Crypto Weekly Highlights: Examining the Performance of Bitcoin, Ethereum, Toncoin

In Brief

The article provides an overview of crypto price movements and developments in the last week of July, highlighting bullish trends in Bitcoin and Ethereum driven by ETF launches and institutional interest, while Toncoin gains prominence in DeFi through notable technological advancements.

Bitcoin News & Macro

Let’s break down the key crypto price moves and developments over the last week of July. The week kicked off with bullish momentum, pushing BTC towards $70K as futures premiums soared. However, mid-week saw a pullback, with BTC consolidating around $68K due to profit-taking and technical resistance.

Source: Laevitas.ch

Institutional interest spiked with Hong Kong’s launch of its first inverse Bitcoin ETF by CSOP and major inflows into BlackRock’s Bitcoin ETF. These moves initially drove prices up but also triggered volatility. Geopolitical news added to the mix, with Trump considering Bitcoin as a strategic reserve and Biden exiting the 2024 race, both events shaking market sentiment and causing price swings.

On the tech front, Bitcoin’s mainnet received its first-ever verified ZK-proof – definitely a long-term positive that could attract more developers.

Looking ahead, all eyes are on the SEC’s upcoming decisions on Bitcoin ETF applications, which could be the next game-changers. Analysts are watching key resistance around $69K, with the potential to retest $72K and beyond.

BTC Price Analysis

Now, let’s dive into Bitcoin’s (BTC) price action over the past week. The daily chart shows a strong rally, breaking past the $66,000 resistance and turning it into support. This bullish momentum is backed by the price crossing above the 20-day and 50-day EMAs, aligning the short-term trend with the long-term. Before the breakout, a bullish flag pattern signaled continuation, driving Bitcoin to nearly $70,000, a critical psychological level. Reduced wicks on the candles indicate strong bullish control.

Source: TradingView

Zooming in on the 4-hour chart, we see the breakout above $66,000, confirmed by multiple candles closing above this level, cementing it as new support.

Source: TradingView

The market consolidated around $66,000 – $67,000, forming a bullish flag and allowing gains to be digested before the next move. The following rally surged towards $70,000, with the 50-EMA providing dynamic support during minor pullbacks. The RSI stayed in bullish territory, showing strong buying momentum but hinting at possible short-term overextension.

Key levels like $66,000 and $70,000 have already served as major support or resistance – breaking them indicates bullish confidence. High volumes of around $66,000 validate its importance. The consolidation before the breakout shows this move was well-anticipated, not just a fluke.

The weekly close above $66,000 last week set the stage for a potential rally (who knows, maybe next week already?). Daily closes above this level bolster the bullish sentiment. Holding above $70,000 is key for continuing the bullish trend, potentially targeting $75,000 or $80,000. However, if $70,000 is rejected, we might see a retest of the $66,000 support.

Ethereum News & Macro

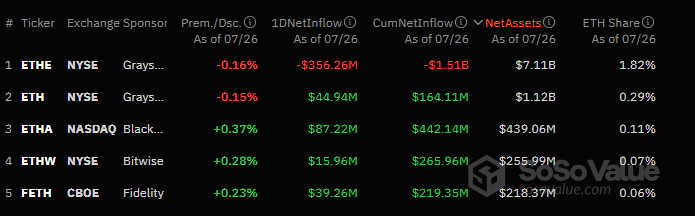

Let’s move over to the Ethereum camp. The launch of spot Ether ETFs by BlackRock, Fidelity, and Grayscale was the week’s highlight, as it’s expected to inject billions into the ecosystem. However, this excitement was tempered by $1.5 billion in outflows from Grayscale’s Ethereum Trust, causing volatility despite initial price boosts.

Source: SoSo Value

Vitalik Buterin introduced Circle STARKs amid a 127% surge in layer-2 addresses. Despite these positives, Ethereum’s price dropped over 8% in 24 hours post-ETF launch in a ‘sell-the-news’ rush.

The regulatory front was active, with the SEC approving VanEck’s Ethereum ETF. Broader market sentiments were influenced by Biden’s 2024 race withdrawal, initially boosting and then correcting the market. Looking ahead, analysts predict potential price recovery driven by expected ETF inflows. As you’d expect, regulatory and geopolitical factors will play a critical role here, and the closer we are to the elections, the higher the stakes.

ETH Price Analysis

With that in mind, let’s break down Ethereum’s (ETH) price action over the previous week. The daily chart shows a drop to around $2,700 – a solid support level that’s been a battleground before. Buyers rushed in, driving ETH back up through $3,300, flipping it into support in a classic role reversal. A climb above the 20-day and 50-day EMAs can signal a momentum shift.

Source: TradingView

Zooming into the 4-hour chart, things get even more interesting. After breaking $3,300, ETH consolidated between $3,300 and $3,500, forming a bullish flag pattern.

Source: TradingView

This pause let the market catch its breath before another push. Breaking out from the flag, ETH aimed for $3,500 but pulled back slightly, finding support at the 50-EMA. The RSI mostly stayed above 50, showing strong buying pressure but hinting at short-term fatigue.

Breaking the $3,300 and $3,500 levels shows buyers are eager, and the trading volume confirms these moves were well-anticipated. Last week’s close above $3,300 set the stage for this week’s rally, mirroring Bitcoin’s momentum. If ETH holds above $3,500, we could target $3,700 or higher. If not, a retest of $3,300 might be in the cards.

Toncoin News & Macro

Not much has happened this past week for Toncoin (TON), but some noteworthy developments did take place. On July 25, TON introduced gasless fees with its new W5 smart wallet, allowing efficient transactions using USDT and Notcoin on the TON blockchain. Though it might not sound groundbreaking, TON also made headlines as the largest gainer in DeFi TVL this year, with a staggering 5087.9% year-to-date growth, highlighting its rising popularity and strong position in the decentralized finance sector.

Further boosting its utility, on July 28, Tether integrated USDT on the TON blockchain within TokenPocket, enabling seamless USDT transactions and broadening its appeal. While these advancements may seem routine, they position TON well in the broader crypto market, which is witnessing significant moves from Bitcoin and Ethereum with their ETF launches. So, TON’s steady growth in DeFi is setting a solid foundation for further adoption and price appreciation.

TON Price Analysis

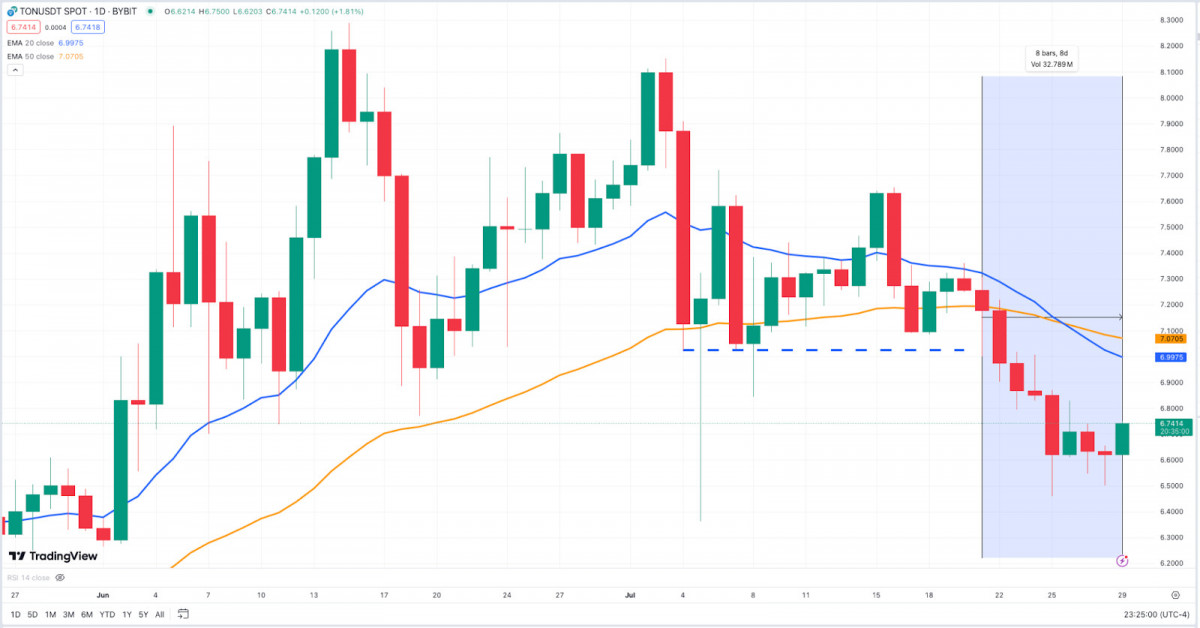

And now let’s break down Toncoin’s (TON) price action over the past week. The blue-highlighted areas and dashed lines mark recent support and resistance levels. The daily chart reveals a sharp drop below the $7.00 support, flipping it into resistance. Strong bearish candles signaled intense selling pressure, and with prices staying below the 20-day and 50-day EMAs, the bearish trend was clear.

Source: TradingView

After crashing through $7.00, TON hit a low around $6.40, says the 4-hourly. The sharp selloff was followed by a modest rebound, but resistance near $6.80 capped the recovery, leading to a short-term consolidation. The price action struggled to gain upward momentum, with the 50-EMA acting as a dynamic resistance barrier.

Source: TradingView

The 4-hour RSI dipped into oversold territory during the sell-off but bounced back to neutral, hinting at indecision.

Watch for $7.00 as a major resistance and $6.50 as critical support. Breaking above $7.00 could ignite a bullish reversal, while slipping below $6.50 might drag prices down to $6.00. If TON can reclaim $7.00, it might signal a reversal, but given the current setup, that looks tough.

Daily closes under this level have reinforced bearish sentiment, making any rebound challenging – at least for the time being.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.