fundamental security requirements are fulfilled.

It is important to enhance incident response processes. The sector must create uniform protocols for handling hacker attacks, which should include improved user outreach and more open recovery procedures. Furthermore, more money has to be spent on security innovation, specifically on creating innovative solutions that are specifically designed to address the particular difficulties presented by blockchain.

It is imperative that user education be prioritized. In-depth instructional programs are required to assist users in comprehending and putting appropriate security procedures into effect.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.