Mid-September Crypto Watch: Fed Cuts, ETF Flows, And A Harsh Reset For BTC, ETH, And TON

In Brief

Bitcoin broke below consolidation to the 112K range, dragging Ethereum to oversold levels near 4.2K and Toncoin beneath its $3.0 floor, with all three showing potential for short-term relief bounces if key supports hold.

Bitcoin (BTC)

BTC looked pretty composed for most of the week, holding that tight 115–117K corridor like it was glued there. Then Monday the 22nd came, and the floor collapsed into the low 112Ks in one clean sweep. It’s a pretty classic move, as we know that consolidations are almost guaranteed to be followed by a strong impulse move.

Speaking of the reasons, the first domino would be the Fed’s rate cut on September 17th. A 25 bps trim was widely expected, and sure, BTC did its polite pump toward 117K. But Powell’s messaging wasn’t exactly champagne — he left guidance mushy, so the market’s initial cheer quickly faded. What’s important here: Bitcoin didn’t crash on the cut itself, but the seeds of indecision were planted right there.

Then came the options expiry around the 19th, which turned 115–118K into a magnet all week. Traders love to call this “max pain” because price just gets stuck where contracts hurt the most people. Once those contracts rolled off, BTC was free to move — and it did, violently, to the downside.

Under the surface, miners actually pushed network difficulty to a fresh all-time high. Sounds bullish, right? In the long run, sure. But in the short run, that also means more coins hitting the market from operators who need to cover costs, which adds to sell pressure exactly when liquidity is thin. That’s not a crash trigger by itself, but it’s one more weight pressing down.

If 112–113K continues to hold on closing bases, we’d like to see a messy mean-reversion back toward 115.3K and then another poke at 117–118K. Lose 112K with pace and the market might go price-shopping at 111K and 110K/109.8K.

Ethereum (ETH)

Ethereum spent Sept 15–22 chopping in that 4.4–4.6K band, hugging the 9-SMA (orange line), but momentum kept bleeding out. RSI rolled downhill all week, and when BTC cracked its own shelf, ETH followed suit — plunging straight through supports and tagging ~4.21K. That wick also lined up neatly with the August 20th low around 4.06K, which is now the major line in the sand. Structurally, ETH is oversold (RSI ~21), and the 4H candle looks more like a liquidation flush than a steady trend break. Now let’s break down the why’s.

One ‘stealthy-big’ piece of news came from Coinbase, which rolled out on-chain USDC yields directly in-app. That may sound niche, but it’s effectively a mainstream bridge into Ethereum’s DeFi plumbing. Suddenly, grandma with a Coinbase account is one click away from protocol yields without knowing what “liquidity pool” means.

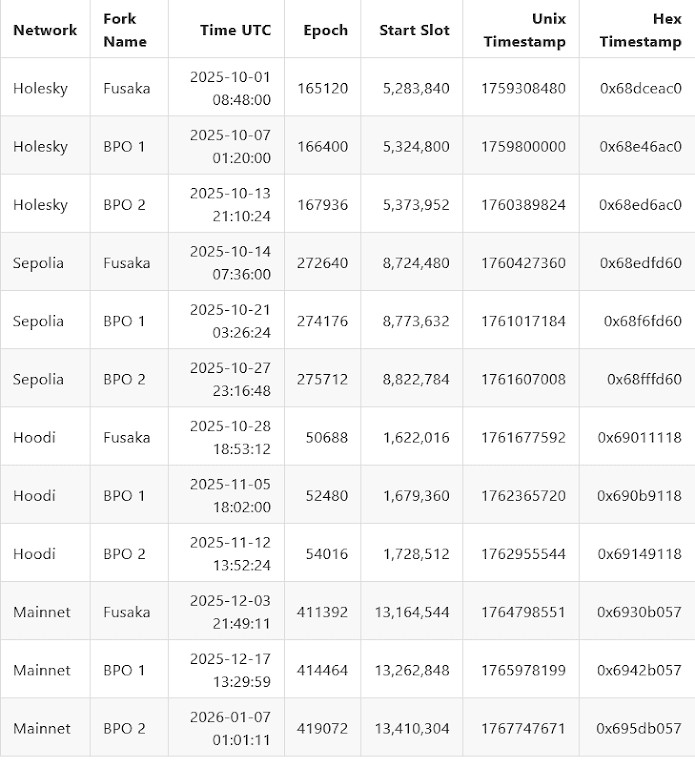

And then there’s Fusaka, the next hard fork, officially locked in for December 3rd. It’ll double blob throughput, cut costs, and generally grease Ethereum’s scaling machine. It’s the kind of thing institutions quietly love, so stay tuned.

The irony is that all this bullish ETH-specific momentum got completely drowned out by Bitcoin’s crash. Correlation still rules. When BTC breaks a range, ETH doesn’t get to say “but fundamentals!” — it just gets dragged, usually even harder.

So where does that leave it? If ETH can hold above 4.18–4.20K on closing bases, the path back to 4.36–4.42K (and eventually the 4.5K handle) is open as a relief bounce. But if 4.06K gives way with volume, that would confirm a deeper retrace, forcing the market to build a new base lower. We’re probably looking at a messy chop, then a rebound attempt toward mid-4.3Ks, as long as Bitcoin doesn’t do a second leg down.

Toncoin (TON)

TON spent Sept 15–22 glued around the 3.0 handle, right on top of its June low support (~3.04). But instead of lifting, it cracked — and the break was brutal. Price free-fell to ~2.60–2.70 before catching a bounce, while RSI on the 4H collapsed to ~12, deep in oversold territory. It was a clean rejection of the 3.0 floor that had held for months.

Believe it or not, this week we haven’t actually got any major news coming from the TON camp. Unlike BTC and ETH, TON had no fresh catalyst or narrative to attract dip buyers. So when the broader market flushed, liquidity just wasn’t there. That’s why the move exaggerated — not because TON was “broken,” but because it had nothing to stand on.

As long as TON can reclaim the 2.95–3.05 band quickly, this will look like an ugly stop-hunt rather than a true breakdown. Fail to get back above 3.0, and the market will likely treat 2.6–2.7 as the new base, with downside risk into the mid-2.5s. For now, TON looks oversold enough for a relief bounce, but it needs either BTC stability or its own catalyst to make that bounce stick.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Alisa, a dedicated journalist at the MPost, specializes in cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a keen eye for emerging trends and technologies, she delivers comprehensive coverage to inform and engage readers in the ever-evolving landscape of digital finance.

More articles

Alisa, a dedicated journalist at the MPost, specializes in cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a keen eye for emerging trends and technologies, she delivers comprehensive coverage to inform and engage readers in the ever-evolving landscape of digital finance.