Closing Out June In Crypto: Sideways Charts, Subtle Signals, And A Market Poised To Move

In Brief

Bitcoin is holding steady around $107K–$108K amid mixed institutional optimism but shows uncertainty ahead of a potential July breakout, while Ethereum and Toncoin closely follow Bitcoin’s lead without significant independent moves.

Bitcoin (BTC)

So here we are, at the tail end of June, watching Bitcoin kind of hover with no direction in sight. Just awkwardly camping out around $107K–$108K like it’s waiting for someone else to make the first move. If you’re staring at the 4-hour chart, you’ll notice the price has been stuck in this neat little consolidation zone since that big rebound off the $98K lows. Classic V-bounce recovery, right? But now it’s pacing back and forth at resistance like it forgot why it came here in the first place.

What’s been driving this range-bound limbo? A weird mix, actually. On the one hand, we’ve had a flood of institutional optimism – Metaplanet snapped up $108M in BTC, casually pushing its holdings past Tesla.

Pompliano’s ProCap scooped up nearly $400M.

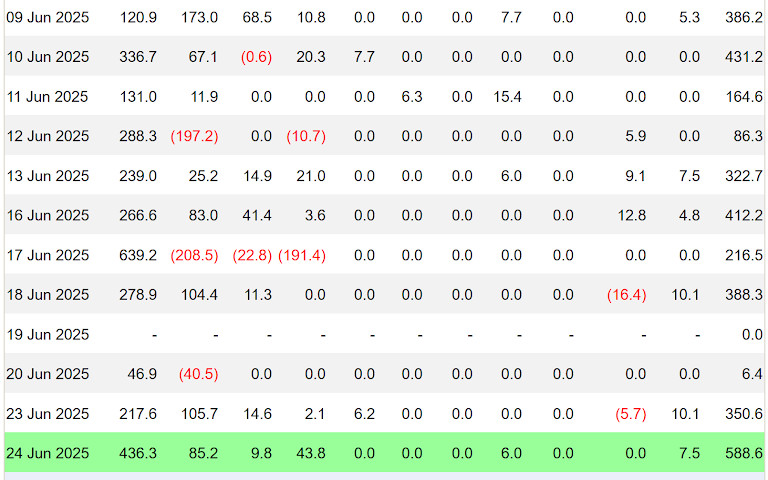

And spot BTC ETFs just posted their biggest one-day inflow of the month ($588M, if you’re counting).

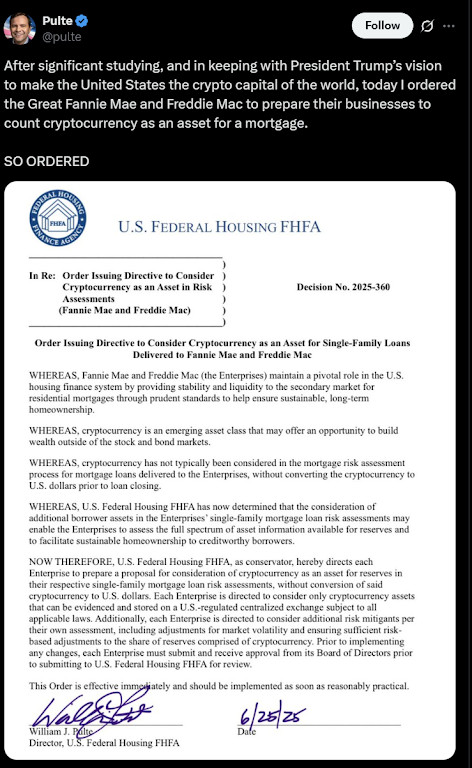

There was even an out-of-left-field moment: Fannie Mae and Freddie Mac, two U.S. mortgage giants, are apparently mulling over Bitcoin as a risk asset. If that doesn’t scream “we’re in the upside-down,” then we don’t know what does.

But here’s the thing: all of this feels bullish, yet price hasn’t broken out. There’s a visible “bull pennant” pattern floating around on CT with targets in the $165K range, but these textbook setups don’t always follow the script – especially when volume’s fading and traders are half-asleep waiting for July to kick in.

We’re also at a weird macro juncture. Rate cut chatter is back on the table for July (again), and the dollar’s been bleeding. It’s the kind of setup that should light a fire under Bitcoin, but so far, we’re just consolidating.

Could it break out from here? Sure. But price discovery up here is unforgiving. If BTC doesn’t pull off a strong Q2 close above $107K, we might just get a fakeout before things truly reset. On the flip side, if bulls can close the month on a high, early July could surprise to the upside.

Either way, we’ve seen enough end-of-month plot twists by now to know that bold predictions without a backup plan usually age poorly.

Ethereum (ETH)

At the end of this June, Ethereum’s doing what it does best – quietly following Bitcoin like a younger sibling. After that quick trip down to $2,200 last week, ETH managed a respectable bounce and is now hanging out just above $2,460.

Technically speaking, it’s back above the 50 SMA on the 4h chart, and the RSI is floating around in that indecisive 50s zone. So yes, it’s trying to stay bullish – but if we’re being honest, it’s more limping than walking. And no, over the week ETH hasn’t broken anything significant yet – either up or down.

You can pretty much blame Bitcoin for that. ETH’s been moving in lockstep with BTC all month – when big bro rallied off the $98K lows, ETH came along for the ride. But it’s definitely not keeping pace when it comes to attention or capital. BTC had ETF flows, headlines, corporate buys. ETH had some early-month inflows and a few whale bets, but the follow-through just fizzled out. Even ETH futures are looking sleepy right now.

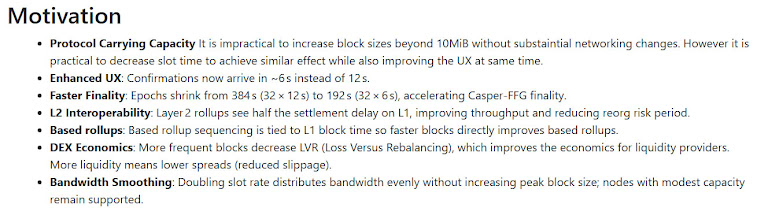

And, if we’re honest, we don’t think altseason is quite here yet. ETH would need to convincingly break above $2.6K and stay there for people to actually believe it. Until then, it’s just hopium. There was a short-lived buzz last week when devs floated the idea of cutting slot times in half – down to 6 seconds. That kind of upgrade could make Ethereum feel faster and more responsive, sure. But let’s be real: price won’t care unless the broader market does.

So what does ETH need? The usual – for BTC to make a move. If Bitcoin punches through that $108K resistance and heads for new highs, ETH could finally get pulled toward $3K with some conviction. But if BTC stalls out or slips back, ETH probably won’t have the strength to do anything meaningful on its own.

Toncoin (TON)

Now here’s an odd one. Toncoin had a deep drawdown into late June, bottoming under $2.70, then started crawling back up at a glacial pace. It’s now reclaimed $2.89 and poked just above its 50 SMA. RSI’s perky, around 59, suggesting mild but building momentum. Also, this past week we’ve actually had little-to-no big news on the TON ecosystem – no big integration, no fresh institutional buy-in, etc. Pretty much tumbleweed vibes rolling into July.

And fair enough – TON doesn’t really thrive on headlines the way Bitcoin or Ethereum do. It doesn’t need ETF hype or multi-billion-dollar whale buys to get going. Instead, it’s been living off the broader market’s good mood. As Bitcoin dragged itself out of the gutter, TON came along for the ride. But there’s a bit more going on under the hood too. Its connection to Telegram keeps getting stronger, and while that might not scream “price action” in the short term, it’s a real use case – and in 2025, that still counts for something.

So is it leading anything? No, not yet. If Bitcoin blasts through resistance in early July, TON could easily ride the tailwind through $3 and start getting noticed again. But it’s clearly a follower, not a leader – at least for now.

So, what’s the mood heading into July?

Wrapping up the June mood, things look suspiciously calm. June was forecast as a danger zone, especially with everything going on globally (Iran, Israel, Trump, rates, dollar moves – you name it). But instead of imploding, crypto kind of exhaled. BTC dropped and then quickly rebounded. ETH didn’t die either. Even the lesser-knowns are floating back up.

Institutions are still buying, retail’s peeking in again, although they’re not back in force. Feels like everyone’s waiting to see if the Q2 close turns into a real breakout – or just another opportunity for whales to dump into low liquidity.

The first few days of July could be decisive. If Bitcoin clears $108K and closes strong into the monthly candle, there’s real potential for a July breakout across the board. ETH could ride it to $2.6K+, TON could finally break $3, and altseason whispers might actually get louder.

And if not? Then hey, welcome back to sideways town, a place we’ve all got used to already.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Alisa, a dedicated journalist at the MPost, specializes in cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a keen eye for emerging trends and technologies, she delivers comprehensive coverage to inform and engage readers in the ever-evolving landscape of digital finance.

More articles

Alisa, a dedicated journalist at the MPost, specializes in cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a keen eye for emerging trends and technologies, she delivers comprehensive coverage to inform and engage readers in the ever-evolving landscape of digital finance.