Past Week in Crypto: Bitcoin, Ethereum, Toncoin Recovery After Crash

In Brief

The past week in crypto saw a dramatic market crash on August 5, with Bitcoin plunging below $50,000, sparking panic and heavy liquidations, but by week’s end, Bitcoin, Ethereum, and Toncoin began showing signs of a cautious recovery despite continued bearish sentiment and critical resistance levels.

Bitcoin News & Macro

Last week kicked off with a brutal market crash on August 5 that shook the entire crypto world. The price of Bitcoin nosedived below $50,000, setting off a wave of panic and more than $1 billion in liquidations. Aggressive selling from market makers and firms like Jump Trading turned the downturn into a full-blown freefall, pushing Bitcoin and other major cryptos into deeper waters.

Source: Lookonchain

The broader market slump was only made worse by growing fears of a recession, with analysts bracing for more pain ahead.

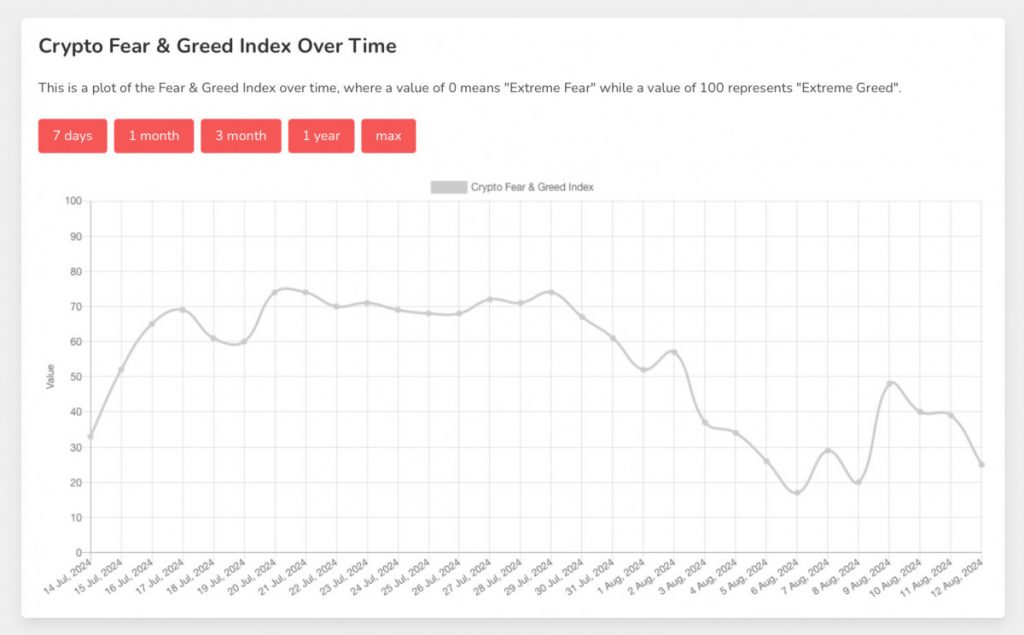

The Crypto Fear & Greed Index, at some point, hit historical lows – talk consistent extreme fear – and it hasn’t been willing to leave that area yet.

The Crypto Fear & Greed Index is aty historical lows

As Bitcoin stumbled, its dominance index soared, putting further downward pressure on the rest of the market.

Source: TradingView

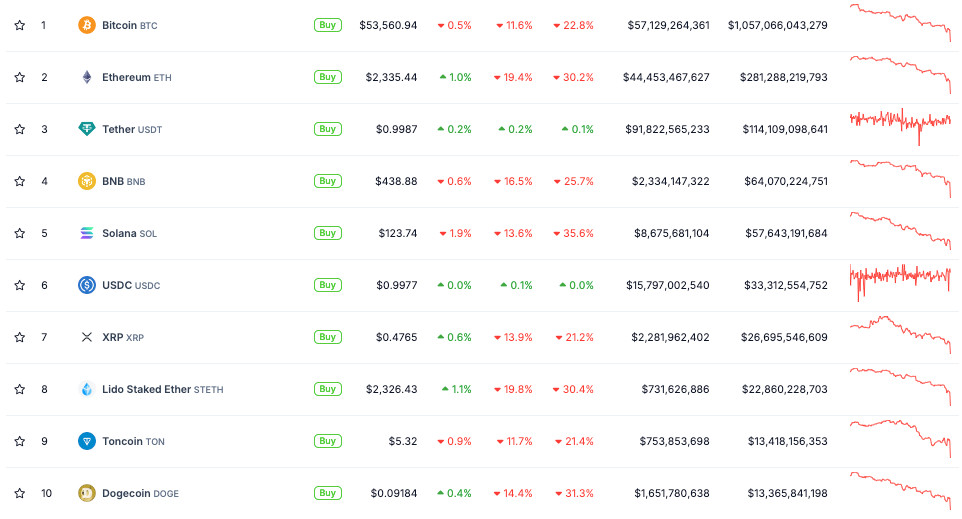

As we approach the middle of August, all major cryptos are deep in the red, down double digits since last week.

Source: CoinGecko

As the week wound down, Bitcoin was hovering near $60,000, hinting at a cautious recovery as market sentiment began to thaw. But no one’s ready to pop the champagne just yet – traders and analysts remained on edge, wary of economic shifts.

BTC Price Analysis

With that in mind, let’s zoom in on the technicals of the last week’s freefall. As we know, it started with a sharp sell-off that sliced through the $62,000 support, plunging it to $58,000. This breakdown was fueled by panic selling, with heavy volume signaling potential capitulation. Bitcoin found temporary support around $57,000, consolidating in what looked like a bear flag – a classic setup for more downside. But instead of breaking lower, it briefly popped back above $62,000, though the lack of follow-through hinted at strong selling pressure.

Source: TradingView

The 1D chart flashed a death cross with the 20-day EMA dipping below the 50-day, amplifying the bearish sentiment. The 4H chart mirrored the chaos with a descending triangle pattern, signaling weakening bullish momentum as Bitcoin repeatedly tested $58,000. Every bounce was weaker, leading to an inevitable breakdown that brought the price back to precarious levels.

Source: TradingView

But even in the chaos, Bitcoin showed some fight. In the days after the crash, the price started to stabilize, though it was far from out of the woods. Analysts made it clear that holding above $50,000 was critical to avoid further drops, but a quick rebound to $57,000 brought a flicker of hope. This bounce had traders speculating that perhaps the bottom was in.

Throughout the week, $57,000 and $62,000 emerged as critical battlegrounds to watch. Defending $57,000 is crucial to avoid a deeper dive into the low $50,000s. The overall market tone remains bearish, especially with Bitcoin struggling to gain traction above key levels. If $57,000 cracks, then we can reasonably expect more downside. On the contrary, reclaiming $60,000 could ignite a rally, but the odds are currently stacked against it. Traders should watch these levels closely as they will dictate Bitcoin’s next big move.

Ethereum News & Macro

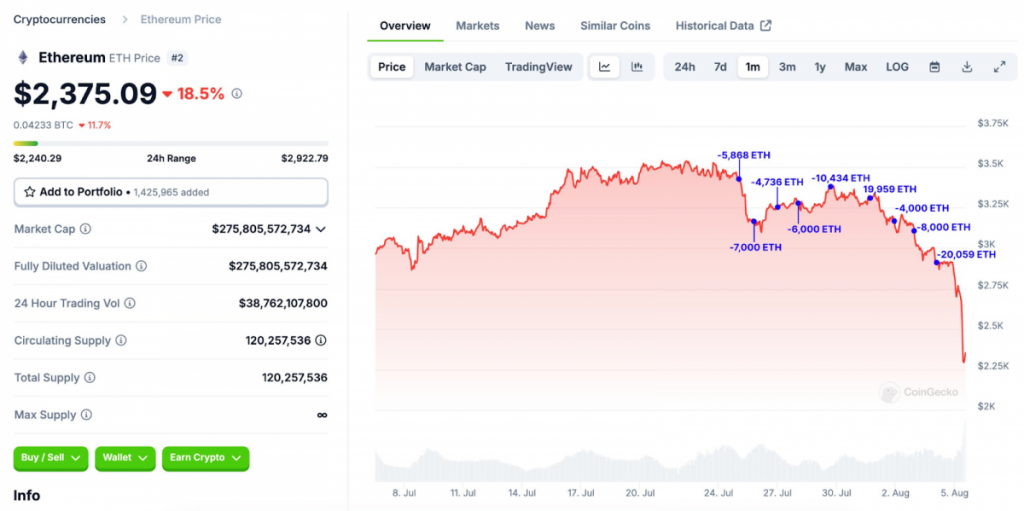

As you would expect, Ethereum took a beating this week, caught in the same storm that rocked the entire crypto market. On August 5, Ether plunged below $2,100, following Bitcoin’s lead and sparking a wave of liquidations.

Despite the chaos, Ethereum began to show some signs of stabilizing, much like Bitcoin. Analysts were quick to point out that $2,100 was the line in the sand – if Ethereum could hold there, it might dodge further declines. Still, the recovery was shaky at best, with macroeconomic jitters keeping the volatility dial turned all the way up.

Complicating the recovery narrative was the mixed performance of the newly launched spot Ether ETFs. Even though they posted positive inflows, it wasn’t enough to boost trader confidence. Adding to the unease, Ethereum transaction fees dropped to a five-year low, highlighting a cooling in network activity that mirrored the broader market’s slowdown.

As the week wore on, Ethereum’s price action danced in lockstep with Bitcoin, both struggling to regain their footing. The market watched closely for any hint that Ethereum might break free from Bitcoin’s gravitational pull, but caution remained the prevailing mood. All eyes were on that $2,100 mark, seen as a crucial test of Ethereum’s staying power.

ETH Price Analysis

Ethereum’s price action over the past week has been mirroring the broader market chaos. The August 5 crash saw ETH slice through the $3,000 support like butter, plunging it to the $2,100-$2,200 zone amidst panic and liquidations.

Source: TradingView

On the 1D chart, ETH found some shaky footing at $2,500, but the consolidation that followed hinted at more bearish vibes. Like Bitcoin, Ethereum briefly rallied (towards $2,700), but only for a weak follow-through to send it back down. The 20-day and 50-day EMAs have crossed bearish, amplifying the downside risk.

On the 4H chart, the story is the same: ETH rebounded from oversold conditions but hit a wall at the 50-EMA, forming a descending triangle – a clear sign of fading bullish momentum. Source: TradingView

Source: TradingView

As we approach mid-August, the $2,500 level stands as critical, much like $57,000 for Bitcoin. If ETH can’t reclaim $2,700 soon, it risks a deeper dive toward the low $2,000s. The past week’s failed breakout and relentless selling pressure show the bears are still firmly in control.

Toncoin News & Macro

The crash that shook the market didn’t spare Toncoin, though it held its ground far better than expected. As Bitcoin tumbled and Ethereum wrestled with key support levels, Toncoin saw significant developments that influenced its price action. The integration of advanced analytics through IntoTheBlock, offering over 60 indicators, gave a solid boost to TON’s ecosystem. Not a mere tech update, it was a strategic play to enhance user engagement and transparency within the TON network, likely helping to steady the coin amid the market’s rough seas.

Still, Toncoin wasn’t entirely insulated from the overall volatility. Like Bitcoin and Ethereum, it faced its own struggles in sustaining momentum. Toncoin’s listing on Binance gave the coin a welcome lift, but the broader bearish mood kept any runaway optimism in check.

As the week wrapped up, Toncoin, like its heavyweight peers, showed tentative signs of recovery. However, Toncoin’s future hinges on overcoming key resistance levels.

TON Price Analysis

Last week’s crash saw TON slice through the $6.80 support, plunging to $5.20 with force, echoing Bitcoin and Ethereum’s volatility. A quick rebound followed, but the rally towards $6.80 lacked staying power, hitting resistance and quickly losing steam.

Source: TradingView

On the 1D chart, TON briefly reclaimed $6.80 before slipping back below this critical level. The hovering 20-day and 50-day EMAs reinforce the bearish tone, signaling a market where every rally gets sold off. The 4H chart reveals the same struggle – TON’s recovery was short-lived, with a double top forming around $6.80, indicating strong resistance. The RSI’s bearish divergence further suggests fading bullish momentum.

Source: TradingView

For now, TON now hovers around $6.20, with $5.50 support back in play. Much like Bitcoin and Ethereum, Toncoin’s next moves hinge on these key levels. If $6.20 doesn’t hold, a retest of $5.50 would seem likely. However, if TON can reclaim $6.80 with conviction, a stronger rally could be on the horizon. But for now, the bears are clearly in control.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.