Discover Crypto Whales: Who’s Who in the Market

In Brief

Influential figures in sectors like real estate, stocks, and tech, known as “whales” in the crypto sphere, hold massive amounts of cryptocurrencies, significantly impacting the market with a single asset movement.

Mogul, magnate, tycoon, etc. These are terms to describe the most influential figures in different sectors like real estate, stocks, and tech. In the crypto sphere, they’re called “whales” and hold massive amounts of cryptocurrencies, enough to dramatically impact the market with a single asset movement.

So, it’s important to know who these figures are and track their steps to get a better insight into the future. Here are the ten major crypto whales listed in no particular order.

Satoshi Nakamoto

Starting the list is almost impossible without this name. Born apparently on April 5, 1975, Satoshi Nakamoto is the legendary figure who created Bitcoin in 2009.

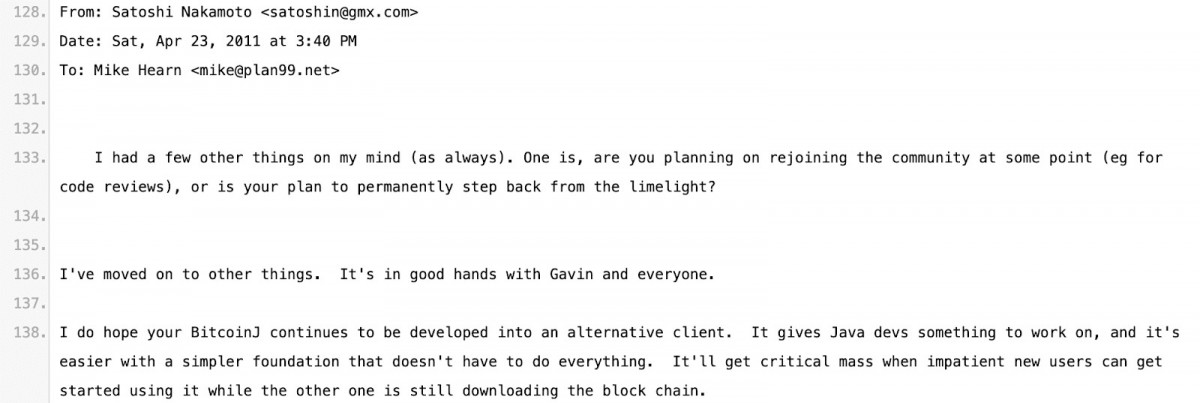

A 2011 email exchange between Satoshi and Mike Hearn, Bitcoin’s core developer, recently took the headlines. In one line, Satoshi says, “I’ve moved on to other things,” suggesting that the mysterious figure is no longer associated with Bitcoin.

Source: Mike Hearn

He is also said to have been the first person to mine crypto in human history. The data also shows that he mined an enormous quantity of blockchain blocks for the whole cryptocurrency existence, earning him over a million BTCs.

Some people think that Satoshi is still holding onto these coins and not using them, which is fascinating. Perhaps it’s for the best because if he/she decides to release his entire holding back to circulation, it’s hard to fathom the impact on market prices.

Winklevoss Twins

The coin market called “Gemini” has a purpose behind its name. It was started by twin brothers Cameron and Tyler Winklevoss. In 2014, they established the company using a portion of a $65 million settlement with Facebook.

The brothers claimed that they had purchased 1% of the Bitcoin supply while they were about to launch Gemini.

According to reports, they lost more than 50% of their BTC holdings during the 2022 crypto winter, which caused many major players to exit and prices to drop sharply. At this point, rumors say that the brothers have more than 70,000 BTCs.

Changpeng Zhao

Many people in the crypto community consider Changpeng Zhao, AKA “CZ,” as one of the biggest crypto whales in the business. Binance founder and former CEO, born in China, allegedly sold his flat for $1 million in 2014, which led him to invest in Bitcoin. With that million dollars, CZ may have acquired up to 3,000 BTC, depending on the time of selling the house.

But, after pleading guilty to money laundering violations, CZ has received a 4-month prison sentence from the U.S. District Judge Richard Jones. It’s a relatively lenient sentence because the judge said, “There’s no evidence that the defendant was ever informed” of the illegal activities.

Despite the sentence, CZ announced that he will remain a “passive holder” of crypto as the market has entered a new era.

There is no way to know how many bitcoins CZ currently has, but his net worth is currently reported to be around 33 billion dollars. Also, the crypto whale has said in the past that he doesn’t own much fiat, so it’s likely that a substantial portion of that may be in crypto, mostly BTC.

Michael Saylor

Even though Saylor isn’t the creator or engineer of a crypto project, his impact comes from the fact that MicroStrategy holds a lot of Bitcoin, leading it to be one of the biggest business Bitcoin users. After deciding to use Bitcoin as the principal reserve asset, MicroStrategy has acquired over 214,000 BTC as of April 29.

The crypto community respects and admires Saylor for always speaking out for Bitcoin and believing in its long-term promise. During the late 1990s, he rode the dot-com boom to multimillionaire status. Just a few years ago, he claimed to hold around 17,700 BTC.

Knowing how much Saylor believes in Bitcoin, it’s not impossible that he has expanded his BTC portfolio since then.

Tim Draper

At the auction for the now-defunct Silk Road assets, the wealthy American VC reportedly purchased 29,600 BTC from the United States Marshals. He is a well-known opponent of excessive state interventions and a supporter of decentralization.

No one knows exactly how much Bitcoin he has now, but he is still a strong advocate whose BTC holdings may be worth over one billion dollars.

In a recent interview during Paris Blockchain Week, he stated that everyone must possess BTC because “when the dollars become worthless, there will be a hole in your life.”

He was instrumental in launching and supporting a wide range of blockchain-related initiatives and businesses as the brains behind Draper Associates and Draper University. Investors like Draper have made a lot of money by being smart and investing in projects like Ripple and Tezos.

Chris Larsen

Chris Larsen, who co-founded Eloan and Prosper, two platforms for online personal loans, is the founding member of Ripple’s 2012 debut. The number of crypto whales using the Ripple system has increased throughout the years.

Over time, the entrepreneur became a Bitcoin whale thanks to this blockchain platform, which has greatly simplified international financial transactions. There is no publicly available data on Larsen’s total cryptocurrency holdings, but he does own 5.20 billion XRP, which brings his net worth to around $3.2 billion.

Back in December, the SEC filed a lawsuit against Ripple and Larsen for selling over $1 billion XRP without seeking an exemption or classifying it as a security.

Larsen’s legal team strongly challenged the claims, suggesting that the SEC “still cannot” show that Larsen was aware XRP units were securities.

Jed McCaleb

Laren’s former partner at XRP is also on the list. Having helped create Ripple, McCaleb has become one of the top XRP holders on the market. McCaleb left the business because he didn’t agree with the other owners, and despite selling a major share of his holdings, he is still said to own about 3 billion XRP.

Based on today’s values, McCaleb has a net worth of about $2.9 billion, which is a big chunk of his total wealth. It looks like Jed is also interested in other cryptocurrencies, but he hasn’t talked about his full holdings.

Barry Silbert

As the CEO of Digital Currency Group (DCG), Silbert contributes to many crypto projects and companies as a VC but is not personally engaged in development.

Coinbase, Grayscale, and several other major crypto players are among the well-known companies that DCG has invested in. Silbert has been a key figure in shaping the crypto industry by offering financial support and guidance to innovative projects.

Through his key role in these organizations, Barry Silbert oversees a range of digital assets, including BTC and ETH, with a combined value of over $28 billion.

Brian Armstrong

Coinbase CEO is one of the top names on the list. Nobody knows for sure how many BTC Armstrong has, although he does control at least 19% of the company’s total holdings. That is, Armstrong can take out Bitcoin whenever he wants.

At the end of 2018, he was worth a million dollars after starting Coinbase in 2012. After a few years, his share of the business had grown many times over. His net worth reached $15 billion in the first three months of 2021 when the exchange made more than $1 billion, but now he stands at $11.2 billion.

Matthew Roszak

Matt Roszak rounds out the list of the top crypto whales. An experienced entrepreneur and VC, Roszak began amassing a cryptocurrency portfolio in 2012. Bloq, a Chicago-based blockchain tech startup, is his current project, and he also serves as the company’s chairman.

Also, he is an influential advisor on major banking projects that aim to establish safety measures for crypto assets. At the moment, he is valued somewhere about $3.1 billion.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.