Crypto Weekly: Ethereum Tops $3.2K, Tether Expands into Tokenization, and AI Meets Blockchain with $290M Funding

In Brief

Among the most notable shifts in the crypto landscape this week: Ethereum is flexing its muscles, Tether is diving into tokenized assets, and new funding is pouring into blockchain-AI projects.

Curious where smart money is flowing in crypto this week? This roundup covers the most notable shifts that occurred on the crypto landscape. Ethereum is flexing its muscles, Tether is diving into tokenized assets, and new funding is pouring into projects bridging blockchain with AI. If you’re looking to stay ahead of the curve, here are some potential hot picks to keep in mind while rebalancing your portfolio.

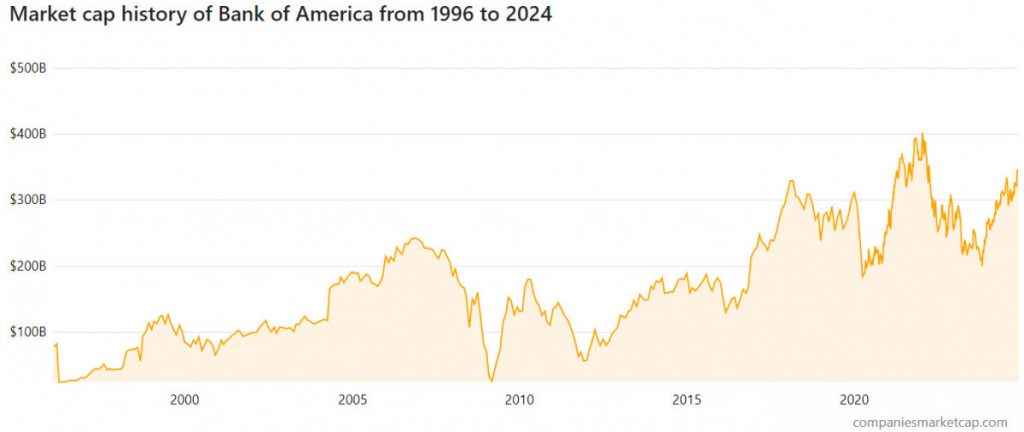

Ethereum Hits $3.2K, Surpasses Bank of America’s Market Cap

Ethereum just hit $3,200, flexing a market cap of $383 billion, which puts it $40 billion ahead of Bank of America. Not bad for “magic internet money,” right? Ethereum’s growing clout is clear as decentralized finance (DeFi) keeps pulling users away from traditional finance (TradFi). With the U.S. SEC eyeing the first spot ETH ETFs, Ethereum’s appeal to big-money players is only getting stronger.

If you’re into DeFi, blockchain innovation, or just the idea of holding an asset that’s outpacing Wall Street staples, ETH may be worthy of attention. Institutional players might find the ETF buzz irresistible, while retail traders could ride the wave of DeFi’s expanding playground.

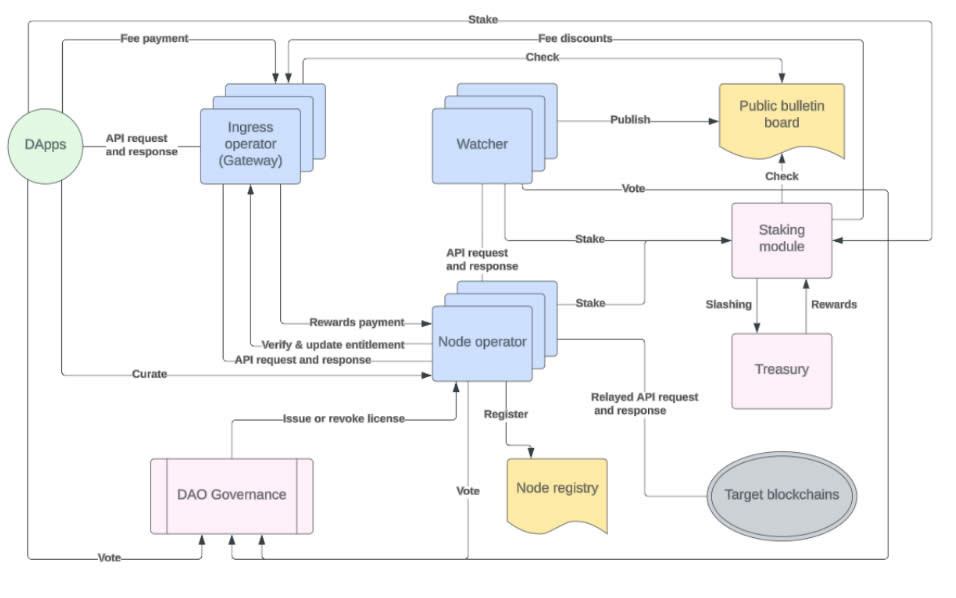

Consensys Decentralizes Infura with EigenLayer

Consensys has launched its Decentralized Infrastructure Network (DIN) as an Actively Validated Service (AVS) on EigenLayer, an Ethereum restaking protocol. DIN operates as a decentralized marketplace for Web3 infrastructure – a kind of blockchain API hub – connecting developers to networks like Ethereum, ZKsync, Mantle, and BNB Smart Chain. DIN’s integration with EigenLayer aims to cut costs, enhance reliability, and simplify the rollout of new decentralized services.

This signals shifting priorities in the blockchain ecosystem: scalable, developer-friendly infrastructure is taking center stage. EigenLayer has already been known for leveraging staked Ethereum to secure new services and has locked in $13.4 billion in value earlier this year. This collaboration may prove DIN as a key player in shaping the backbone of Web3.

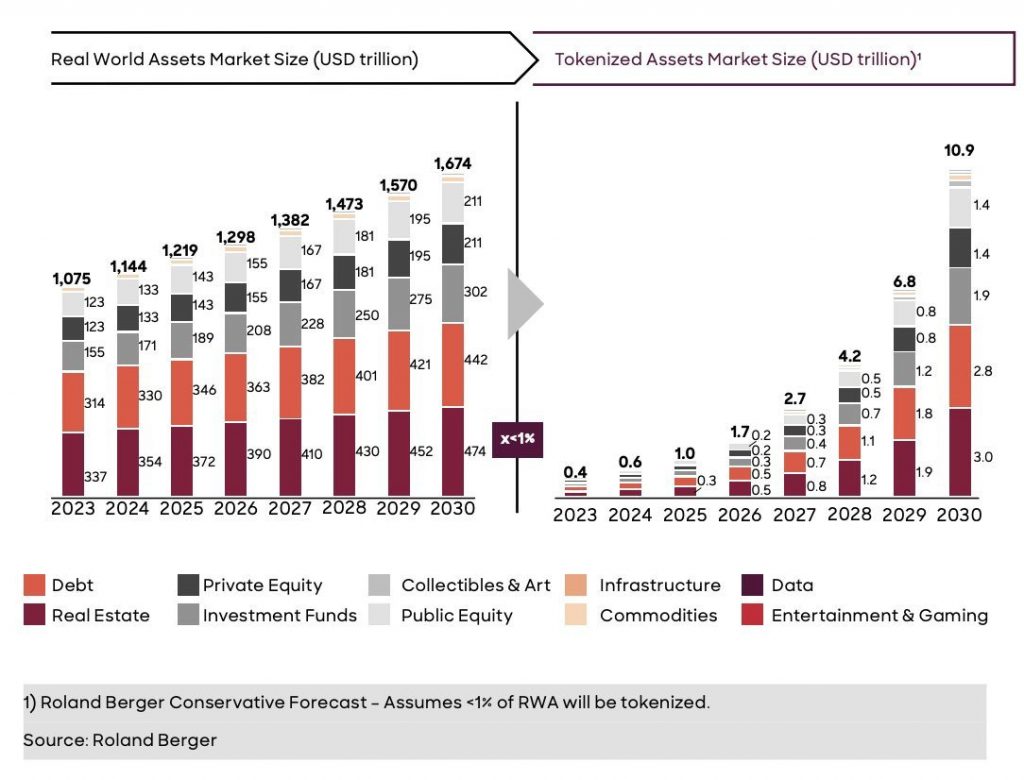

Tether Introduces Hadron for Real-World Asset Tokenization

Tether has rolled out “Hadron,” a platform to bring real-world financial instruments – stocks, bonds, commodities, and so on – into the digital age. Hadron will have built-in KYC and AML controls, and will allow businesses, asset managers, and even governments to issue and manage tokenized assets. It also supports basket-collateralized products, so big players can roll out their own digital tokens backed by collections of assets like commodities or currencies. Tokenized assets are expected to hit $10.9 trillion by 2030, and so far, Hadron is in step with one of finance’s fastest-growing trends.

Tether is already known as *the* stablecoin issuer with a $126 billion market cap – and now it’s expanding. So, Hadron could well be a key development for those tracking the tokenization of traditional finance.

Zero Gravity Labs Raises $290M for Blockchain AI OS

Zero Gravity Labs (0G Labs) has locked in $290 million to build what it’s calling the first decentralized AI operating system (dAIOS). The funding includes $40 million from heavyweights like Animoca Brands, Samsung Next, and Polygon, plus a $250 million liquid line of credit tied to token purchases. This system aims to transform how decentralized AI apps handle data. Once in place, it should have 100% on-chain live interactions, while the expected throughput is set to clock a staggering 50GB per second.

The intersection of blockchain and AI is heating up, and dAIOS sits squarely at the crossroads. With a focus on reducing costs and complexity for AI applications, 0G Labs could appeal to those betting on the scalability of blockchain-based AI infrastructure. If the future looks data-driven and decentralized, this is one project to keep in sight.

PayPal USD Links Ethereum and Solana

PayPal’s stablecoin, PYUSD, is making moves with a new integration into LayerZero, a cross-chain protocol designed for seamless blockchain transfers. This upgrade allows PYUSD to hop natively between Ethereum and Solana using LayerZero’s Omnichain Fungible Token (OFT) Standard – no centralized middlemen like Venmo needed. It’s a step toward making stablecoins more flexible and DeFi-friendly. Self-custody users looking for smooth cross-chain functionality will find this a welcome update.

Overall, it’s a signal that PayPal is doubling down on making PYUSD a player in the interoperability game, even as its market cap has dropped from $1 billion to $513 million since August. With Ethereum seeing the majority of PYUSD’s supply, and Solana offering high-speed, low-cost transactions, this could appeal to those watching for bridges between institutional finance and decentralized ecosystems. LayerZero’s integration is another example of cross-chain tech turning silos into highways – worth tracking if you’re eyeing infrastructure or stablecoin innovation.

Ronin’s Katana DEX Launches V3 Upgrade

Ronin Network is rolling out a v3 upgrade for its decentralized exchange (DEX), Katana, designed to boost trading efficiency and optimize capital utilization. The upgrade introduces concentrated liquidity pools, customizable fees, and deeper liquidity, allowing liquidity providers (LPs) to better tailor profit margins and risk levels. The move also reduces reliance on high RON token emissions, a strategic shift to improve the network’s long-term sustainability by cutting liquidity rewards by 50% in the next phase of adjustments.

Katana’s enhancements align with the broader trend toward more capital-efficient DEXs. Additionally, Ronin’s integration of Chainlink’s Cross-Chain Interoperability Protocol (CCIP) underscores its focus on interoperability and security, further strengthening its ecosystem appeal for investors interested in cross-chain innovations.

Cardano Foundation Reports $478M in Assets

The Cardano Foundation, the nonprofit driving the Cardano blockchain, closed 2023 with $478 million in assets, the majority – 82.5% – held in ADA tokens, alongside 10.1% in Bitcoin and a small slice in USD. According to its Financial Insights Report, the foundation allocated $19.22 million across its core focus areas: education, adoption, and operational resilience. Notable achievements included keeping the network running uninterrupted for over 2,000 days, testing decentralized governance models at the University of Zurich, and supporting the Valentine hard fork.

The foundation’s heavy ADA holdings reflect its confidence in the network’s potential, while its push into education and adoption – via initiatives like Cardano Academy and global events – signals a focus on long-term growth. For those tracking blockchain projects that prioritize resilience and scalability, Cardano’s track record and roadmap may offer food for thought.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Alisa, a dedicated journalist at the MPost, specializes in cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a keen eye for emerging trends and technologies, she delivers comprehensive coverage to inform and engage readers in the ever-evolving landscape of digital finance.

More articles

Alisa, a dedicated journalist at the MPost, specializes in cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a keen eye for emerging trends and technologies, she delivers comprehensive coverage to inform and engage readers in the ever-evolving landscape of digital finance.