Five Projects That Made Real Progress In June 2025 (No Shilling)

In Brief

In June, amid the usual crypto hype, five standout projects — GPUNet, Sei, Tron, Chainlink, and Celestia — delivered real progress across decentralized compute, state-backed stablecoins, public listings, cross-chain finance, and modular infrastructure.

If you’ve been anywhere near crypto Twitter/X lately, you’ve probably seen the usual buzzword soup: “hyperperformance,” “modular from day one,” “decentralized AI compute for everyone, forever.” But June wasn’t all fluff – a few projects actually launched and, more surprisingly, delivered.

So here’s our list of the ones that stood out. We’re not pushing tokens, and nobody paid to be here – but we also won’t pretend any of this guaranteed to moon. Think of this more like a field report – critical hat on, and let’s get into it.

GPUNet – The GPU Side Hustle Might Finally Be Real

This one’s been circling the ecosystem for months, but it officially went live mid-June – and yeah, there’s actually something here.

On the surface, it’s another modular, subnet-friendly Layer-1. But it’s not trying to be just another L1. GPUNet is GPU-native – as in, the whole thing is built around turning spare GPU power into something useful (and ideally profitable) through a decentralized marketplace. You plug into the network, offer up your GPU cycles, and get paid in $GPU, their freshly minted token.

That basic idea isn’t new. Plenty of teams have tried to tokenize compute before. What’s different here is that GPUNet didn’t just launch a whitepaper and a Discord – they launched a functioning network. They’re claiming 1,500+ subnets, 6,000 GPU nodes, and about 250,000 daily users. The user number feels high – maybe even sus – but the node count checks out, and the infra is real.

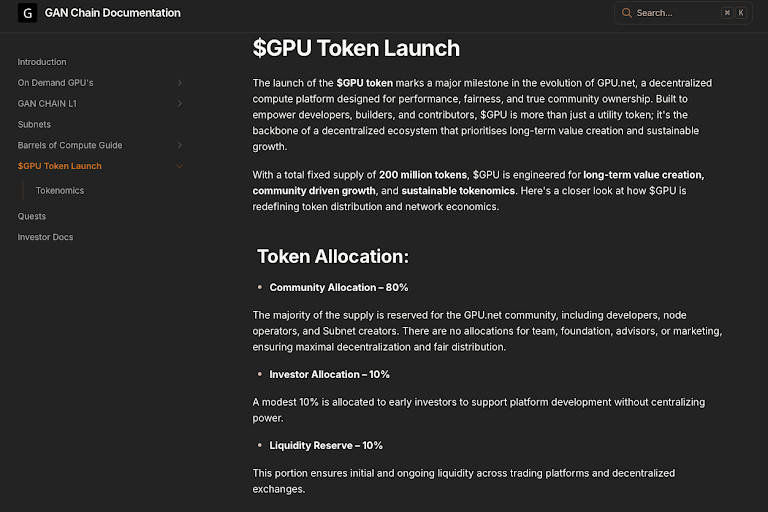

The token setup is also worth noting. $GPU launched with zero insider allocation. No team stash, no advisor cut, nothing carved out for early VCs. Every token went to node runners, subnet devs, and contributors. They even used $4M in platform revenue to buy tokens back from early supporters – not hype revenue, actual revenue. Word is they pulled in $10M last year and are aiming for $40M this year. Seems aggressive, but not impossible if demand keeps pace.

Now, there’s definitely a version of this that turns into “Filecoin but for shaders” – where subnets are spun up just to chase rewards, and the whole thing becomes a gamified emissions farm. But at least for now, GPUNet seems to be working backward from a real business model, not just making numbers go up on a dashboard.

Final verdict: GPUNet doesn’t feel like a grift. Feels like they’re actually trying to build a network that does something useful – and maybe even makes money doing it. If you care about blockchain infra or GPU marketplaces, it’s probably worth keeping on your radar.

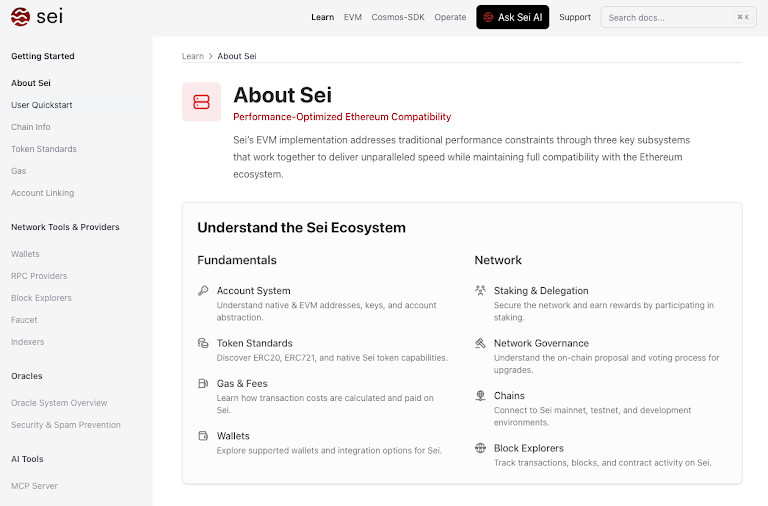

Sei Giga – The Chain That Might Actually Be Built for a State Stablecoin

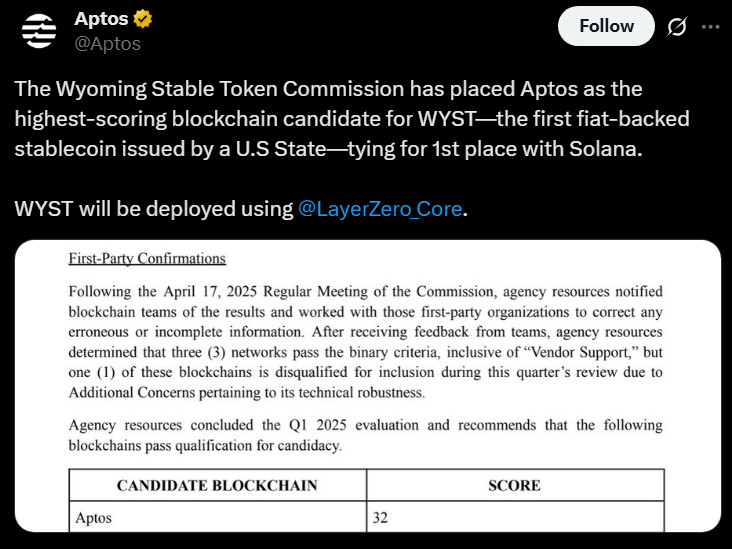

You know a chain’s having a moment when it goes from “another high-speed L1” to being shortlisted for a U.S. state’s stablecoin pilot. That’s what happened in late June, when the Wyoming Stable Token Commission picked Sei and Aptos as the final contenders to run the upcoming WYST stablecoin – the first government-backed coin at the state level.

Sei actually scored second in Wyoming’s technical performance tests – right behind Aptos, but ahead of Ethereum, Avalanche, and a dozen others. Not bad for a chain that’s still best known for pitching “Giga” throughput: 5 gigagas/sec, or about 250K TPS. It’s ambitious, maybe a little ridiculous, but here’s the thing – real institutions are paying attention.

On the protocol side, Sei also rolled out a v6.1.0 upgrade mid-month with barely a hiccup. Mostly under-the-hood stuff: improved access controls, optimized gas for historical queries, cleaner state syncs, and a WASM engine refresh. Nothing flashy, but it’s the kind of plumbing you need if you’re serious about scaling. They even killed off an old block size cap, which shows they’re clearing the deck for higher throughput.

And yeah – the “Giga” rebrand isn’t just a name. It came with a whitepaper, a new roadmap, and a push toward Web2-level performance. Sei’s aiming for speeds that could actually support things like real-time games or enterprise finance, not just swapping JPEGs. Whether they’ll get there is an open question, but they’re at least shipping toward it.

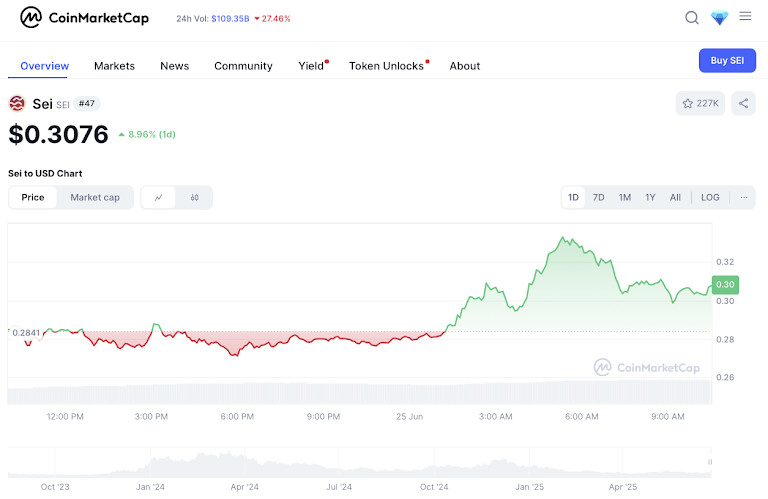

Meanwhile, the broader ecosystem’s been warming up. $SEI jumped ~10% on the Wyoming news, and TVL’s approaching $1B. They’ve got GameFi and AI-native apps popping up, and dev interest is trending in the right direction – especially on the DeFi and gaming side.

So yeah, some of the Giga branding still feels a bit “chain go fast,” but beneath the surface there’s a network quietly making moves – both technical and political. If WYST ends up running on Sei, it could be a breakout moment not just for the chain, but for the idea that L1s can do more than just run casinos. Worth watching.

Tron – Going Public the Backdoor Way (and Dragging SRM Along for the Ride)

In classic Justin Sun fashion, Tron didn’t just announce something – it dropped a full-blown headline grab. On June 16, Tron revealed it’s heading for a public U.S. listing… not through an IPO, but via a reverse merger with SRM Entertainment, a tiny Nasdaq-listed company best known for kids’ toys and collectible deals.

Here’s the deal: a private investor is putting up $100 million (potentially more with warrants) to buy out Tron’s crypto assets. SRM will get rebranded to “Tron Inc.,” and Sun – naturally – will slide in as an advisor. No new token, no Tron equity IPO – just a shell company pivoting into crypto at warp speed.

Why does this matter? Because if the merger goes through, Tron becomes one of the first major blockchain networks to be publicly traded on a U.S. stock exchange. Not a crypto ETF, not a token wrapper – the actual parent company, listed on Nasdaq. That’s a big deal for mainstream optics, even if the mechanics are more financial judo than market innovation.

Tron’s TRX token bumped ~4% on the news. SRM’s stock, meanwhile, went vertical – spiking 250–300% in a single day. And just to make it weirder, the deal was arranged by Dominari Securities, whose parent company has both Trump sons on its board. At one point, rumors flew that Eric Trump was going to be involved with the new Tron Inc., though he denied it quickly (and loudly).

So, what’s the bigger picture? This is Justin Sun doing what he’s always done – chasing legitimacy, headlines, and proximity to power. He’s been supporting pro-crypto political projects, including the Trump-affiliated World Liberty Financial and its USD1 stablecoin, and this move fits right into that playbook. The fact that his old SEC fraud case is currently on pause only clears the runway.

If this reverse merger closes, it puts Tron in a new category – not just another Layer-1, but a publicly listed crypto org with a front-row seat to regulatory scrutiny and retail exposure. What that means for the community is still fuzzy: governance? ownership structure? accountability? Nobody’s saying much yet.

But one thing’s clear: Tron just threw itself back into the spotlight, and this time it’s aiming for Wall Street, not just Binance.

Chainlink – CCIP Is Quietly Becoming the Internet of Blockchains

While most projects were busy hyping new chains or launching tokens, Chainlink spent June doing something less flashy and maybe more important: quietly stitching the entire crypto ecosystem together.

First up, Maple Finance used Chainlink’s Cross-Chain Interoperability Protocol (CCIP) to move its stablecoin, syrupUSD, from Ethereum to Solana. That alone might not sound like a huge deal – stablecoins get bridged all the time – but this was one of the first proper CCIP uses on Solana mainnet. It wasn’t a mere bridge though; it was a live example of CCIP moving data and value between the EVM world and Solana’s SVM. And it launched with $30M in liquidity on Solana DeFi platforms like Kamino and Orca, so this wasn’t a test run.

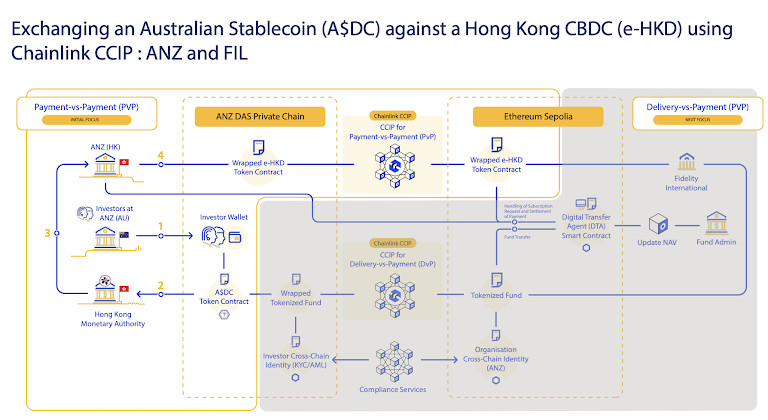

Then, just days later, Hong Kong’s government tapped CCIP for a cross-border CBDC trial – part of its second-phase e-HKD pilot. The setup involved a tokenized asset purchase by an Australian investor, split across both permissioned and public chains, with CCIP handling all the cross-chain logistics. The partners are not small names too: Visa, ANZ, Fidelity – the usual TradFi suspects. If this trial works, it could lay the groundwork for actual CBDC infrastructure down the road, with Chainlink at the center.

And it didn’t stop there. By mid-June, analysts were pointing out that UBS, Swift, and even the Abu Dhabi Global Market had active CCIP pilots running – all part of Chainlink’s push to become the default interoperability layer for the so-called $260 trillion tokenized assets market. That number might be aspirational, but the trajectory’s clear: Chainlink is pivoting from “oracle middleware” to infrastructure glue for global finance.

Our read is this: CCIP’s not getting a ton of retail hype (yet), but it’s starting to look like the TCP/IP of blockchain finance. If that narrative sticks, it could be the most (boringly) bullish development of the year.

Celestia – Modular’s First Mover Starts to Look Like the Real Thing

If 2024 was about explaining what a modular blockchain even is, 2025 might be the year Celestia proves why it matters. By June, the “data availability layer” had gone from infrastructure thought experiment to something developers were actually building on – with more than 60 dapps and rollups either live or in the works.

Over 25 rollups have launched just since Q1, most of them using Celestia’s “blobspace” – a fancy word for cheap, scalable storage of blockchain data. That’s the core promise: you don’t have to bootstrap your own security or spin up a full chain. Just build your rollup, plug into Celestia for data availability, and go. Judging by the 2 billion+ testnet transactions and a TVL nearing $200M, the pitch is landing.

But so far, it seems like it’s not just a dev playground – institutions are nibbling, too. Back in early June, 21Shares launched a Celestia Staking ETP (ticker: ATIA) on Euronext, giving mainstream investors exposure to $TIA and its staking yields through a fully regulated product. Not bad for a project that still feels like it’s in early innings.

Meanwhile, $TIA listings on major exchanges (including Upbit in Korea) gave the token a liquidity bump, and analysts started pointing out the obvious: a $1.1B market cap feels light if Celestia really becomes the go-to base layer for the next wave of app chains.

Technically, the project’s not standing still either. The Mammoth testnet phase kicked off in June, along with a new community roadmap laying out upgrades coming in Q3 – lower validator unbonding times, better data compression, more throughput. The devs claim running rollups on Celestia could soon be 100× cheaper than on Ethereum. That’s bold, but if they land even half of that, it’s still a game-changer.

Our take: Celestia’s not just pushing a new architecture – it’s watching that architecture get adopted. And with the modular trend heating up, Celestia’s role as the neutral, chain-agnostic data layer might age very well indeed.

Wrap-up

That’s it for June. Five projects that made noise, but also made moves. None of this is financial advice, obviously. We’re just here to make sure you’re not mistaking motion for momentum. Or worse – roadmap FOMO for product.

Let’s see who’s still building in July.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Alisa, a dedicated journalist at the MPost, specializes in cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a keen eye for emerging trends and technologies, she delivers comprehensive coverage to inform and engage readers in the ever-evolving landscape of digital finance.

More articles

Alisa, a dedicated journalist at the MPost, specializes in cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a keen eye for emerging trends and technologies, she delivers comprehensive coverage to inform and engage readers in the ever-evolving landscape of digital finance.