End-of-January Crypto Sum-up: Bitcoin Loses $100K as Market Recalibrates, Ethereum Faces Selloff, TON Expands Amid Price Drop

In Brief

In February, Bitcoin lost a significant milestone, triggering a market reaction. Ethereum also suffered while institutional players made moves. TON’s rapid ecosystem expansion led to a sharp price correction.

As January wrapped up, the first week of February wasted no time setting the tone for what’s ahead. Bitcoin lost its grip on a major milestone, triggering a chain reaction across the market. Ethereum took a hit alongside it, while institutional players are quietly making moves beneath the surface – all as per usual. Meanwhile, TON’s rapid ecosystem expansion didn’t stop it from facing one of its sharpest price corrections in months. As you would expect, macroeconomic forces keep fuelling the volatility. It’s clear that the past week laid the groundwork for what could be a pivotal stretch ahead. Here’s how it all played out.

Bitcoin (BTC)

Bitcoin slipped below $100K this week, hitting $96.8K at the low, and keeps sliding.

BTC/USD 4H Chart, Coinbase. Source: TradingView

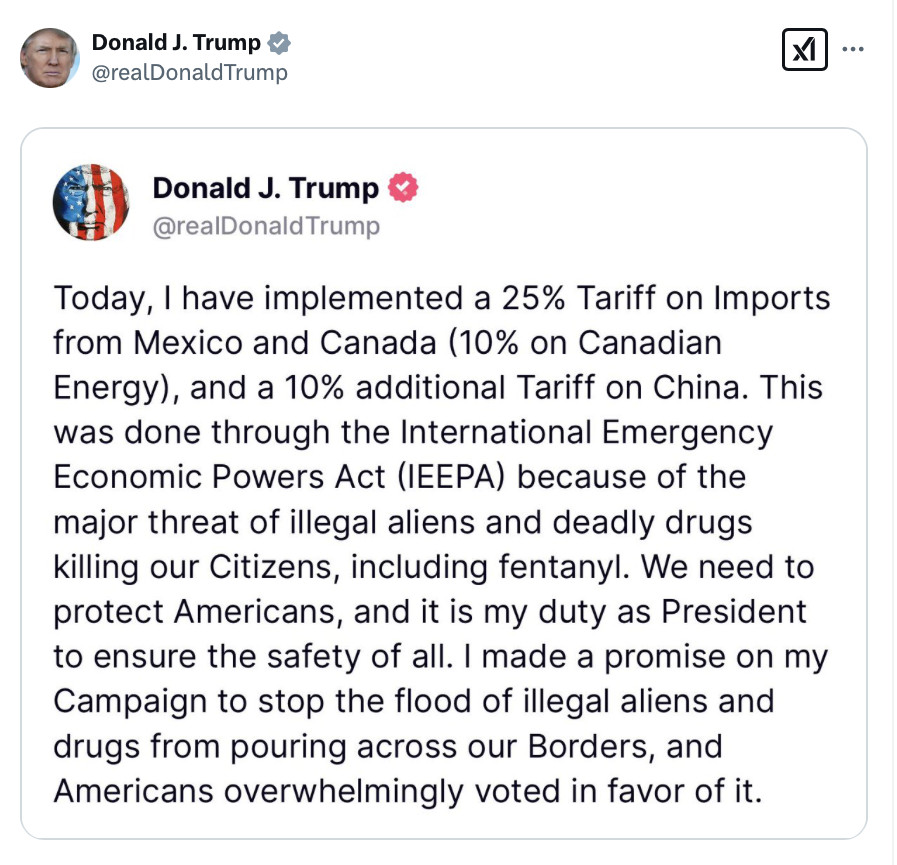

The drop wasn’t a slow fade – it was a hard reaction to Trump’s latest tariff move, a return to trade war policies that markets hadn’t fully priced in. As you may know, the U.S. slapped fresh import taxes on China, Canada, and Mexico, triggering immediate retaliation threats from all three. Investors braced for economic fallout, with stocks dipping and the dollar gaining strength as money fled to safer assets.

Source: Donald J. Trump

Bitcoin, despite its long-term hedge narrative, wasn’t immune to the knee-jerk reaction. Selling pressure built up fast, pushing BTC down 7.3% over the week. But while short-term traders dumped their bags, the big players didn’t blink.

Source: Michael Saylor

MicroStrategy added another $1.1 billion to its Bitcoin stash, doubling down on its strategy of treating BTC as a long-term reserve asset. Meanwhile, Bitcoin ETFs kept attracting fresh capital, as total assets pushed past $125 billion.

Bitcoin ETF dashboard. Source: Dune

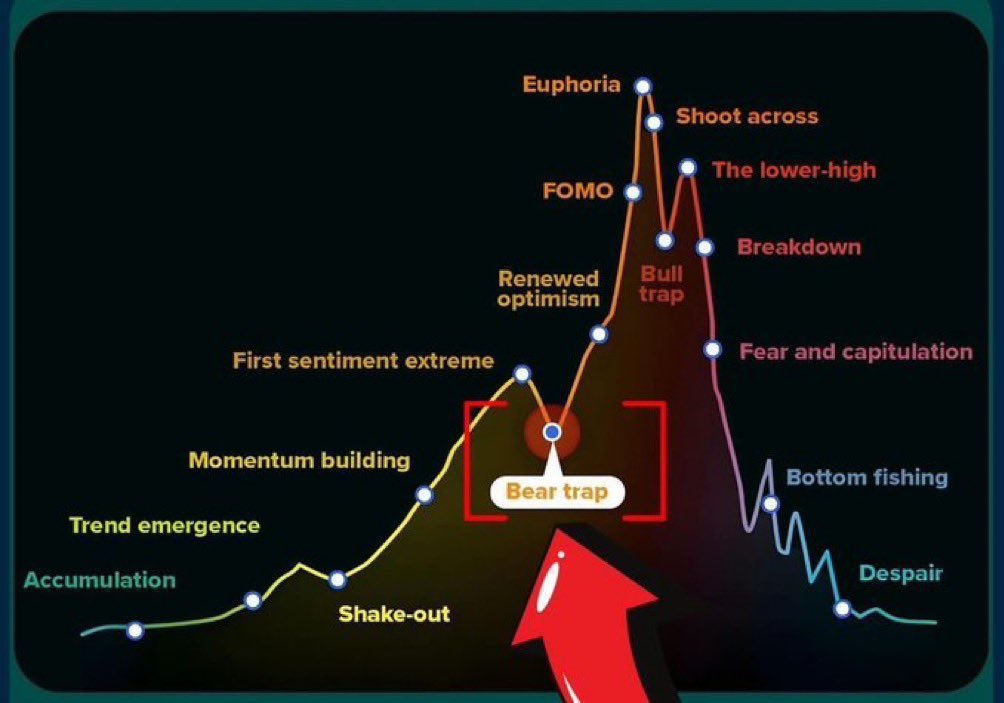

That kind of institutional flow doesn’t suggest a dying market – on the contrary, it suggests a market biding its time. Some analysts call the drop a bear trap, the main argument being that economic shake-ups and inflation risks would only strengthen Bitcoin’s appeal.

Bitcoin bear trap, market psychology. Source: Sensei

Either way, next week’s U.S. labor data will be crucial. A weak jobs report could fuel recession fears, and Bitcoin could reinforce its position as an alternative store of value. This, in turn, could set the stage for a rebound. However, if the numbers come in strong, though, risk appetite might stay low, keeping BTC stuck in this range a little longer.

Ethereum (ETH)

As Bitcoin crashed, Ethereum had no choice but to follow. Bitcoin’s dominance shot past 60.59%, draining liquidity from altcoins, and ETH took a hard dive.

Current Bitcoin dominance at 60.59%. Source: TradingView

The drop came as a steep selloff from $3,546 to $2,802, wiping out nearly 21% in a matter of days. The breakdown gained momentum after ETH lost support near $3,100, accelerating the decline as traders pulled back from risk.

The 50-period SMA at $3,194 had already been acting as resistance, reinforcing the bearish trend. Now, the RSI sits at 23.63, deep in oversold territory, signaling that selling pressure may be nearing exhaustion.

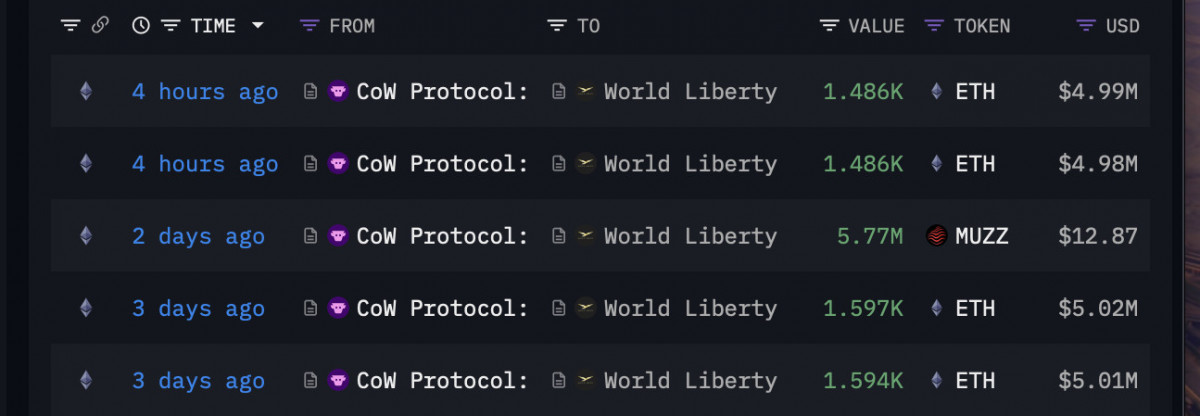

World Liberty Financial’s latest $10M ETH purchase. Source: Arkham

With that said, some big players seem to have spotted a big opportunity here. Trump-linked World Liberty Financial quietly bought another $10 million worth of ETH, increasing its crypto holdings while retail traders sat out. Meanwhile, Bitwise’s Bitcoin-Ethereum ETF cleared an early SEC hurdle, signaling that ETH is carving out a stronger place in institutional portfolios.

Screenshot from SEC approval of 19b-4. Source: SEC

Normally, these moves would be bullish, but with risk appetite low, they weren’t enough to shift market sentiment. Ethereum now needs a catalyst to regain momentum, and that could come either as a resurgence in network activity or a broader market recovery. A clean break back above $3.5K could flip the trend, but until then, ETH is just following Bitcoin’s lead.

TON (TON)

TON once again had been quietly expanding its ecosystem, even though the price action past weeks told a less-than-stellar story. Over the past few days, TON tumbled more than 20%, dropping from around $5.40 to $3.98 in a steep selloff.

TON/USD 4H Chart, Coinbase. Source: TradingView

The 50-period SMA is trending downward, reinforcing the bearish momentum, while the RSI has plunged to 20.99, deep in oversold territory. That usually signals selling exhaustion, but with Bitcoin under pressure and altcoins struggling, buyers aren’t rushing in just yet.

Source: Zodia Custody

Despite the drop, institutional interest in TON has taken a step forward. For one, Standard Chartered’s Zodia Custody added support for TON’s Jetton token standard, so that large financial players can manage TON-based assets. At the same time, Crypto Bot integrated Gram DNS, allowing users to send transactions using human-readable domain names instead of complex addresses – an upgrade that makes TON’s ecosystem more user-friendly.

Source: Gram DNS

On the wallet side, MyTonWallet rolled out a major update, adding support for Telegram Gifts in HD and enabling payments via MyTonWallet Pay, which is poised to strengthen TON’s integration with Telegram’s growing financial tools.

And perhaps the most significant shift was in network security: the minimum stake required to launch a TON validator jumped from 360,000 to 500,000 TON, likely due to a surge of new validators joining in January. That signals growing confidence in TON’s long-term prospects, albeit at the cost of a higher entry threshold. All in all, if Telegram continues integrating blockchain features, TON could quickly go from a quiet builder to a major player when the market turns risk-on again.

For now, Bitcoin is still in control, and everything else is reacting to its moves. Perhaps the drop wasn’t a full-on collapse – just a recalibration. Who knows? What’s clear is that smart money isn’t leaving, ETF inflows are holding strong, and institutional accumulation hasn’t stopped. Next week’s labor data could be the spark that gets Bitcoin back above $100K and pulls the rest of the market with it. If not, we could see more sideways action as traders wait for the next big catalyst.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.