Crypto Weekly Recap: Bitcoin Slips After Fed Cut, Ethereum Flushes To 4.2K, TON Breaks Below $3

In Brief

Bitcoin and Ethereum saw some sideways movement and bounces last week, while Toncoin struggled after breaking key support levels, with the overall market still bearish but poised for potential volatility depending on upcoming ETF news.

Bitcoin (BTC)

The story of last week was pretty simple: down first, then stuck, and finally a little bounce into the weekend. Early on, BTC flushed into the ~$109K area and just sat there, grinding sideways between $109K and $113K for what felt like forever. And only on Sunday did it finally perk up toward $112K.

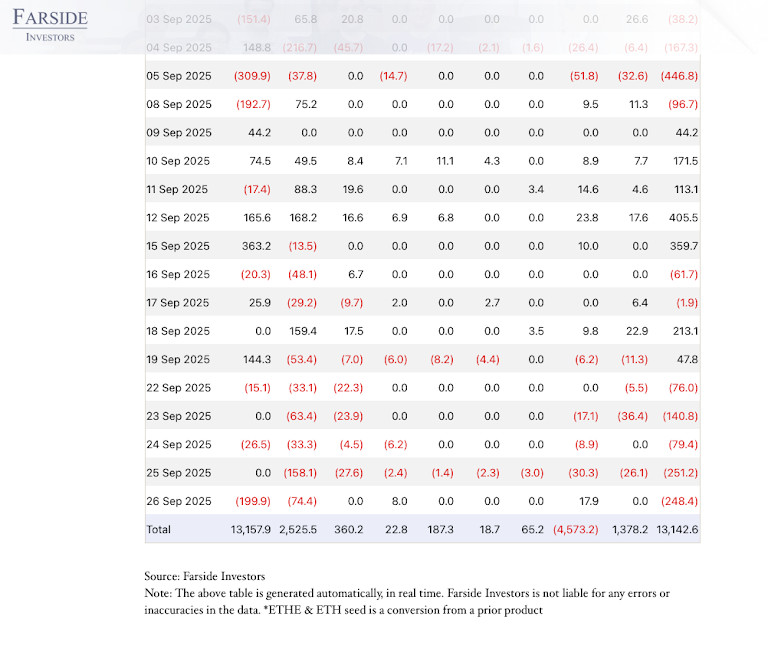

The reasons for this aren’t mysterious. ETF inflows cooled, whales were unloading, and traders were leaning heavy into the big monthly options expiry (mentioned last week). We also had a strong dollar mid-week, so no wonder risk appetite shrivelled across the board.

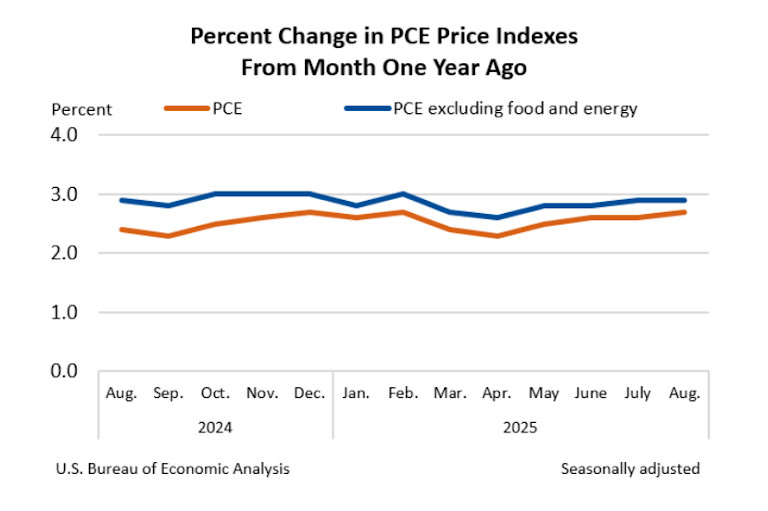

Then the tone flipped late in the week. Inflation numbers (PCE) came in without surprises, stocks and gold pushed higher, and suddenly Bitcoin had room to breathe.

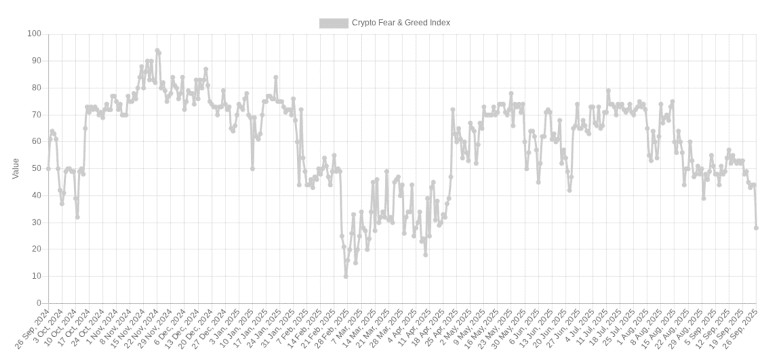

But let’s not get carried away. The weekly candle still closed red, and fear gauges dropped to lows we haven’t seen in months.

Until BTC can climb back above that 18 September high near $118K, this is just a bounce inside a bearish structure. If ETF headlines land right in October, we might see follow-through. If not, the market could easily drag us back to $107K or even $105K.

Ethereum (ETH)

ETH basically followed the same script, just with the volume turned up. It broke clean through the $4,064 support and slipped into the $3.9Ks before bouncing back to around $4.12K on Sunday.

The extra weakness came from five straight days of ETH ETF outflows, plus some big treasury moves that made traders nervous.

On top of that, the whole “supercycle” hype ran into a cold shower from Wall Street. But the backdrop is still there: exchange balances are at a nine-year low, and scaling upgrades like PeerDAS keep moving forward.

We know that the moment Bitcoin stabilizes, ETH usually pops back faster. The key levels now are pretty clear: hold above $4,060 and push through $4,200, and the recovery looks real. But fail there, and we’re probably staring down $3.8K–$3.6K again.

Toncoin (TON)

Meanwhile, Toncoin finally lost its footing. After weeks of clinging to that ~$3 floor, it broke down hard and sank into the $2.65–2.75 range, where it’s now just drifting.

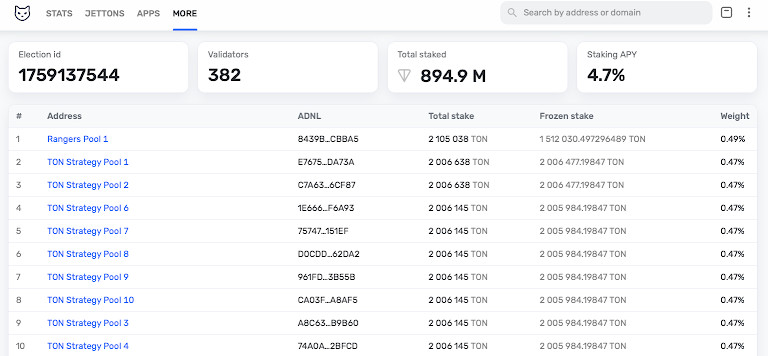

What’s striking is that this happened despite a string of positive headlines. For instance, TON Strategy was added to the S&P Software Index, which is no small feat in terms of visibility. On top of that, the network has been quietly strengthening itself — over 30 million TON moved into staking with 20 new validators spun up in just the past few weeks.

Meanwhile, AlphaTON Capital filed with the SEC, raising $36 million toward a planned $225 million TON treasury, though with a catch: the credit line they opened with BitGo gets liquidated if TON falls another 25%, which would put the pain threshold somewhere near $2.20. So the downside risk is very real. That’s not to mention building advancements on the ecosystem side.

All of that makes TON a weird case right now. Structurally it looks broken — price cracked a key level and hasn’t recovered — but fundamentally, it’s gaining ground in indices, staking security, and DeFi rails. All in all, TON seems caught between good long-term signals and short-term gravity. Until it reclaims and holds above $3, it’s probably going to remain stuck in limbo, shadowing whatever Bitcoin and Ethereum decide to do next.

The big picture

So where are we now? Structurally, markets are still bearish — we’re under the big levels, and the weekly candles are still red. But what’s interesting here is the timing: October is packed with ETF decisions, and that’s the kind of headline risk that can flip flows quickly. If Bitcoin pushes above $118K, the market could rip higher in a hurry. If it slips back under $109K, then the lows from last week might only have been a pit stop. Either way, it feels like the next move is going to be sharp, and we’re all just waiting to see which door opens first.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Alisa, a dedicated journalist at the MPost, specializes in cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a keen eye for emerging trends and technologies, she delivers comprehensive coverage to inform and engage readers in the ever-evolving landscape of digital finance.

More articles

Alisa, a dedicated journalist at the MPost, specializes in cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a keen eye for emerging trends and technologies, she delivers comprehensive coverage to inform and engage readers in the ever-evolving landscape of digital finance.