Crypto Weekly Update: Bitcoin Swings Between $91K–$100K, Ethereum Faces ETF Uncertainty, TON Eyes U.S. Expansion

In Brief

Bitcoin fluctuates between $91K–$100K amid macro uncertainty, Ethereum faces ETF uncertainty and regulatory pressure, while TON pushes for U.S. expansion with increased validator requirements and a $100M fund.

Bitcoin (BTC)

Phew, that’s been a choppy week! Bitcoin’s prices whipsawed between $91,000 and $100,000 as traders tried to make sense of an increasingly unstable macro landscape. The big headline, of course, came from Trump’s 25% steel and aluminum tariffs. As we know, markets don’t like uncertainty, and this move rekindled fears of another drawn-out trade war. If that ensues, risk assets – including Bitcoin – could be sent into a downward spiral.

Source: AP News

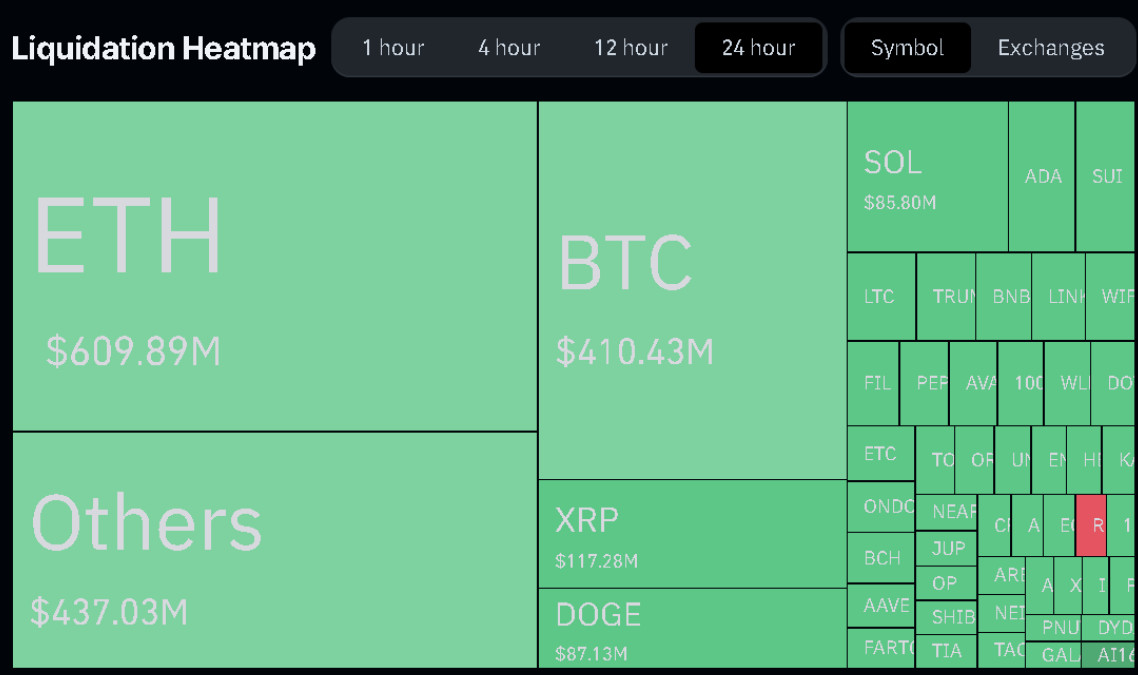

And, as fate would have it, the first reaction was ugly: BTC slipped under $93K, triggering a cascade of liquidations that wiped out over $1.3 billion in leveraged positions.

The pain wasn’t just limited to Bitcoin. The whole crypto market suffered a $10 billion liquidation event, with Ethereum and major altcoins feeling the brunt of the sell-off. Yikes!

Crypto liquidation heatmap. Source: CoinGlass

But just when it looked like Bitcoin might unravel, the institutional crowd stepped in. Several U.S. states, including Kentucky, Missouri, and Utah, pushed forward Bitcoin reserve bills, signaling growing state-level adoption.

US states with Bitcoin reserve bill propositions. Source: Bitcoinlaws

Meanwhile, big money stayed put – Austin University announced a $5 million BTC endowment fund, so we’re going to take that a fresh vote of confidence in Bitcoin’s long-term viability.

Michael Saylor’s Strategy (formerly MicroStrategy) remains all-in, as it holds nearly $15 billion in unrealized Bitcoin gains.

Strategy’s, formerly known as MicroStrategy, Bitcoin purchases over time. Source: SaylorTracker

What’s even more, BlackRock boosted that move by increasing its stake in Strategy to 5%. So it’s still safe to say that institutional conviction in Bitcoin isn’t going anywhere.

BTC/USD 4H Chart, Coinbase. Source: TradingView

So where does that leave us? For now, Bitcoin is hovering around $97,000, trying to claw back lost ground. The 50-day moving average (now at $97,624) has been acting as resistance, and a sustained break above this level could open the door back to six figures. But if macro fears escalate, $93K is the key level to watch. A drop below it could bring a retest of $90K, or worse.

Ethereum (ETH)

Ethereum didn’t escape the market carnage, but it handled the volatility better than most. The sharp market drop saw ETH dip below $2,700, bottoming out around $2,100 before bouncing back. Right now, it’s hovering around $2,633 and struggling to break past its 50-day moving average, which is a key level to watch for a potential bullish recovery.

ETH/USD 4H Chart, Coinbase. Source: TradingView

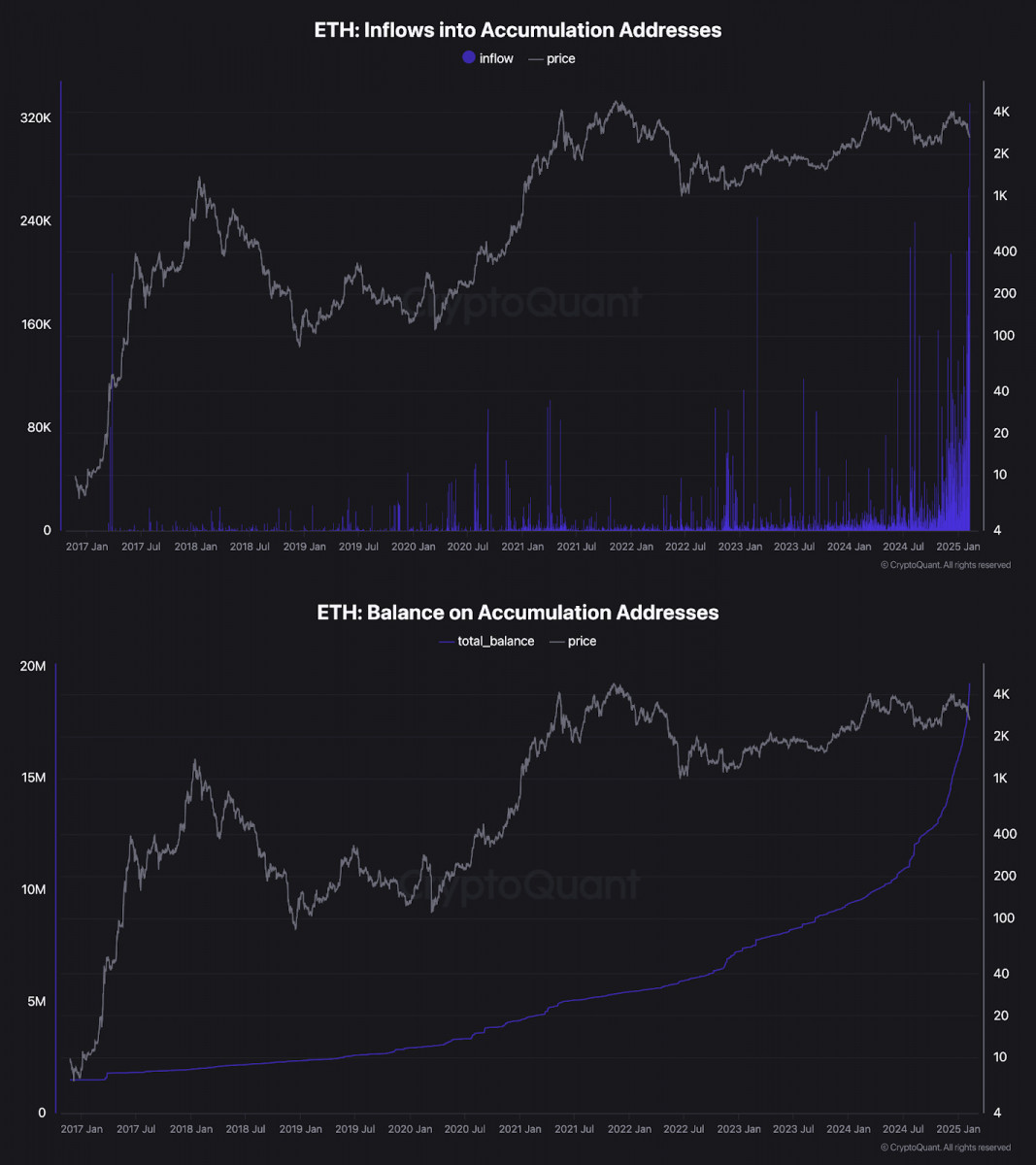

Despite the sell-off, whales and institutional players didn’t seem too worried. On-chain data showed over $883 million in accumulation inflows. So, deep-pocketed investors are quietly taking advantage of lower prices.

ETH accumulation addresses daily inflows vs. balance. Source: CryptoQuant

The macro conversation around Ethereum took an interesting turn this week. Researcher Justin Drake reignited the “sound money” debate. His main argument is that Ethereum’s decreasing issuance makes it a stronger long-term store of value than Bitcoin. The key difference is that Bitcoin’s fixed supply model may eventually create liquidity problems, while Ethereum’s adaptive monetary policy allows for more flexibility. Whether that argument holds water or not, it underscores how Ethereum already positioned itself as not just a smart contract platform, but a monetary asset in its own right.

Regulatory developments also put Ethereum in the spotlight. The SEC is still on the fence about an Ethereum ETF, but industry insiders are confident that it’s only a matter of time.

The SEC is reviewing proposals for options on Ether ETFs. Source: SEC

If Bitcoin ETFs have taught us anything, it’s that once institutions get a taste, the next step is expanding exposure to ETH.

ETH/USD 4H Chart, Coinbase. Source: TradingView

From a technical standpoint, Ethereum is in recovery mode, but the upside isn’t clear-cut yet. ETH tried to reclaim $2,900, but the $3,200 resistance zone remains a major hurdle. On the downside, if Bitcoin stumbles again, ETH could easily slip back to $2,500 or lower. For now, Ethereum bulls need to keep an eye on whether ETH can break and hold above $2,741 (50-day MA) – that’s the line between another leg down and a push higher.

TON (TON)

Meanwhile, TON has been making headlines, and not just because of its price swings. The network is stepping up on multiple fronts – validator upgrades, fresh funding, and a bold expansion play into the U.S. market. It’s a lot to unpack.

As you may remember, the first big shift came on February 1, when the minimum validator entry requirement jumped from 360,000 to 500,000 TON. That’s a hefty increase, and it likely stems from a wave of new validators joining in January. More validators mean a stronger, more decentralized network, which is exactly what TON needs as it scales.

Source: CNBC

Then came the money. Steve Yun, former president of the TON Foundation, announced TVM Ventures – a $100 million fund dedicated to TON projects. That’s a huge injection of capital aimed at developers building on TON, and it signals that major players are betting on the ecosystem’s long-term potential.

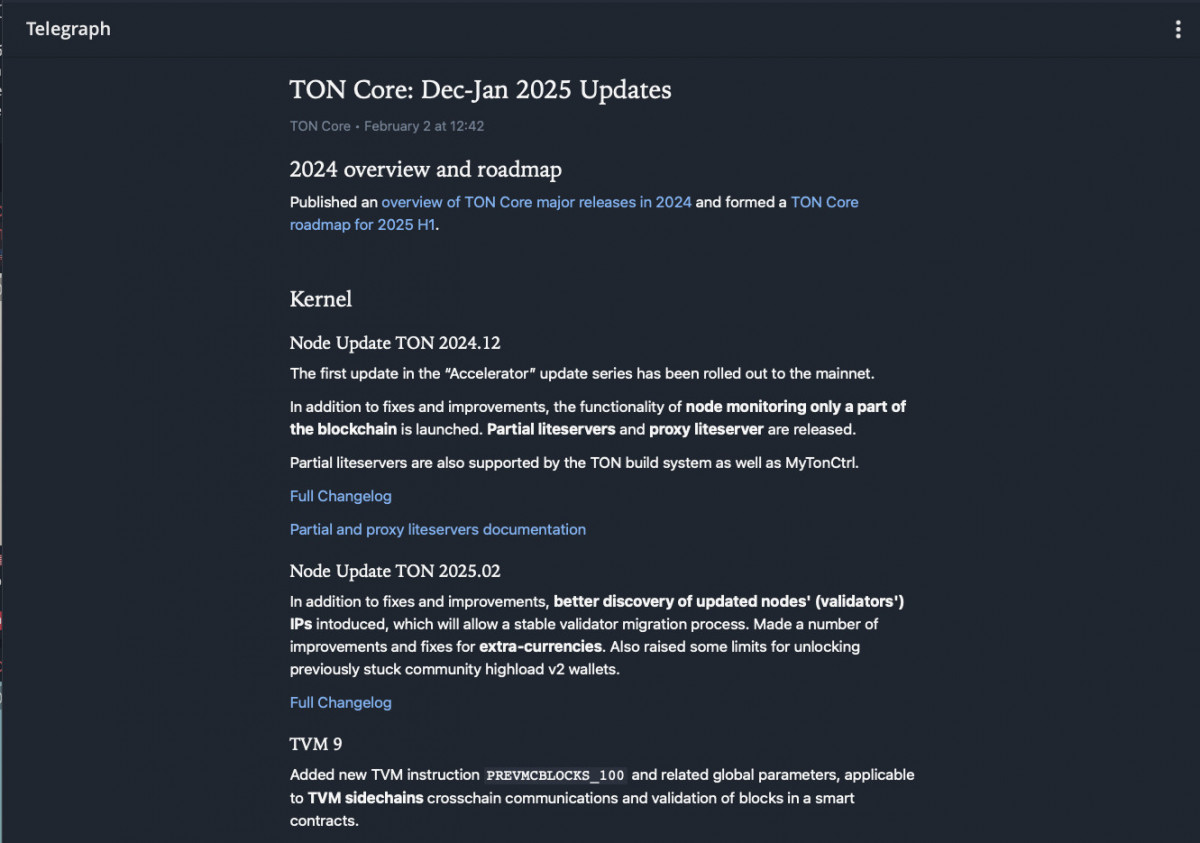

Source: TON Core

The funding news landed alongside a progress report from TON Core, detailing 48 updates over the past two months. Key improvements include better validator stability, new TVM instructions for cross-chain communication, and expanded API support for more currencies. In other words, the TON team is hard at work refining its infrastructure to support broader adoption.

But the biggest bombshell is this: TON wants in on the U.S. market. The new president of the TON Foundation recently sat down with Donald Trump (Sic!) to discuss bringing TON to the U.S. Need we say how massively this could boost TON’s adoption. Given Telegram’s global dominance, integrating TON into the U.S. crypto ecosystem would be a game-changer. So, let’s hold our breaths for what’s up ahead.

TON/USD 4H Chart. Source: TradingView

Market-wise, TON has been riding the crypto rollercoaster. The early February drop saw TON crash to $3.00, before stabilizing around $3.82. Right now, it’s testing resistance at $3.88, right near the 50-day moving average. A clean breakout above this level could open the door to further upside. But if Bitcoin wobbles again, TON could easily slide back into consolidation. RSI at 49.38 suggests TON isn’t in overbought territory yet, meaning there’s still room to move in either direction.

So what’s next? If institutional backing continues growing, and if TON manages to break into the U.S. market, demand could surge. But for now, traders should keep an eye on whether it can push past $3.88 – or risk another dip if momentum fades. One thing’s for sure: TON isn’t slowing down.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.