Deep Dive into NFT Marketplaces on Ethereum

Explosive market growth created a high demand for marketplaces to buy and sell NFTs. 2021 saw a rapid expansion of the existing marketplaces and appearance of the new ones. NFTs can be minted and traded on different blockchains, like Solana, Tezos, Flow. However, most of the trades still happen on Ethereum, and Ethereum-based marketplaces have been dominating the market since its inception.

What is Ethereum?

After Bitcoin, Ethereum is the biggest and most known blockchain project. It was created in 2013 by Vitalik Buterin with the vision to expand blockchain potential beyond cryptocurrency. Ethereum does have its own currency – ether, but also provides a platform for various decentralized apps (dapps) in DeFi, gaming, metaverse, and other industries. The number of dapps on Ethereum is estimated at 3000.

Ethereum has a market capitalization of $373 billion, which is roughly twice less than Bitcoin. At the same time, Tether, which is third in ranking, has only $83 billion.

What are Ethereum-based marketplaces?

Marketplaces allow creators to sell their NFTs and earn royalties, and all other users – to buy, store and resell NFTs. Marketplaces register all transactions on corresponding blockchains, so Ethereum-based marketplaces empower trading NFTs on Ethereum.

Ethereum has two major token standards for NFTs – ERC-721 and ERC-1155. ERC-721 is most commonly used to date, it sets the minimum data such as ownership details and security required for transactions on the network. ERC-1155 allows less costly creation and storage.

Ethereum is one of the original blockchains for NFTs. First NFTs on Ethereum appeared as early as 2015-2016, and the first Ethereum-based NFT collections that popularized NFTs and boosted the market were CryptoPunks and CryptoKitties, both from 2017.

A number of the Ethereum-based marketplaces are primary marketplaces for specific NFT collections, games, or metaverse projects. Examples are CryptoPunks, Decentraland, Axie Infinity marketplaces. Other marketplaces offer their users NFTs from all segments, including collectibles, art, sports, metaverse, gaming, etc. OpenSea, the biggest NFT marketplace to date, is an example of such a diversified marketplace. Other marketplaces focus on unique art NFTs, catering to collectors and investors in digital art. SuperRare and Foundation are among such projects.

Who are the biggest players?

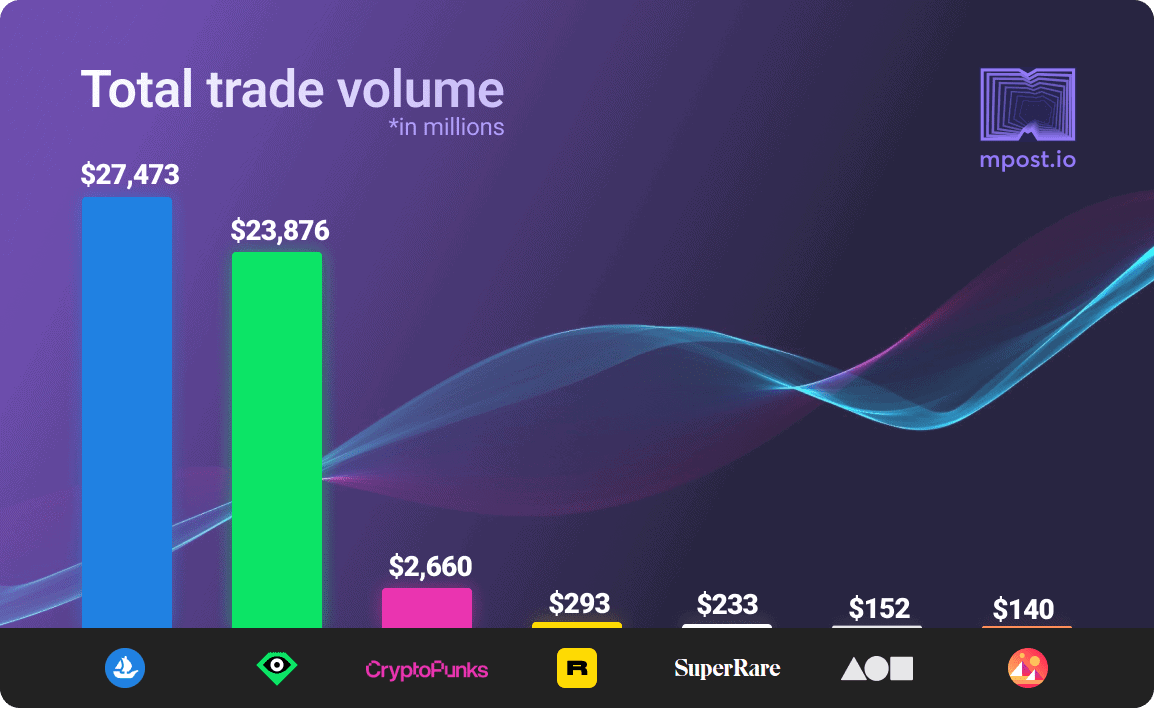

According to Dune Analytics, the total volume of Ethereum-based NFT trades to date has exceeded $50 billion.

Historically, OpenSea has dominated the market not only in Ethereum-based trades, but in NFT trade in general. It still has the highest share in the total trades (estimated at 55% in the last 30 days, according to Dune Analytics), though LooksRare managed to take over a significant share of the trade volume since its launch in January 2022.

Data sources: DappRadar.com, Dune Analytics

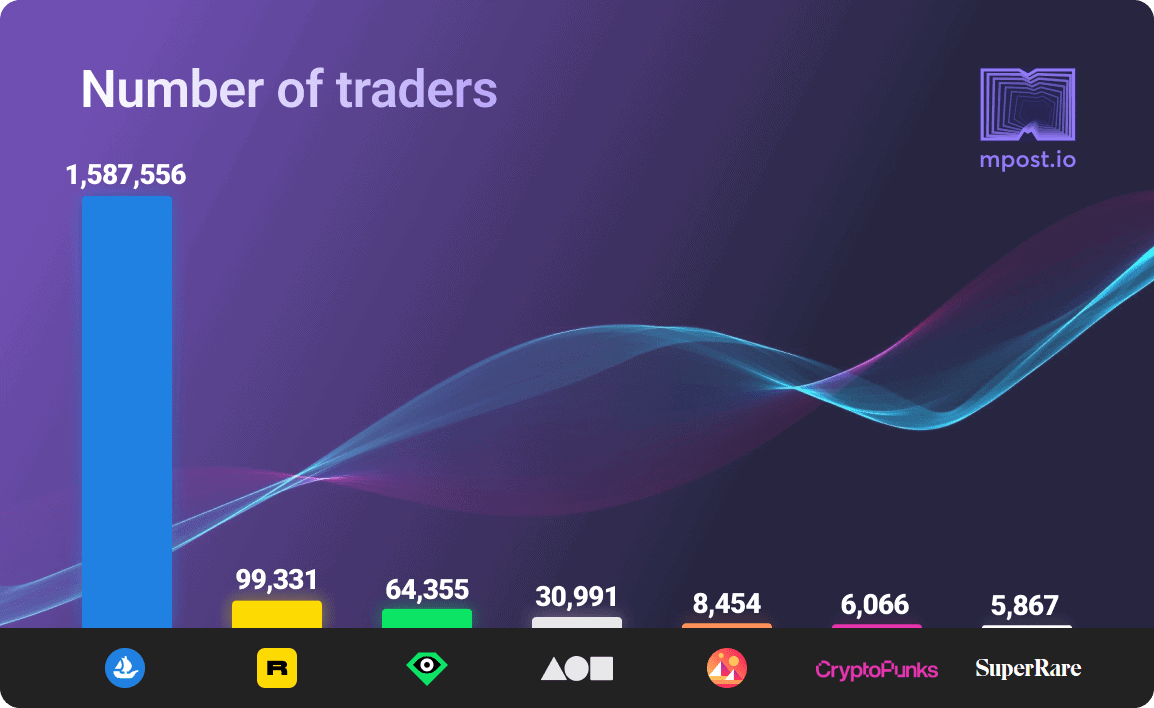

OpenSea is also an absolute market leader by the number of traders: with more than 1.5 million users it is significantly ahead of both LooksRare and Rarible. Art and metaverse marketplaces, and primary marketplaces like CryptoPunks by LarvaLabs also have significantly less users, as they are much more specialized compared to OpenSea.

Data sources: DappRadar.com, Dune Analytics

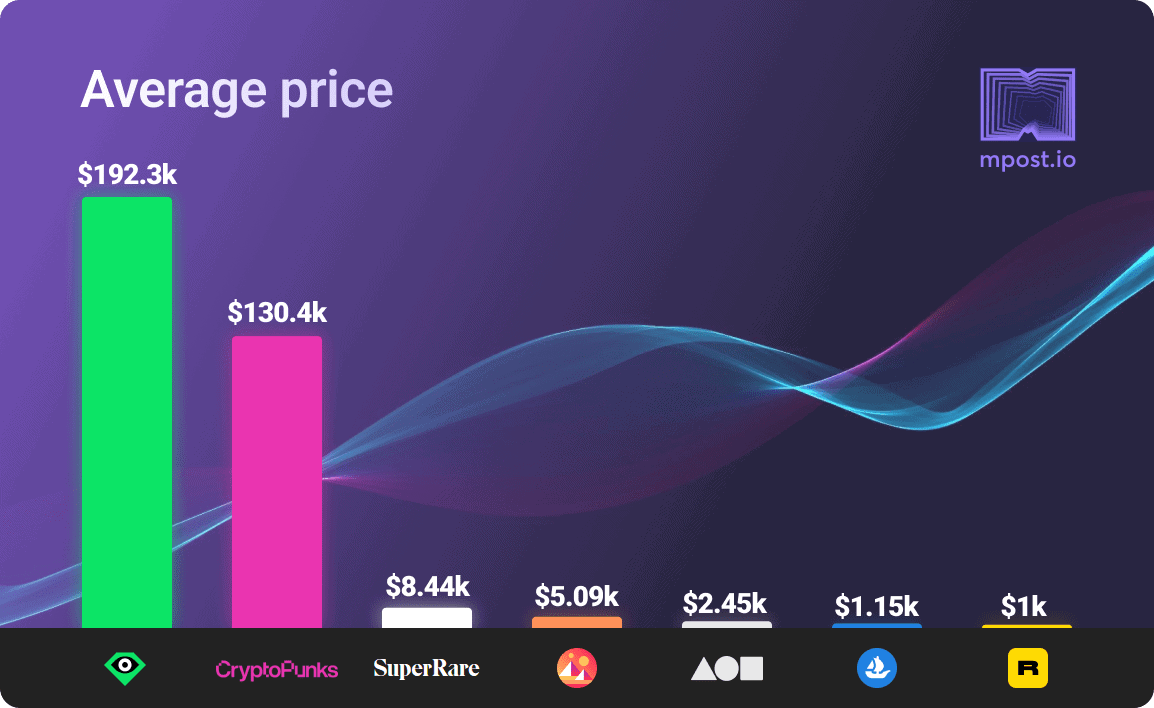

An average NFT price is the highest on the LooksRare marketplace which explains how it managed to take over such a big share of the market volume in a short period of time, with significantly fewer traders than OpenSea. One of the reasons for such high prices on LooksRare is wash-trading which is discussed further.

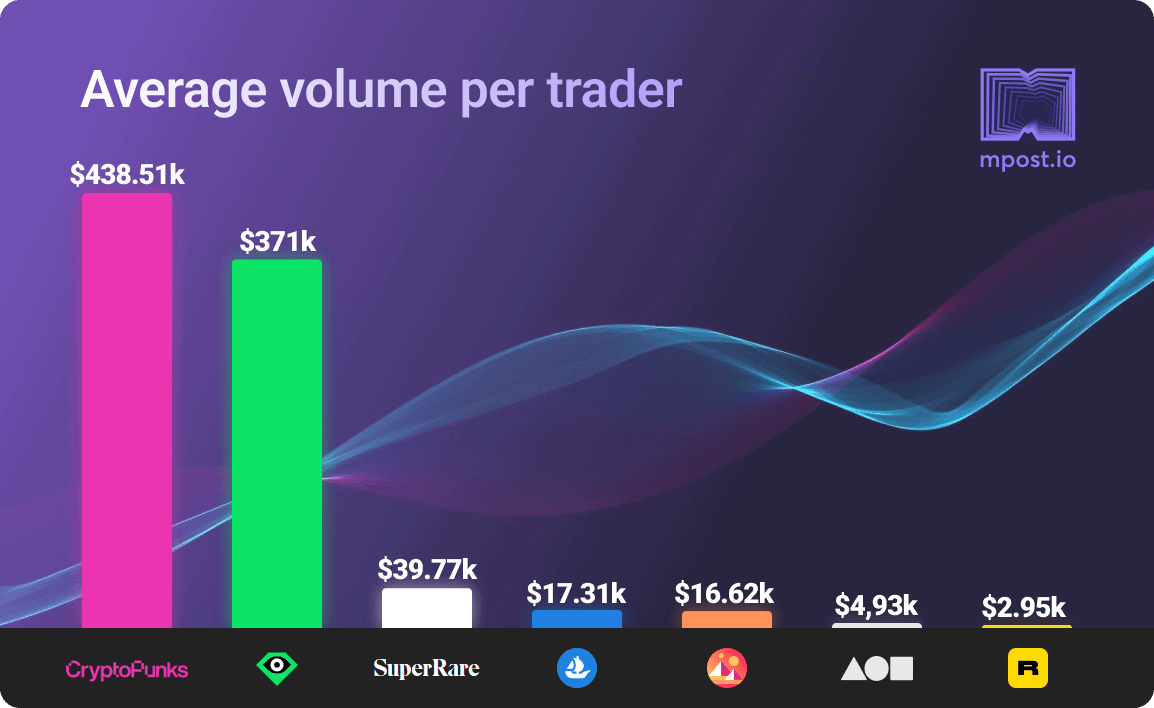

CryptoPunks is one of the most coveted NFT collections, and some of the NFTs were sold for historically high prices. Hence, the average price of CryptoPunks of more than 100k USD does not come as a surprise. The average volume per trader exceeds 400k USD, and is the highest among Ethereum marketplaces.

The lowest average NFT price and volume per trader are observed on Rarible. One reason for this is its significant loss of the market share by the end of 2021-2022, when trades actually peaked and NFTs were trading at increasing prices. Most of the sales on Rarible happened in the first half of 2021 when the average NFT prices were significantly lower.

Data sources: DappRadar.com, Dune Analytics

Data sources: DappRadar.com, Dune Analytics

As the data shows, the absolute majority of the NFT trades happen on the multi-segment marketplaces, i.e. OpenSea and LooksRare. Here is the overview of the biggest market players.

OpenSea

Trade volume

Total $27.5B

1 month $2.48B

Average price

All time $1.15K

1 month $1.56K

Number of traders

Total 1,587,556

1 month 489,796

Fees 2.5%

OpenSea was founded in 2017 by Devin Finzer and Alex Atallah, who were inspired by CryptoKitties success. The idea was to create a “NFT marketplace with everything for everyone”. This describes OpenSea pretty well, as it has developed into a huge marketplace which now hosts more than 2 million NFT collections, more than 80 million individual NFTs, and 600K active users. The number of employees also increased to more than 200 people.

In 2021, the company experienced rapid growth, together with the overall NFT market. The sales growth rates from month to month were in the hundreds percent. In January 2022, its trade volumes peaked at $5 billion.

While most trades on OpenSea are still Ethereum-based, the project also expanded to Polygon, which is supposed to provide cheaper transactions. NFT trading on Solana is currently in beta.

As a fast growing company in a booming market, OpenSea hasn’t escaped its share of “growing pains”. In the beginning of 2022, OpenSea experienced a security breach, where almost $1,7 million was stolen from its users.

Another issue was a controversy related to IP rights of the NFT creators. In 2021, OpenSea banned NFT collections that were considered to be “fake” versions of the famous Bored Ape Yacht Club NFTs. In 2022, OpenSea banned users from some countries according to the US sanctions list. These moves have put OpenSea at odds with the web3 principle of no censorship.

In addition, OpenSea has a completely centralized management and hasn’t issued any governance tokens. Combined with the rumors of the coming IPO, this has put OpenSea under severe criticism of crypto adepts.

Top-5 collections (in the last 30 days)

- Moonbirds

- Azuki

- Mutant Ape Yacht Club

- Bored Ape Yacht Club

- Clone X

LooksRare

Trade volume

Total $23.87B

1 month $2.36B

Average price

Total $192.3K

1 month $93.9K

Number of traders

Total 64,355

1 month 15,390

LooksRare launched in January 2022 as a direct challenge to OpenSea’s dominance in the market, and with the vision of a truly decentralized and uncensored marketplace – “By NFT People, to NFT People”. The founders, also in the best traditions of crypto, remained anonymous under aliases Zodd and Guts.

The full decentralization included distribution of 100% of the revenue among platform users with the project’s coin – $LOOK. On January 10, $LOOK was airdropped, and already the next day the sales on the platform shot above $115 million, more than on OpenSea. Aggressive marketing in the crypto community was a big help.

Since January, LooksRare has managed to cannibalize a large chunk of the market from OpenSea. However, the average price of the sold NFTs is significantly higher, and the monthly number of traders is significantly lower on LooksRare. This suggests the practice of wash-trading, when users sell assets to themselves to inflate prices. In the case of LooksRare, wash-trading also earns $LOOK to those who practice it.

Significant volumes of wash-trading were confirmed by several blockchain researchers. According to CryptoSlam, the volume of wash-trading on LooksRare was estimated at $8.3 billion, with Meebits and Terraforms most represented in such trades.

Wash-trading is illegal on the financial markets as a form of market manipulation, and while it is not illegal in NFTs at the moment, it is a gray area, and many market participants might consider it at least unethical. It is interesting to see how this will affect the future of LooksRare, which still has a significant chunk of the market in real trades.

Top-5 collections:

- Terraforms

- Mebeets

- Dotdotdot

- CATGIRL ACADEMIA

- Mutant Ape Yacht Club

Rarible

Trade volume

Total $293.04M

1 month $1.62M

Average price

Total $1K

1 month $491.02

Number of traders

Total 99,331

1 month 3,315

Fees 2.5%

Rarible was created in 2020 by Alex Salnikov. Its business model is very similar to the one of OpenSea. It hosts NFTs from different segments (collectibles, art, sports, metaverse, gaming), and caters to a wide range of users. Lower average price compared to OpenSea suggests that the platform has sold more gaming NFTs (which are usually priced lower than collectibles or art) and less valuable and hiped collectibles, due to the platform’s decreasing popularity in the recent months.

Unlike OpenSea, Rarible has decentralized governance. The holders of its token $RARI can vote and decide on crucial issues of the project. $RARI were distributed weekly to active users until January 2022, when the community voted to devote the tokens to the building of projects on the Rarible protocol.

While Rarible has 2,5% fees of sales, similar to OpenSea, it offers higher royalty to NFT creators (up to 50% compared to 10% on OpenSea).

Rarible supports multiple blockchains, including Ethereum, Tezos, and Flow, which means the users can mint, sell and buy NFTs on any of these blockchains.

With its similar offers, decentralized governance and higher royalties, Rarible still has a significantly lower market share compared to OpenSea. One possible reason for that is OpenSea’s first-comer advantage, together with the accumulated network effects. Another possible reason is the higher flexibility of OpenSea’s management in adapting to the market demands.

Top-5 collections (in the last 30 days)

- Moonbirds

- Azuki

- Mutant Ape Yacht Club

- Bored Ape Yacht Club

- Clone X

SuperRare

Trade volume

Total $233.32M

1 month $880.52K

Average price

Total $8.44K

1 month $10.6K

Number of traders

Total 5,867

1 month 131

Fees 3% (only buyer)

SuperRare was founded in 2018 by John Crain, Charles Crain, and Jonathan Perkins as a marketplace for unique digital artworks. The project is self-positioned as “Instagram meets Christie’s”. SuperRare is one of the more niche platforms compared to OpenSea or LooksRare, and targets art collectors and investors. While the number of traders is not high, the platform can earn significant fees on some expensive art sales.

In 2021, SuperRare decentralized its governance, introduced DAO and community curated collections, and distributed RARE tokens, of which 15% were airdropped, and 14,5% went to investors.

SuperRare hosted some of the most expensive NFT sales to date. In 2018, an artwork A Coin for the Ferryman by XCOPY was sold for $6 million. In 2021, Ross Ulbricht Genesis Collection, consisting of original writings, artworks, and animation in one NFT, was sold on SuperRare for $5.93 million.

Foundation

Trade volume

Total $152.89M

1 month $6.45M

Average price

Total $2.45k

1 month $1.78k

Number of traders

Total 30,991

1 month 3,398

Fees 5%

Foundation is a relatively new marketplace which has quickly managed to take a significant share of the art NFT trades.

Foundation was launched in 2021 by Kayvon Tehranian and Matthew Vernon. It is a platform for curated fine art. It is an invitation-only platform, meaning that the art pieces can be minted only by invited artists, which gives the platform a flavor of exclusivity. The list of artists include such famous in the digital art names as Pak, Jen Stark, Shawna X.

The NFT sales are administered through auctions. Foundation charges a commission of 15% on all primary sales, which is similar to other digital art-focused platforms, like SuperRare.

Some of the most expensive sales on the platform include the sale of the Nyan Cat meme NFT for more than half a million dollars, and the sale of Pak’s Finite artwork for $800K.

MakersPlace

Trade volume

Total $25.76M

1 month $26.44K

Average price

Total $1.52K

1 month $1.2K

Number of traders

Total 4,805

1 month 41

Fees 2.5%

MakersPlace is one of the earliest “art gallery”-type NFT marketplaces. The work on it started in 2016 by Pinterest employees Yash Nelapati, Dannie Chu, and Ryomi Ito, and the platform was fully launched in 2019. The key feature of the platform is the authenticity of all artworks, which is verified through a multi-step process.

In 2021, MakersPlace made headlines when it collaborated with the famous artist Beeple and Christie’s auction house in sourcing as an NFT and auctioning The First 5000 Days artwork by Beeple. The artwork was sold for $69.3 million – the most expensive NFT sold to one owner.

Despite raising a significant $30 million in venture funding in 2021, the trade volumes on the platform never exceeded $20K per day, and in recent months the activity has been further declining. This paints a bleak future for the project, unless some significant changes are introduced.

Primary marketplaces

Primary marketplaces are places where NFTs from a specific collection, game, or metaverse are minted and traded. Usually, these NFTs can also be traded on secondary markets like OpenSea and LooksRare, so the stats on trades include data from both primary marketplaces and secondary.

One of the first specialized primary marketplaces on Ethereum was the CryptoPunks marketplace. CryptoPunks are a collection of 10,000 unique characters. It was created by LarvaLabs in 2017, and became an inspiration for the ERC-721 token standard. Total sales of Cryptopunks amounted to $2.66 billion since its launch, with some of the most expensive NFTs sold on record. Recently, the Cryptopunks copyrights were bought by YugaLabs.

A classic example of a gaming marketplace on Ethereum is the Axie Infinity marketplace. Axie Infinity is a blockchain-based video game, launched in 2018 by Sky Mavis. Players in the game can mint and collect digital creatures called Axies. The game quickly gained popularity, and the volume of Axies trade on Ethereum reached $18 million, with the average price of $110. In 2021, Axie Infinity moved to the Ethereum side-chain, Ronin.

The largest metaverse marketplace on Ethereum is Decentraland. Decentraland is a virtual world where users can explore, interact, and develop their own spaces. On the Decentraland marketplace, users can buy and sell LAND tokens representing assets in the metaverse. Decentraland marketplace does not charge any fees. Total sales volume on Decentraland amounts to $140 million, with an average price of $5K. In 2021, a patch of land on Decentraland was sold for $2.4 million, making it one of the most expensive virtual real estates.

The future of Ethereum-based marketplaces

The NFT market experienced meteoric growth in 2021 and became the fastest-growing segment in crypto. In January 2022, the market volume peaked, then started to show signs of cooling. While some experts expressed concerns about a bubble burst, the market contraction is as likely to signify the entering into a more mature state after an initial boom.

Ethereum-based marketplaces have been dominating the market from the beginning. However, the competition is becoming tougher as other blockchains often offer lower fees and faster transactions. JPMorgan analysts estimate that Ethereum share in NFTs has dropped to 80%, compared to 95% in the beginning of 2021.

Ethereum, like Bitcoin, is a proof-of-work blockchain which means running the network consumes a lot of electricity. This Ethereum feature resulted in claims that the NFTs are not climate-friendly, as most NFTs are on Ethereum. This might become a problem when more and more tech companies and investors with ESG concerns enter the market. Solana, one of the Ethereum challengers, is a proof-of-stake blockchain which is much more environmentally-friendly.

The marketplaces quickly adapt to the challenges and user demands. Many Ethereum-based marketplaces now offer multichain support. For instance, OpenSea launched on Polygon in 2021, and currently Solana-based NFTs are traded in beta.

Though losing positions, Ethereum is likely to be a big player in NFTs for some time. The future of Ethereum-based NFT trading will have an impact on Ethereum itself, as NFT and metaverse are likely to be one of the dominating sectors in crypto.

Here is the list of best Solana NFT marketplaces that you should know about.

Read related posts:

- OpenSea delists Not Okay Bears after the collection tops in sales

- NFT activity is growing, but NFT marketplace app downloads are down 90%

- New NFT collection explores photography and poetry

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.