$CLO TGE Kickstarts the Cross-Chain Liquidity Revolution with Binance Alpha and Binance Futures

In Brief

Clovis, built by Yei Finance, is launching its $CLO token to unify cross-chain DeFi liquidity, offering a hub-and-spoke system for lending, trading, bridging, and yield across multiple ecosystems.

Clovis, the cross-chain settlement layer built on top of Yei Finance’s proven infrastructure, is preparing to launch its native token $CLO through a combined IDO which was sold out in minutes on Salior and TGE announcement with Binance Alpha and Futures happening on October 14. The rollout will mark a major inflection point in its efforts to unify liquidity across chains and eliminate one of DeFi’s longest-running pain points.

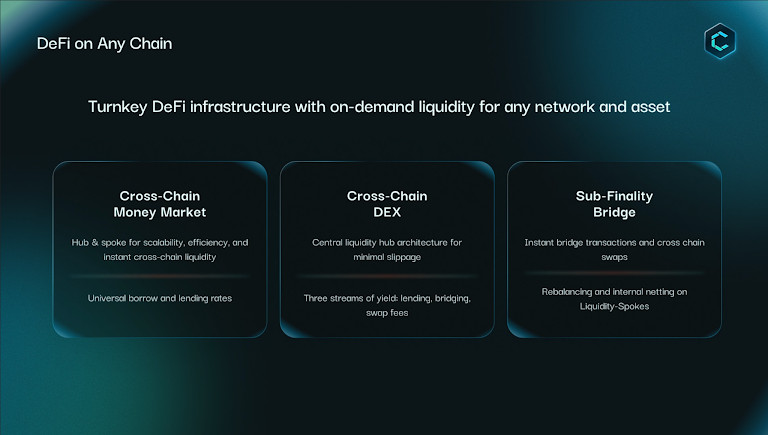

Today, the same primitives – lending markets, DEXs, and bridges – are rebuilt chain by chain, operating in isolation and leaving the majority of liquidity idle. Clovis is re-inventing DeFi with a hub-and-spoke model where settlement takes place in its main application, while execution occurs on connected chains. The result: one liquidity layer powering lending, swaps, bridging, and yield across ecosystems.

Clovis is the flagship product of Yei Labs, the team behind Yei Finance, a protocol born out of the Sei Foundation’s DeFi ecosystem. YeiLend went on to surpass $300M in liquidity, generate $5.5M annualized revenue, and push over $240M in monthly trading volume on YeiSwap and $147M in bridge flow through YeiBridge. Clovis takes Yei’s proven foundation and expands it across chains.

“Liquidity is everywhere and nowhere at the same time, and we’ve all had this problem for years,” said Austin, Co-Founder of Yei Finance. “Clovis routes assets seamlessly across chains and unifies liquidity in one app, delivering a significantly better user experience.”

$CLO Token Launch

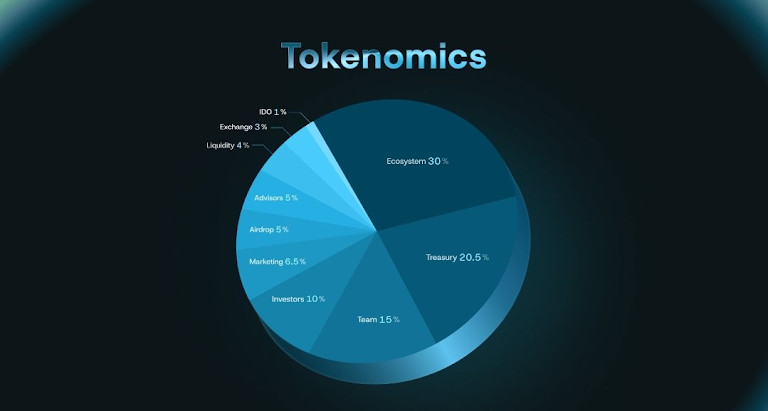

The $CLO token will launch with a total supply of 1,000,000,000, distributed through both IDO and TGE formats.

Airdrop recipients will have a 30-day claim window, with two optional claim modes, users can decide what works best for their strategy:

- Immediate Claim: Receive 1× your allocation upfront, fully unlocked right away.

- Extended Claim: Users can lock for 90 days and unlock 2.5× your allocation.

Example: An airdrop of 1,000 $CLO becomes 2,500 $CLO if claimed via this option.

Both options are available for all eligible users.

Token Allocation

“We designed tokenomics around utility, not hype,” said Sushant, Co-Founder of Yei Finance.

“$CLO is the coordination layer for a cross-chain liquidity network.”

Roadmap Highlights

Clovis is rolling out in two stages. In Q4 2025, the team will launch the $CLO token through its IDO and TGE, alongside the release of cross-chain lending markets, a native decentralized bridge, and mainnet deployments across major EVM chains with LayerZero and Wormhole messaging support. The next phase begins in Q1, 2026 with the launch of the Clovis cross-chain DEX and its own messaging layer, followed by expansion into non-EVM ecosystems like Solana and Sui. That phase also includes the introduction of yield vaults designed to put idle capital to work without fragmenting liquidity.

What Clovis Solves in DeFi

Existing lending markets like Aave, Morpho, Euler, and Fluid still operate in siloed deployments on each network. Borrow rates vary wildly chain to chain, liquidity is fragmented, and the user experience punishes anyone who isn’t chain-native.

DEX liquidity is similarly scattered, with inconsistent pool depth and capital inefficiency across ecosystems.

Clovis consolidates these primitives into one system:

- Clovis Market: Cross-chain lending with global liquidity and unified interest rates.

- Clovis Exchange: A DEX built on top of the lending layer using interest-bearing LP assets.

- Clovis Transport: A fast bridge that settles using local liquidity buffers instead of external relayers.

- Clovis Vaults: Yield strategies that put idle capital to work without fragmenting liquidity.

“Everyone talks about interoperability, but no one has fixed the liquidity layer. We didn’t want another bridge or forked lending market. We built the clearing layer that everything else plugs into” said Howard, Co-Founder of Yei Finance.

Why It Matters

With $CLO going live, Yei Finance moves from infrastructure build-out to expansion into Clovis. The protocol is positioning itself as the backbone for multichain DeFi, a network where liquidity acts as one system, not a patchwork of isolated deployments.

More chains and integrations means deeper markets, better rates, instant settlement, and higher capital efficiency across ecosystems.

Further announcements on the listings, and exchange partners will follow in the coming days.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Gregory, a digital nomad hailing from Poland, is not only a financial analyst but also a valuable contributor to various online magazines. With a wealth of experience in the financial industry, his insights and expertise have earned him recognition in numerous publications. Utilising his spare time effectively, Gregory is currently dedicated to writing a book about cryptocurrency and blockchain.

More articles

Gregory, a digital nomad hailing from Poland, is not only a financial analyst but also a valuable contributor to various online magazines. With a wealth of experience in the financial industry, his insights and expertise have earned him recognition in numerous publications. Utilising his spare time effectively, Gregory is currently dedicated to writing a book about cryptocurrency and blockchain.