October Crypto Recap: Bitcoin Rebounds, Ethereum Holds the Line, TON Quietly Builds

In Brief

Bitcoin and Ethereum rebounded in October, boosted by softer inflation and renewed market optimism. Toncoin quietly gained, supported by strategic reserves, Grayscale interest, and growing ecosystem momentum.

Bitcoin (BTC)

From ~105 K lows back toward 116 K, reclaiming mid-range ground after the October nuke.

BTC/USD 1H Chart, Coinbase. Source: TradingView

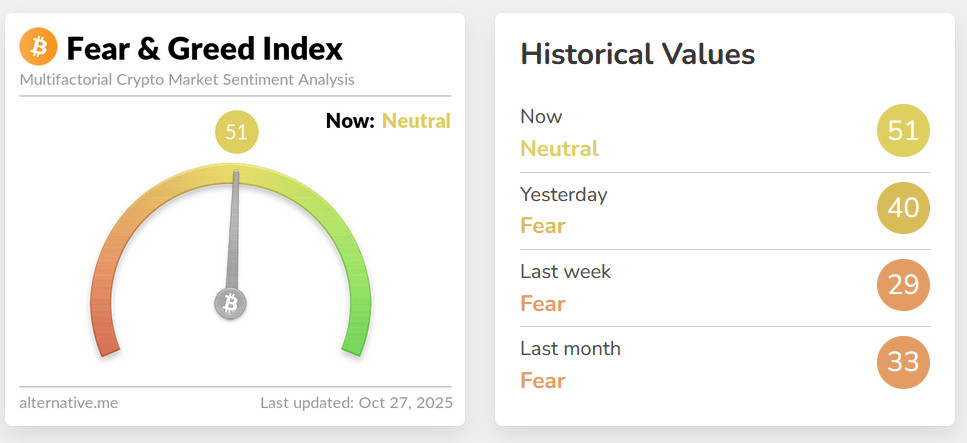

So yeah, BTC finally decided it’s had enough of the post-tariff hangover and pushed a pretty convincing local rebound. What’s funny is that it doesn’t feel euphoric — sentiment’s only just crawled out of “fear” territory, according to the Crypto Fear & Greed Index. You can almost sense the hesitation: traders are buying, sure, but with one foot still hovering over the brake pedal.

The current Crypto Fear and Greed score. Source: Alternative.me

Macro helped a bit here. The odds of a Fed rate cut jumped to 98%, and inflation data came in softer than expected. That combination alone gave crypto a much-needed tailwind. Stocks hitting record highs didn’t hurt either — risk appetite’s slowly seeping back in.

Scott Bessent breaks the news of positive trade negotiations between the US and China. Source: The White House

And politically, Trump’s Treasury team reached what they called a “substantial” trade framework with China. That eased the tariff panic — the very one that triggered October’s crash in the first place.

US President Donald Trump answers reporters’ questions on several topics, including CZ, at Thursday’s press conference. Source: The White House

Then there’s the crypto-native side of things. CZ’s presidential pardon reignited speculation about Binance’s possible U.S. return.

Ferrari 499P. Source: Wikimedia

Even Ferrari wandered into the picture, teasing a digital token auction for its Le Mans-winning car. Random, sure — but sort of symbolic. When old luxury brands keep inching toward crypto, it makes the rebound feel a little more “real.”

So where does that leave Bitcoin? Right at the top of its crash-range again, hovering near 116 K. Maybe it breaks through, maybe it doesn’t. The range is still a minefield, and the easy gains are done. If you’re trading short-term, you keep your stops tight. If you’re thinking bigger picture, you probably wait for this box to break cleanly before pretending the road to new highs has reopened.

Ethereum (ETH)

Bounced from 3.7 K to 4.25 K, shadowing BTC’s recovery and poking its own local ceiling.

BTC/USD 1H Chart, Coinbase. Source: TradingView

Ether’s move this week feels like déjà vu — it’s still dancing to Bitcoin’s rhythm, just with a slightly smoother beat. Spot ETH ETFs, though, told a different story: outflows for a second straight week.

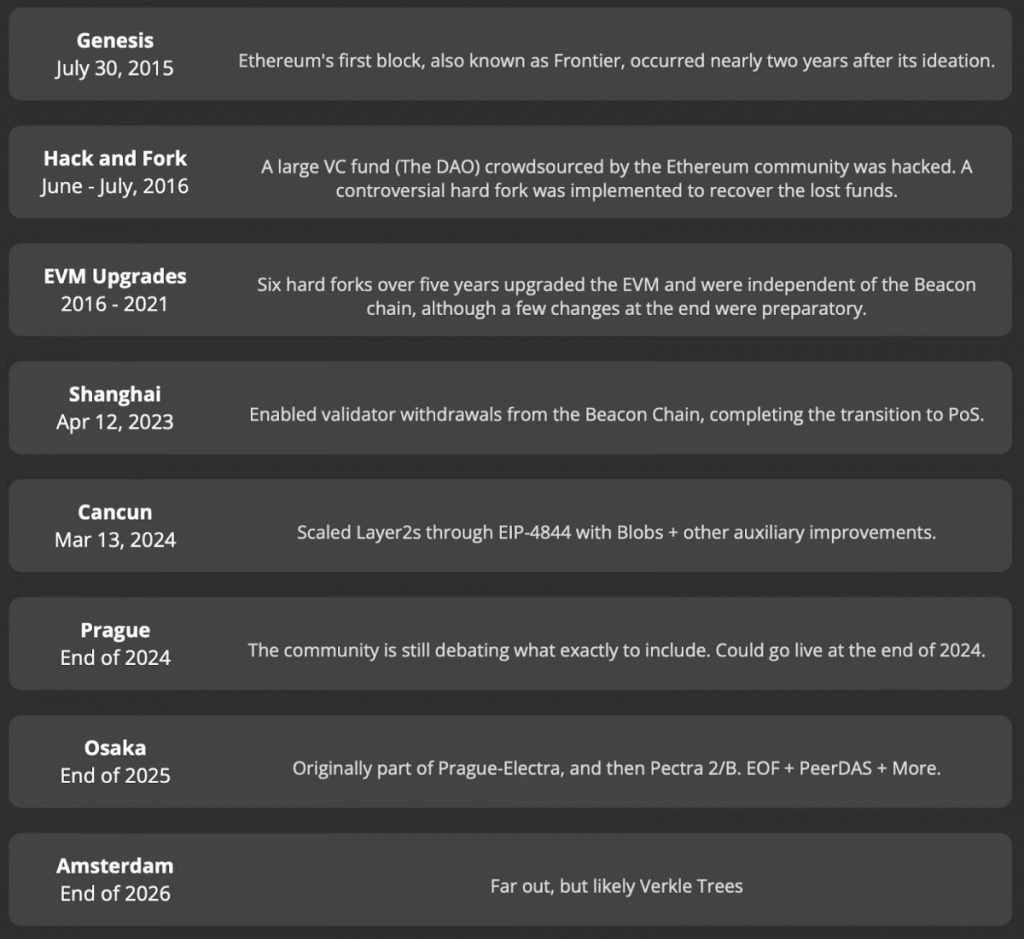

Even so, the market shrugged it off. Traders are looking ahead to the December 3 Fusaka upgrade, now in its final testnet phase, which reminded everyone that, beyond all the noise, Ethereum still ships code.

Ethereum Hard Fork timeline. Source: ethroadmap.com

Technically, ETH remains trapped below that thick 4.3 K resistance — the same one that’s rejected every breakout attempt this month. It’s visible, it’s psychological, and it’s not breaking until Bitcoin clears its own ceiling.

Narratively, the Ethereum camp had a noisy week. ConsenSys’ Joe Lubin called Ether “the highest-powered money on the planet.”

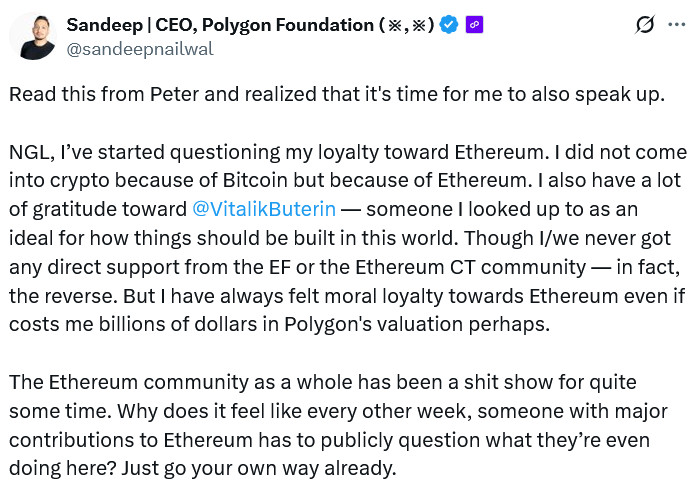

Polygon’s founder publicly questioned his “loyalty” to Ethereum, while Solana’s Anatoly couldn’t resist calling L2s “centralized security liabilities.” It’s like everyone’s back to arguing theology again — and that’s a classic sign the cycle’s maturing.

Source: Sandeep Nailwal

Still, correlation is king right now. No matter what tech milestones or philosophical debates play out, ETH won’t decouple until BTC’s direction becomes clearer.

Toncoin (TON)

From ~2.06 to 2.25, late to the party but joining the rebound.

BTC/USD 1H Chart, Coinbase. Source: TradingView

TON didn’t exactly rip, but it’s finally catching a bid again — and this time, the optimism actually has some substance behind it. The new TON Strategic Reserve site quietly went live this week, showing that TON Strategy and AlphaTON Capital together now hold about 229 million TON, roughly 4.7% of total supply.

Around the same time, Grayscale re-added TON to its “assets under consideration” list, which is a pretty big nod from the TradFi side. It’s the second time they’ve done this, and the fact that it’s resurfacing a year later suggests the interest in Telegram’s blockchain is becoming more systematic than ‘experimental’.

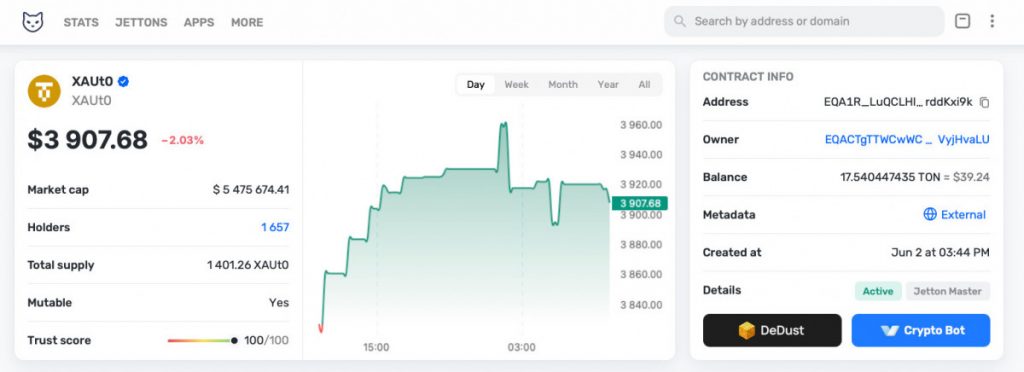

On the infrastructure front, TON’s still benefiting from having Tether Gold (XAUt0) as its first omnichain token — that little experiment now sits at a $10.7 million cap, with more than half of it circulating right on TON. It’s a small number in the grand scheme, but symbolically, it shows TON’s evolving into a serious multi-asset platform, not just a chat-app chain.

AlphaTON itself also made headlines this week with a new CFO appointment — Wes Levitt (formerly of Theta Labs), who’ll be compensated half in fiat, half in TON, plus a chunky options package. It’s a corporate move, but one that says the money around this network is getting more professional.

All in all, TON’s looking steadier — not exactly a breakout story, but definitely reasserting its relevance after a few quiet weeks. Its price is moving in sync with the majors, yes, but this time there’s genuine ecosystem momentum under it. Still, if Bitcoin stumbles near 116 K, TON will likely give back ground like everyone else.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.