Crypto 2025 Kicks Off: Bitcoin Tests Six Figures, Ethereum Eyes New Highs, Altcoin Season Ahead

In Brief

Crypto markets start 2025 with Bitcoin testing six-figure highs and Ethereum poised for growth, as institutional interest, new projects, and shifts in market dynamics fuel optimism for another transformative year in decentralized technology.

Happy New Year, crypto enthusiasts! After a blockbuster 2024 that saw Bitcoin smash through the $100,000 barrier and redefine market expectations, 2025 kicks off with the kind of buzz only crypto can deliver. It’s the perfect time to reflect on the wild ride so far and gear up for what’s next. Make no mistake, fresh opportunities and big moves are already brewing, so this year is shaping up to be another thrilling chapter in crypto evolution. So, here’s to bold trades, sharper charts, and new records – let’s dive into what’s heating up the market as we charge into the new year!

Bitcoin (BTC)

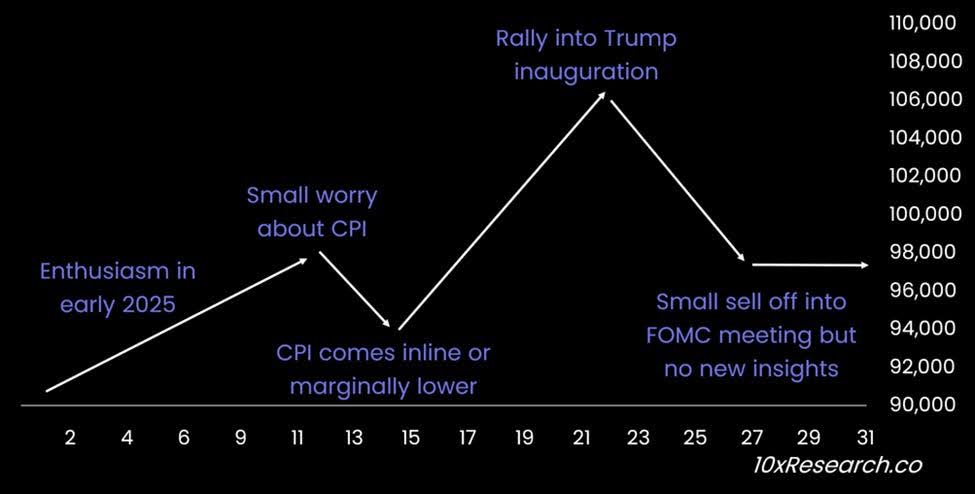

Bitcoin kicked off 2025 with a mix of excitement and uncertainty. After smashing through the long-awaited $100,000 barrier in December and peaking at $108,000, the momentum fizzled out over the holidays, dragging the price down by more than 10%. Now, as the new year begins, the big question is whether Bitcoin can stage another rally or if it’s in for a breather.

This week though, the markets have been buzzing. Bitcoin clawed its way back to $97,000, fueled by some heavyweight moves from institutional players.

For one, MicroStrategy isn’t done yet – they’ve announced plans to raise up to $2 billion to pad their already massive Bitcoin stash. Not to be outdone, Metaplanet wants to boost its holdings by nearly 500%, aiming for 10,000 BTC this year. These kinds of headlines remind us that the big money still believes in Bitcoin’s long-term story.

On the regulatory front, there’s a new sense of optimism with President-elect Donald Trump set to take office. Many in the crypto world are hoping for a friendlier climate for digital assets, and it’s not just wishful thinking. The broader crypto market saw a lift this week, riding on the back of these expectations. Still, some analysts are waving caution flags, warning that the Federal Reserve’s upcoming decisions could cool Bitcoin’s so-called “Trump rally” later this month.

Digging deeper, some of Bitcoin’s fundamentals are showing strength. Exchange inflows and miner outflows are down, which typically means less selling pressure on the market.

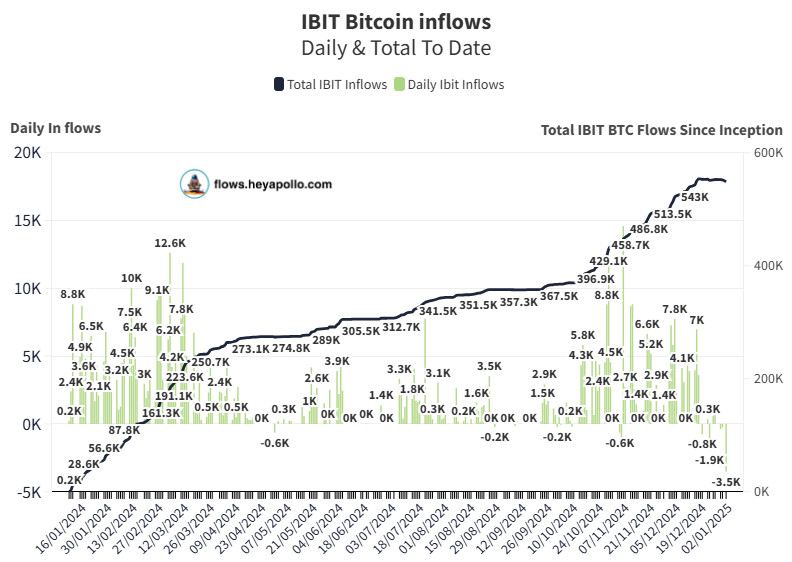

On top of that, Bitcoin ETFs are still pulling in serious capital after a record-breaking 2024, with funds like BlackRock’s bringing billions into the fold. But here’s the flip side: trading volumes are nowhere near what they were during December’s peak, and analysts say that’s going to need to change if Bitcoin wants to reclaim six-figure territory.

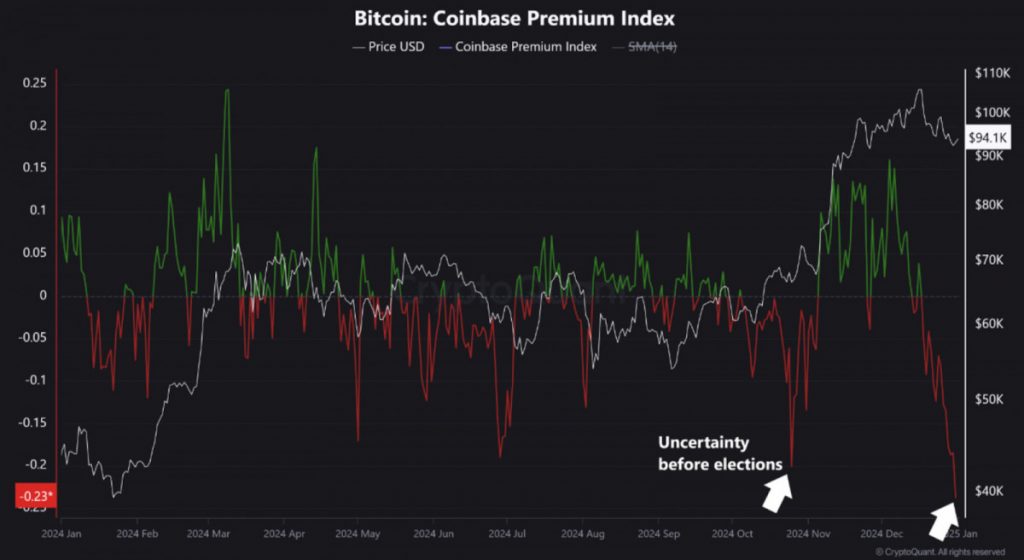

Not everything is rosy, though. U.S. markets showed increased selling pressure, with the Coinbase Premium Index hitting a one-year low.

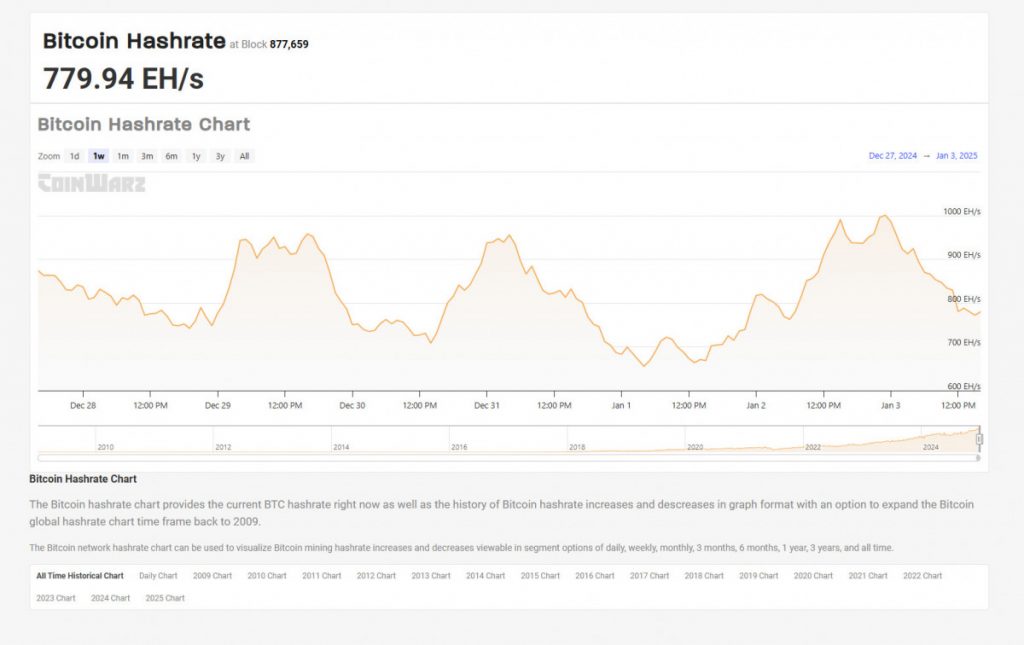

And while Bitcoin’s hashrate hit an all-time high this week – a bullish signal for network strength – some are keeping an eye on macro risks like ETF outflows and upcoming Fed decisions. For now, Bitcoin seems to be stuck in a tug-of-war between bullish momentum and lingering doubts.

Where does that leave us? As we settle into 2025, Bitcoin’s clearly at a critical crossroads. Institutional interest is alive and well, and the groundwork for another breakout seems solid. But the market’s going to need a little extra fuel – volume, sentiment, or some fresh narrative – to make another charge past $100,000. So, the next few weeks will tell us if Bitcoin’s ready to run again or if it’s taking a breather before the next big move.

Ethereum (ETH)

While Bitcoin has been stealing the spotlight with its headline-grabbing rally, Ethereum is quietly making its own waves as we step into 2025. After a strong finish to 2024, holding firm above $4,000, there’s once again a fresh buzz surrounding Ether’s potential.

Already, the new year has been kind to ETH. A slight dip in Bitcoin’s dominance has traders speculating about the start of an “altcoin season,” with Ether leading the charge. As Bitcoin’s momentum cools, Ether is soaking up attention from those rotating profits into promising alternatives. December’s massive $2.6 billion in ETF inflows only adds to the optimism, signaling that institutions are still heavily invested in Ethereum’s future.

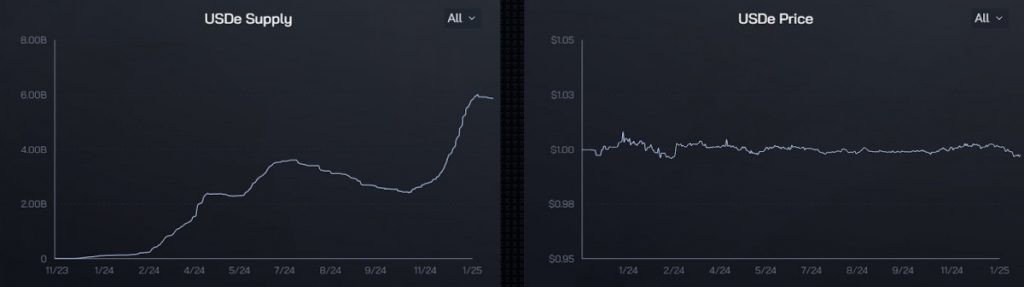

On the development side, Ethereum continues to flex its innovative muscles. Take Ethena’s synthetic dollar, for instance. This ambitious project aims to bridge the gap between traditional finance (TradFi) and decentralized finance (DeFi), showcasing Ethereum’s versatility and its ability to remain a beacon of innovation.

Overall, Ethereum’s fundamentals remain rock solid. The network is at the heart of DeFi, tokenization, and countless other innovations, making it a cornerstone of the broader crypto ecosystem. While Bitcoin may be crypto’s financial powerhouse, Ethereum continues to stand out as the creative engine driving new possibilities. If 2024 was a year of building, 2025 could be the year Ethereum shows just how far it’s come.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Alisa, a dedicated journalist at the MPost, specializes in cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a keen eye for emerging trends and technologies, she delivers comprehensive coverage to inform and engage readers in the ever-evolving landscape of digital finance.

More articles

Alisa, a dedicated journalist at the MPost, specializes in cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a keen eye for emerging trends and technologies, she delivers comprehensive coverage to inform and engage readers in the ever-evolving landscape of digital finance.