BitMEX Investigates Aggressive Bitcoin Sell-Off Following Price Drop to $8,900 on Exchange

In Brief

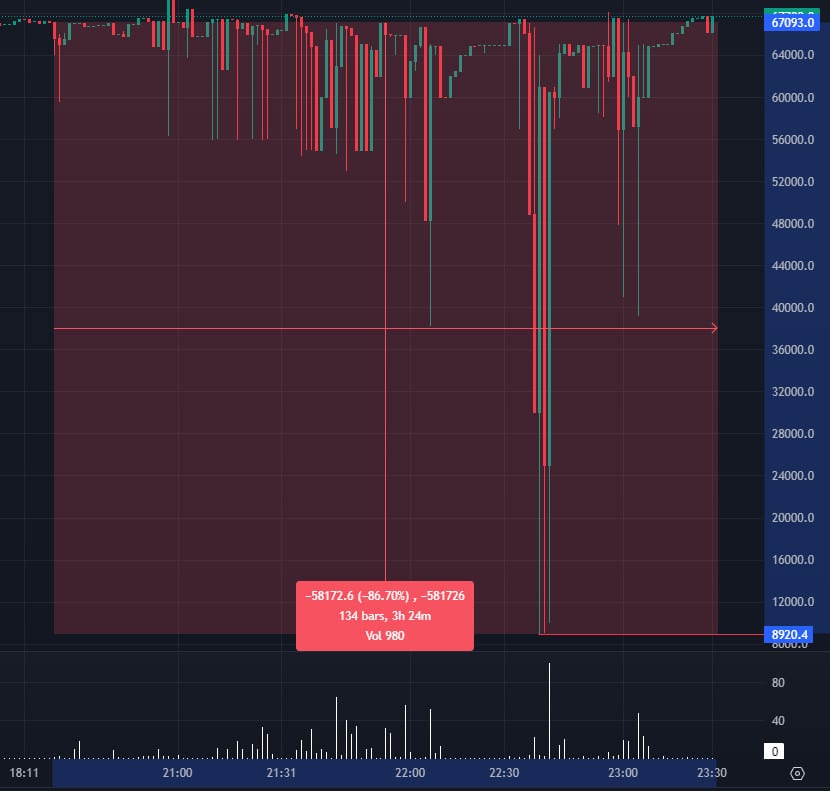

BitMEX experienced a sudden drop in Bitcoin price to $8,900 and is examining “unusual activity” related to sell orders on its BTC-USDT spot market.

Cryptocurrency exchange and derivatives trading platform BitMEX experienced a sudden drop in Bitcoin (BTC) to $8,900 in its USDT spot market. In a post published on the social media platform X, the company disclosed that it is currently examining “unusual activity” related to substantial sell orders on its BTC-USDT spot market.

Cryptocurrency users quickly noted the issue, remarking that someone executed the sale of over 400 BTC within 2 hours, dividing the transactions into 10-50 BTC segments on the XBTUSDT pair on BitMEX, resulting in slippage of over 30%, likely incurring losses of at least $4 million. A pseudonymous community member, “Syq”, further commented, “I’m guessing that they’re done (for now?). Total volume so far is just shy of 1,000 BTC over 3.5 hours with a low of $8,900. Now BitMEX has disabled withdrawals.”

In response, the cryptocurrency exchange clarified that it had not disabled withdrawals for all users but only for a few accounts pertinent to its ongoing investigation.

BitMEX later announced that it was investigating “aggressive selling behavior” and “potential misconduct” by traders in its BTC-USDT spot market, reiterating that the incident had no impact on its derivatives markets despite reports of the sudden price drop. Furthermore, the incident did not affect mark prices, and no liquidations were triggered by it, as BitMEX’s indices are independent and thoroughly tested.

The exchange clarified the cause of the price drop, stating that it maintains fair and impartial markets by abstaining from employing internal market makers. “The large and frequent BTC sell orders today exceeded the capacity for independent market makers and other traders to respond. As per protocol, our compliance team is examining the accounts and transactions behind this price shift.” BitMEX also assured users that deposits and withdrawals are operating normally on the platform.

BitMEX’s Bitcoin Price Drop Coincides with Wider Crypto Market Decline

The unexpected Bitcoin price drop on BitMEX aligned with the broader cryptocurrency market downturn, occurring as Bitcoin saw a notable drop from its recent all-time high of $73,750.07, reached just last week.

The largest cryptocurrency by market capitalization is trading at $63,161 as of writing time, marking a decline of almost 12% in the last seven days, as per CoinMarketCap data. The downward trend in Bitcoin’s price is associated with significant outflows totalling $643 million from the Grayscale Bitcoin Trust (GBTC), with the selling of its shares reaching an all-time high.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Alisa, a dedicated journalist at the MPost, specializes in cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a keen eye for emerging trends and technologies, she delivers comprehensive coverage to inform and engage readers in the ever-evolving landscape of digital finance.

More articles

Alisa, a dedicated journalist at the MPost, specializes in cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a keen eye for emerging trends and technologies, she delivers comprehensive coverage to inform and engage readers in the ever-evolving landscape of digital finance.