Crypto Weekly: BTC Pulls Back From Highs, ETH Waits on Catalyst, TON Moves on Telegram Sentiment

In Brief

Last week’s market surge was accompanied by bullish headlines, but this week’s volatility was marked by political noise, regulatory stalls, and macro jitters, affecting confidence.

Last week felt like the market had one hand on the throttle – Bitcoin blasting past all-time highs, ETF flows pumping, Ethereum trying to keep up. This week, though, felit a lot more like second-guessing. The charts didn’t fall apart, but momentum had clearly hit a wall. Every bullish headline got met with something sour, be it political noise, regulatory stalls, or macro jitters and such. Price action across majors mostly remained rangebound, and confidence clearly took a step back. Let’s break down what happened – and why it matters if you’re trading this stuff.

Bitcoin (BTC)

First things first: Bitcoin did set a new ATH last Monday by breaking above $111K. And for a moment, it felt like the next leg up was on, didn’t it? But within 48 hours, it was already back down near $107K, and that move down clearly wasn’t a random pullback.

BTC/USDT 4H Chart, Coinbase. Source: TradingView

It came right as Trump reignited EU tariff talk, and spooked global markets again (controlled chaos much?). Then over $300 million in BTC longs got flushed as traders rotated to safer ground. So, for anyone who thought Bitcoin would act like a “chaos hedge” – this week was a reality check.

But what made all that worse was leverage. Open interest in BTC futures hit record highs midweek, as per Coinglass. That’s fine in a clean uptrend, but deadly when sentiment flips. And with everyone loaded up, even a modest drop turned sharp real fast.

Source: Coinglass

On the upside, ETF inflows didn’t let up – with more than $2.75 billion pouring into spot Bitcoin funds over just seven days, as per Fairside. That kind of number usually sets a strong tone for the week.

Source: Fairside Investors

Then there was Michael Saylor, who dropped a not-so-subtle hint that MicroStrategy might buy more BTC on this dip. That kind of talk, especially from someone with his track record, tends to give the market a little backbone.

Meanwhile, Texas passed a bill supporting a Bitcoin reserve, signaling state-level political backing that’s still rare in the U.S. It didn’t get much airtime, but it added fuel to the longer-term institutional case.

Source: Bitcoin Laws

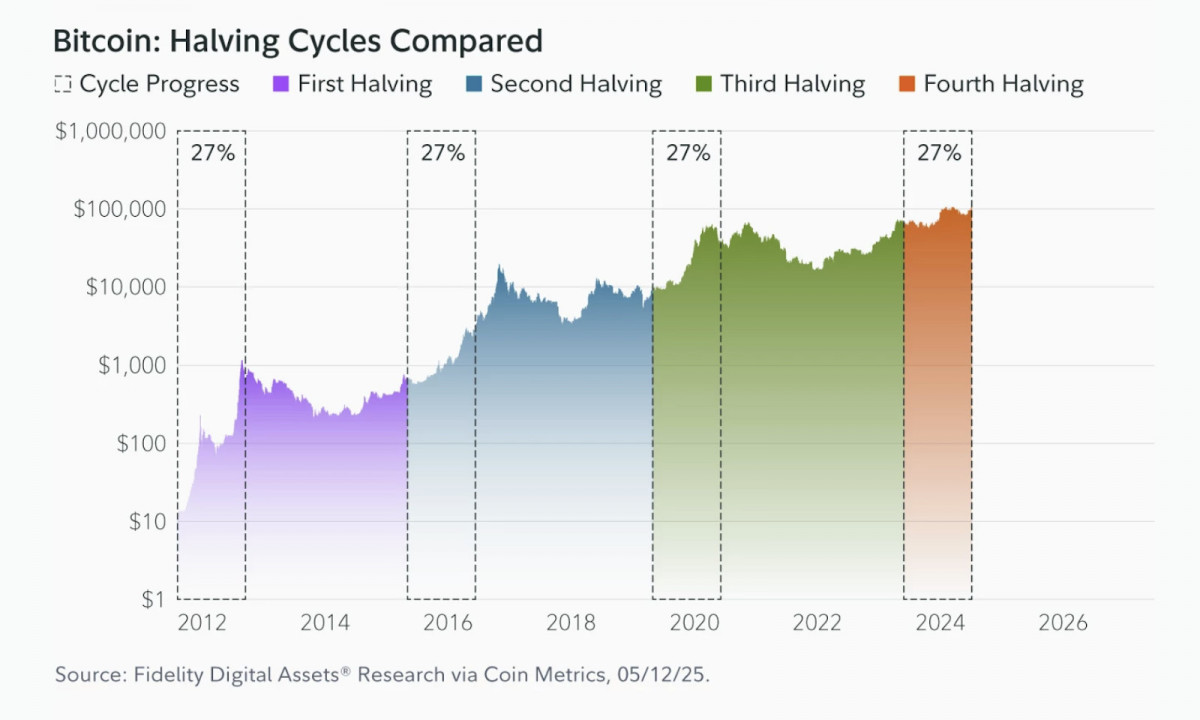

And on top of all that, Fidelity came out with research reaffirming Bitcoin’s place as a core piece of a modern investment portfolio. Nothing flashy, but the kind of validation that tends to stick with slow-moving capital.

Source: Fidelity Digital Assets

If you’re trading BTC, the message here is simple: the long-term trend still looks solid, but for now it’s not a clean trending environment. Whipsaws are back. Stay nimble, especially heading into options expiry and more tariff talk. A decisive reclaim of $112K could flip the switch again – but we wouldn’t expect smooth sailing.

Ethereum (ETH)

ETH followed BTC higher early in the week, tapping $2,725, then slipped back under $2,600 by Wednesday and… pretty much stayed there until further notice.

ETH/USDT 4H Chart, Coinbase. Source: TradingView

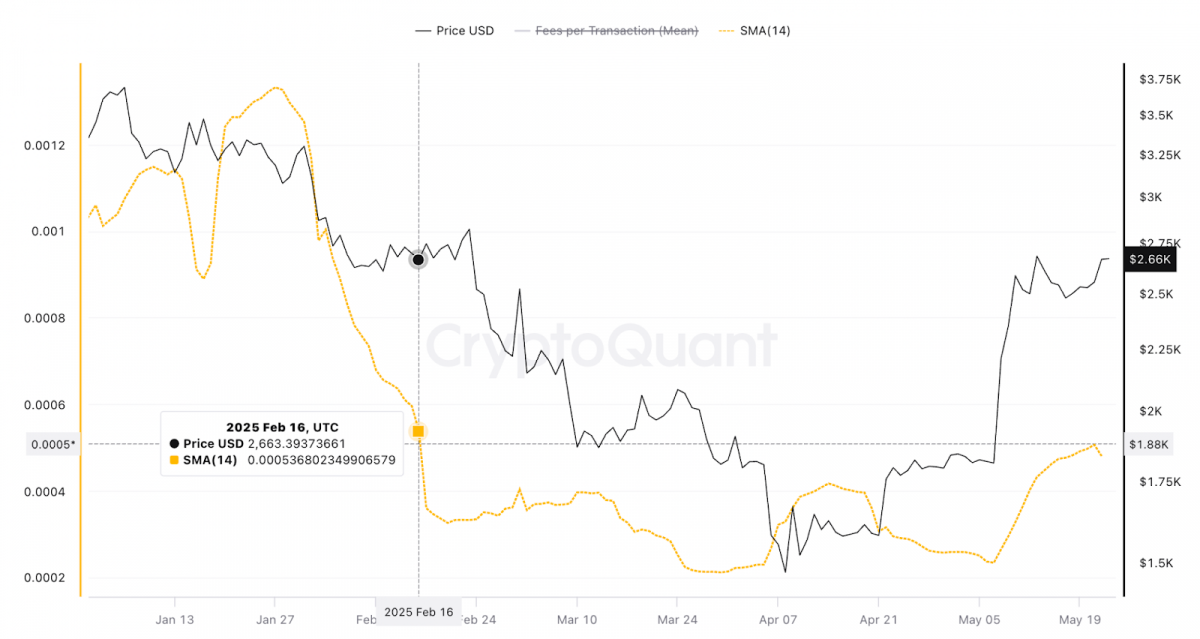

There was a quiet uptick in network activity – gas fees hit a three-month high. EthCC[8] announced it’s headed to Cannes, which was a nice nod to Ethereum’s builder culture. But that stuff didn’t seem to move the charts much.

Source: CryptoQuant

Then came the SEC delay on ETH ETFs – not surprising, but ever a buzzkill. Every pushback now makes it harder to believe Ethereum’s going to ride the same institutional wave BTC did.

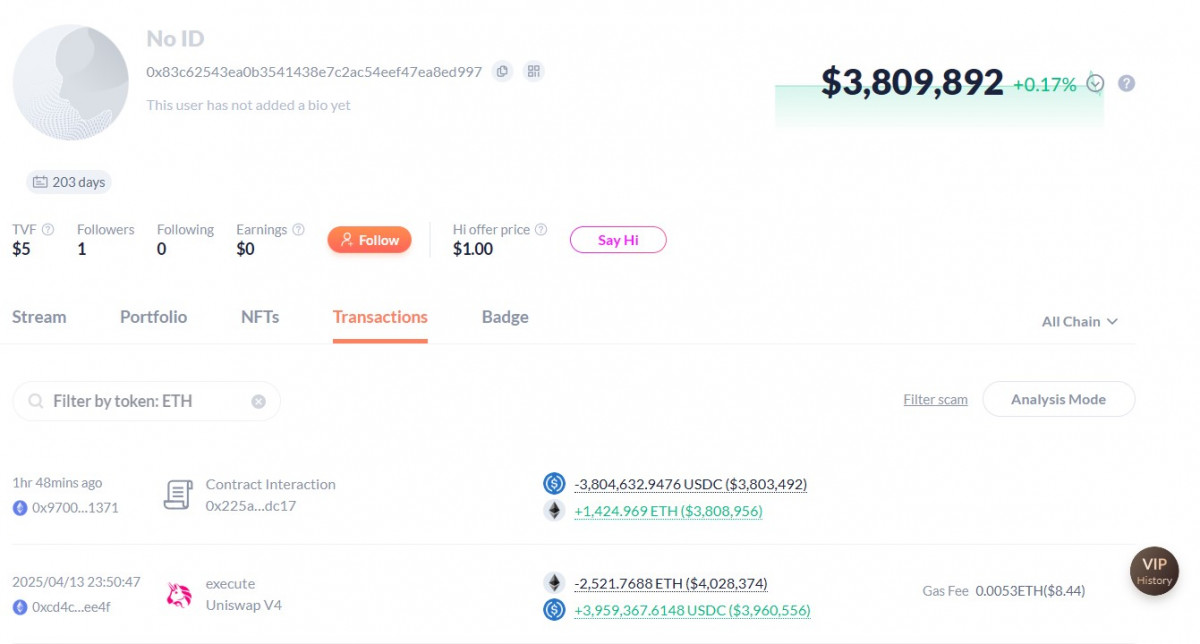

What did catch some attention this week was a whale buyback of 2,500 ETH midweek, at a price higher than the previous sell. Maybe it was conviction, maybe regret (or both?). Either way, there was no follow-through.

Whale buys ETH after selling over a month ago. Source: DeBank

And, needless to say, Trump’s tariff kerfuffle shook the whole market, ETH included. Ether did follow BTC lower, but did so with much less drama. Probably because leverage is lighter here. But it also showed ETH isn’t moving on its own news – it’s just reacting to the big dog.

If you’re trading ETH, it’s still range-bound and reactive. If BTC stabilizes, ETH might take another shot at $2,800, but without its own spark – like ETF momentum or a killer DeFi/L2 breakout – ETH is just… drifting.

Toncoin (TON)

Meanwhile, TON had a bit of a pulse this week. Early on, it made a sharp move from $2.85 to $3.25 – not explosive, but enough to snap some traders out of their boredom and get them eyeing the chart again. After weeks of quiet, that kind of price action felt like it might be the start of something.

TON/USD 4H Chart. Source: TradingView

But so far it seems like another vibe-based rally that couldn’t hold. But this time, the TON ecosystem actually had some things going on behind the scenes. For one, Telegram reported $540M in profits, an eyebrow-raising stat given all the legal pressure it’s under.

Source: Financial Times

Notably, Vietnam moved to block the app entirely, and France denied Pavel Durov permission to travel to the U.S., citing national concerns over his ongoing legal disputes.

Source: Reuters

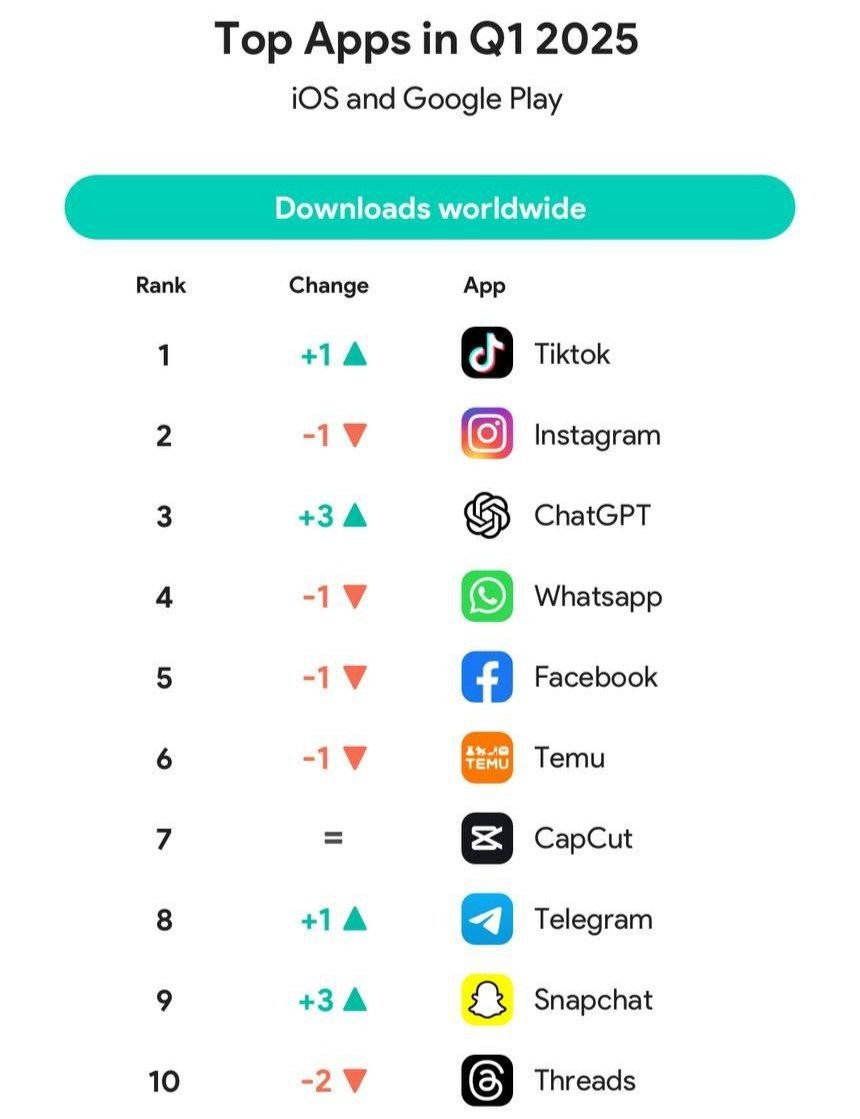

Despite all that, Telegram managed to jumped a spot in the 2025 global app rankings, showing that user growth isn’t flinching.

Source: Unknown

All this matters for TON because, fair or not, its fate is still psychologically tethered to Telegram’s. When the app is thriving, TON gets some benefit of the doubt. When legal storms start swirling, that benefit fades.

As for price, $2.90 held up as support, but the bounce off it wasn’t emphatic. Buyers showed up – they always do in that zone – but they weren’t chasing. Without a new catalyst, TON is back in that familiar state: reactive, not leading.

If you’re trading TON, the message is pretty simple – the ecosystem isn’t dead, but headlines are steering the bus. Until TON puts out a clear, self-contained catalyst, every price move is going to be tied to either Bitcoin’s direction or the latest stray bit of Telegram drama. Sure, the chart looks fine and even shows some decisive moves here and there, but the conviction behind it still feels thin.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.