Crypto Traders Anticipate Bullish Breakout After U.S. Election Amid Sharp Drop in Short-Term Implied Volatility

In Brief

The Bybit X Block Scholes Crypto Derivatives Analytics Report published October 23, 2024, provides insights into the market’s current state, highlighting potential macro events and a cautious optimism.

On October 23, 2024, the Bybit X Block Scholes Crypto Derivatives Analytics Report was published, offering comprehensive information on the market’s present situation. The research focuses on important patterns in implied volatility, open interest in options and futures, and financing rates across different tokens to highlight the possible effects of macro events, especially the impending election, on the trading of cryptocurrency derivatives.

The prevailing picture is one of cautious optimism, with traders prepared for potentially large market changes following the election but anticipating a tranquil time in the immediate lead-up. Declining short-term volatility and the accumulation of leveraged long positions across a number of major tokens, such as Ethereum (ETH) and Bitcoin (BTC), are indicators of this situation.

Sources: Bybit, Block Scholes

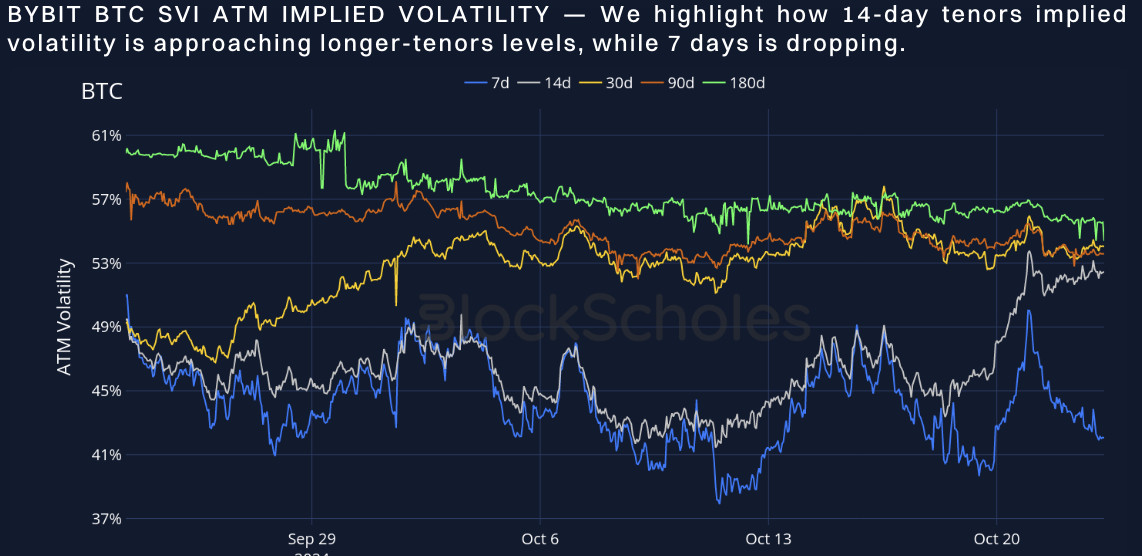

Implied Volatility Trends: A Tale of Two Markets

The difference in implied volatility (IV) between short- and medium-term options is among the report’s most notable aspects. ATM implied volatility for 14-day tenor options has increased despite the general decreasing trend in implied volatility. The volatility curve now has a steep term structure, indicating predictions of large price fluctuations in the medium future as a result of this spike, which was fueled by market anticipation of the US election.

The 7-day ATM implied volatility, on the other hand, has fallen, indicating a more relaxed short-term view. This decline in short-term volatility indicates that market players are mainly ignoring the near future in favor of concentrating on the election’s possible effects on the larger financial landscape. One important measure of market expectations is the difference between short- and medium-term volatility: traders anticipate relative calm for the time being, but they are bracing for activity following the election.

The research emphasizes that short-term uncertainty has considerably decreased, even though long-term attitude is still positive. There is less chance of price fluctuations in the near future because market players seem satisfied to wait out the two weeks before the election. Before major geopolitical events, markets are typically quiet before the storm, with traders hedging their bets and waiting for additional information.

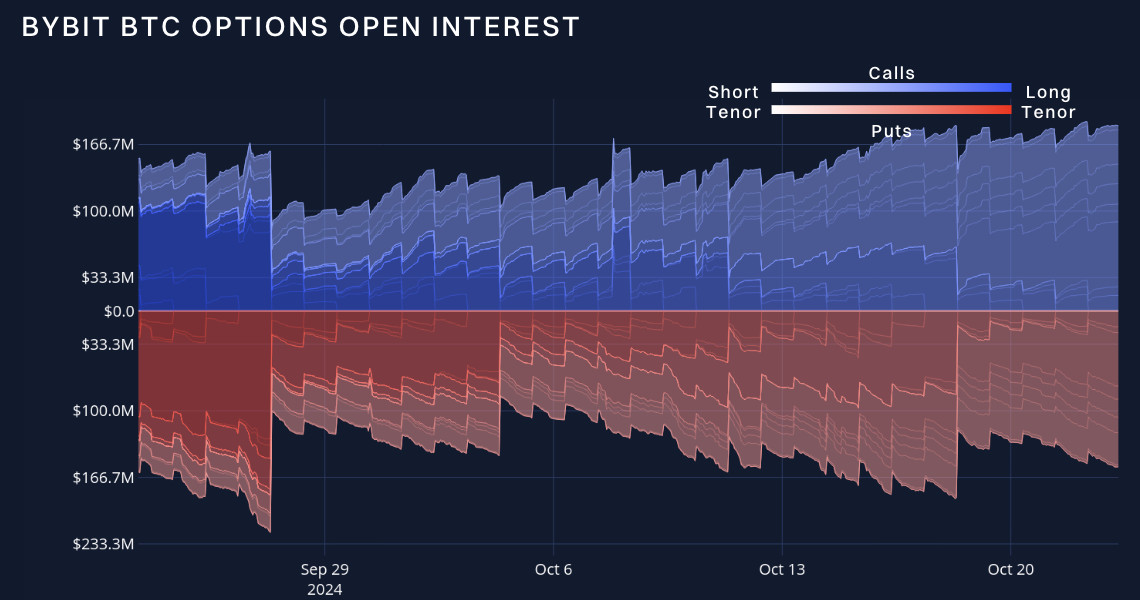

Options and Futures Markets Show a Bullish Attitude

The rising optimism in the futures and options markets stands in stark contrast to the tranquility in the short-term volatility markets. Bullish sentiment has clearly increased, according to the Bybit X Block Scholes report, especially for Bitcoin call options. The steady increase in open interest in Bitcoin call options indicates that traders are setting themselves up for possible gains after the election.

The prevalence of Bitcoin call options is an accurate indicator of the mood of the market. Call options are a common instrument for traders who wager on price increases since they provide holders the right, but not the responsibility, to purchase an asset at a fixed price. Particularly following the election, the increase in open interest in these options indicates confidence in the market’s upward direction.

Sources: Bybit, Block Scholes

A comparable pattern is showing up in future markets. Open interest in both BTC and ETH futures has been growing, further strengthening the optimistic picture. According to the research, robust demand for leveraged long bets is shown by positive financing rates across all coins under observation. This demonstrates traders’ confidence in the market’s future direction by indicating that they are not only placing bets on price increases but are also prepared to pay funding costs to keep their positions open.

It’s interesting to note that this accumulation of long positions is taking place in spite of the decline in spot prices from the early October rise. This implies that traders are seeing the recent decline as a chance to purchase, expecting prices to bounce back and keep rising following the election. Strong financing rates, an increase in call options, and growing open interest all point to a market that is subtly getting ready for a bullish breakout.

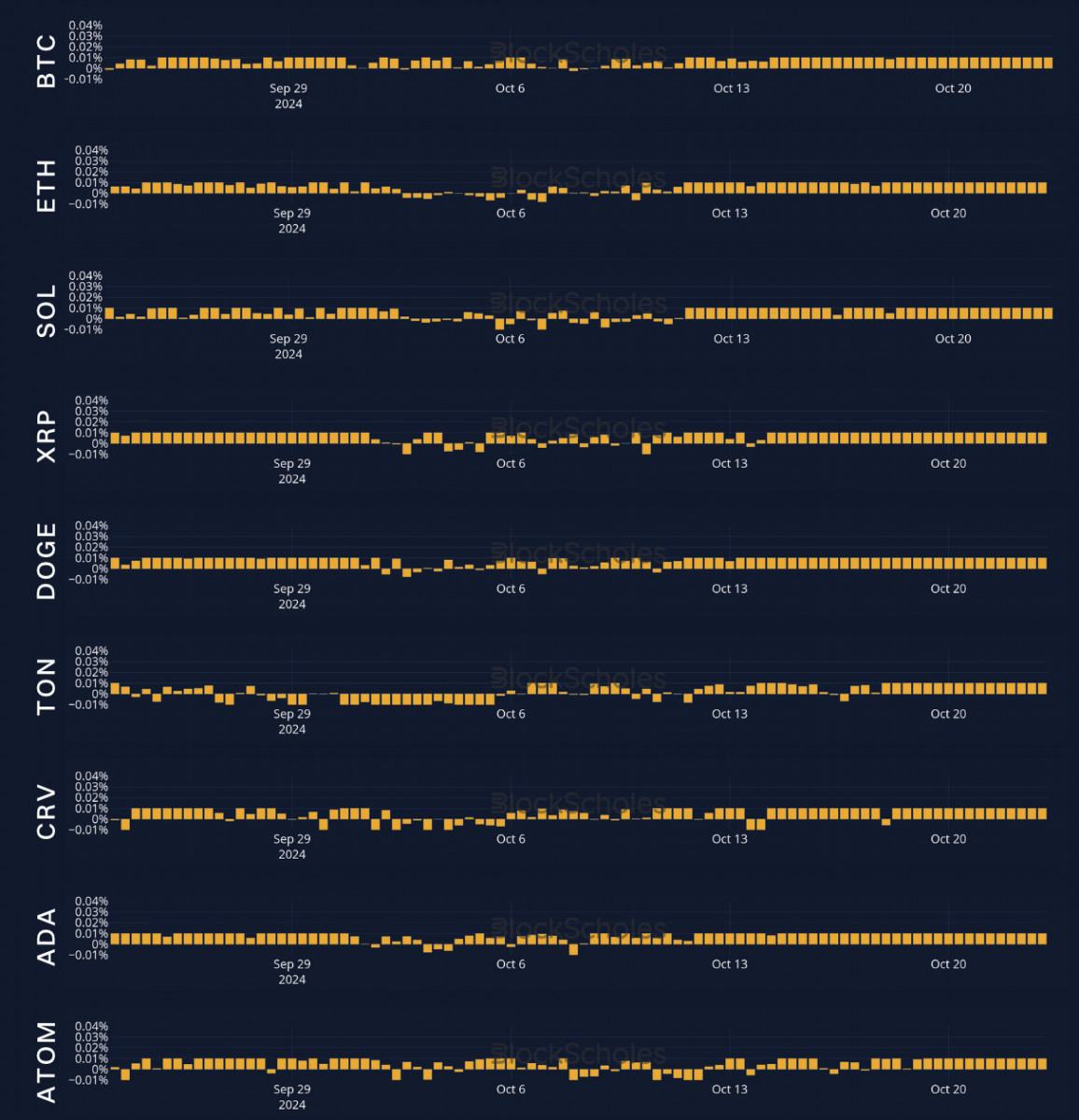

Rates of Funding and Extended Positioning

The continuously high financing rates for perpetual contracts across all major tokens are one of the important indicators that the paper highlights. In perpetual futures contracts, funding rates are the regular payments made between holders of long and short positions with the goal of maintaining the contract price in line with the spot price of the underlying asset. Traders are paying more to keep long positions when funding rates are positive, which is the situation for all tokens in this instance.

The robust demand for leveraged exposure to the cryptocurrency market is highlighted by this pattern of rising financing rates. In addition to placing bets on rising prices, traders are also prepared to pay extra funding costs in order to keep their positions open. As traders anticipate that the possible profits from a price increase would more than balance the expense of holding their holdings, this is a blatant indication of optimistic mood.

One important tendency to keep an eye on is the buildup of long holdings before the US election. It implies that traders are preparing for a post-election surge in the hope that the election’s conclusion would bring clarity and maybe spark notable market moves. However, this increase in leverage also adds a certain amount of danger. These investments may be abruptly unwound in the event of a market-shocking election result, which might raise volatility and raise the chance of a decline.

The Catalyst Effect of the Election

One of the biggest macro factors affecting the cryptocurrency market right now is definitely the impending U.S. election. Elections have always had an effect on financial markets, especially in the US, and the cryptocurrency market is no different. In the options market, where the steep term structure implies predictions of heightened volatility after the election, the research emphasizes that the election is a major driver of the present volatility patterns.

The election’s result may act as a trigger for notable price changes, even though the market is anticipated to stay quiet in the short run-up to the vote. A resounding election outcome might lead to a surge in the value of Bitcoin and other tokens, especially if it offers clarity about economic policies and legal frameworks for the cryptocurrency sector. However, when markets respond to heightened uncertainty, a contentious or ambiguous outcome may cause volatility.

According to the article, market players may wait for greater clarity on the political scene before revealing Bitcoin’s price objective of $70,000. This cautious optimism is a reflection of the general mood in the cryptocurrency market, as traders are waiting to make big movements in anticipation of a possibly turbulent post-election period.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.