Bitcoin Registered $33 Million in Net Outflows Last Week Amid Altcoin Surge, says CoinShares

In Brief

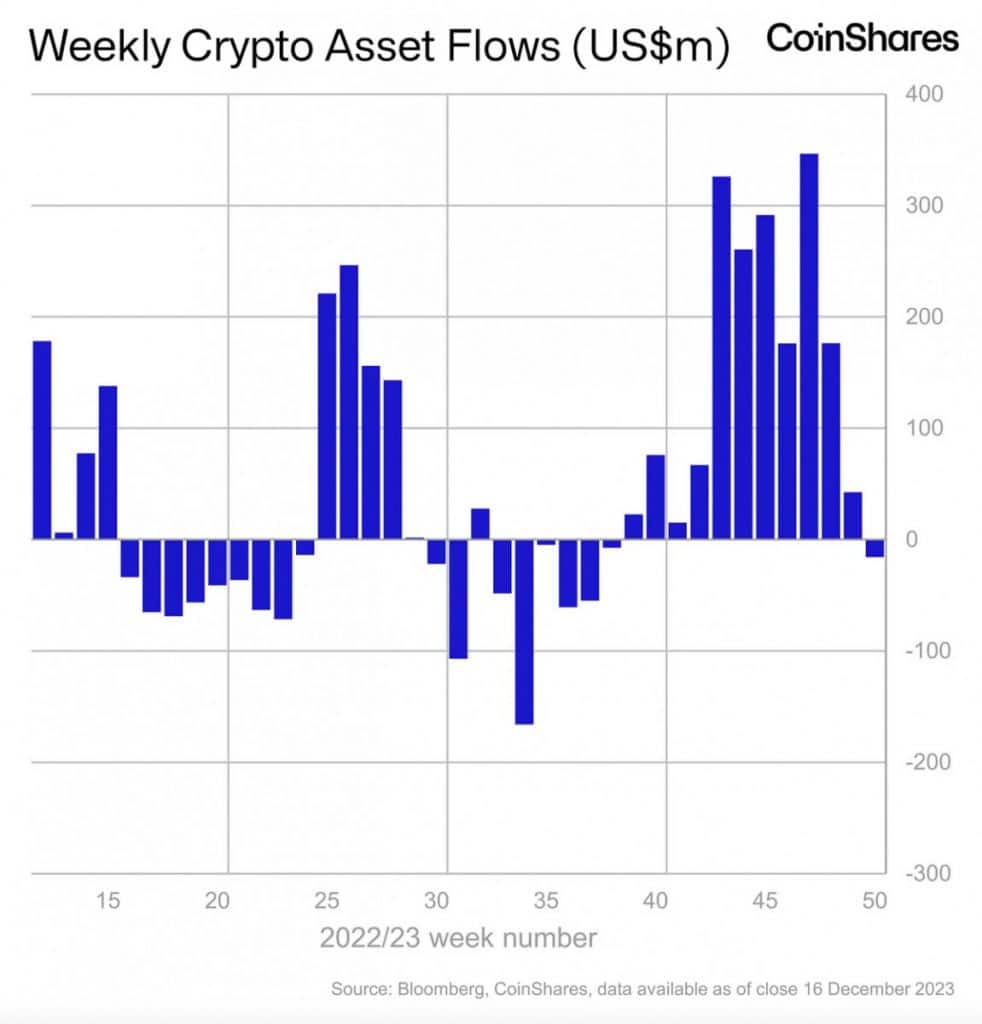

Digital asset investment products witnessed a net outflow of $15.8 million last week, marking the first net outflow in nearly 12 weeks.

Digital asset investment products witnessed a net outflow of $15.8 million last week, marking the first net outflow in nearly 12 weeks, as reported by CoinShares in its weekly report. Despite this, trading activity remained significantly above the yearly average, totaling $3.6 billion for the week compared to the year-to-date average of $1.6 billion.

Bitcoin investment products recorded the most substantial net outflow at $32.8 million, followed by Ethereum investment products with a lesser net outflow of $4.3 million.

Altcoins defied the trend, attracting $21 million in inflows, with the primary beneficiaries being Solana ($10.6 million), Cardano ($3 million), XRP ($2.7 million) and Chainlink ($2 million), respectively.

Blockchain concept stocks saw net inflows of $122 million last week.

US and Germany See Crypto Outflows, While Canada and Switzerland Offset With Inflows

Regionally, the outflows were mainly concentrated in the US, which witnessed $18 million in outflows, while Germany experienced minor outflows totaling $10 million.

However, continued inflows into Canada and Switzerland, amounting to $6.9 million and $9.1 million, respectively, partially offset this. The mixed regional flows suggest that this was more related to profit-taking than a shift in sentiment towards the asset class.

Blockchain equities continued to garner positive sentiment, witnessing substantial inflows totaling $122 million last week. This brings the total for the last nine weeks to $294 million, marking the largest run on record.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Alisa, a dedicated journalist at the MPost, specializes in cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a keen eye for emerging trends and technologies, she delivers comprehensive coverage to inform and engage readers in the ever-evolving landscape of digital finance.

More articles

Alisa, a dedicated journalist at the MPost, specializes in cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a keen eye for emerging trends and technologies, she delivers comprehensive coverage to inform and engage readers in the ever-evolving landscape of digital finance.