Crypto Weekly Recap: Bitcoin Stuck In Range, Ethereum Quietly Gains, TON Keeps Building

In Brief

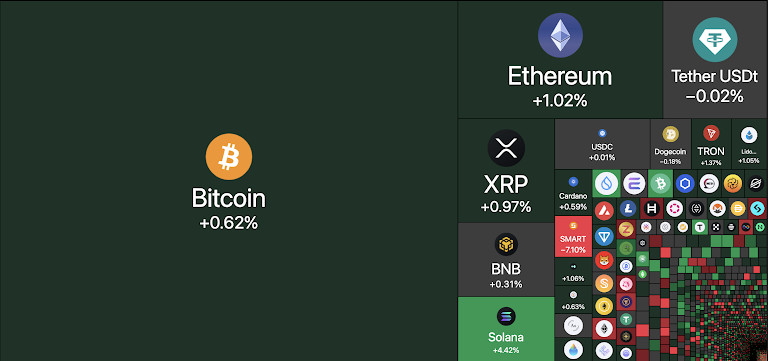

The crypto market remained range-bound this week, with Bitcoin holding steady despite geopolitical tensions, Ethereum seeing quiet accumulation by whales, and TON advancing technically while awaiting broader momentum.

Alright, let’s not pretend anything too wild happened this week. It’s been one of those “choppy but not disastrous” stretches, where the market isn’t exactly dead, but it’s definitely not sprinting either. Prices are mostly stuck in their ranges, people are nervously watching headlines, and everyone’s trying to figure out who blinks first: the bulls or the bears. Let’s break it down.

Bitcoin: same range, different week

Bitcoin’s been basically trapped in this box between $103K and $110K. Every time it dips toward $103K, buyers show up; every time it gets near $110K, it’s the sellers. Right now we’re hovering around $106.6K, which at this point feels like no man’s land.

It’s flirting with the 50-period SMA on the 4H chart (sitting right around $106.8K now), but not convincingly breaking above it yet. This moving average keeps acting like a sort of mid-range pivot point – it’s neither proper support nor resistance, but everyone’s watching it.

The funny part is that, despite all the Middle East drama (Israel-Iran heating up again), Bitcoin (and the rest of the market) actually held up pretty well. The whole “digital gold” angle seems to kick in when things get tense globally – at least for now.

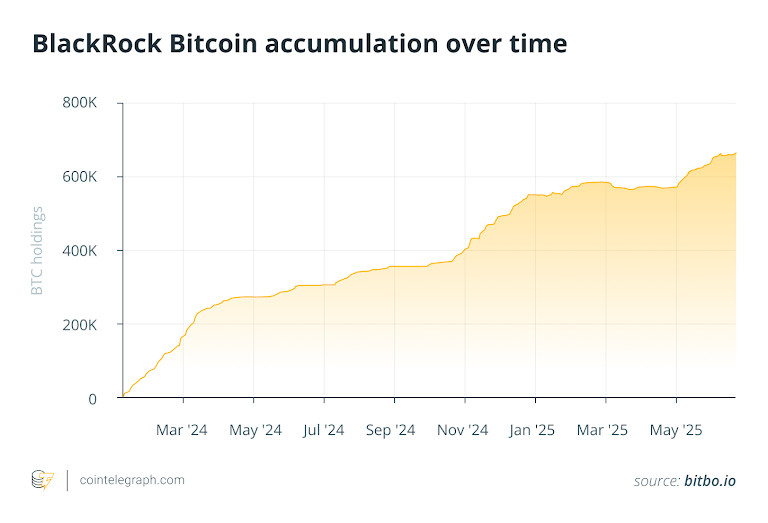

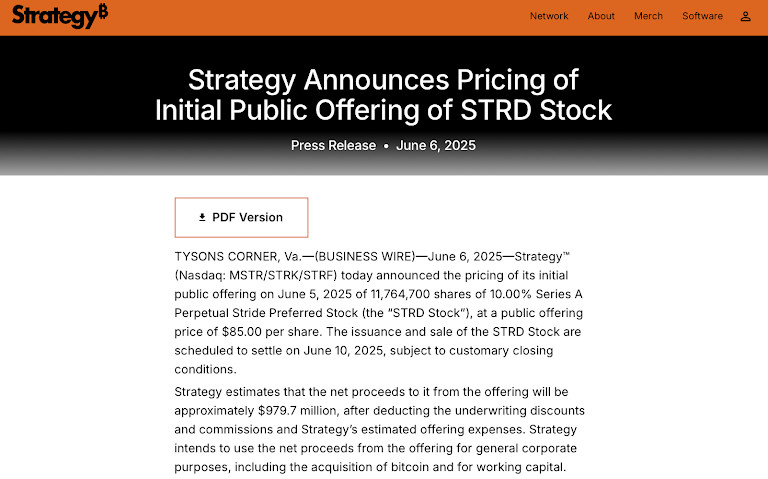

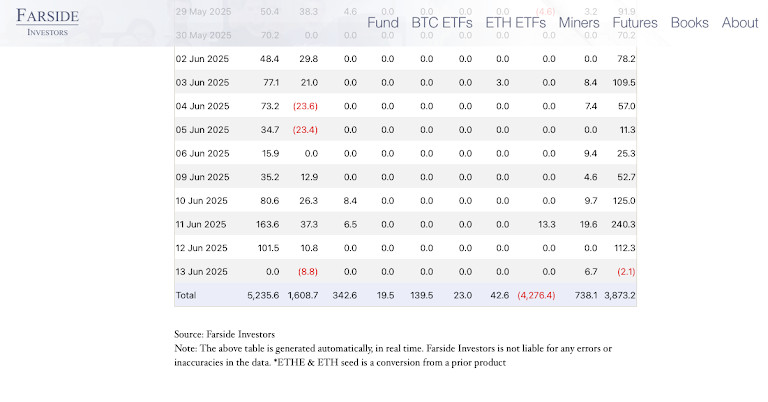

Institutional money hasn’t gone anywhere either. Bitcoin ETFs quietly kept pulling in cash – five days of inflows in a row last week. BlackRock’s still stuffing its bags (sitting on ~3% of total supply by some estimates), and of course Michael Saylor made some more noises about buying – Saylor’s gonna Saylor.

There’s also been some chatter floating around about oil price correlations (the old “if oil pumps, Bitcoin follows” argument). Some folks throwing around $119K targets if that plays out – which honestly feels a bit premature – but you can see why people are itching for a new narrative.

Ethereum: whales load up while retail gets bored

Ethereum’s handled the pullback better than Bitcoin, hovering around $2,605 after failing to hold $2,880 earlier in the week. It’s currently wrestling with the 50 SMA on the 4H (roughly $2,616), while RSI sits right around 54 – again, indecisive.

The recent RSI climb out of sub-40 lows shows some quiet dip-buying strength, but ETH probably needs BTC to lead before it can meaningfully reclaim $2,700+.

What’s driving it? Mostly the big wallets. While a lot of retail traders bailed out to book profits, whales and sharks have quietly kept adding ETH. One report said whale wallets added almost 4% more ETH over the past couple weeks. They’re clearly seeing something they like.

Then you’ve got the ETF flows still humming in the background. After that insane 19-day inflow streak, it finally cooled a bit – but overall, ETH ETFs are doing their job, and institutions keep nibbling.

The SharpLink purchase ($463M worth of ETH in one gulp) was kind of a big flex too. Basically: the suits are buying while everyone else keeps second-guessing.

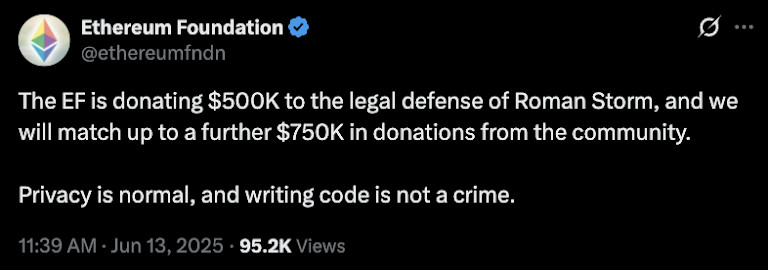

There’s also been some regulatory noise – Tornado Cash, the Ethereum Foundation dropping $500K to support the developer’s legal battle – but the market mostly shrugged that off. The bigger story is still about staking yield, ETFs, and ETH’s slow morph into something TradFi can stomach.

If Bitcoin finally breaks north, ETH’s probably first in line to ride shotgun toward $3K. Right now, though, it’s mostly waiting for its bigger cousin to make the move.

TON: solid tech progress, price still catching its breath

TON’s chart hasn’t been quite as forgiving. After tagging $3.40 not too long ago, it’s mostly been fading lower and now sits around $3 flat. RSI lingers at 46, still below neutral, showing buyers aren’t really stepping in with conviction.

Last week’s RSI bounce from 35 shows some seller exhaustion, but momentum remains weak unless price can reclaim that SMA zone and drag RSI back above 50. But – and this is important – under the hood, TON’s still stacking a ton of legit progress.

The TON Core team pushed out some big updates: faster validator syncs, partial archive nodes, a bunch of backend improvements that make the network smoother for devs and validators.

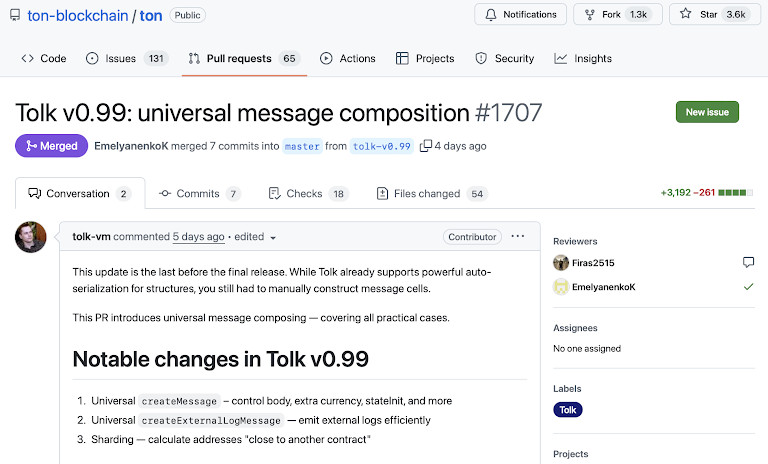

Plus, the TOLK language is basically production-ready now. In simple terms: TON’s quietly becoming a much more developer-friendly chain. That matters long-term, even if price doesn’t care right this second.

Pavel Durov also reminded the world that TON’s doing serious daily NFT volume – depending how you measure, it’s battling Ethereum for top spot there. Again: legit growth, but not exactly price-moving headline stuff – yet.

But the truth is that TON’s still very dependent on overall market risk appetite. If BTC and ETH go into true breakout mode, TON will likely follow. Until then, it’s kind of in limbo: strong fundamentals, weak near-term momentum.

Zooming out: what’s the general vibe?

If you’ve been feeling like you’re watching paint dry – yeah, you’re not alone. The market right now has that frustrating vibe where tons of narratives are lining up (ETF flows, whale accumulation, new regulations, even some big real-world adoption headlines like Vietnam legalizing crypto), but price action isn’t fully following through yet.

For now: Bitcoin’s holding support, Ethereum’s quietly outperforming under the radar, and TON’s building behind the scenes waiting for its moment. Nobody’s in full FOMO mode – but you can sense the coiled spring underneath.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Alisa, a dedicated journalist at the MPost, specializes in cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a keen eye for emerging trends and technologies, she delivers comprehensive coverage to inform and engage readers in the ever-evolving landscape of digital finance.

More articles

Alisa, a dedicated journalist at the MPost, specializes in cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a keen eye for emerging trends and technologies, she delivers comprehensive coverage to inform and engage readers in the ever-evolving landscape of digital finance.