The Growing Debate on Cryptocurrency Regulation and How It Could Shape the Future of Global Finance

In Brief

Bitcoin’s emergence sparked cryptocurrency’s global prominence, prompting leaders to balance investor protection with innovation, balancing regulation for market stability and potential expansion.

The creation of Bitcoin a little over ten years ago introduced the idea of cryptocurrency, which has since grown to be an important player in the global financial system. Today’s leaders in government, technology, and finance must find a way to combine safeguarding investors with encouraging innovation. Some contend that regulation is necessary to foster market stability and confidence, while others worry that enforcing regulations would stifle the sector’s potential for innovation and expansion.

Why Regulation is Necessary

The decentralized and often volatile nature of cryptocurrency markets presents both possibilities and threats. Regulation proponents contend that laws are necessary to safeguard investors from fraud, uphold market integrity, and preserve financial stability. Bad actors can take advantage of the system in the absence of regulations, harming customers and undermining confidence in digital currency.

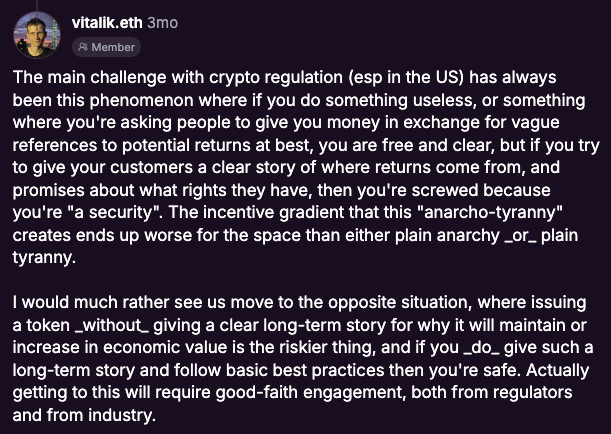

Ethereum co-founder Vitalik Buterin emphasized these dangers by highlighting the industry’s large number of dishonest players. In order to stop misuse and fraud, he underlined the necessity of regulations that restrict leverage, uphold openness, and mandate frequent audits. Many people in the sector share this viewpoint, believing that the absence of clear regulations has created an atmosphere that encourages fraud and badly planned projects.

Photo: Warpcast comments

The financial soundness of the overall economy worries regulators as well. The possibility of systemic problems increases with the degree of cryptocurrency integration into international financial institutions. For example, stablecoins, which are based on official currencies, are being utilized more and more in daily transactions. The conventional financial system may become unstable if these coins were to crash.

In order to avoid such consequences, SEC Commissioner Hester Peirce underlined the need of unambiguous regulatory monitoring while acknowledging the difficulties presented by stablecoins. She pointed out that in the absence of regulation, there may be negative interactions between the crypto community and the established banking system.

Difficulties in Developing Efficient Regulation

Determining the legal status of cryptocurrencies is one of the biggest challenges facing regulation. There is considerable disagreement about whether cryptocurrencies belong in the securities, commodities, or other categories. Many cryptocurrency assets are similar to securities, but applying current securities regulations to cryptocurrencies might hinder innovation, according to Hester Peirce, who is known as “Crypto Mom” for her advocacy of the sector.

A large portion of the present legal structure was created in the 1930s and was not intended to manage decentralized technology like blockchain. According to Peirce, authorities should pause and reevaluate how to implement current legislation in a way that makes sense, given the special characteristics of digital assets.

Stephanie Desanges of PayPal underlined the difficulty of integrating cryptocurrencies into pre-existing regulatory categories. Regulations created almost a century ago might not be appropriate for the digital world of today, she said, as technology has advanced in ways that were unthinkable at the time.

Cryptocurrencies, particularly those that power decentralized networks rather than raising money for a particular corporation, may not necessarily pass the Howey Test, which has been used to evaluate whether an asset qualifies as a security. The objectives of financial stability, consumer protection, and market integrity are still crucial, as Desanges said, but the means by which they are accomplished must be modernized to take into account the state of technology.

Regulation’s Effect on Innovation

The possible influence on innovation is one of the main issues with cryptocurrency regulation. Many in the sector are concerned that strict rules may inhibit the innovation and spirit of entrepreneurship that have propelled the rise of cryptocurrencies. The CEO of Signum Growth Capital, Angela Dalton, cautioned that excessively stringent laws may hurt competition by consolidating existing firms and making it difficult for newcomers to enter the market.

She voiced worry that huge firms’ well-funded lobbying efforts would result in laws that prioritize established businesses over smaller, more creative initiatives. As a result, the market may become dominated by a small number of powerful companies, which would restrict the development of new concepts and technology.

This stance was shared by Vitalik Buterin, who criticized Michael Saylor’s opinions on Bitcoin custody, contending that the industry’s decentralized culture is violated by depending too much on big institutions for cryptocurrency custody.

Buterin thinks that the core of cryptocurrencies is personal liberty and self-management, not ceding authority to large banks and other centralized organizations. Instead of promoting a system that benefits exclusively big institutions, he said that rules should concentrate on leveling the playing field so that innovation may thrive.

International Coordination for Mitigating Loopholes and Uncertainty

Since cryptocurrencies are cross-border by nature, it is challenging for any one nation to adequately govern them. The Global Blockchain Business Council’s CEO, Sandra Ro, emphasized the necessity of international cooperation in cryptocurrency regulation. The regulatory environment is currently fragmented, with several nations implementing various strategies for the management of digital assets.

This patchwork of regulations makes it simpler for criminals to take advantage of legal loopholes and causes uncertainty for businesses that operate in several countries. Ro maintained that in order to establish a uniform regulatory framework that protects consumers and encourages innovation, a more concerted worldwide strategy is required.

Given the increasing usage of cryptocurrencies in underdeveloped nations, there is a particular need for international collaboration. According to Ro, authorities in nations like South Korea, Nigeria, and Kenya are actively working with the sector to create regulations that meet their unique requirements. However, in the absence of a global framework, disparities in national laws might jeopardize these initiatives. The secure and effective cross-border usage of cryptocurrencies would be ensured by a concerted effort, promoting global financial inclusion and economic expansion.

Technology’s Function in Regulation

Regulators can handle the intricacies of the bitcoin industry with the use of technology. Sandra Ro proposed that the burden on businesses and regulators may be lessened by using technology to automate compliance with certain regulatory requirements.

For instance, blockchain and smart contracts might be used to automatically enforce compliance after clear regulations are set, with authorities only becoming involved when anything goes wrong. This strategy may simplify the regulatory process and free up businesses to concentrate more on innovation rather than figuring out intricate regulatory structures.

Neha Narula, MIT’s head of the Digital Currency Initiative, also underlined the significance of leveraging technology to improve the effectiveness of regulation. Instead of trying to fit blockchain into outdated regulatory structures, she urged that regulators should collaborate with the sector to learn how the technology may make their jobs simpler.

Regulators can better monitor transactions and guarantee compliance by utilizing blockchain’s inherent transparency and traceability than they could with conventional banking systems. Narula did, however, issue a warning that this shouldn’t lead to too onerous regulations that hinder the expansion of the sector.

It will be crucial for authorities to interact with the cryptocurrency business in a sincere manner as the US government continues its attempts to create a regulatory framework. Buterin has emphasized how crucial it is for authorities and the cryptocurrency industry to work together to develop regulations that safeguard consumers without impeding innovation. Brad Garlinghouse, the CEO of Ripple, shared this attitude and has advocated for practical regulations that spur innovation and generate employment in the cryptocurrency industry.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.